Seabridge near Redhill starts Drilling Seabridge Gold Begins Drilling for High Grade at KSM

TORONTO, CANADA--(Marketwired - May 22, 2013) - Seabridge Gold (TSX:SEA)(NYSE:SA) reported today that exploration drilling has begun at its KSM project in Northwestern British Columbia, Canada. Four highly prospective targets are likely to be tested this summer for their potential to host large deposits with grades at multiples of the project's currently reported reserves.

The New Gold director said the estimate is based on exploration on the Blackwater and nearby Capoose properties as well as ground in between.

.

In an era when large gold deposits are increasingly hard to find, a Canadian mining executive had some good news for investors in New Gold Inc. (TSX: T.NGD, Stock Forum) and junior companies exploring in the vicinity of the gold miner’s Blackwater project in central British Columbia.

.

New Gold director Pierre Lassonde said there is an even chance that the Blackwater property and others nearby will eventually rank among the province’s largest gold mining camps.

.

“There is a 50/50 chance that it will be a 25 million ounce camp,’’ Lassonde told reporters following a speech to the Roundup mining conference in Vancouver Thursday.

.

As Blackwater hosts a gold resource of just over 10 million ounces, exploration crews still have a long way to go to reach 25 million ounces. When asked to elaborate, Lassonde said his projections are based not only on indicated and inferred resources in the Blackwater zone, but also on additional discoveries on nearby ground, including the nearby Capoose property.

As Blackwater hosts a gold resource of just over 10 million ounces, exploration crews still have a long way to go to reach 25 million ounces. When asked to elaborate, Lassonde said his projections are based not only on indicated and inferred resources in the Blackwater zone, but also on additional discoveries on nearby ground, including the nearby Capoose property.

.

“In between, there is a lot of interesting geochemistry,’’ he said.

.

Blackwater is the site of a proposed open pit mine that is expected to cost $1.8 billion to develop, producing an annual average of 507,000 ounces of gold and 2 million ounces of silver over a 15-year life span, according to a preliminary economic assessment announced in September 2012.

.

Its prospects for securing mining permits are thought to be good because of its proximity to Vanderhoof, a logging region descimated by the Pine Beetle infestation.

.

When reached in Toronto, New Gold spokeswoman Julie Taylor said she was unaware of the 25 million ounce target mentioned by Lassonde, who in addition to his role as a New Gold director is also Chairman of Franco-Nevada Corp. (TSX: T.FNV, Stock Forum) (NYSE: FNV, Stock Forum), one of the gold mining sector’s most successful royalty companies.

.

“These are numbers that we can’t comment on,’’ she said.

.

Still, Taylor said the company is excited about the prospects for Blackwater, and company officials will convey that enthusiasm when they meet with analysts on Tuesday to discuss the company’s production forecasts.

.

If Lassonde’s predictions are correct, Blackwater would be very large. But it would still rank behind British Columbia’s biggest gold projects.

.

They are Seabridge Gold Inc.’s (TSX: T.SEA, Stock Forum) Kerr-Sulphurets-Mitchell (KSM) project, which hosts 38.2 million ounce of gold (plus 9.9 billion pounds of copper), and Pretium Resources Inc.’s (TSX: T.PVG, Stock Forum) (NYSE: PVG, Stock Forum) Snowfield project, which contains 25.9 million ounces of measured and indicated gold resources, plus another 9 million ounces of inferred gold.

.

Snowfield and KSM are both located near Stewart in northern British Columbia.

.

When reached for comment, B.C. regional geologist Paul Jago described the 25 million-ounce target as “news to me.’’

.

However, he agreed that the potential for new discoveries in the Blackwater area is significant, especially as New Gold was running one of the most aggressive exploration programs in Canada last year, one that featured 18 drill rigs.

.

“There is a lot of activity in that area,’’ he said.

.

Aside from New Gold, active companies include, Parlane Resource Corp. (TSX: V.PPP, Stock Forum), which is exploring between Capoose and Blackwater, Amarc Resources Ltd. (TSX: V.AHR, Stock Forum), Troymet Exploration Corp. (TSX: V.TYE, Stock Forum), RJK Exploration Ltd. (TSX: V.RJX.A, Stock Forum) (which is exploring the Blackwater East and Blackwater West projects), Independence Gold Corp. (TSX: V.IGO, Stock Forum), and Red Hill Resources Corp. (TSX: V.RHR, Stock Forum).

