Introduction

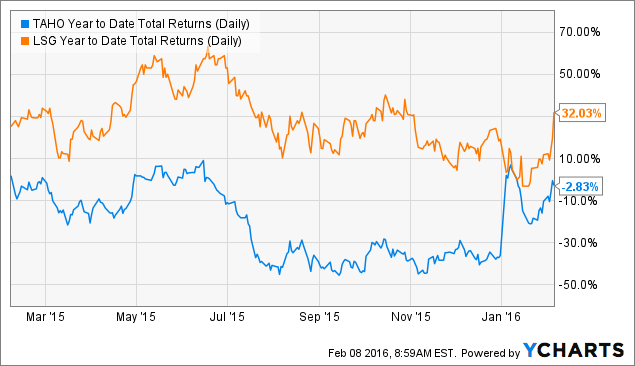

There has been a lot of chatter lately about Lake Shore Gold (NYSEMKT:LSG) being bought out by Tahoe Resources (NYSE:TAHO) to create a much larger precious metals producer. These rumors have now been confirmed as Lake Shore has agreed to be acquired by Tahoe Resources in an all-share deal. An earth-moving transaction, and I'd like to provide my two cents here as I have been keeping an eye on Lake Shore Gold for quite a while now. Additionally, Lake Shore also released a maiden resource estimate on the 144 Gap project as well, and the total amount of gold is higher than I expected.

TAHO Year to Date Total Returns (Daily) data by YCharts

Lake Shore Gold: the predator gets eaten

Tahoe Resources has made an all-share offer to acquire all outstanding shares of Lake Shore Gold. Per share of Lake Shore, Tahoe is offering 0.1467 new shares of Tahoe to gain control of Lake Shore, and based on the most recent closing prices (in US Dollar), this represents a 15.2% premium. This does sound low but you should keep in mind Lake Shore's share price increased by in excess of 10% on Friday whereas Tahoe Resources saw its stock price go down.

Source: Tahoe website

The deal does make a lot of sense for Tahoe Resources as it will further increase its attributable gold production rate, and the consolidated entity will produce approximately 20 million ounces of silver this year as well as approximately 400,000 ounces of gold. The all-in sustaining costs will be quite competitive at $10.5/oz and $975/oz for respectively the silver and the gold.

So, yes, it does look like the combined entity will be stronger and Tahoe Resources is paying a fair price for Lake Shore Gold as the total deal value is almost US$700M, which actually isn't bad at all. However, there's one elephant in the room that will have to be dealt with from an investor's perspective. Tahoe Resources is operating in Guatemala and Peru and whilst I do consider Peru to be an okay country, I do have my reservations about Guatemala. As the economies of these developing nations are struggling as well, the governments might become 'creative' in trying to make the companies pay more taxes [see for instance Primero Mining's (NYSE:PPP) recent problems with the Mexican tax authorities which are trying to nullify an advance tax ruling].

So, yes, Tahoe Resources is offering a premium (and a nice premium), but I don't consider this premium to be 'excessive' considering the increased (perceived) risk of the combined entity.

Additionally, as the buyout of Lake Shore Gold by Tahoe Resources triggers a 'change of control' event, Tahoe Resources will have to make an offer to redeem all of Lake Shore's existing convertible debentures at face value (100%). As the maturity date of these debentures is close by (2017), and as the bonds are currently trading above par you'd be pretty stupid to tender your bonds, considering the fair value is approximately 117% of par (based on the implied value per Lake Shore share and the conversion rate of the bond).

Too bad the shareholders won't benefit from the 144 Gap discovery, which is larger than I expected

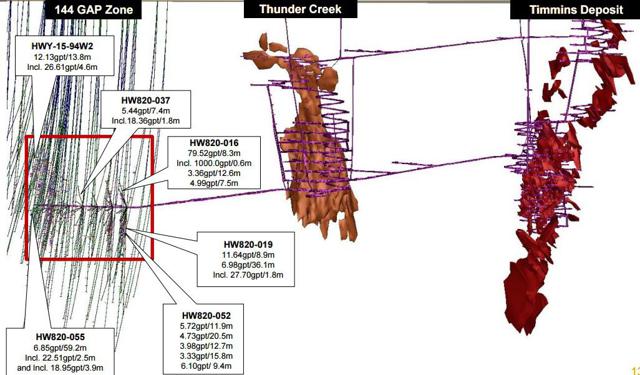

Lake Shore Gold's IR department probably had to put in some overtime last week and in the past weekend, as the company also released the maiden resource estimate at the 144 Gap zone which is located within walking distance from its existing Timmins West and Thunder Creek deposits.

Source: company presentation

This resource estimate very likely had to be published before the buyout agreement with Tahoe Resources was announced, as Lake Shore's shareholders definitely deserve to enjoy the benefits of full disclosure as it would allow them to make a better informed decision.

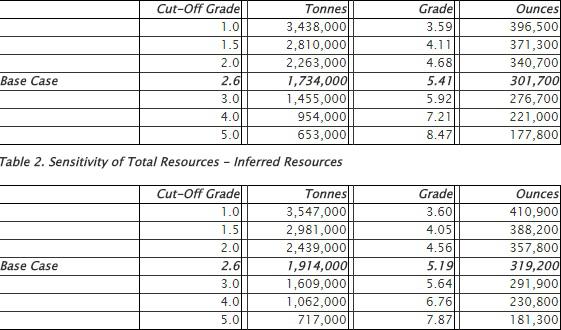

Source: press release

In a previous article, I said I had the impression Lake Shore Gold was close to being fully valued unless the 144 Gap zone would include in excess of half a million ounces of gold in the first resource estimate. Not only was this most definitely the case (with a total of 621,000 ounces of gold included in the maiden resource estimate), the average grade was also higher than I expected (at approximately 5.3 g/t, which compares favorable to Lake Shore Gold's average head grade of 4.4 g/t in 2015). But more importantly, approximately half of the resources are already located in the indicated resource category, which means Lake Shore's plans to develop this new underground zone by the end of this year are gaining momentum and credibility.

Investment thesis

Lake Shore shareholders are receiving a nice premium based on the most recent closing prices of the company's common stock, but it's not a golden deal. Even though they will continue to benefit from an increase in the gold (and silver) price, one cannot deny the geopolitical risks will increase as Tahoe Resources is operating in 'riskier' countries like Guatemala and Peru.

You might want to refrain from tendering your shares to Tahoe Resources as it's not unlikely another third party will make an offer to acquire Lake Shore Gold. Kirkland Lake Gold (OTCPK:KGILF) and Goldcorp (NYSE:GG) come to mind as potentially interested parties.