Welcome to the September 2020 edition of the "junior" lithium miner news. I have categorized those lithium miners that won't likely be in production before 2022 as the juniors. Investors are reminded that most of the lithium juniors will most likely be needed in the mid and late 2020s to supply the booming electric vehicle [EV] and energy storage markets. This means investing in these companies requires a higher risk tolerance and a longer time frame.

September saw depressed lithium prices continue, lots of new increased lithium demand forecast for the decade ahead, and plenty of lithium junior news.

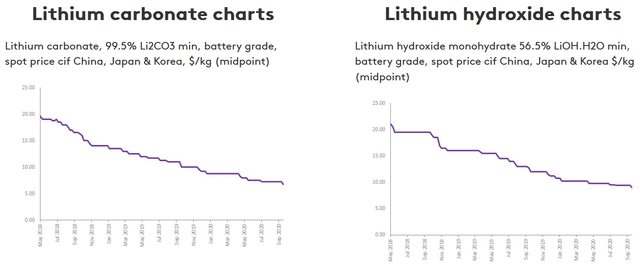

Lithium spot and contract price news

During September, 99.5% lithium carbonate China spot prices were up 0.75%. Lithium hydroxide prices were down 1.43%. Spodumene (5% min) prices were unchanged.

Fastmarkets (formerly Metal Bulletin) reports 99.5% lithium carbonate battery grade spot midpoint prices cif China, Japan, and Korea of US$6.75/kg (US$6,750/t) and min 56.5% lithium hydroxide battery grade spot midpoint prices cif China, Japan, and Korea of US$9.00/kg (US$9,000/t).

Benchmark Mineral Intelligence has August global weighted average prices at US$6,128 for Li carbonate, US$8,774 for Li hydroxide, and US$375 for spodumene (6%).

Lithium carbonate & hydroxide, battery grade, cif China, Japan, and Korea

Source: Fastmarkets

Lithium market news

For a summary of the latest lithium market news and the "major" lithium company's news, investors can read my "Lithium Miners News For The Month Of September 2020" article. Highlights include:

- EU sounds alarm on critical raw materials shortages. The EU estimates that to meet its climate neutrality goal, it will need up to 18 times more lithium and five times more cobalt in 2030. The forecasts rise to 60 times more lithium and 15 times more cobalt by 2050.

- Striving for green recovery, EU adds lithium to critical materials list.

- BMI - Simon Moores - We now have 167 of these Megafactories in the pipeline to 2028 with a cumulative capacity of 2697 GWh.

- Ex-Tesla engineer says solid-state batteries are a 'False Hope'.

- Battery metals to boom despite widespread Covid-19 disruption.

- WoodMac - Nearly 800 kt LCE of additional lithium would need to come online in the next five years....sees EVs make up around 40% of passenger car sales by 2030.

- LG Chem plans to separate battery business as electric cars take off.

- Simon Moores - "There is no doubt now that regardless of how well Tesla's vehicles continue to sell, raw material availability will be the primary slowing factor on the company scaling."

- Tesla expects significant (battery) shortages in 2022 and beyond. Tesla's Nevada lithium plan faces stark obstacles on path to production.

- Morningstar - Falling lithium prices provide buying opportunity.

Junior lithium miners company news

Rio Tinto [ASX:RIO] [LN:RIO] (RIO)

Rio owns a large lithium deposit called Jadar, which is yet to be developed. Jadar is a unique, world-class lithium-borate deposit near the town of Loznica in Serbia. Rio plans to start production at Jadar in 2023. They also have a potential US lithium project from their Boron Mine tailings.

No lithium related news.

Sigma Lithium Resources [TSXV:SGMA] (OTCQB:SGMLF)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo property in Brazil.

On September 1, Sigma Lithium announced:

Sigma Reports 2020 second quarter results and reaches pivotal milestones towards construction. Sigma completed raising the equity funding required to build the Grota do Cirilo Project (the "Project"). On August 12, 2020 Sigma closed a non-brokered private placement and has issued 8,285,200 common shares at a price of C$2.15 per share for gross proceeds of approximately US$13.3 million (the "Offering"). The Offering was upsized from US$10.0 million initially announced due to strong institutional investor demand. Sigma also signed a term sheet for a US$45 million senior secured project finance facility with Societe Generale, which is subject to customary closing conditions. These amounts will be complemented by US$ 27 million that remains to be disbursed under a production pre-payment agreement with Mitsui & Co. Ltd. to fully fund the Project. Sigma also signed with Duro Felguera ("DF") a contract for front-end engineering design....Primero Group Americas Inc. was the nominated engineering firm in the FEED Contract. Subsequently, Sigma received a letter of intent from the Spanish export credit agency CESCE to supply financing for up to 85% for the FEED Contract. The Project will be designed to produce 220,000 tonnes per year of high purity battery grade 6% lithium concentrate in its first phase (the "First Phase of Production"), followed by an additional 220,000 tonnes per year in its second phase estimated to initiate in 2023 (the "Second Phase of Production"), doubling the planned production capacity of the Company to 440,000 tonnes per year.

