Deep Value In H&R's Portfolio https://seekingalpha.com/article/4369962-deep-value-in-h-and-rs-portfolio?utm_medium=email&utm_source=seeking_alpha&mail_subject=hruff-deep-value-in-h-r-s-portfolio&utm_campaign=rta-stock-article&utm_content=link-2

Deep Value In H&R's Portfolio

H&R released its Q2 results and it marked down the fair values of its properties.

The market still continues to price the shares at a 50% discount to the marked down NAV as if it were a currency peg.

We analyze the results and provide our take.

I do much more than just articles at High Dividend Opportunities: Members get access to model portfolios, regular updates, a chat room, and more. Get started today »

All values are in CAD unless noted otherwise

Prior to February 2020, a "diversified" REIT bought a smile to every real estate investor's face which outlasted their waking hours well into their dreamy nights. Those were simpler times. Now investors immediately whip out their calculators to discount the office and retail portions of any diversified REIT portfolio. And then discount it again, because you know, for an extra margin of safety. Majority of the previously office going workforce is working from home with no end in sight. Malls have reopened but are not operating at the same scale or popularity as the days of yore. We cannot blame investors for being afraid of the two real estate sectors. When it's your hard earned money on the line, it is tough to trust analysis contrary to what you fear.

Most of the second quarter was the epicenter of the pandemic impact. A previously exalted diversified REIT released its Q2 results recently. This REIT's diversification is tilted in favor of the aforementioned two less favored sectors. Today, we analyze this REIT in light of the financial results for one of its most turbulent quarters and see if we can still find value in this investment. We personally own this one, so the decision to be made is should we hold on to it, add to our position or cut our losses and get out of dodge?

The REIT

H&R Real Estate Investment Trust (OTCPK:HRUFF) is one of Canada's largest real estate investment trusts that owns and operates office, retail, residential and industrial properties in North America.

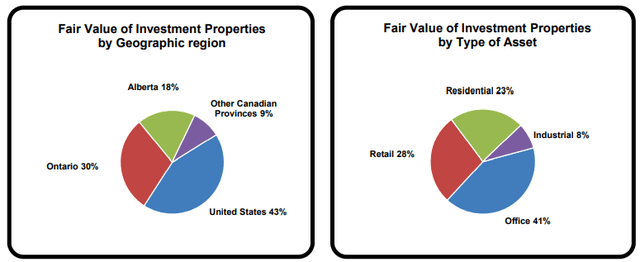

Source: Q2-2020 Report

These values are based on Q2-2020 numbers and as one can see, residential and industrial assets provide very little support to the company's balance sheet.

2020 IFRS Fair Value Adjustments

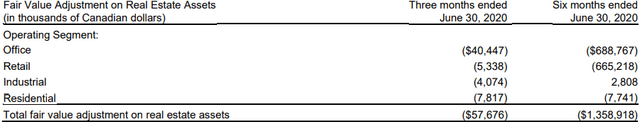

H&R proactively wrote down the fair value of its properties to reflect the impact of the pandemic on property values along with the impact of the turmoil in the energy sector on the credit quality of its related office tenants. Its industrial properties had a minor mark up, whereas the decline in residential was less than a percent of the total markdown in this year.

Source: Q2-2020 Report

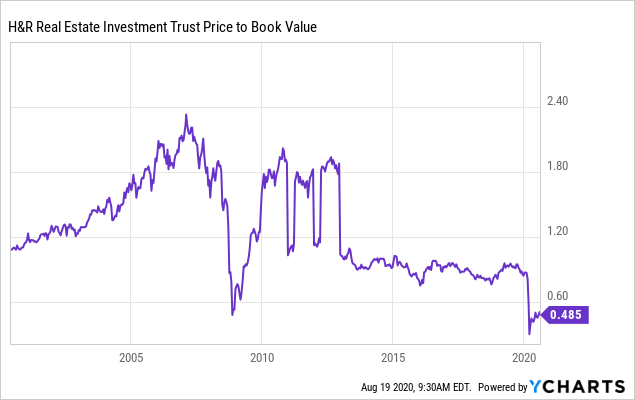

The biggest source of the write-down is the movement in rates being used to discount the cash flows. The current market is characterized by wide bid-ask spreads and even trophy assets would not sell easily. That said, we have to note that H&R trades at a 50% discount to even this downtrodden NAV.

