Enbridge (NYSE: ENB) is a Canadian multinational energy company with a massive market capitalization of almost $75 billion. The company has impressive legacy midstream assets, however, it's focused on also positioning itself for the upcoming energy transition. As we'll see throughout this article, the company's strong positioning for the upcoming changes will help drive substantial shareholder rewards.

Enbridge - BOE Report

Enbridge 2020 Performance

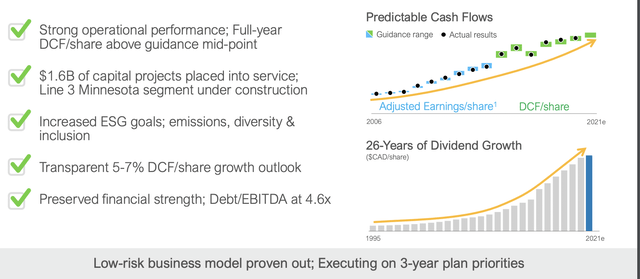

Enbridge had strong performance in 2020 highlighting its overall asset strength.

Enbridge 2020 Results - Enbridge Investor Presentation

Enbridge 2020 Results - Enbridge Investor Presentation

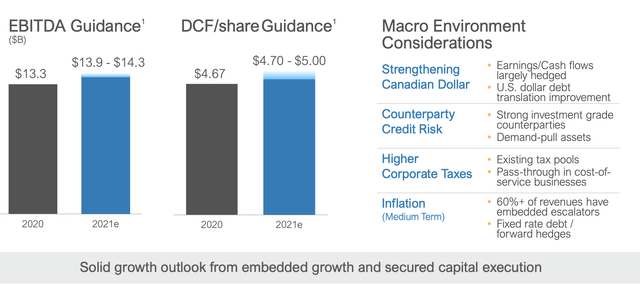

Enbridge saw strong operational performance with full-year DCF / share above the company's midpoint guidance. The company has continued to invest in its business with $1.6 billion in capital projects placed into service. The company is continuing to invest in its massive Line 3 Minnesota segment. The company's guidance is for 5-7% DCF / share growth going forward.

Enbridge has achieved 26 years of impressive dividend growth while maintaining its financial strength with a debt / EBITDA of just 4.6x. The company's guidance is for 5%-7% DCF / share growth going forward, which will help support additional shareholder returns. This means consistent shareholder returns for those who invest now.

Enbridge Asset Portfolio

Enbridge's impressive growth potential is backed up by an unparalleled asset portfolio.

Enbridge Asset Portfolio - Enbridge Investor Presentation

Enbridge Asset Portfolio - Enbridge Investor Presentation

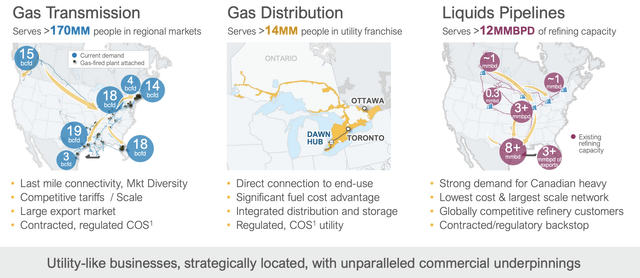

Enbridge asset portfolio has numerous main segments. One of the company's largest is gas transmission which serves >170 million people in regional markets and its gas distribution business which serves >14 million people in its Canadian utility franchise. The company is focused on competitive tariffs and last mile connectivity.

Its large export market here and fuel cost advantage will enable it to drive consistent returns from its utility based business model.

The company also has a massive liquids pipeline business that supplies >12 million barrels / day. The majority of this travels to the U.S. Gulf Coast from numerous supply areas. Here the company's infrastructure is incredibly hard to duplicate. However, the overall strength of the company's diverse business here is impressive to see.

Enbridge Growth Investments

Enbridge, past its existing and impressive asset portfolio, is investing heavily in growth.