Bacanora Lithium [LSE-AIM:BCN] [GR:2F9] (OTCPK:BCLMF)

On September 10, Bacanora Lithium announced:

Sonora operational update... The Pilot Plant has completed the bulk sampling required for the Sonora plant and engineering designs. These samples have been sent to the Company's relevant partners in the USA and China for optimisation of the final designs.

Investors can view the Company's latest presentation here.

Note: Ganfeng and Hanwa have a see-through ownership of more than 50% of Sonora.

Catalysts include:

- 2020 - Possible further project financing announcements for Sonora, and/or Zinnwald.

- 2021/22---> Plan to commence Sonora production ramping to 17,500 tpa, and in stage two 35,000 tpa.

Core Lithium Ltd. (formerly Core Exploration) [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

Core 100% own the Finniss Lithium Project (Grants Resource) in Northern Territory Australia. Significantly, they already have an off-take partner with China's Yahua ($2.4b market cap, large lithium producer). The Company states they have a "high potential for additional resources from 500km2 covering 100s of pegmatites."

On August 31, Core Lithium Ltd. announced: "Finniss Lithium Project update." Highlights include:

- Evaluation of key underground Pre-Feasibility Study findings identifies significant opportunities to further add value resulting from recent increases to the Finniss Lithium Project's Mineral Resources and Ore Reserves and doubling of life of mine [LOM] including: Increasing Finniss' production capacity, based on growing offtake interest and expanded LOM, with only minor change to start-up capex. Assessing the growth potential of the Grants prospect. Optimising the balance between initial Grants open pit and new Grants underground mining operation to minimise strip ratio and start-up capex. Assessing grid connection for the Finniss Project to reduce power cost and emissions footprint. Further increases to Resource, Reserve and LOM.

- Update to the June 2020 PFS to Definitive Feasibility Study [DFS] level in Q1 2021 to include these opportunities.....

- New Lithium price forecasts predict increasing lithium prices in 2022 and accelerating upward in 2023.

- Finniss final investment decision [FID] in 2021 timed for expected post-COVID-19 recovery in global lithium demand and prices.

- DFS update aimed to maximise Project outcome without delaying Core's capability to achieve target FID.

- Core has approvals in place to build and operate the Finniss Lithium Project as soon as global COVID-19 economy and lithium sector recovers and can be ready if the world economy recovers sooner than expected."

On September 21, Core Lithium Ltd. announced: "BP33 lithium mine approvals progress."

Investors can read a company presentation here.

Catalysts include:

- 2020 - Updated Feasibility Study for the Finniss Lithium Project.

- 2020 - Fieldwork on the Adelaide River Gold Project.

Wesfarmers [ASX:WES] (took over Kidman Resources) (WFAFF)

The Mt Holland Lithium Project is a 50/50 JV between Wesfarmers [ASX:WES] (OTCPK:WFAFF) and SQM (SQM), located in Western Australia. There is also a proposal for a refinery located in WA. Wesfarmers acquired 100% of the shares in Kidman for A$1.90 per share, for US$545 million in total.

No significant news for the month.

You can view the latest company presentation here.

Upcoming catalysts include:

- Q1 2021 - Final investment decision on Mt Holland.

Sayona Mining [ASX:SYA] (OTC:DMNXF) (with news about Nemaska Lithium restructuring)

On September 1, Sayona Mining announced: "Qubec eyes multi-billion dollar lithium investments in revival push."

- Nemaska Lithium restructuring announced in C$600 million [AUD$624m] deal seen as 'first piece of the puzzle' in Qubec lithium sector's revival.

- Qubec economy minister flags batterymaking push could require more than C$7 billion of investment.

- Following Nemaska Lithium deal, monitor further extends bid deadline for North American Lithium [NAL] to end September, with Sayona confident of delivering successful turnaround."

