NEW RELEASE TODAY - https://www.stockwatch.com/News/Item?C:HIVE&bid=Z-C:HIVE-3040832

ORIGINAL: HIVE Reports Record Top Line Income From Digital Currency Mining for Q3 F2021 up 174% From Q3 F2020 or $13.7 Million, and Record Year Over Year Cash Flow Growth. Total Income for 9 Months F2021 was $28 Million or $0.08 Cents per Share and $0.05 per Share for Q3 F2021

2021-03-01 22:15 PT - News Release

This news release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated February 2, 2021 to its short form base shelf prospectus dated January 27, 2021.

VANCOUVER, BC / ACCESSWIRE / March 2, 2021 / HIVE Blockchain Technologies Ltd. (TSX.V:HIVE)(OTCQX:HVBTF)(FSE:HBF) (the "Company" or "HIVE") announces its results for the third quarter ended December 31, 2020 (all amounts in US dollars, unless otherwise indicated).

Income from digital currency mining was $13.7 million in this third quarter, a 174% increase from the same quarter last year, and 5% higher than the previous quarter. Record cash flow of $13.7 million, up significantly from $5.7 million a year earlier, and $3.1 million higher than the previous quarter. Gross mining margin expanded to $10.6 million, from $3.8 million last year, and is $1.4 million higher than that experienced in the prior quarter of $9.2 million. Net income per share grew to $0.05 from $0.01 during the prior year period ended December 31, and is $0.02 higher than the previous quarter of September 30, 2020.

"In spite of the decreased number of Ethereum coins mined during this quarter as a result of the lower transaction fees when compared to the previous quarter, our Bitcoin operations doubled in the quarter so that our combined revenue and cash flow made new highs. In addition, we started upgrading our memory chips during the quarter from 4 Gigabyte to 8 Gigabyte which has been a big challenge with Europe locking down due to COVID-19 crisis, but we were able to upgrade over 60% of our mining equipment and still deliver record income and cash flow from operations for our shareholders," said Frank Holmes, Executive Chairman of HIVE. "Even with the challenges that have been faced with raising difficulty levels, the strong crypto currency prices coupled by our continued focus on lowering costs at our operations we have seen very strong results for our shareholders.

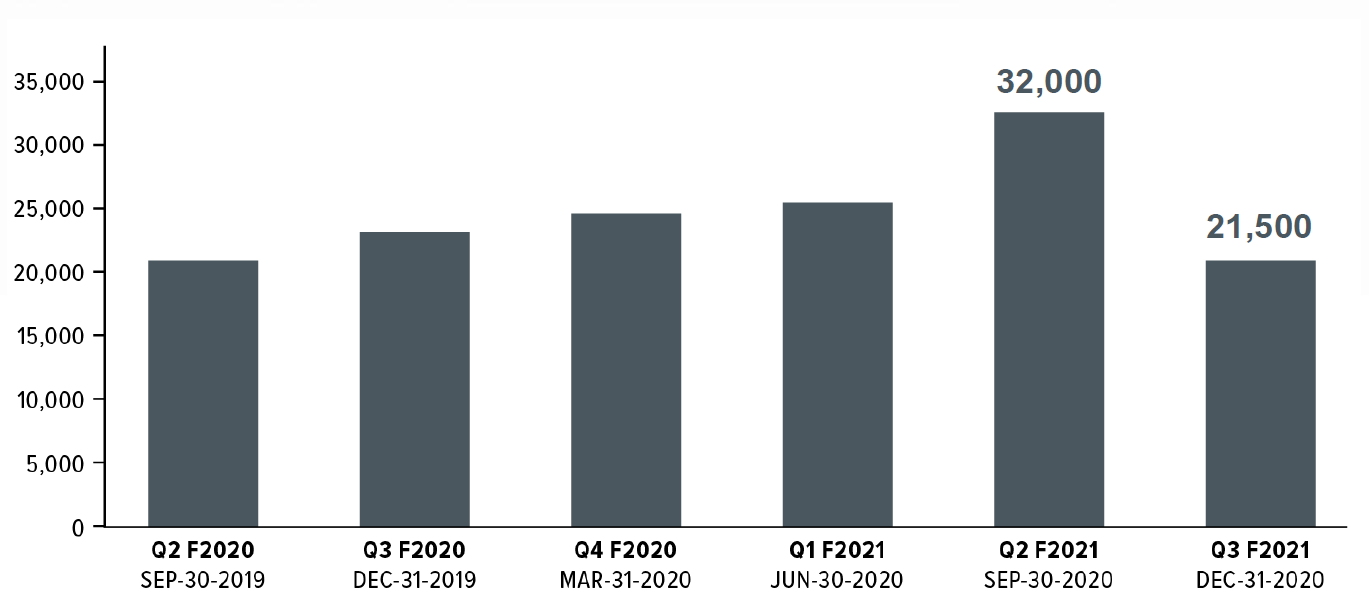

"Our Sweden and Iceland operations mining Ethereum on the cloud has been and continues to be a very stable and profitable business for us. On average we have been producing around 20,000 Ethereum coins per quarter, and when we experience quarters above that level it is due to bonus transaction fees that vary from quarter to quarter,'" expanded Mr. Holmes.

