RE:RE:RE:RE:RE:RE:RE:RE:RE:RE:RE:LSG GOLD Price Here Is The Roadmap To fiat$100.-/sh +++ -

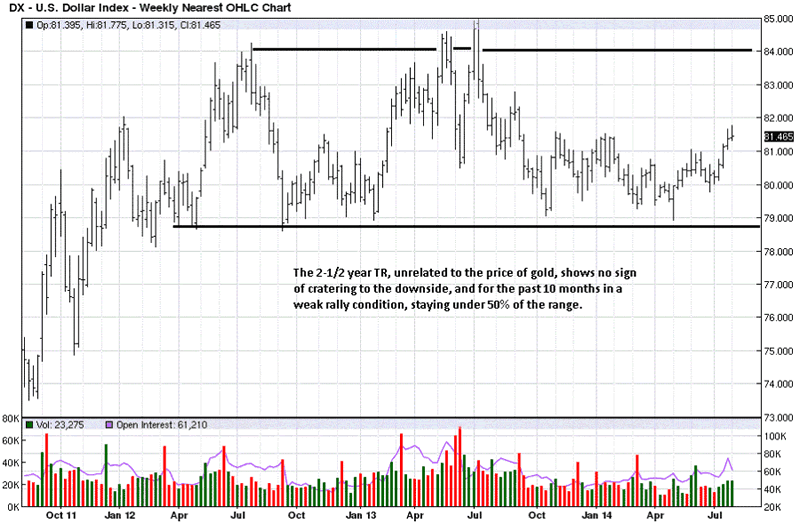

Federal Reserve Notes, aka the "dollar,"

show it locked in a seemingly harmless Trading Range, [TR].

Since October 2013, rallies have been weak, staying under the 50% retracement of range area.

There are no signs of impending demise for the Index, which is exactly

what one would expect from the master manipulators.

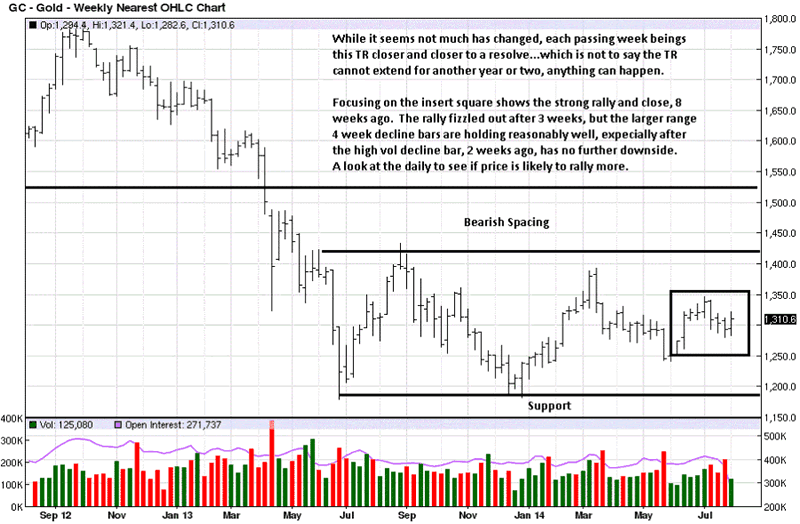

Two things stand out in this chart: 1.

price remains locked in a lower end TR, and 2.

the entire TR is well under the Bearish Spacing price area.

Notwithstanding the comments on the chart, these two obvious, observable facts

tells us that gold continues to be suppressed.

What is kept invisible as a part of the active suppression are

the controlling derivatives and the banker positions

that offset the huge down days to keep prices low.

The collapse of the derivatives may be a function of or

cause of the "dollar" collapse, and when it happens,

it will be the triggering mechanism to catapult gold higher "overnight," literally.

Owning physical gold is a huge risk -

Confiscattion by 666 gov. or 10yrs in jail as the 666 gov. did 1934 -

Retaining whatever physical already in possession will be a financial life-saver

for some people in a free country which has no histroy of confiscations of gold bullion and coins -

Keep buying gold producer stocks whenever and whatever you can, and

do not be concerned about the "When?" question.

No one knows when prices will rise.

Stay the course.

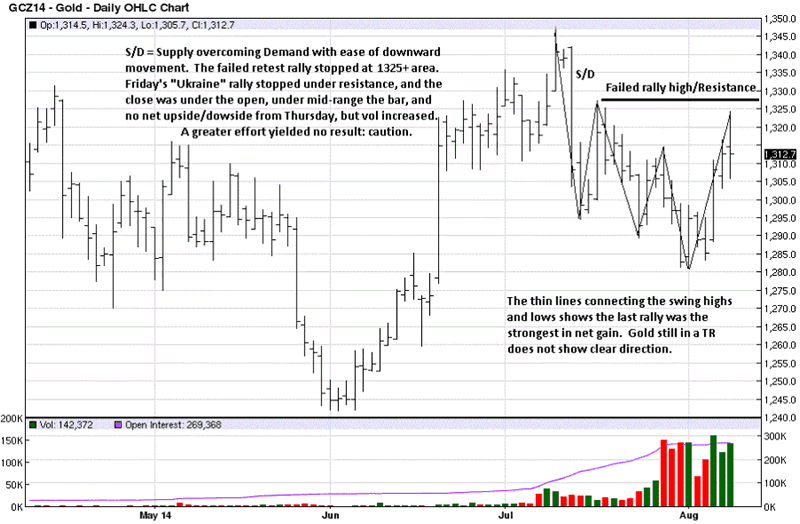

Gold had its strongest rally since the July swing high, but the read of Friday's bar activity

suggests sellers won the battle that day.

It has not worked to buy high for breakouts in gold, so one must be more select

when working the buy side.

What is important to watch for next is how price reacts from Friday's high.

If the market is to continue to rally, the next correction should have smaller ranges

to the downside on a lessening in volume.

This will tell us the selling is weak.

As the daily chart stands, it is not giving any clear sign of market strength.

That could change next week, but until the change occurs,

gold will continue to struggle.

Not much has changed since last week's analysis, except one more week

added to the RHS [Right Hand Side] of the developing TR.

There are no apparent signs of accumulation on the part of buyers,

so more of the same activity can be expected, at least until

a clearer change is affected

its a long hike back UP -

The Real Legal Money Tender =

https://www.biblebelievers.org.au/monie.htm

.