On September 7, Sayona Mining announced: "Placement to U.S. battery metals investor boosts Sayona expansion." Highlights include:

- Placement agreed with Battery Metals Capital Group, LLC, raising up to US$2 million [AUD$2.73m]; additional US$6m available at Sayona's sole request.

- Funds to support Company's growth plans, including Authier Lithium Project, Tansim project and Pilbara lithium/gold portfolio in Western Australia and other potential opportunities, including bid for North American Lithium [NAL] amid accelerating EV revolution."

On September 16, Sayona Mining announced: "Financial report for the year ended 30 June 2020."

Investors can read the Company presentation here, and my Trend Investing CEO interview here.

Upcoming catalysts include:

- 2020 - Authier permitting. Possible project financing and off-take. Result of NAL bid.

Critical Elements Lithium Corp. [TSXV:CRE] [GR:F12] (CRECF)

No significant news for the month.

Upcoming catalysts include:

- 2020 - Rose Lithium-Tantalum Project permitting. Possible off-take or financing announcements.

Lithium Power International [ASX:LPI] (LTHHF)

No significant news for the month.

Upcoming catalysts:

- 2020 - Possible off-take partner and funding announcements for Maricunga Lithium Brine Project in Chile. Exploration results from the Greenbushes tenements.

Millennial Lithium Corp. [TSXV:ML] (OTCQX:MLNLF) (OTCQX:MLNLF)

Millennial has tenements at the Pastos Grande Lithium Project and the Cauchari East Lithium Project, in Argentina. Mining licence and environmental permit has been granted.

On August 25, Millennial Lithium announced:

Millennial Lithium Corp. provides update on activities at its Pastos Grandes Project, Salta, Argentina.....Feed brine in the pilot ponds is concentrating lithium as designed and we have reached 2% Li in several of the feeder ponds. In addition, testwork in the pilot plant indicates no leakages in the system and the initial SX testing shows all equipment is in good working order. Testing of other stages in the process is ongoing and we are planning to fully commission the plant in the next few weeks. Millennial remains well funded and continues in its financing efforts to advance development of the Pastos Grandes Project. Despite the COVID-19 restrictions and slowdown the Company has continued progressing its talks and documentation with a number of offtakers and strategic investors. We are well on track with all our corporate programs."

You can view the Company's latest investor presentation here.

Upcoming catalysts:

- 2020 - Pilot plant trials to be completed. Possible off-take agreements and project funding.

Neo Lithium [TSXV:NLC] (NTTHF)

On September 14, Neo Lithium announced: "Neo Lithium announces strategic investment by CATL." Highlights include:

- CATL to invest C$8.5 million, representing an 8% equity stake in Neo Lithium.

- Investment will be by way of a Private Placement priced at $0.84 per common share.

- The investment results in further strengthening of the Company's balance sheet with more than C$37M of cash post private placement.

- A Technical Committee will be formed to oversee the DFS and collaboratively determine the complete financing requirements for the 3Q Project.

- Investor Rights Agreement will provide CATL with board representation and pre-emptive rights."

Investors can read the latest company presentation here, and an excellent video here. My CEO interview is available on Trend Investing here.

Upcoming catalysts include:

- 2020 Environmental Impact Assessment and permitting approval expected. Possible project partner/funding announcements.

- 2020 - Feasibility Study due.

Mali Lithium Limited (ASX:MLL) (Formerly Birimian Ltd) (EEYMF)

On September 11, Mali Lithium announced: "30 June 2020 half - year financial report."

You can view the latest company presentation here.

Catalysts include:

- Aug./Sept. 2020 - DFS due for the Goulamina Lithium Project.

AVZ Minerals [ASX:AVZ] (OTC:AZZVF)

On September 11, AVZ Minerals announced: "Manono Lithium and Tin Project operational update." Highlights include:

- Discussions with multiple, potential offtake partners for significant volumes of Spodumene Concentrate and Tin are well advanced.

- Negotiations around financing options with several entities in Europe, the Middle East and South Africa are progressing well.

- Tenders for process plants are currently being adjudicated.

- Tenders for rehabilitation of Mpiana Mwanga Hydro Electric Power Plant have been issued and are due back end of October 2020.

- Manono Special Economic Zone Stage 1 Government workshop to commence this month with Stage 2 expected shortly afterwards.

- Resource drilling of the Roche Dure pit floor to commence soon.

- New Ore Reserves to be generated from updated mine design."

