Calgary, Alberta--(Newsfile Corp. - December 5, 2019) - Bonavista Energy Corporation (TSX: BNP) ("Bonavista" or the "Company") is pleased to announce the acquisition of certain oil and liquids rich natural gas weighted properties (the "Acquired Assets") located within our West Central Alberta core area (the "Acquisition") which are synergistic to our existing operations, complementary to our development plans and accretive to our debt leverage.

The transaction closed on December 4th, 2019 with an effective date of November 1st, 2019. The purchase price of $53.3 million, which is subject to customary post-closing adjustments was funded through our existing bank credit facility in addition to adjusted funds flow.

image: https://orders.newsfilecorp.com/files/1742/50440_8030adc804d29938_002full.jpg

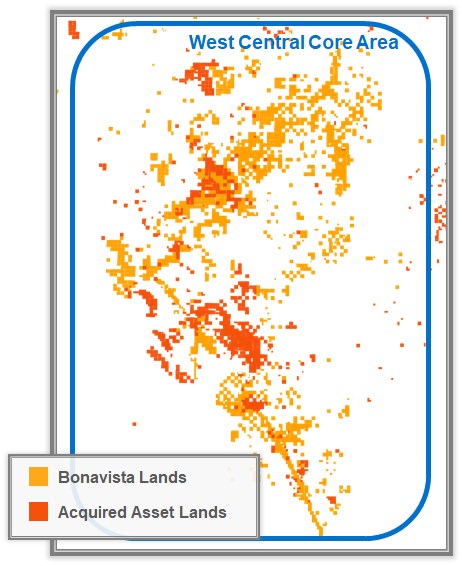

Map 1: West Central Core Area

To view an enhanced version of Map 1, please visit:

https://orders.newsfilecorp.com/files/1742/50440_8030adc804d29938_002full.jpg

TRANSACTION HIGHLIGHTS

This asset acquisition is consistent with Bonavista's strategy to concentrate our portfolio in two core areas in Alberta. Our consolidation efforts have led to sustainable and scalable low-cost operations in our core areas with numerous profitable and predictable development opportunities. The Acquired Assets reside in our West Central core area where we operate numerous oil and natural gas processing facilities, over 70,000 horsepower of natural gas compression and nearly 3,200 kilometers of pipeline infrastructure. In August 2019, average production from the Acquired Assets was 8,900 boe per day (41% oil and natural gas liquids ("NGL")) with a moderate annual production decline of 20%.

The Acquired Assets include ownership in approximately 500 net sections of mineral rights most of which are located in close proximity to Bonavista's existing land position. Approximately 60 net horizontal drilling opportunities have been identified, some of which are extended-reach locations adjacent to our existing lands, enhancing the economic value of the combined drilling spacing unit. The Acquired Assets will have a nominal impact on Bonavista's corporate LMR ratio decreasing it by approximately eight percent to 3.4. Given our significant presence in the area, acquired liabilities will be efficiently managed through our existing area-based closure programs and will result in a modest increase of incremental capital allocation to our annual abandonment and reclamation program in future years.

TRANSACTION BENEFITS

-

Enhances the quality, efficiency and sustainability of our West Central core area with the addition of a low decline, predictable production base estimated to average 8,200 boe per day in the first quarter of 2020, weighted 44% towards oil and NGLs and generating an average operating netback of $11 per boe based on forward commodity prices as at November 19, 2019.

-

Scales up our developed and undeveloped position in the Glauconite formation in central Alberta which is accretive in oil and NGL composition to our corporate production and will be instrumental in enhancing profitability within the core area.

-

With approximately 80% of the acquired production flowing through operated infrastructure, we will immediately align and optimize operations within our West Central core area with the potential to reduce operating expenses on the Acquired Assets by an estimated 30% in 2020 when compared to 2019.

-

Development opportunities that complement our existing opportunities resulting in the allocation of between $30 to $35 million of exploration and development capital spending per year on the Acquired Assets over the next two years. This is expected to generate approximately $80 million of adjusted funds flow over the next 24-month period based on forward commodity prices as at November 19, 2019 on the Acquired Assets.

RESERVES

| | Natural Gas | Oil and Natural Gas Liquids | Total |

| | (Bcf) | (mbbls) | (mboe) |

| | | | |

| Proved Producing (1,2,3) | 58.9 | 7,202 | 17,015 |

| Total Proved (1,2,3) | 99.8 | 13,681 | 30,308 |

| Total Proved plus Probable(1,2,3) | 153.8 | 21,806 | 47,432 |

Notes:

- Reserves are working interest reserves prior to the deduction of royalties and including royalty interests.

- Reserve estimates are based on McDaniels & Associates Consultants Ltd.'s ("McDaniels") reserve evaluations dated June 7, 2019 and effective June 1, 2019 prepared in accordance with NI 51-101 and the COGE Handbook.

- The estimates of reserves for individual properties may not reflect the same confidence level as estimates of reserves for all properties, due to the effects of aggregation.

OUTLOOK

This Acquisition is another meaningful step in strengthening our asset portfolio by improving the sustainability in our West Central core area. The Acquisition increases our inventory of predictable and profitable drilling opportunities and provides incremental operating scale enabling continued cost reductions and heightened profitability in this unpredictable commodity price environment. Ultimately, the synergies created by the proximity of the Acquired Assets to our existing operations will lead to continued improvements in both capital and operating efficiencies, augmented development opportunities and enhanced long-term shareholder value.

With the addition of the Acquired Assets to our portfolio, Bonavista anticipates corporate production to average between 65,000 and 67,000 boe per day in the first quarter of 2020. Notwithstanding recent strength in natural gas and NGL pricing, we will remain prudent with our development plans for 2020 and spend within adjusted funds flow to allow for the continued focus on reducing net debt. Capital spending of between $40 and $50 million on our corporate exploration and development program is currently planned for the first quarter of 2020.