ADW.A data by YCharts

ADW.A data by YCharts

(All dollar amounts in the article are in Canadian dollars. Stock prices refer to Class A shares on the Toronto Stock Exchange. Due to liquidity, I recommend purchasing TSE:ADW-A shares (~35,000 shares daily volume) rather than Class B shares (~260 shares daily volume) or the US-listed ADR (~130 shares daily volume). Andrew Peller's fiscal year ends March 31 of the given year - FY2018 ended March 31, 2018.)

Summary

Andrew Peller (TSE:ADW-A) (TSE:ADW-B) (OTC:ADWPF) is a winemaker with attractive margin growth operating in a stable, low-growth wine market. The Canadian wine market has been growing steadily for the past 12 years (~5.4%/year), driven by growth in wine consumption/capita (~2.4%, grown in 11 of the past 12 years), wine prices matching inflation (~1.7%, grown in 11 of the past 12 years), and increasing population (~1.3%).

ADW investors have especially benefited from ADW's growing gross and EBITA margins which have led to the exceptional returns compared to the Canadian market illustrated above. Over the past decade, ADW's EBITA has grown ~6.5%/year and net income has grown ~10.2%/year. ADW pays a safe 1.2% dividend at a low payout ratio and has increased their dividend six straight years, at an average rate of ~9%/year.

Shares are not cheap compared to their historic multiples. However, based on a discounted cash flow, ADW shares provide attractive value when using low discount rates based on a low beta but are too costly with a higher discount rate.

The Business

(Andrew Peller Fact Sheet, Q1/19)

Andrew Peller is a Canadian winemaker which has a strong market position in English-speaking Canada. ADW has a market share of ~14% of the Canadian wine market (including both foreign-made and domestic-made wines), and ~37% of the domestic Canadian wine market. ADW owns a variety of brands and has wineries in British Columbia, Ontario, and Nova Scotia. ADW also produces and market winemaking products through its subsidiary Global Vintners and operates 101 retail wine stores in Ontario.

ADW is growing through the addition of new products and through acquisitions. In October 2016, they partnered with Wayne Gretzky to launch No. 99 Canadian Whisky. In October 2017, ADW acquired three premium wineries in British Columbia's Okanagan Valley (Black Hills, Gray Monk, and Tinhorn Creek) for a combined $95 million, using a combination of debt and equity to finance the purchases. These upscale wineries are part of management's belief that premium products will generate better margins and profitability than value-priced products:

"Over the long term the Company believes higher-priced premium wine and spirits sales will continue to grow in Canada, generating higher margins and increased profitability compared to its lower-priced products."Q1/19 Management's Discussion & Analysis

Wine is a Growing Market: ~5.4% Annual Growth

Andrew Peller makes substantially all of its sales in Canada, so its fortunes will be tied to those of the Canadian wine market generally.

"The market for wine in Canada continues to grow due to a movement toward the consumption of wine by young consumers who have adopted wine as their beverage of choice, an aging population that favours the more sophisticated experience that wine offers, and the reported health benefits of moderate wine consumption. The Company has focused its product development and sales and marketing initiatives by capitalizing on the trend of increased wine consumption and expects to see continued sales growth." Andrew Peller 2018 Annual Report

The Canadian wine market has been very consistently based on consistent growth in all three drivers - wine price/liter (growing ~1.7%/year, matching inflation), wine consumption/capita (growing ~2.4%/year), and Canadian population growth (growing ~1.3%/year).

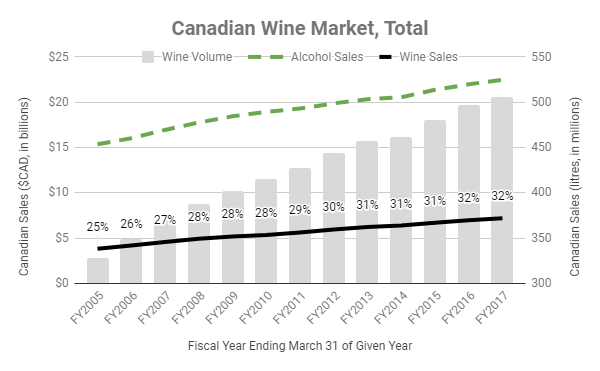

Annual figures from Statistics Canada (a government body) demonstrate this strong growth by all metrics since 2005.

