BlackBerry (BBRY) has solidified a strong base for its turnaround narrative. After the cash payment received from Qualcomm (QCOM), equity investors have found a cushion to extend more bullish bets as the case to lower risk premiums becomes more convincing.

This is a classic prisoner's dilemma with the option to extend more capital needed to invest in ROIC-improving projects, the more attractive of the available dilemmas for equity investors.

Before diving deeper, it will be interesting to know that the tech sector which BlackBerry falls under has been a favorite investment haven for equity investors in 2017.

The chart above details the recent inflows by hedge funds as highlighted by Bloomberg. It appears that these hedge funds were late to the rally which started in the beginning of the year with tech giants like Facebook (FB) and Apple (NASDAQ:AAPL) leading the pack as the most sought after long ideas.

These inflows also highlight the return to US equities which provides a favorable tailwind for BlackBerry.

With the tech sector posing as the new gold haven, and the cyber security industry's recent resurgence off the back of the recent ransomware attack which hit servers and endpoints all over the globe, there is a sound justification to believe in bullish demand-side indicators of sustainable growth in BlackBerry's key security offerings.

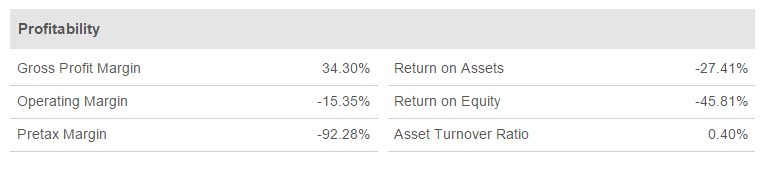

At its current valuation, BlackBerry has a market cap of $5.5 billion. The current EV/Sales of 2.54 suggests that BlackBerry is undervalued given the huge revenue-generating potential that its huge cash position provides. However, the EV/EBITDA ratio tells a different tale at an unattractive 87.64. This raises the over-flogged question of BlackBerry's capabilities to invest in profitable projects that will generate sustainable cash flow.

Therefore, while the comparison with Snap's (SNAP) $25 billion market valuation is understandable, the idea won't fly because Snap faces fewer competition compared to BlackBerry. Also, BlackBerry doesn't play in the largest cyber security segment of network security which involves firewalls and other network appliances, thus capping its TAM.

The biggest revenue drivers will be QNX and the UEM division (both under the software segment).

By focusing strictly on the software segment, we can understand the revenue/cost structure of key alpha generating products.

While QNX and the UEM segment don't generate much profit margins, it is imperative to understand that the narrative driving BlackBerry is more embedded in valuation ratios above the operating margin line.

There is a growing list of software segments where BlackBerry can generate significant revenue, and pending the completion of the turnaround story, the Street is willing to extend more capital to capture significant market share as long as management executes on its promise while leveraging the BlackBerry brand to position the company as the go-to provider of security software and services in the EMM, MDM, cPaaS, IoT, endpoint and automotive segment.

This narrative has been strongly catalyzed by BlackBerry's recent fortune from the Qualcomm deal which increased its cash position as a percentage of market cap, thus improving both the solvency and liquidity position for debt and equity investors. This is also being supported by projected future gains in IP lawsuits, as highlighted by the pending Avaya case.

Going forward, catalysts for upward ramp in valuation appear to be loosely knitted and the key to unlocking hidden value lies in management's flawless execution of its kaleidoscope of cyber security offerings.

Valuation

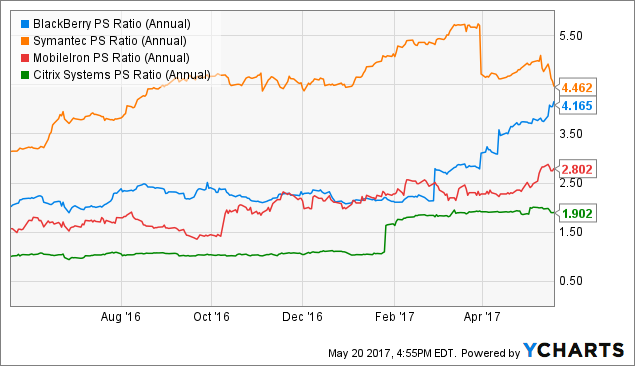

BBRY PS Ratio (Annual) data by YCharts

The above peer group was selected based on companies with a significant market share in endpoint security and UEM. These include Symantec (SYMC), MobileIron (MOBL) and Citrix (CTXS).

While trading at a reasonable ballpark to its peers, examining the case for more upward price action won't be complete without identifying a cash cow in BBRY's growing list of security solutions.

This will be the catalyst that will rejuvenate organic growth while management comes up with a compelling strategy to improve profit margin.

QNX immediately jumps to mind given the recent disruptions in the market for IoT and auto. However, it will be hard to project eye-popping sales from QNX given the modest revenue generated per car by virtue of its licensing deal structure with auto manufacturers.

Making a case for more upside means more multiple expansion on the revenue ratios of P/S and EV/S. This means riding the narrative that BlackBerry will continue to gain market share with QNX, UEM and Radar.

However, until the value chain is torn down and rebuilt, the risk remains that BlackBerry will continue to be overvalued based on key profit ratios going by its outsized EV/EBITDA number.

On the short term, I project more upward price action till the next earnings season when more color is provided on EPS growth and FCF sustainability.

I raise my price target for market share based bets to $12/share with a high likelihood of a pullback after the next earnings report. This gives a market cap of $6.366 billion assuming a P/S ratio of 7.12 (driven by near-term sustained momentum with expected gains from more patent monetization forays) using the median FY'18 revenue consensus of $891.19 million and shares outstanding of 530.49 million. This represents a bullish short-term valuation in the absence of macro headwinds.

This projection is to inform investors who are long-term holders. I believe BlackBerry can successfully complete its turnaround if management successfully monetizes its key revenue drivers. Therefore, I admit to my oversight in hidden value inherent on the patent monetization front. These opportunities represent a classic Black Swan scenario. They can't be predicted, but when they are positive, they ultimately alter the narrative and valuation of a stock. BlackBerry is one such stock that benefitted from a positive Black Swan in the recent Qualcomm case. No one can predict with certainty that it will enjoy such windfall of fortune in the future.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.