On September 21, AVZ Minerals announced: "AVZ to increase equity stake in Manono Lithium and Tin Project to 75%."

- AVZ secures rights to an additional 10% equity in Manono Project for US$15.5M.

- AVZ to own 75% of Manono Project on completion of transaction.

- Ongoing discussions to acquire additional equity in Manono Project.

- Potential increase in share of Project NPV10 from US$1,409M to US$1,761 M [PreTax] and up from US$616 M to US$771 M [Post Tax] based on 75% project interest."

Upcoming catalysts include:

- 2020 - Initial project work, possible project funding/partner.

ioneer Ltd [ASX:INR] [GR:4G1] (OTCPK:GSCCF)

On August 31, ioneer Ltd. announced:

Plan of operations for Rhyolite Ridge Project accepted by BLM....marking a major milestone toward completion of the NEPA process.

On September 3, ioneer Ltd. announced:

ioneer reiterates commitment to Project timeline. ioneer Ltd, an emerging lithium-boron supplier, reiterates its previously stated timeline for its Rhyolite Ridge Lithium-Boron Project ("Rhyolite Ridge" or the "Project") in Nevada, as it aims to be permitted and ready to begin construction as early as Q2 2021.

Upcoming catalysts include:

- 2020 - Possible off-take and project financing discussions.

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Project in Argentina, targeting a fast-track development strategy.

On September 11, Argosy Minerals announced: "Half yearly report - June 2020."

On September 17, Argosy Minerals announced: "500KG high purity lithium carbonate product sample delivered to Japanese customer.": Highlights include:

- Product sample testing forms the basis and is required for supplier qualification process, and potential Stage 2 off-take arrangements.

- Further validation of the Company's exclusive and proprietary environmentally clean chemical process technology.

- Japanese battery cathode market targeted by Argosy for potential larger off-take arrangements."

Investors can view the company's latest investor presentation here.

European Metals Holdings [ASX:EMH] [AIM:EMH] [GR:E861] (OTC:ERPNF)

No significant news for the month.

Upcoming catalysts include:

- 2020 - Bankable Feasibility Study to be released.

Wealth Minerals [TSXV:WML] [GR:EJZN] (OTCQX:WMLLF)

Wealth Minerals has a portfolio of lithium assets in Chile, such as 46,200 Has at Atacama, 8,700 Has at Laguna Verde, 6,000 Has at Trinity, 10,500 Has at Five Salars.

No news for the month.

Investors can view the company's latest presentation here.

Piedmont Lithium [ASX:PLL] (PLL)

Piedmont Lithium state they are "the only US lithium spodumene project", with their 100%-owned Piedmont Lithium project in North Carolina.

On August 25, Piedmoint Lithium announced: "Piedmont resumes drilling to further increase mineral resources in the Carolina Tin-Spodumene Belt." Highlights include:

- Drilling has commenced testing new target areas on the Company's Core and Central Properties.

- Drilling will also test previously identified regional drill targets in the prolific Tin-Spodumene Belt

- Piedmont is focused on increasing its Mineral Resources and potential increased production of American sourced lithium."

On September 23, AP News reported:

Piedmont Lithium signs sales agreement with Tesla. Piedmont Lithium Limited ( "Piedmont" or "Company" ) is pleased to announce that it has entered into a binding agreement ("Agreement") with Tesla, Inc. ("Tesla") for the supply of spodumene concentrate ("SC6") from Piedmont's North Carolina deposit to Tesla. The Agreement is for an initial five-year term on a fixed-price binding purchase commitment from the delivery of first product, and may be extended by mutual agreement for a second five-year term. The Agreement covers a fixed commitment representing approximately one-third of Piedmont's planned SC6 production for the initial five-year term as well as an additional quantity to be delivered at Tesla's option. The Agreement is conditional upon Tesla and Piedmont agreeing to a start date for spodumene concentrate deliveries between July 2022 and July 2023 based on the development schedules of both parties.

Note: Piedmont Lithium has withdrawn their announcement (covered above). ASX probes Piedmont Lithium's Tesla deal. The new one is below.

On September 27, Piedmont Lithium announced:

Piedmont Lithium signs sales agreement with Tesla....Five year fixed-price binding agreement with optional five-year extension.....Agreement covers a fixed commitment representing approximately one-third of Piedmont's planned SC6 production of 160,000 tonnes per annum for the initial five-year term as well as an additional quantity to be delivered at Tesla's option.

