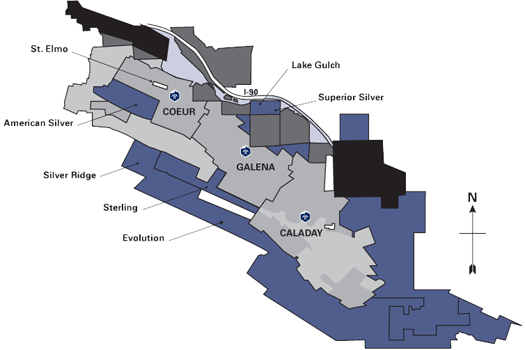

Adjacent Coeur and Caladay Mines Provide Future Mineable Resource

for U.S. Silver’s Galena Mine -

U.S. Silver’s Coeur Silver Mine -

&

Caladay Mines

flank the Galena Mine property -

flank the Galena Mine property -

The two mines provide tremendous growth potential for U.S.

Silver’s Galena mine complex -

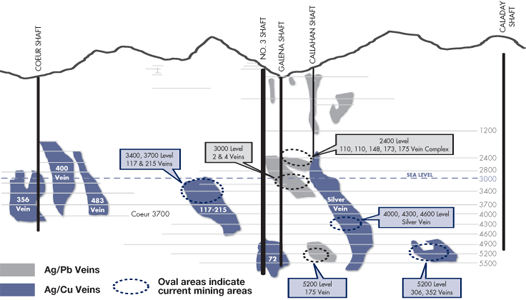

The Coeur and Galena Mines are connected underground by rail

The Coeur and Galena Mines are connected underground by rail

tunnel at the 3700 foot level, while the Caladay property

is connected to the Galena Mine by an underground tunnel

at the 4900 foot level -

Both of these levels are used to exhaust ventilation air.

The 3700 level tunnel also allows for the underground movement

of lead-silver ore to the operational Coeur Mill.

The Coeur Mine operated until mid-1998, and historically

produced some 39 million ounces of silver and 33 million pounds

of copper.

The mine has a flotation mill that now processes lead-silver

ores from the Galena Mine.

Detailed engineering and geological reviews are currently

underway to bring this mine back into production with

redevelopment this year -

The Caladay Property has a 4900 foot deep shaft that is now

used primarily to provide ventilation to the Galena Mine.

RE: Investment Considerations

The U.S. Silver (USSIF) company has significantly

improved its financial position over the past two years,

largely by making management changes, cutting operating costs

and producing more silver, according to Parker.

The Company raised a small amount of additional capital in late

2010 with a private equity placement that sold out in a few days.

As silver prices continue to perform exceptionally well and

production continuing at healthy levels, the company has

invested in the development of new areas to mine and has made

additional infrastructure improvements to support increased

future production levels while maintaining its cash position.

US Silver also plans to use the strong cash flow to expand its

exploration program covering its large land position in

the Silver Valley.

Currently, U.S. Silver Corporation stock is significantly

under-priced when compared to its peers, according to Parker,

who compares his company’s stats to such other silver producers

as Scorpio, Endeavour, Fortuna, and First Majestic.

“We are profitable, have good cash flow, are debt free

and pay no royalties,” says Parker.

“2009 and 2010 were years of continuing achievements in mine

operations, productivity and profitability.

With renewed infrastructure and equipment, a highly skilled work

force and the rebuilt Galena shaft, we are now well positioned

for the future.

Our goal is to increase silver production at the Galena Mine to

between 3 million and 3.25 million ounces a year.”

85% Silver Production Makes Idaho-based

U.S. Silver A Virtually Pure Silver Play

Galena Mine in Idaho’s Historic Silver Valley is Second-Largest

Producing Silver Mine in U.S.

U.S. Silver Corporation (OTC QX: USSIF; TSX.V: USA) --

www.us-silver.com

represents one of the best exposures available to investors

as a “pure silver play” -

And in these exciting times in the silver market this leverage

can really pay off.

This is a company that derives over 85% of its revenue from

the production of silver.

Also, it is a company with no debt, and no royalties that must

be paid out of profits.

In 2010 the Company produced almost 2.3 million ounces

of silver, nearly matching the strong performance in 2009 of

2.4 million ounces.