Enbridge Capital Program - Enbridge Investor Presentation

Enbridge Capital Program - Enbridge Investor Presentation

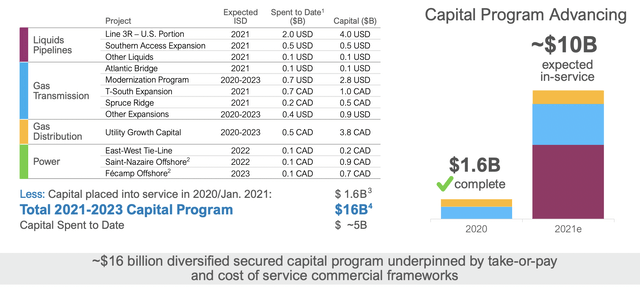

Enbridge's massive capital spending program also joins with significant parts of its previous capital program coming in service. The company put $1.6 billion in capital into service in 2020. In 2021, it's expected to put $10 billion into service. From 2021-2023, it will have a massive $16 billion capital program.

The company's capital spending will primarily be its core businesses, with ~$2 billion in renewables. Massive projects going into service include its Line 3 replacement program where it's already spent $7 out of $9 billion. For those concerned about its debt, the EBITDA growth means it expects its 4.6x debt to EBITDA to become ~4.3-4.4x by YE 2023.

Enbridge Financial Priorities

Enbridge plans to deliver on its financial priorities using this growth.

Enbridge Financial Priorities - Enbridge Investor Presentation

Enbridge Financial Priorities - Enbridge Investor Presentation

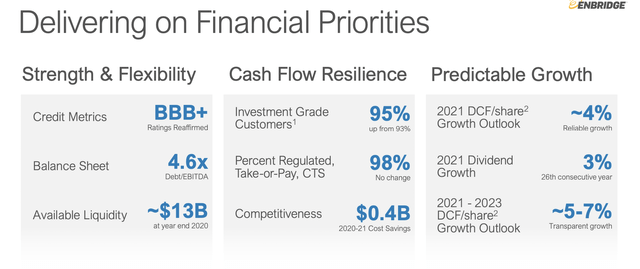

Enbridge plans to maintain its same credit metrics and its strong balance sheet with significant available liquidity. The company has 95% investment grade customers with 98% regulated contracts. It anticipates $0.4 billion in 2020-2021 cost savings continuing to upcoming years. That will help it improve its margins and earnings.

The company's 2021 outlook is ~4% DCF / share growth with 3% dividend growth. From 2021-2023 it sees ~5-7% annual transparent growth. That will enable consistent mid-single digit growth, which will help support shareholders.

Enbridge Shareholder Return Potential

Enbridge has the ability to drive incredibly strong shareholder returns.

Enbridge Potential - Enbridge Investor Presentation

Enbridge Potential - Enbridge Investor Presentation

Enbridge is guiding for 2021e DCF / share at a midpoint of $4.85 / share. Compared to the company's $36.6 price / share, that's a yield of more than 13% which the company can use for a variety of shareholder rewards. Past the company's dividend of more than 7%, the company sees itself having ~$5-6 billion in additional financial capacity.

The company plans to spend ~$2 billion / year on share buybacks, other organic growth, and asset M&A to the tune of ~3% off its market capitalization annually (on top of its 7% dividend). Additionally, the company plans to spend ~$3-4 billion (~5% of its market cap) on regular growth projects. This will enable the company's continued DCF growth.

Enbridge Risk

Enbridge's risk is the continuing focus on spending massive capital on growth. However, it's facing an increased regulatory program. The company's more than $9 billion Line 3 replacement is continuing to face government protests in the United States. If it doesn't come to fruition that could cause the company to lose billions.

This is a risk that investors in growth need to pay consistent attention too.

Conclusion

Enbridge has an impressive portfolio of utility-based assets. The company serves hundreds of millions of customers with a tough to replicate asset portfolio worth $10s of billions. From this portfolio, the company has the ability to join double-digit FCF with significant long-term growth potential for shareholders.

For investors who want a reliable dividend of more than 7%, and a company with a consistent commitment to growing long-term shareholder returns, Enbridge is a valuable investment. At the same time, Enbridge's regulatory heavy business means it's hard to replace. That means it will face minimal competition.

Overall, we expect Enbridge to drive valuable long-term shareholder returns.