RE:RE:RE:approaching the end of Q2 FLYHT: SaaS For Airlines, And The Most Extraordinary Acquisition I've Seen

Summary

A leader in airline SaaS and the only company providing real-time transmission of black box data.

Currently has over $62 million backlog (with $33.1 million added in 2018).

Recently executed a truly extraordinary acquisition, doubling their revenue (among other benefits).

Yet it carries a market cap of only $25 million, and is barely trading off its all-time lows.

(from FLYHT website)

(from FLYHT website)

[NOTE: The main sources of information for the article are FLYHT's 2018 MD&A (the Canadian equivalent of a 10-K) and its 2019 Q1 Report.]

FLYHT Aerospace Solutions' (OTCQX:FLYLF) (FLY on TSX) core offering is AFIRS, a device installed on aircraft that monitors hundreds of essential functions from the aircraft. That includes data recorded by the flight data recorder. AFIRS uses satellite networks on FLYHT’s UpTime servers to send this data in real-time to customers (airlines and other air carriers).

So if you’ve ever watched televised coverage of the search for a downed plane’s black box and wondered, “Don’t they have Internet?,” it is actually available—by (and only by) FLYHT. However, as with much in the airline industry, the pace of adoption has been glacial.

FLYHT, with its AFIRS technology, have been around for a while. Its stock price peaked (~7.5) in 2014 over early excitement about its technologies. It has since been gaining market share and developing its products. As its stock price has been continually declining from that high. Industry standards had to change to make FLYHT more necessary, and frankly it seems they needed to offer a suite of services that would offer airlines increased profitability, flight-by-flight, in addition to increased safety. In both regards, dramatic steps forward have been made and further are in process.

Greatest Acquisition Ever

The company turned a corner on October 10, 2018 with an acquisition that the market has yet to digest, or I think really even understand—likely because it is hard to believe. It wasn't until I had a call with the CEO that I was sure I understood the terms correctly.

The background necessary to understand this acquisition is that the counterparty, Panasonic Avionics, was devastated by a bribery probe. New management came in to try to find new homes for areas of the business, along with their contractual commitments and the employees working in those areas. FLYHT was deemed (by both parties) to be uniquely well suited to take on the business and operational functions of Panasonic Weather Solutions (“PWS”). (This article from Avionics International offers a clearer sense of the value of the acquisition, versus FLYHT’s release announcing it.)

Another key factor was that Panasonic (“PAC”) was never able to make money with PWS. They tried to sell weather forecasts, competing with government agencies. FLYHT is instead selling the raw data, to those government agencies (and other clients). FLYHT integrated it with their other system-monitoring hardware, allowing aircraft to anticipate conditions that will cause wing icing and other issues.

So if you read management’s explanation of the acquisition and think, “it sounds like PAC is paying FLYHT to acquire PWS,” you are correct. PAC will pay FLYHT subsidies totalling USD$3.3 million (potentially $4.3 million) “to keep the asset acquisition cash-flow neutral” and help ensure successful integration. That it despite the fact that in addition to acquiring their licenses, tech, and employees, FLYHT also acquired $20 million in contracts from PAC that immediately doubled their revenue while providing a new long-term revenue stream that is highly complementary to their existing business.

So, to reiterate, “FLYHT is paying no monetary consideration to PAC for the PWS assets.” Nor are they giving PAC any FLYHT stock (so the acquisition is also non-dilutive). Nor is FLYHT assuming any liabilities. But even though as far as I can see this acquisition basically doubled the value of FLYHT stock by most metrics, and allowed to company to grow in other important ways—including turning it profitable—FLYHT stock is only about $0.50 off its all-time lows.

Additionally, FLYHT currently carries over USD$62 million in contract backlog, with $33.1 million added in 2018. Yet it only has a market capitalization of USD$23 million. FLYHT's backlog promises a very long-lived stream of recurring revenue that exceeds that capitalization.

The kind of pricing error we are seeing in FLYHT is something you can only find in microcaps, where there is no analyst coverage (thought there has been some buzz (and here, here). It is an example of why I focus on microcaps, and a perfect example of what I look for in the microcap market.

FLYHT hardware is most often (to date) retrofitted into existing aircraft. Those aircraft typically already have connectivity that is focused more on revenue-generating customer connectivity (a big money area, with big money companies--such as Panasonic). FLYHT’s data transmission services are supplementary and focus more on the cockpit and operations.

Panasonic is the leader for customer and entertainment-oriented data connectivity in airlines. FLYHT is a leader in connectivity for safety and operations. That PAC and FLYHT will most likely continue working together after the acquisition integration period is over (in 2020) has been mentioned in discussions of the acquisition. Partnership with such an industry dominant company is another benefit of this acquisition. (FLYHT is already partnered with L3-Communications.)