.

During his speech to the Roundup conference, Lassonde said the Blackwater project is considered a success story. “It was discovered in 2010 and will probably come into production by the end of 2016.’’

.

However, he was less optimistic about the short term prospects for gold itself. “The next six to nine months is looking at the same short of channel, US$1,680, plus or minus $100.’’

.

Lassonde said this is because the U.S. economy and the U.S. dollar is doing much better than the Euro.

.

“But at some point inflation will raise its ugly head, and when inflation raises its ugly head, you can be sure that gold will be really rocking.’’

.

On Friday, New Gold shares closed at $10.12, up 4.4%, leaving the company with a market cap of $4.82 billion, based on 476 million shares outstanding. The 52-week range is $12.50 and $7.20.

---------------------------------

.

Aspen Project - Redhill's Gold Project:

.

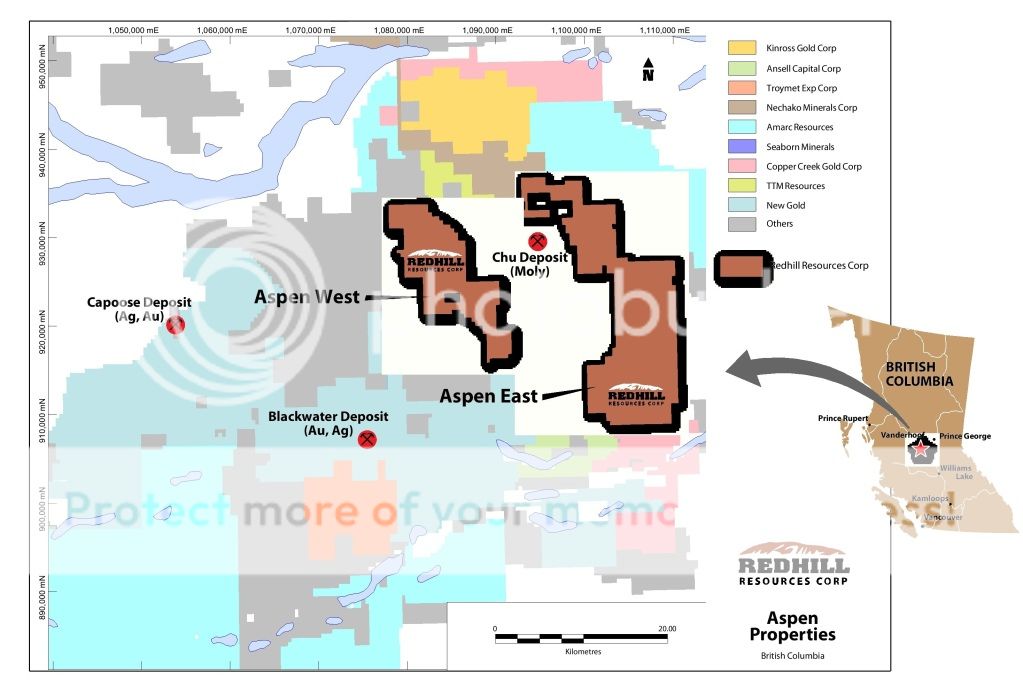

Redhill Resources' Aspen Properties are situated approximately 15 kilometers northeast from New Gold's Blackwater deposit, in the Blackwater area of the Nechako Plateau region of British Columbia. The Properties are comprised of 65 claims in two blocks, encompassing a total of 29,137.30 hectares -- Aspen West and Aspen East.

.

The Aspen properties are readily accessible along a well developed network of well maintained forestry roads. The district is well served by existing transportation and power infrastructure and a skilled work force, which support a number of operating mines, as well as late-stage mineral development and exploration projects.

.

The Nechako Plateau is located within the Stikine Terrain which underwent regional uplifting that exposed a horst of Jurassic and Cretaceous volcanics and intrusives surrounded by Tertiary and younger volcanics and volcaniclastics. Extensional faulting and related structural activity, in addition to the presence of significant precious metal-rich hydrothermal systems, present an attractive geological setting for high-level precious metal epithermal, subvolcanic intrusive porphyry and transitional deposits.

.