Upcoming catalysts include:

- Q4 2020 - DFS due.

- 2020 - Possible off-take and project funding announcements.

You can view the company's latest presentation here.

Standard Lithium [TSXV:SLL] (OTCQX:STLHF)

On September 9, Standard Lithium announced: "Standard Lithium ships first large volume of lithium chloride product from Arkansas facility." Highlights include:

- 20,000 liters of lithium chloride product shipped.

- Conversion to lithium carbonate will be done using conventional batch process and also proprietary SiFT process.

- Design work begins on first commercial Direct Lithium Extraction plant."

On September 18, Standard Lithium announced: "Media Advisory: Standard Lithium commences operations at first-of-its-kind direct lithium extraction plant in Arkansas."

On September 21, Standard Lithium announced: "Standard Lithium marks commencement of operations at Arkansas Plant with a virtual ribbon cutting ceremony."

Plateau Energy Metals [TSXV:PLU] [GR:QG1A] (OTCQB:PLUUF)

Plateau Energy Metals Inc. (formerly Plateau Uranium) is a Canadian lithium and uranium exploration and development company focused on its properties on the Macusani Plateau in southeastern Peru.

On September 17, Plateau Energy Metals announced: "Plateau Energy Metals provides Peru and corporate update." Highlights include:

- Falchani Lithium Chemical Project desktop work for project optimization programs in progress: Lithium chemical product flexibility to evaluate lithium hydroxide and lithium sulphate from lithium sulphate solution. Lithium process flowsheet optimization program design. By-product phase 2 program design.

- Community support initiatives in Peru ongoing to help ensure the health, safety and wellbeing of our host communities."

Cypress Development Corp. (TSXV:CYP) (OTCQB:CYDVF)

Cypress Development owns tenements in the Clayton Valley, Nevada, USA.

No news for the month.

Liontown Resources [ASX:LTR] (OTC:LINRF)

Liontown Resources 100% own the Kathleen Valley Lithium spodumene project in Western Australia.

On September 24, Liontown Resources announced: "Large, strong EM conductors identified at the Moora Project, WA." Not lithium, but a possible sign for Ni, Cu, PGMs, or Au finding.

You can view the company's latest presentation here.

Upcoming catalysts include:

- Q4 2020 - Updated PFS on Kathleen Valley

Frontier Lithium [TSXV:FL] (OTC:HLKMF)

Frontier Lithium own the PAK Lithium (spodumene) Project comprising 6,976 hectares and located 175 kilometers north of Red Lake in northwestern Ontario. The PAK deposit is a lithium-cesium-tantalum [LCT] type pegmatite containing high-purity, technical-grade spodumene (below 0.1% iron oxide).

On September 9, Frontier Lithium announced:

Frontier Lithium initiates fully integrated North American Lithium Project Preliminary Economic Assessment [PEA] to produce lithium hydroxide from the PAK Lithium Project.....The PEA will include a vertically integrated spodumene mining, milling and downstream lithium hydroxide production facility. The decision to pursue the vertically integrated model is being driven by strong lithium demand outlook, growing need for higher quality battery raw materials and very encouraging hydrometallurgical progress with ongoing evaluation test work.....

E3 Metals [TSXV:ETMC] (OTCPK:EEMMF)

On September 8, E3 Metals announced:

E3 Metals awarded Alberta innovates grant.....totaling $98,798 from Alberta Innovates that will assist in funding a project to determine the development plan and costs of brine production from the Leduc Reservoir in Alberta....

On September 15, E3 Metals announced:

E3 Metals discovers new lithium enriched Aquifer. E3 Metals Corp., an emerging lithium developer and leading lithium extraction technology innovator, today announces the discovery of lithium enrichment in the Nisku Aquifer (the "Nisku"), located within the Company's permit area in south-central Alberta, with sampled lithium grades ranging up to 75.0mg/L.

You can read the company's latest presentation here.

Lithium processing and new cathode technologies

Nano One Materials [TSXV:NNO] (OTCPK:NNOMF)

On September 9, Nano One announced: "Nano One adds battery materials strategist Robert Morris to address the market need for environmentally sustainable battery metals."