A Little More on the Company

FLYHT management is a very impressive team of airlines industry veterans. The CEO, for instance, previously held senior-level engineering positions with L3-Communications, AirNet Communications, and Harris Corporation, after serving as a Captain in the Army Corps of Engineers. (Here is a recent interview with the CEO.)

Nina Jonsson, previously SVP at Air France-KLM, was recently appointed to the BOD.

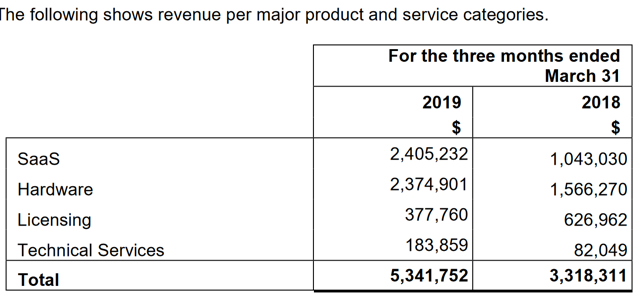

Airline customer connectivity has become the norm, and the industry is moving toward fully connected cockpits and safety/operational systems. FLYHT is a leader in the latter area and will benefit greatly from this final move to the fully connected aircraft. Software-as-a-service is their fastest growing category of revenue. Q4 2018 SaaS revenues increased 126% YoY (against Q4 2017) and 97% versus Q3 2018 (thanks in part to the PWS acquisition).

Q1 2019 SaaS revenues increased 130% YoY against Q1 2018.

(Revenue By Category, from FLYHT's Q1 2019 Report)

(Revenue By Category, from FLYHT's Q1 2019 Report)

The growth through much of 2018 was offset by a decline in licensing revenue. SaaS has now displaced licensing as the company's primary source of recurring revenue.

Q1 2019 hardware shipments exceed last year’s shipments by 52%.That is more important longer-term, as every AFIRS unit installed generates long-term recurring SaaS revenues (at roughly USD$1000 per month).

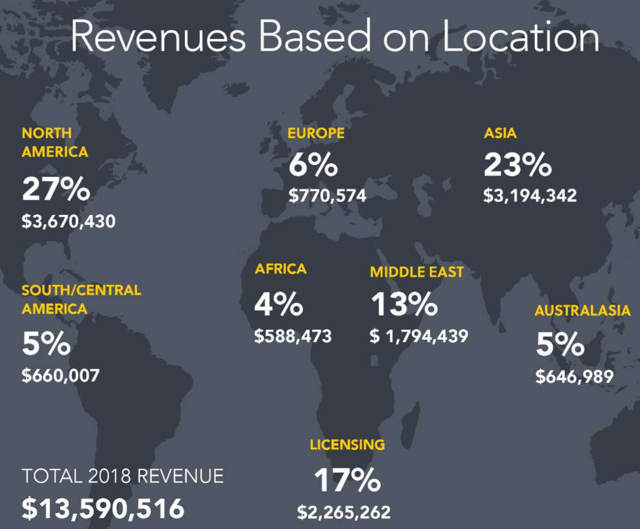

The company’s business is global, with the largest share in North America. China is their fastest growing area and represents the largest share of FLYHT’s current backlog. That is in part because China’s airline industry is growing quickly, and in part because of Chinese government mandate CCAR 121 R5, which requires all domestic aircraft to have Satcom-based voice communications and 4-minute responsiveness by the end of 2019. FLYHT products meet these requirements. That will be a major driver in growth for hardware and SaaS revenues throughout 2019.

(FLYHT revenue by geographic area in 2018, from FLYHT's 2018 Annual Report. The great majority of revenue in Asia is from China.)

(FLYHT revenue by geographic area in 2018, from FLYHT's 2018 Annual Report. The great majority of revenue in Asia is from China.)

It is important to note that the International Civil Aviation Organization (ICAO) adopted Amendment 40 to Annex 6, which institutes similar requirements internationally by the end of 2020. One key requirement is that airlines be able to recover flight data recorder information in a timely manner. As the only provide of "Black Box in the Cloud," FLYHT products best meet that requirement. FLYHT’s level of service offering will still exceed industry standards, but the confluence of rising regulations and improving services is pushing it toward being the standard in airlines.

FLYHT recently successfully completed trials with Boeing and Embraer to prove the ability of its services to meet those standards. FLYHT was also the first company approved by Inmarsat’s CAP program, which certifies the effectiveness of its services on Immarsat networks.

The minuscule margins airlines operate under were another reason for the slow adoption pace for FLYHT’s services, as was the price of satellite data transmission. Satellite transmission prices continue to fall at a dramatic rate, allowing FLYHT to add services and even begin testing continuous transmission throughout flights.