(Author based on data from Statistics Canada; wine market share of alcohol sales listed)

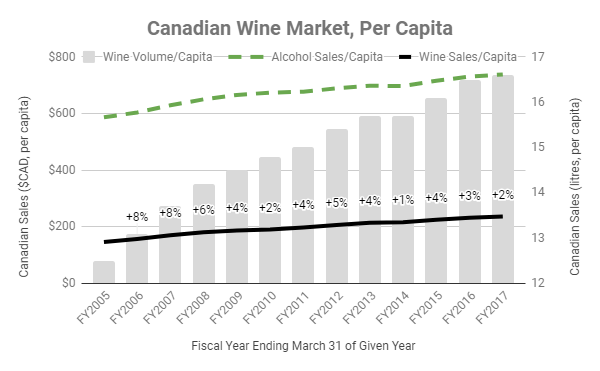

(Author based on data from Statistics Canada; wine market share of alcohol sales listed)

From 2005 until 2017, Canadian wine sales grew from $3.8B to $7.2B (~5.4%/year) while increasing their share of the Canadian alcohol market (by dollar value) from 25% up to 32%. In volume, Canadian wine sales increased from 328 million litres up to 505 million litres (~3.7%/year).

Meanwhile, wine price/litre grew from $11.63 to $14.22 in twelve years at a rate of ~1.69%/year - matching the Canadian consumer price index, which also grew at ~1.66%/year. The Canadian wine market is growing not due to rising prices - which merely match inflation - but due to higher wine consumption.

The growth in wine consumption is caused by both a growing population and by growing per capita consumption of wine:

(Author based on data from Statistics Canada; labels refer to wine spending per capita y/y increases)

From 2005 to 2017, wine sales per capita in Canada grew from $146/year to $236/year (~4.1%/year). In volume, Canadian per capita wine sales increased from 12.5 litres/year to 16.6 litres/year (~2.4%/year).

From the data, we observe that a majority (~76%) of the ~5.4%/year increase in wine sales is due to increasing per capita consumption rather than Canada's growing population (~1.3%/year during the relevant period).

Growth in the Canadian wine market has been extremely consistent, lending safety to an investment in Andrew Peller. Growth is based on three factors: population growth, price/litre growth, and consumption/capita growth. Based on the above data, wine price/litre has grown in 11 of the past 12 years (at an average of 1.7%/year). Meanwhile, wine consumption per capita has also grown in 11 of the past 12 years (at an average of 2.4%/year) and was flat in the year it did not grow.

At least two of these three drivers of industry growth are likely to continue to grow in the future. Based on past wine price/litre growth, it is fair to suggest that wine prices/litre will continue to match inflation. Similarly, the Canadian population is expected to continue to rise - Statistics Canada projected growth of ~0.5% to 1.3%/year for the next decade back in 2015. Future wine consumption/capita is unknown, although studies continue to tout the health benefits of wine.

ADW's Revenue Growth And Profitability

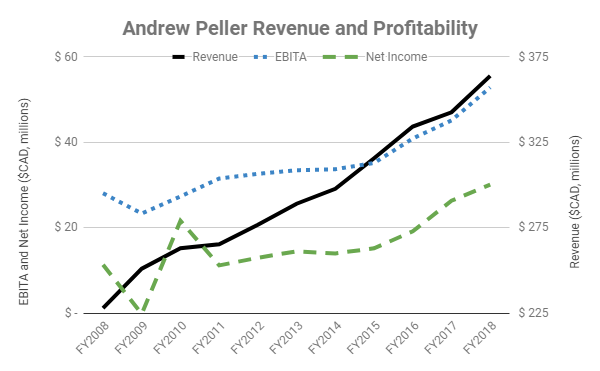

(Author based on data from 2018 Annual Report; past years restated and EBITA/net income sometimes excluding one-time costs)

ADW has been quite consistent over the past decade. Since FY2008, ADW's revenues have increased every year, growing from $228M to $364M (~4.8%/year). ADW's revenues grew slightly faster in the overlapping portion than the Canadian wine market as a whole: From FY2008 to 2017, ADW grew revenues 4.6%/year while the Canadian wine market grew at 4.3%/year.

ADW has also grown EBITA and net income at strong rates during this span: EBITA has grown to $53M in FY2018, up ~6.5%/year, and net income has grown to $30M in FY2018, up ~10.2%/year.