Data by YCharts

Data by YCharts Rent Collection

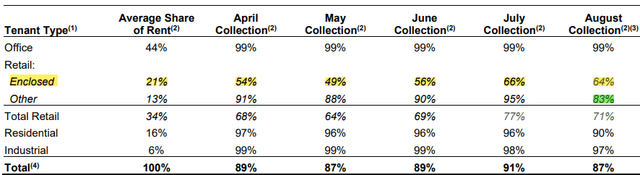

The office, residential and industrial sectors have performed spectacularly in terms of rent collection. On the office side, 86.6% of H&R's tenants are investment grade and hence this should not come as a surprise.

Source: Q2-2020 Report

H&R's grocery-anchored centers and single tenant buildings have also shown month on month improvement to a 95% collection in July. The August collections (83%) were still ongoing at the time of the results and as such exclude rent from its government tenants which are only collected at month end.

The enclosed retail space was the most impacted due to COVID-19 with most tenants only resuming operations by end of June. Subsequently, July has shown improvement, whereas August appears to be stronger with it already at 64% by mid month. The rent collection for the distressed retail segment continues to be aided by the government program CECRA. This program provides a rent subsidy to the tenant, while enabling the landlord to collect 75% of the outstanding rent. This magic is accomplished with government funds bridging the gap between the two [government pays 50%, tenant pays 25% and the landlord takes a 25% haircut]. Overall this appears headed in the right direction but tenants will struggle as long as the big draw of many enclosed malls, movie theaters, remain closed for business.

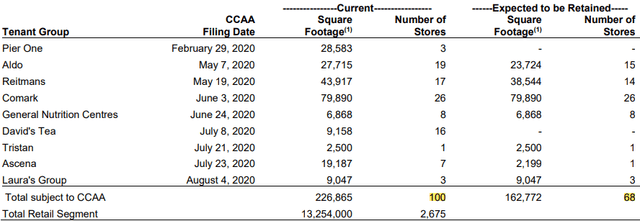

Retail Store Closures

H&R is facing 47 store closures as the following tenants have filed for creditor protection under the CAA. Missing from the list below is the retailer, Le Chateau, that intends to close 13 locations and is in talks with the management at the time of the results:

Source: Q2-2020 Report

While H&R has accounted for the store closures in its provisions for bad debt expense to June 30. We expect this number to increase to account for the store closures that happened after Q2, as evident in the above table.

Distributions

H&R slashed its distribution by 50% effective May in order to retain liquidity in order to combat income interruption and invest in their properties without increasing their financial leverage. Currently, the REIT yields 6.7% and with an AFFO payout ratio of 60% [0.69 annual distribution and Q2 AFFO of 29 cents annualized], we do not expect a cut unless there is a retail apocalypse.

This one gets the lowest danger level rating on our proprietary Kenny Loggins Scale.

A low danger rating implies a less than 15% probability of a dividend cut in the next 12 months.

A low danger rating implies a less than 15% probability of a dividend cut in the next 12 months.

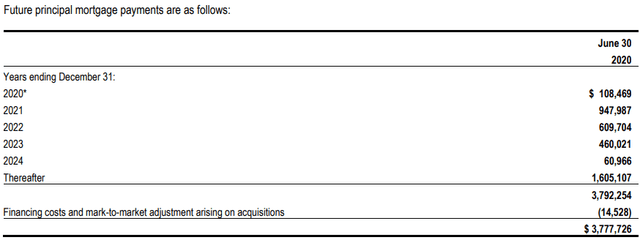

Debt and Liquidity

As the end of Q2, the REIT had $108 million of principal repayments due for the balance of 2020:

Source: Q2-2020 Report

And more than enough liquidity to do so. It had $131 million of cash along with about a billion of unused borrowing capacity available under its lines of credit. The weighted average interest rate of H&R's debt as of June 30, 2020 was 3.5% with an average term to maturity of 3.9 years.