Ethereum Mined by HIVE Blockchain Technologies

"As we have mentioned previously and we are so proud of is that HIVE is the only public crypto mining company producing Ethereum on an industrial scale, sourcing green energy from facilities in Sweden and Iceland. With the continued explosion in DeFi, which has increased the demand for Ethereum, and now the debut of Ethereum 2.0, which will shrink the supply of Ethereum, we continue to be in a very envious position," continues Mr. Holmes.

Q3 F2021 Highlights

- Generated income from digital currency mining of $13.7 million, an increase of 174% year-over-year

- Generated gross mining margin[1] of $10.6 million, or 78% of income from digital currencies

- Mining output of newly minted digital currencies:

- 21,500 Ethereum

- 165 Bitcoin

- Generated Adjusted EBITDA1 of $13.7 million, a significant increase from $5.7 million a year earlier

- Generated net income of $17.2 million for the period, or $0.05 per share, compared to $3.4 million, or $0.01 per share, last year

- Digital currencies of $15.0 million, as at December 31, 2020

- Working capital was $23.2 million as at December 31, 2020

Q3 F2021 Financial Review

For the three months ended December 31, 2020, income from digital currency mining was $13.7 million, an increase of 174% from the prior comparative quarter. The increase was primarily due to an increase in cryptocurrency prices, the increased production of Bitcoin with the Quebec facility acquisition and the purchase of miners for that facility, which are partially offset by a decrease in the production of Ethereum.

Gross mining margin1 during the quarter was $10.6 million, or 78% of income from digital currency mining, compared to $3.8 million, or 77% of income from digital currency mining, in the same period in the prior year.

Net income during the quarter ended December 31 was $17.2 million, or $0.05 per share, compared to $3.4 million, or $0.01 per share, in the prior year period. The increase was primarily due to a significant reduction of operational costs experienced since the Company has shifted from the former service provider over the past year, and increased crypto currency prices.

| | | Three months ended December 31, | | | Nine months ended December 31, | |

| | | 2020 | | | 2019 | | | 2020 | | | 2019 | |

| | | | | | | | | | | | | |

| Income from digital currency mining | | $ | 13,707,879 | | | $ | 5,003,944 | | | $ | 33,277,753 | | | $ | 23,968,532 | |

| Operating and maintenance costs of digital currency mining | | | (3,078,934 | ) | | | (1,170,145 | ) | | | (10,846,921 | ) | | | (19,296,937 | ) |

| Gross Mining Margin1 | | | 10,628,945 | | | | 3,833,799 | | | | 22,430,832 | | | | 4,671,595 | |

| Gross Mining Margin %1 | | | 78 | % | | | 77 | % | | | 67 | % | | | 19 | % |

| | | | | | | | | | | | | | | | | |

| Depreciation | | | (2,476,592 | ) | | | (1,345,212 | ) | | | (5,903,235 | ) | | | (3,850,241 | ) |

| Gross gain | | | 8,152,353 | | | | 2,488,587 | | | | 16,527,597 | | | | 821,354 | |

| | | | | | | | | | | | | | | | | |

| Revaluation of digital currencies2 | | | 6,315,970 | | | | (727,064 | ) | | | 8,635,736 | | | | (2,639,579 | ) |

| Gain on sale of digital currencies | | | 1,679,213 | | | | 107,960 | | | | 4,156,500 | | | | 934,220 | |

| Hosting revenues | | | 393,518 | | | | - | | | | 585,318 | | | | - | |

| | | | | | | | | | | | | | | | | |

| General and administrative expenses | | | (911,076 | ) | | | (1,125,864 | ) | | | (2,039,296 | ) | | | (3,791,320 | ) |

| Foreign exchange | | | 1,746,573 | | | | 2,860,408 | | | | 1,661,155 | | | | 1,192,270 | |

| Share-based compensation | | | (209,726 | ) | | | (62,220 | ) | | | (868,947 | ) | | | (371,119 | ) |