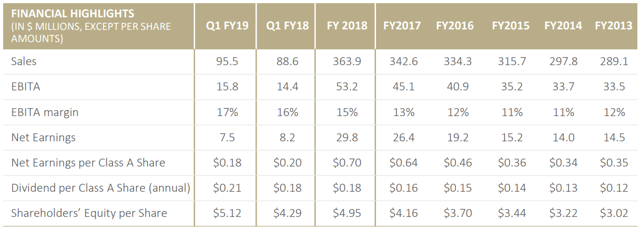

(Andrew Peller Fact Sheet, Q1/19)

Growth has been particularly impressive since FY2015 results (in June 2015) have been impressive. Shareholders have more than tripled their money while the broader Canadian market has only returned ~10% (see YCharts above).

Those heightened returns are not the result of increased risk: ADW is a low-beta stock with a beta of 0.2. Instead, ADW's returns are based on continued sales growth (~5%/year since FY2015) and margin growth (gross margins up 5.7pp and EBITA margins up 3.5pp since 2015).

Both of these trends continued in Q1/19 (ending June 30, 2018).

| (in $CAD) | Q1/19 | Growth (y/y) | Growth (trailing) |

| Sales | $ 95.5M | 8% | 8% |

| Adjusted EBITA | $ 17.9M | 24% | 32% |

| Adjusted EBITA Margin | 18.8% | +247 bps | |

| Adjusted Earnings | $ 9.7M | 18% | 22% |

| Adjusted Earnings Margin | 10.2% | +87 bps | |

(Author based on company filings)

In Q1/19, ADW grew revenue by 8% (both y/y and trailing), with sales growth due primarily to the contribution of the three premium wineries purchased in October 2017. Looking forward, ADW expects sales growth will continue:

"The Company believes that sales will grow going forward due to strong positioning of key brands, the continued launch of new and innovative products in the Canadian wine, cider and spirits markets, continued growth in new wine-related markets, and the full year's contribution from the three estate wineries acquired in October 2017." Q1/19 Management's Discussion & Analysis

In Q1/19, ADW also continued their trend of margin expansion. The company typically prefers to use adjusted EBITA and adjusted earnings (excluding one-time items) as their metrics of choice. ADW's adjusted EBITA rose to $17.9 million in Q1/19, up 24% y/y and 32% trailing. ADW's adjusted earnings rose to $9.7 million for Q1/19, up 18% y/y and 22% on a trailing basis.

Adjusted EBITA and earnings were higher than IFRS figures due primarily to the acquisition of three B.C. wineries last October. At that time, ADW added $10.4 million in inventory to represent the fair value of goods acquired. That increase is being expensed over time, resulting in a $2.1 million expense item in Q1/19 which is removed from ADW's adjusted figures. On an unadjusted basis, EBITA increased 9.3% and net income dropped $0.6 million y/y (due to the $2.1 million charge).

Both adjusted EBITA and adjusted earnings margins are up y/y, with gains of ~250 bps and ~90 bps, respectively. The company highlighted a few reasons for these margin improvements:

"Gross margin in fiscal 2019 has benefited from the rationalization of lower performing products, an increased focus on higher margin products, and the positive impact of the Company's cost control initiatives. Management is continually focused on efforts to enhance production efficiency and productivity as well as developing synergies from the addition of the three new wineries acquired in October 2017."Q1/19 MD&A

Dividend And Balance Sheet

ADW's dividend is safe and should continue to increase. ADW has enough credit capacity to run their business and their debt levels are well within reason with an interest coverage ratio that implies an investment-grade bond rating.

ADW has a two-class share structure with Class A shares receiving 15% higher dividends than Class B shares but foregoing the right to vote. Class B shares can be converted into Class A shares, but I will focus on Class A shares since they are 100x as liquid, by volume.

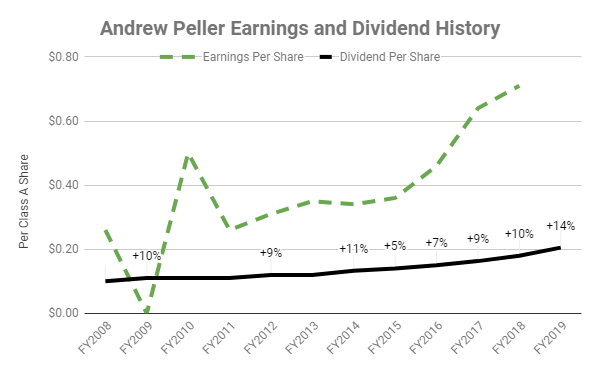

ADW has paid dividends since 1979 and has increased their dividend for six consecutive years. Since FY2008, below, ADW's dividend has been well-covered by earnings - EPS has exceeded DPS in every year but one with a cumulative payout ratio is 34%. Cumulatively, dividends have been increased 105% in the past 11 years (6.7%/year) or 71% in the past six years (9.3%/year).