The Bull Case

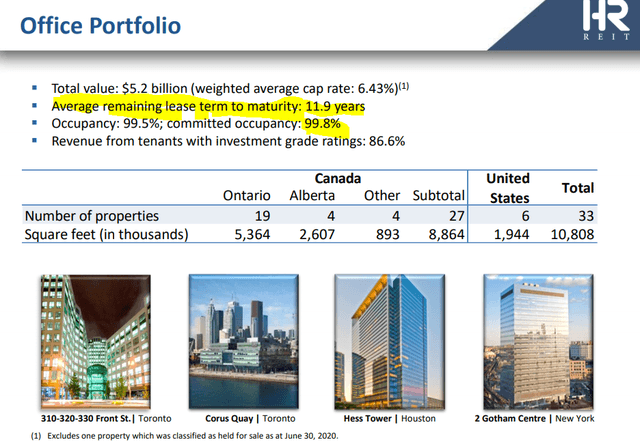

The bull case is based on a few strong legs. The first being that H&R's office space is almost 100% leased for about 12 years.

Source: H&R Q2 Presentation

This is the longest lease length in the pure office space and exceeds the lease lengths seen even in the triple net space. So while property values may move around in the shorter term, the cash flow is more or less secured. If work from home trends gain some force, and our view is that it will be modest at best, construction of new office space will come to standstill and that will help supply and demand balance out better.

On the retail front, backfilling of redeveloping spaces from Sears Canada and Target (TGT) is still ongoing. These will add substantial NOI in future years and work as an offset to current turmoil. H&R tenants in non enclosed malls should also continue to do well and that can be seen in the strength of the rent collections.

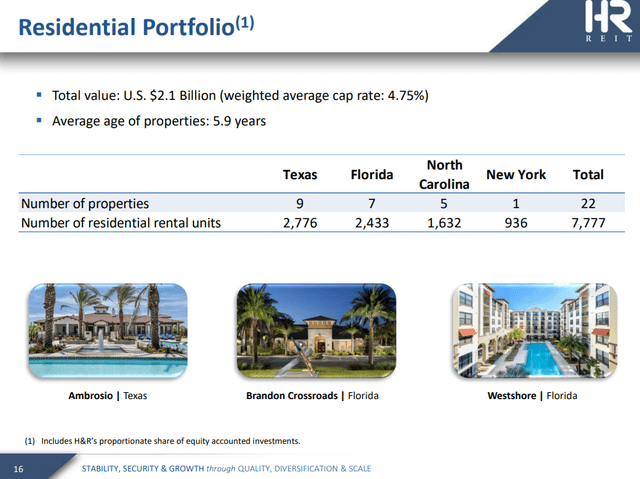

Residential faces shorter term headwinds in areas where H&R is still leasing up the property, like Jackson Park. But longer term there is little to dislike about H&R premium portfolio in the Sunbelt.

Source: H&R Q2 Presentation

Verdict

We like H&R here as a fully leased high quality REIT trading under 6X funds from operations. It is currently pricing armageddon, and if the pricing for H&R is correct, then the broader market should decline by at least 50%. We think the truth lies somewhere in between, as in H&R is undervalued by at least 50%, while the broader indices are overvalued. The REIT is a good long-term play for those that believe that some level of normalcy will be restored in 1-3 years. We will be adding to our position over time.

If you enjoyed this article, please scroll up and click on the "Follow" button next to my name to not miss my future articles. If you did not like this article, please read it again, change your mind and then click on the "Follow" button next to my name to not miss my future articles.