Other lithium juniors

Other juniors include: Vision Lithium [TSXVABE] [GR:1AJ2] (OTCQB:ABEPF), Alpha Lithium Corporation [CVE:ALLI] (OTCPK:ALLIF) American Lithium Corp. [TSX-V: LI] (OTCQB:LIACF), Anson Resources [ASX:ASN] [GR:9MY] (OTCPK:ANSNF), Ardiden [ASX:ADV], Argentina Lithium and Energy Corp. [TSXV: LIT] (OTCQB:PNXLF), Avalon Advanced Materials [TSX:AVL] [GR:OU5] (OTCQX:AVLNF), Carnaby Resources Ltd [ASX:CNB], Eramet [FR: ERA] (OTC:ERMAF) (OTCPK:ERMAY), Far Resources [CSE:FAT] (OTCPK:FRRSF), Hannans Ltd [ASX:HNR] (OTC:HHNNF), Iconic Minerals [TSXV:ICM] [FSE:YQGB] (OTCPK:BVTEF), Infinity Lithium [ASX:INF] (OTCPK:INLCF), Ion Energy [TSXV:ION], Jadar Resources Limited [ASX:JDR], Kodal Minerals (LSE-AIM: KOD), Lake Resources [ASX:LKE] [GR:LK1], Latin Resources Ltd [ASX: LRS], Liberty One Lithium Corp. [TSXV:LBY] (OTC:LRTTF), Lithium Australia [ASX:LIT] (OTC:LMMFF), Lithium Chile Inc. [TSXV:LITH][GR:KC3] (OTCPK:LTMCF), Lithium Energi Exploration Inc. [TSXV:LEXI](OTC:LXENF), MetalsTech [ASX:MTC], MGX Minerals [CSE:XMG] (OTCPK:MGXMF), Noram Ventures [TSXV: NRM] (OTCQB:NRVTF), NRG Metals Inc. [TSXV:NGZ] (NRGMF), One World Lithium [CSE:OWLI], Portofino Resources Inc. [TSXV:POR] [GR:POT] (OTCPK:PFFOF), Power Metals Corp. [TSXV:PWM] (OTCPK:PWRMF), Prospect Resources [ASX:PSC], Pure Energy Minerals [TSXV:PE] (OTCQB:PEMIF), Rock Tech Lithium [CVE:RCK], and Savannah Resources [LSE:SAV] (GR:AFM].

Conclusion

September saw lithium spot prices mixed but remain low.

Highlights for the month were:

- EU sounds alarm on critical raw materials shortages - Needs 18x more lithium by 2030, 60x by 2050. BMI is tracking 167 megafactories (2,697GWh) by 2028.

- WoodMac - Nearly 800 kt LCE of additional lithium would need to come online in the next five years... sees EVs make up around 40% of passenger car sales by 2030.

- Tesla expects significant (battery) shortages in 2022 and beyond. Tesla's Nevada lithium plan faces stark obstacles on path to production.

- Morningstar - Falling lithium prices provide buying opportunity.

- Nemaska Lithium restructuring announced C$600 million [AUD$624m] deal seen as 'first piece of the puzzle' in Qubec lithium sector's revival.

- Sigma completed raising the equity funding required to build the Grota do Cirilo Project (the "Project") and signed a term sheet for a US$45 million senior secured project finance facility with Societe Generale.

- Neo Lithium announces strategic investment by CATL.

- AVZ Minerals - Early works program commenced at Manono Lithium and Tin Project. AVZ to increase equity stake in Manono Lithium and Tin Project to 75%.

- Argosy Minerals - 500KG high purity lithium carbonate product sample delivered to Japanese customer.

- Piedmont Lithium signs 5+5 year lithium spodumene sales agreement with Tesla.

- Standard Lithium commences operations at first-of-its-kind direct lithium extraction plant in Arkansas, ships 20,000 liters of lithium chloride.

As usual, all comments are welcome.

Trend Investing

Thanks for reading the article. If you want to sign up for Trend Investing for my best investing ideas, latest trends, exclusive CEO interviews, chat room access to me, and to other sophisticated investors with a focus on renewable energy & the EV and EV metals sector. You can learn more by reading "The Trend Investing Difference", "Subscriber Feedback On Trend Investing", or sign up here.

Latest articles:

Disclosure: I am/we are long GLOBAL X LITHIUM & BATTERY TECH ETF (LIT), NYSE:ALB, JIANGXI GANFENG LITHIUM [SHE: 2460], SQM (NYSE:SQM), ASX:ORE, ASX:GXY, ASX:PLS, ASX:AJM, AMS:AMG, TSX:LAC, TSXV:NLC, ASX:AVZ, ASX:CXO, ASX:NMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information in this article is general in nature and should not be relied upon as personal financial advice.