ADW announced a 13.9% dividend increase in Q1/19, up to $0.2050 per Class A share annually (~1.2% forward yield).

(Author based on company filings, labels are percentage dividend increases)

ADW has increased their dividend by an average of 9% since 2013, with the most recent two increases being the largest. During the same time, ADW's payout ratio has declined from 34% to 26%. This low payout ratio implies safe dividends for investors and high chances of future dividend increases.

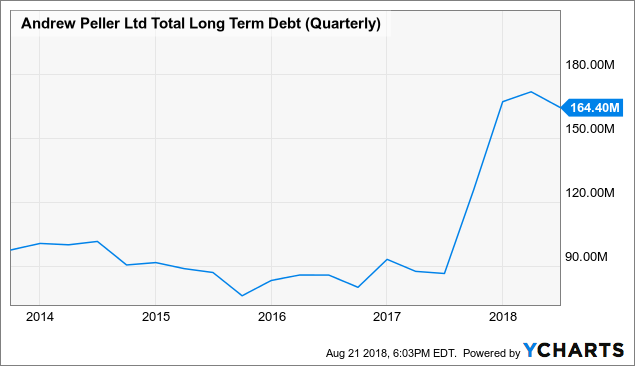

ADW.A Total Long Term Debt (Quarterly) data by YCharts

ADW.A Total Long Term Debt (Quarterly) data by YCharts

ADW has no cash on their balance sheet and instead operates using a credit facility from a bank. ADW took on additional debt in 2017 to purchase the three B.C. wineries but has been paying down their debt otherwise - paying off $21.3M between 2013 and Q1/18 and paying off $7.3M in the Q1/19.

ADW's debt levels are very manageable with an interest coverage ratio that implies an investment-grade company.

Last quarter, ADW paid $2.0M in interest, or $7.8M on an annual basis (ADW paid less interest than that trailing but took on a lot of debt during that time). ADW's debt is held with a bank at an interest rate of CDOR+1.9% (up from CDOR+1.25% last year). Over the past twelve months, ADW has had debt of ~$143M (average) and paid $6.5M in interest, for an effective rate of ~4.6%.

During the last 12 months, ADW has earned an operating profit of $41.8M (and about $6M more if you adjust for one-time costs). This implies an interest coverage ratio of 5.3x - ADW has easily enough EBIT to cover their interest costs. According to the methodology of Aswath Damodaran, this interest coverage ratio implies a bond rating of ~A3 or A-, well into investment grade.

ADW has well enough profits to pay interest on their debt and will have little trouble paying down their debt while continuing to increase their dividend. ADW's credit facility are not at their maximum: ADW has a borrowing limit of $310M with $90M to be used for day-to-day expenditures and $220M for acquisitions or capital expenditures. At the end of March, ADW had a credit capacity of $43M on their operating facility and $95M on their investment facility and debt has declined $7.3M since then.

Valuation

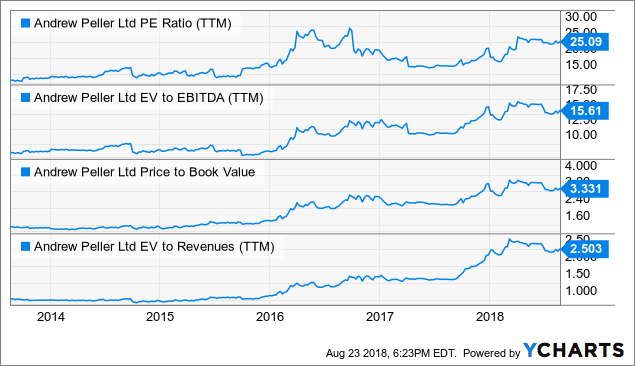

ADW.A PE Ratio (TTM) data by YCharts

ADW.A PE Ratio (TTM) data by YCharts

ADW looks expensive compared to its historic multiples. Each of its PE Ratio, EV/EBITDA, P/Book, and EV/Revenue are elevated from their levels in 2017, much less from 2014 to 15 levels.