| Realized gain on investments | | | 6,639 | | | | - | | | | 6,639 | | | | 1,531,464 | |

| Unrealized gain on investments | | | 148,967 | | | | - | | | | 148,967 | | | | - | |

| Finance expense | | | (111,918 | ) | | | (153,792 | ) | | | (342,283 | ) | | | (261,314 | ) |

| Net income (loss) from continuing operations | | $ | 17,210,513 | | | $ | 3,388,015 | | | $ | 28,471,386 | | | $ | (2,584,024 | ) |

| | | | | | | | | | | | | | | | | |

| EBITDA1 | | $ | 19,799,023 | | | $ | 4,887,019 | | | $ | 34,465,698 | | | $ | (3,933 | ) |

| Adjusted EBITDA1 | | $ | 13,692,779 | | | $ | 5,676,303 | | | $ | 26,950,115 | | | $ | 3,006,765 | |

| | | | | | | | | | | | | | | | | |

| Diluted income (loss) per share | | $ | 0.05 | | | $ | 0.01 | | | $ | 0.08 | | | $ | (0.01 | ) |

| | | | | | | | | | | | | | | | | |

| Net cash inflows from operating activities | | $ | 12,877,046 | | | $ | (2,404,273 | ) | | $ | 18,792,467 | | | $ | (1,216,180 | ) |

| Net cash outflows from investing activities | | $ | (17,999,415 | ) | | $ | - | | | $ | (22,094,739 | ) | | $ | - | |

| Net cash inflows (outflows) from financing activities | | $ | (497,629 | ) | | $ | - | | | $ | (1,052,112 | ) | | $ | 306,712 | |

1. Non-IFRS measure. A reconciliation to its nearest IFRS measures is provided under "Reconciliations of Non-IFRS Financial Performance Measures" in the Company's MD&A.

2. Revaluation is calculated as the change in value (gain or loss) on the coin inventory. When coins are sold, the net difference between the proceeds and the carrying value of the digital currency (including the revaluation), is recorded as a gain (loss) on the sale of digital currencies

Financial Statements and MD&A

The Company's Condensed Interim Consolidated Financial Statements and Management's Discussion and Analysis (MD&A) thereon for the three and nine months ended December 31, 2020 will be accessible on SEDAR at www.sedar.com under HIVE's profile, and on the Company's website at www.HIVEblockchain.com.

Webcast Details

Management will host a webcast on Tuesday, March 2, 2021 at 10:00 am Eastern Time to discuss the Company's financial results. Presenting on the webcast will be Frank Holmes, Interim Executive Chairman and Darcy Daubaras, Chief Financial Officer. IMPORTANT - Click here to register for the webcast. The direct link is https://us02web.zoom.us/webinar/register/WN_c5rTbXcwQ8uOyYHX6023wQ.

At-the-Market Offering

Pursuant to the ATM Equity Program, as required pursuant to National Instrument 44-102 - Shelf Distributions and the policies of the TSX Venture Exchange ("TSXV"), the Company announces that, since the beginning of the program on February 3, 2021, it has issued an aggregate of 13,201,800 common shares (the "ATM Shares") over the TSX-V, for aggregate gross proceeds to the Company of C$65,022,582. The ATM Shares were sold at prevailing market prices, for an average price per ATM Share of C$4.93. Pursuant to the Equity Distribution Agreement associated with the ATM Equity Program (the "EDA"), a cash commission of US$1,539,706 on the aggregate gross proceeds raised was paid to the agent in connection with its services under the EDA.

Pursuant to the EDA, the Company may, from time to time, sell up to US$100 million of common shares in the capital of the Company. The Company intends to use the net proceeds of the ATM Equity Program, if any, principally for general corporate and working capital requirements, funding ongoing operations, to repay indebtedness outstanding from time to time, to complete future acquisitions, or for other corporate purposes.

This news release does not constitute an offer to sell or the solicitation of an offer to buy securities in the United States or in any jurisdiction where the offer, sale or solicitation would be unlawful. The Common Shares referred to in this news release may not be offered or sold in the United States absent registration or an applicable exemption from registration.

About HIVE Blockchain Technologies Ltd.

HIVE Blockchain Technologies Ltd. is a growth oriented, TSX.V-listed company building a bridge from the blockchain sector to traditional capital markets. HIVE owns state-of-the-art green energy-powered data centre facilities in Canada, Sweden, and Iceland which produce newly minted digital currencies like Bitcoin and Ethereum continuously on the cloud. Our deployments provide shareholders with exposure to the operating margins of digital currency mining as well as a portfolio of crypto-coins.