More importantly, FLYHT’s basket of services is now a considerable driver of cost savings for airlines. FLYHT’s other services allow airlines real-time monitoring of fuel-use efficiency. Another key value-driver is the real-time monitoring of critical systems, which allows airlines to prepare necessary maintenance while the plane is still in-air. Faster maintenance means more time in-flight (versus on the ground).

(Description of AFIRS services, from 2018 MD&A)

(Description of AFIRS services, from 2018 MD&A)

FLYHT’s acquisition of PWS included the latter’s Tropospheric Airborne Meteorological Data Reporting (TAMDAR) weather sensor, along with 200 revenue generating TAMDAR units and TAMDAR contracts with AirAsia, which is now FLYHT’s largest single client. All TAMDAR units contribute to FLYHT’s USD$15 million contract with the National Oceanic and Atmospheric Administration (NOAA). (FLYHT also sells the weather data to Synoptic Data PBC.)

The weather sensors allow every airplane to function as a weather balloon. Indeed the goal is to have them largely replace weather balloons. Now that the sensors are combined with FLYHT’s UpTime real-time satellite transmission, FLYHT is now able to sell real-time weather data. Revenue from the sale of weather data is included in SaaS revenue, as is all revenue gained from the data collected by FLYHT hardware.

It is important to note that FLYHT can sell, and is selling, that weather data to multiple clients. Its use to weather services is established, and its value to airlines is rapidly becoming established as well.

Conclusion

The developments within the company and within the airline industry have already given FLYHT its first two consecutive quarters of positive earnings (Q4 2018 and Q1 2019). That is the most important corner for the company to turn. It did win interest-free loans (from the WINN (Western Economic Diversification Canada for a Western Innovation) program) and has the subsidies from PAC to work through. Those subsidies should keep earnings positive through 2019. But FLYHT's ability to continue operations longer term without diluting equity does depend on the company generating increased positive cash flow in 2010. It also has $2.7 million in cash, and once FLY.V trades over $1.80 for 20 consecutive trading days it can force conversion of outstanding warrants, generating CAD$1.1 million.

FLYHT's result from operations in Q1 2019 was negative USD$820,960 (the PAC subsidize played a large role in pushing earnings positive). They are currently growing revenues rapidly, and their backlog suggests they will continue doing so. And they have the support of the aerospace industry. But it is not clear that they can reach profitability without another capital raise (or even multiple capital raises).

That said a a $5 million capital raise would certainly not be the end the world, especially if the stock is trading at significantly higher levels (which I believe it most certainly will be, and very soon). It could use the additional liquidity. The most important thing is that they continue growing revenue, and progressing toward profitability without needing to scale back administrative costs or R&D.

The company just had two quarters of ~100% YoY revenue growth. It will take FLYHT several years to work through its current contract backlog of USD$62 million (while it will be adding to its backlog, most likely at an increasing rate). That is where the slow rate of change in the airline works to its advantage. Their hardware is generally installed with a five-year contract, but that contract is generally extended through the life of the plane—30 years is a good estimate. Through that 30 years FLYHT will receive recurring revenue of roughly USD$1,000 a month for every installed AFIRS unit, in addition to what they earn from the TAMDAR weather units (variable now, as most TAMDAR revenue currently comes from the NOAA contract).

That continually growing SaaS revenue carries gross margins ranging from 70-85%.

FLYHT peaked at over $7.5 in 2014 with early excitement regarding its technology. That peak was actually two weeks after the Malaysian Air crash (and during the nonstop coverage of the search for its black box). After the expected onslaught of contracts didn’t immediately materialize, disappointed shareholders drove the price down for the next four years--until December 21 of 2018, when it hit USD$0.68 a share. They even continued to sell after the extraordinary PWS acquisition was announced. It took the positive Q4 2018 earnings to stop the downtrend, and a second consecutive positive earnings announcement in Q1 to begin an uptrend. This stock is trading for less than 3X Q1 revenue--but with a lot of negative sentiment sitting on top of it.

(FLYHT weekly chart, from TradingView)

(FLYHT weekly chart, from TradingView)

If historic patterns hold, FLYHT should be releasing 2Q earnings in the first week of July. With the very reasonable assumption that it will also show positive earnings, that should give it the stock its next bullish bump...and perhaps the momentum it deserves.

Other Risks

No other company offers the “Black Box in the Cloud" service, but others do offer connectivity solutions for the cockpit. Collins Aerospace is the closest competitor I can find. This article discusses FLYHT's data generation in comparison to that of several competitors. Having their China business be such a key driver of near term growth would seem to be a risk to FLYHT (though the upcoming international ICAO regulations are a much bigger deal or FLYHT's future). But as they have operations in China (and generally outside the United States), tariffs shouldn’t be an issue. And FLYHT’s technologies are protected under Chinese patents. It does seem odd to me that China would enact regulations that push a foreign company into a near-monopoly position, but that is currently where things stand.

Disclosure: I am/we are long FLYLF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.