These higher multiples are easily explained by growth:

| | FY2014 | FY2015 | FY2016 | FY2017 | FY2018 | Trailing |

| Earnings y/y | -3% | 9% | 26% | 37% | 14% | 14% |

| Adjusted Earnings y/y | | 10% | 32% | 26% | 14% | 22% |

| EBITA y/y | 1% | 4% | 16% | 10% | 17% | 21% |

| Adjusted EBITA y/y | | | | 13% | 24% | 32% |

(Author's estimates based on company filings)

Since 2016, ADW has been able to grow their earnings and EBITA - adjusted and unadjusted - at much quicker rates than they had prior. Growth isn't cheap, as attested to by ADW's higher multiples than their five-year averages on both IFRS and adjusted levels:

| (Trailing) | FY2014 | FY2015 | FY2016 | FY2017 | FY2018 | 8/23/18 | 5yr Avg |

| P/E | 14.5x | 16.4x | 19.6x | 17.6x | 26.4x | 25.6x | 18.9x |

| EV/EBITA | 9.4x | 9.6x | 11.3x | 12.2x | 18.3x | 16.9x | 12.2x |

| P/Adjusted E | 14.6x | 16.2x | 18.5x | 18.1x | 27.1x | 24.5x | 18.9x |

| EV/Adjusted EBITA | | | 11.3x | 11.9x | 16.9x | 15.1x | 13.4x |

(Author's estimates based on company filings, at price of $17.06/share and counting Class B shares equally)

ADW trades at a price-to-adjusted earnings multiple of ~25x, well over its five-year average of ~19x. However, ADW also offers trailing adjusted earnings growth of 22%, leading to a PEG ratio that implies shares are priced fairly. Similarly, ADW's EV/EBITA (trailing, adjusted) is ~15x, over the three-year average of ~13x. As with earnings, adjusted EBITA is growing quickly - at 32% over the past year - meaning that this multiple is well-deserved.

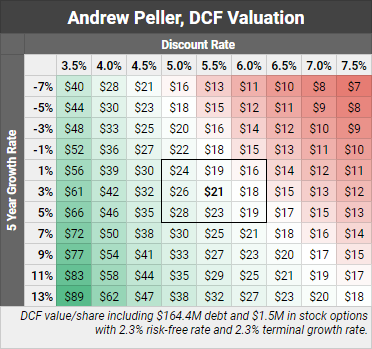

Based on a DCF analysis, I value shares of ADW at ~$21, based on a 5.5% discount rate and a 3% growth rate. This is ~24% above the $17 market price.

ADW's revenue growth is made up of three components - population growth, inflation, and wine consumption growth. We can safely expect two of those to continue to grow, while wine consumption/capita growth is unclear. Because of that, I expect a growth rate of ~3%. While margins have expanded in the past, there's an upper limit to how far those expand, so profit growth is going to have to come from revenue growth.

As above, ADW's debt carries and interest rate of ~4.6%. Given ADW's two-year tax rate of 25%, this implies an after-tax cost of debt of 3.4%. ADW is a low beta stock, with a beta of 0.2 on Yahoo Finance, making a low 6% cost of equity appropriate. At an 18% debt and 82% equity at market prices, this results in a discount rate of 5.5%.

All values in this table are based on a two-step discounted cash flow, with a five-year growth rate given on the left and a discount rate given along the top. All values use a 3% of revenue reinvestment rate (matching past reinvestment rates), a 2.3% risk-free rate and terminal growth rate, and include $164.4 million in debt and ~$1.5 million in outstanding employee stock options.

Takeaways

ADW is a stable company which operates in a steadily-growing Canadian wine market. Growth rates here aren't huge, but they are very steady, with wine prices and consumption both steadily rising in Canada. ADW has benefited from this and has also been able to increase their margins as they rationalize their product line, control costs, and move into more upscale products.

Shareholders have benefited richly over the past few years and will continue to benefit for as long as ADW can continue to grow their revenue and margins.

I value shares at ~$21 or about 24% over their closing price on Friday. ADW is an attractive holding for investors who are looking for Canadian dividend stocks in safe industries - unlikely to fare too poorly in any economy, good or bad.

Happy investing!

Did you enjoy this article? Please consider giving me a "Follow" or "Like" this article. I also welcome all constructive feedback in the comments below. Thanks for reading!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.