The Aspen West property is strategically located adjacent to properties hosting the Chu molybdenum deposit (TTM Resources Inc.) and 15 km northeast of the Blackwater gold-silver deposit (New Gold Inc.). The Aspen West property is also located 26 km northeast of the Capoose silver-gold deposit (New Gold Inc.).

.

Most of the Aspen East and some parts of Aspen West property are underlined by middle to upper Jurassic volcanic and sedimentary rocks of Hazelton Group intruded by felsic intrusive rocks of Late Cretaceous to Terciary age, the same geological setting present at New Gold's Inc.'s Blackwater deposit.

.

Exploration Activities of Redhill Resources Corp

.

In September and October 2012 the Company completed a reconnaissance sampling program over the Aspen Properties. In total, 52 rock, 96 soil, 121 biogeochemical (trees) and 8 silt samples were collected. Initial results are encouraging, identifying three new IP target areas.

.

The Company has engaged the services of Peter E. Walcott & Associates to conduct an IP survey of 58.7 km of IP lines on the Aspen Properties, covering 4 target areas.

.

Three targets areas will be surveyed over the Aspen East Property, including one that hosts a large portion of the historic CH claims. The fourth target area is on the Aspen West Property.

.

The northern target of the Aspen East property is known to host Pb, Zn, Cu, Mo, Ag and Au porphyry style mineralization (historic CH claims). Mineralization has been identified over 1.5 kilometres along the contact of a granodiorite intrusion, primarily by anomalous soils collected by Placer Dome in 1991.

.

Historic soil sampling by Placer Dome on the northern part of the Aspen East Property returned over 1170 ppm copper, up to 1310 ppb gold, up to 2320 ppm lead, and up to 909 ppm zinc. Silver is also highly anomalous in several samples, assaying between 5 and 30 ppm. Other than soil sampling, Placer Dome also did a limited magnetometer survey on the property, but no IP or drilling had been done.

.

The IP survey should be completed by December 31, 2012

.

Exploration in the Blackwater Area of the Nechako Plateau

.

The exploration activities by Richfield Ventures Corp., Silver Quest Resources Ltd., and Geo Minerals Inc. in the area of the Blackwater and Capoose deposits have resulted in acquisition of all three companies by New Gold Inc. in 2011 to consolidate their property position and mineral deposits. Combined with exploration activities by Independence Gold Corp., on their 3T's gold-silver project, and several other exploration companies, this area represents one of the busiest for exploration in Canada.

.

The Blackwater area of the Nechako Plateau continues to be a focal point of exploration for many companies due to the recent discovery of a world class gold-silver deposit by New Gold Inc.

.

At New Gold's Blackwater deposit, disseminated gold-silver mineralization is associated in shear-hosted veins, hosted in Jurassic-aged Hazelton Group volcanic rhyolites. The Capoose silver-gold deposit mineralization is associated with younger Cretaceous-aged rhyolitic sills that have intruded the Hazelton rocks. At the historic Chu deposit, molybdenite and copper mineralization is associated with quartz stockwork hosted by hornfelsed sandstone and granodiorite.

.

On July 18, 2012, New Gold Inc. announced an updated Indicated and Inferred Mineral Resource estimate for the Blackwater deposit representing drill results through 2012.This latest resource update incorporates an additional 4.5 months of drill hole data added to the project's resource database when compared with the previous estimate announced in March, 2012. With these additional data, the indicated and inferred mineral resources have increased by 30 per cent, or 1.7 million ounces of gold, and 7 per cent, or 200,000 ounces of gold, respectively. The resource estimate now includes all drilling through May 14, 2012, adding 151 holes totalling 57,064 metres since the March, 2012, estimate. In total, the current Blackwater mineral resource estimate is supported by analytical data received from 417 holes totalling 147,619 metres. An additional 32 holes supplied geologic information, but assays had not been received by the cut-off date for this July resource estimate:

.

Indicated mineral resource: 230 million tonnes at an average grade of 0.96 gram gold per tonne containing 7.1 million ounces of gold at a cut-off grade of 0.40 g/t gold equivalent;

.

Inferred mineral resource: 98 million tonnes at an average grade of 0.77 g/t Au containing 2.5 million ounces of gold at a cut-off grade of 0.40 g/t AuEq.

.

.

https://www.redhill-resources.com/i/pdf/REdhill-BCClaims-Nov13.pdf