RE:Cobalt ...Dec 26, 2016 article. Two of the writers 5 recommendations.

Katanga Mining (TSXV:KAT) - Price = USD 0.085, CAD 0.12

Katanga Mining is a Swiss mining company (majority owned by Glencore) with copper and cobalt mines in the Katanga province of the DRC. It owns 75% of the mines, with partner Gecamines (Congo Government owned) owning 25%. It is reported to have by far the world's largest reserves of cobalt. According to the company website, "Katanga Mining Limited operates a large-scale copper-cobalt project with substantial high-grade mineral reserves and integrated metallurgical operations in the DRC. Our single-site operation, which comprises brownfield assets and new facilities under construction, will have one of the lowest unit production costs in the world, net of by-product credits." After closing in September 2015, the mine is now set to re-open in late 2017 or 2018, and is currently undergoing waste stripping and an $880 million upgrade to its processing plants, to significantly improve recoveries and operating unit costs when processing resumes.

I see the stock as very undervalued, due to the fact it is not currently in production, and the risks of doing business in the DRC. Katanga is a turnaround story and could be re-rated as soon as it recommences production. The stock price is around 10 times lower than where it was back in 2011 and 2012. If we see copper and cobalt prices move back to 2011 and 2012 levels, Katanga will be a multi-bagger. Katanga is currently my favorite cobalt stock, due to its massive resource, and current discounted valuation. It could also be another possible takeover target for the Chinese. Investors will need some patience and understanding of the risks of investing in companies mining in the DRC.

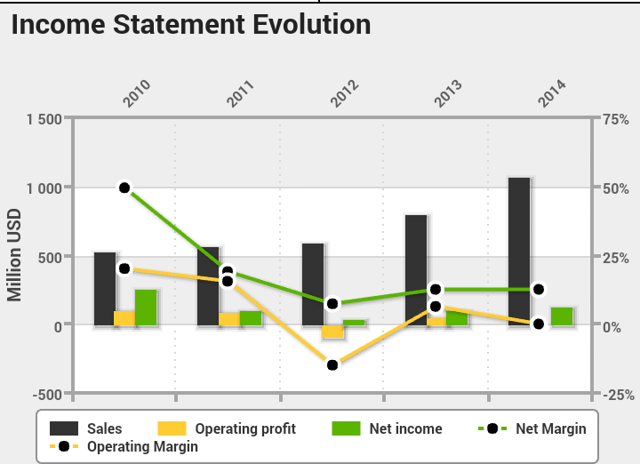

Currently, it is trading on a market cap of CAD 229m, with no 2017 PE. The chart below is not updated as mining was suspended in 2015. My very preliminary model (still being improved as no production numbers as guidance) has a price target of CAD 1.43 by end 2019. A high-risk, high-reward stock.

Katanga Mining financials graph

Source: 4-traders

Fortune Minerals (OTCQX:FTMDF) [TSX: FT] - Price = CAD 0.11

Fortune Minerals is a Canadian mining company with a very large cobalt-gold-bismuth-copper deposit (NICO) in the Northern Territories. Primarily focused on cobalt, it has excellent by-products, resulting in a negative estimated production cost of -USD5.03/lb of cobalt, net of by-product credits.

It has a large resource with 33m tonnes of proven and probable ore reserves, with 82.3m lb cobalt @ 0.11%, 1.11m oz gold @ 1.03g/t, 102.1m lb bismuth @ 0.14%, 27.2m lb copper @ 0.04%. NICO has the world's largest deposit of bismuth with 12% of global reserves.

Its 2014 FS resulted in a post tax 7% NPV of C$224 million, and an IRR of 15% pa. (base case price assumptions are US$1,350/troy ounce ("oz") for gold, US$16/pound ("lb") for cobalt (US$19.04/lb in sulphate), US$10.50/lb for bismuth (US$12.64/lb bismuth in average production of ingot, needles and oxide), and US$2.38/lb for copper at an exchange rate of C$1=US$0.88). It forecasts a 21-year mine life with 1,615 tonnes of cobalt pa (contained in battery-grade cobalt sulphate) production. Sensitivities were done at cobalt US$19/b (same gold and bismuth as above), resulting in a post tax 7% NPV of C350m, and a 19.0% IRR. You can read the full details here.

It also has exploration and production volume upside potential, with its NICO site and with its nearby Sue-Dianne copper-silver-gold deposit.

Its negatives are that its grade is lower (compensated by excellent by-product credits), it has a high CapEx (CAD 589m to build the mine and processing plants) as it plans to be a vertically integrated producer of the final cobalt product, and it is waiting on an all-weather access road to be built. I see these issues as very solvable, given the scale of its project, and the pressing need for cobalt, especially from a reliable source. The road is currently awaiting government approval now, with some news expected in early 2017.

Its main positives are its large resource, great by-products, negative cobalt production cost (net of credits), North American location, and non dependence on nickel or copper prices (a pure play cobalt miner). It will probably need a US$15-20/lb plus cobalt price to help get it financed and into production; however, I see that level of cobalt prices being very likely in 2017. You can read more on Fortune Minerals in my article here, or view its November 2016 company presentation here. Overall, I rate it as a speculative buy.

Currently, Fortune Minerals are trading on a market cap of CAD 29.8m, with no 2017 PE.