USA also produced 6.6 million pounds of lead and 1 million

pounds of copper in 2010.

These results, which are significantly higher than 2008

production totals, are expected to rise to 2.4 to 2.6 million

ounces of silver in 2011.

With these strong production results and high silver prices,

2010 generated record levels of revenue and operating cash

flows, further strengthening an already strong cash position.

U.S. Silver has two different types of silver veins –

one that yields copper-silver ore, and the other,

lead-silver ore.

Currently, U.S. Silver’s proven and probable reserves are:

copper-silver:

17 million ounces of silver,

5,160 tons of copper;

lead-silver: 4.7 million ounces of silver

and 49,920 tons of lead.

Measured and indicated resources:

copper-silver: 7.7 million ounces silver

and 2,500 tons of copper;

lead-silver: 825,900 ounces of silver

and 8,370 tons of lead.

Inferred resources:

copper-silver: 10.7 million ounces of silver

and 3,186 tons of copper;

lead-silver: 6.154 million ounces of silver

and 66,760 ton of lead.

This will support mining for years to come,

however the Company has demonstrated repeatedly that it can

find more silver than it produces every year,

further extending production in this historic mining camp.

“We are very leveraged to the price of silver through our

production profile and silver in the ground,”

says U.S. Silver Corporation CEO Thomas Parker.

“We are an 85% pure silver play and will be for years to come.”

Continuing Exploration at Galena Silver Mine

Boosts Reserves & Resources

U.S. Silver’s Galena Mine,

which sits in the heart of Idaho’s famed Silver Valley –

also known as the Coeur d’Alene Mining District –

is the second most prolific silver mine in U.S. history.

Mining began in the Silver Valley area in the mid-1880s.

The district, located in northern Idaho’s panhandle, is a

significant silver, lead and zinc producing area.

Historically, the area has produced about 1.2 billion ounces

of silver.

Work on the Galena Mine also dates back to the 1880s.

Modern mining began in 1953 when ASARCO sank a shaft to

the 3,000 foot level and excavated lateral drifts.

Since 1953, the Galena Mine has produced more than 180 million

ounces of silver and still has some 21 million ounces of proven

and probable reserves of silver.

ASARCO’s joint venture partner Coeur d’Alene Mines, assumed

control of the properties in the mid-1990s.

In 2006, U.S. Silver Corporation acquired 100% of the

Galena Mine, the Coeur Mine and the Caladay Project from

Coeur d’Alene Mines -

The properties encompassed some 11,000 acres of patented and

unpatented mine claims.

Since then, the company has added over 3,000 acres of unpatented

claims, including the historic

Dayrock Silver Mine and Mill,

to create

a land package that is over 11 miles long and over 4 miles wide.

The combined Galena Mine properties include five shafts,

two operating flotation mills,

and extensive surface and underground mining works

and equipment.

More than 250 employees work at the Galena Mine,

producing 800-900 tons of ore per day, five days a week.

This can increased to 7 days a week and more 8hrs shifts -

The Galena Mine

has two main shafts,

the primary No. 3 shaft that descends 5,825 feet underground,

and the Galena shaft which is 5,540 feet in depth.

The latter moves men and materials, and provides utility access

for water, electrical power and compressed air.

Silver and copper are recovered by a flotation mill which

produces a silver-rich concentrate.

The Galena mill has a total capacity of 900 tons per day.

Silver-copper concentrates are shipped to Xstrata for smelting

in Quebec.

Silver-lead concentrate is sent to Teck’s Trail Smelter in

British Columbia.

Since acquiring the Idaho properties, U.S. Silver has conducted

an aggressive underground exploration drilling program that

has expanded reserves and resources 106%.

Recent underground drilling indicates the potential for

higher-grade silver resources. Last year, U.S. Silver’s

continuing exploration program replaced more than every ounce

of silver mined.

The company plans to complete some 47,000 feet of drilling

this year.

“We have a number of things to worry about but running out of

ore is not one of them,” says Parker.

“There is a lot of silver in this mine and we will continue

to find it and produce it.

We have excess hoisting and milling capacity which makes

incremental production very inexpensive.”

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=60128030

https://investorshub.advfn.com/boards/read_msg.aspx?message_id=60128030

God Bless