Grid Metals Reports New Drill Results from East Bull Lake Palladium Property; Completes Initial Drilling at Bannockburn Nickel Property

Toronto, Ontario, June 17th, 2021 – Grid Metals Corp. (the "Company") (TSXV:GRDM)(OTCQB:MSMGF) is pleased to report the final results from the Q1 2021 Parisien Lake area drill program at its East Bull Lake palladium property (the "Property") located near Sudbury, Ontario. Drilling continued to intersect palladium-dominant mineralization in the Central Parisien Lake Zone, including large step outs to the east of the main area of drilling. Similar palladium-rich mineralization was also intersected in two drill holes located several hundred metres to the south. One of these holes also intersected a pyroxenite-hosted, platinum-dominant style of mineralization – adding to a growing list of PGM-Cu-Ni sulfide mineralization styles discovered on the Property. The Company also completed an eight-hole drill program targeting bulk tonnage nickel sulfide mineralization at its Bannockburn Township property located in the Timmins region of Ontario. Results are pending for those holes.

Highlights

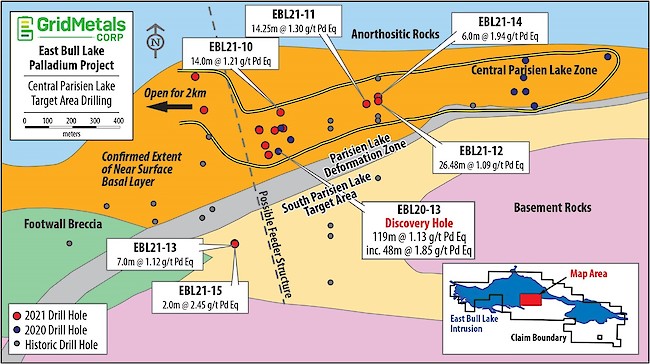

- The Central Parisien Lake Zone was intersected in four additional holes (see Figure 1) including step outs of up to 400 metres east of the main area of drilling. Significant results from these four holes are summarized in the table, below, and include:

- 14.0 metres of 1.2 g/t palladium equivalent (Pd Eq) grade in hole EBL21-10 containing a 1.0 metre interval of 7.0 g/t Pd Eq

- 14.2 metres of 1.3 g/t Pd Eq in hole EBL21-11

- 16.0 metres of 1.6 g/t Pd Eq in hole EBL21-12 including 8.0 metres with 2.4 g/t Pd Eq

- 6.0 metres of 1.9 g/t Pd Eq in hole EBL21-14

- Two additional holes were completed in the South Parisien target area, located 400 metres south of the main area of drilling on the Central Parisien Lake Zone. Both holes intersected near surface palladium-rich mineralization having similar characteristics to the mineralization in the Central Parisien Lake Zone. One of the holes intersected a new, platinum-rich style of mineralization. The most significant results are:

- 7.0 metres averaging 1.1 g/t Pd Eq in hole EBL21-13 from 3.0 metres downhole depth

- 2.0 metres of platinum-rich mineralization averaging 1.6 g/t Pt and 1.2 g/t Pd in hole EBL21-15

The geochemistry and mineralogy of this Pt-rich intersection are broadly similar to those observed in the Merensky Reef of the Bushveld Complex in South Africa. Previous geological investigations (e.g., Peck et al., 2001, Economic Geology, v.96, p.559-581) on the Property have identified a number of similar occurrences of pyroxenite-hosted disseminated sulfide mineralization that tend to have a greater proportion of platinum relative to palladium than is typically observed on the Property. However, these occurrences are exclusively present as sub-metre size inclusions within the Basal Layer. Accordingly, the intersection reported in hole EBL21-15 could represent a potential source layer for these inclusions – a concept to be tested by completing short step-out holes adjacent to EBL21-15 in the next program.

Dr. Dave Peck, the Company’s Vice-President of Exploration and Business Development, stated "the palladium-rich Basal Layer, which is the primary host to palladium mineralization at East Bull Lake, has now been intersected in over thirty (30) historic and recent drill holes over a strike length of >1.5 km. In addition, the first two holes drilled into the South Parisien Target area, located several hundred metres to the south, both collared in the same style of palladium-rich disseminated sulfide mineralization. One of these two holes also intersected platinum-dominant mineralization hosted by a narrow pyroxenitic unit. This represents an intriguing new target type on the Property - possibly a Bushveld-style PGM reef.”

Figure 1. Location of drill holes EBL21-10 to 15, Parisien Lake area, East Bull Lake palladium property. Drill hole specifications are provided in the Appendix. The current extent of the Central Parisien Lake Zone is outlined in yellow.

Selected analytical results for Drill Holes EBL21-10 through EBL21-15, Central Parisien Lake (CPL) Zone and South Parisien Lake (SPL) target. See Figure 1 for hole locations and Appendix 1 for hole specifications.

Hole

ID | Target

Area | From

(m) | To

(m) | Length

(m) | Pd

(g/t) | Pt

(g/t) | Au

(g/t) | Cu

(%) | Ni

(%) | Pd Eq

(g/t) |

| EBL21-10 | CPL | 66.00 | 80.00 | 14.00 | 0.94 | 0.37 | 0.03 | 0.01 | 0.01 | 1.21 |

| inc. | | 67.00 | 68.00 | 1.00 | 5.74 | 2.01 | 0.15 | 0.03 | 0.01 | 7.02 |

| and | | 76.00 | 79.00 | 3.00 | 1.53 | 0.55 | 0.04 | 0.01 | 0.01 | 1.90 |

| EBL21-11 | CPL | 69.00 | 71.00 | 2.00 | 1.57 | 0.37 | 0.08 | 0.04 | 0.03 | 1.97 |

| and | | 93.00 | 107.25 | 14.25 | 0.91 | 0.26 | 0.07 | 0.05 | 0.05 | 1.30 |

| inc. | | 94.00 | 98.00 | 4.00 | 2.40 | 0.65 | 0.08 | 0.10 | 0.05 | 3.09 |

| EBL21-12 | CPL | 73.00 | 78.00 | 5.00 | 0.57 | 0.19 | 0.04 | 0.19 | 0.08 | 1.13 |

| and | | 89.00 | 115.48 | 26.48 | 0.78 | 0.21 | 0.04 | 0.05 | 0.04 | 1.09 |

| inc. | | 94.00 | 110.00 | 16.00 | 1.18 | 0.30 | 0.05 | 0.07 | 0.05 | 1.60 |

| and inc. | | 98.00 | 106.00 | 8.00 | 1.86 | 0.43 | 0.09 | 0.10 | 0.06 | 2.45 |

| with | | 98.00 | 102.00 | 4.00 | 2.33 | 0.51 | 0.11 | 0.10 | 0.06 | 2.97 |

| EBL21-13 | SPL | 3.00 | 19.00 | 16.00 | 0.46 | 0.16 | 0.02 | 0.10 | 0.04 | 0.78 |

| inc. | | 3.00 | 10.00 | 7.00 | 0.68 | 0.24 | 0.03 | 0.14 | 0.05 | 1.12 |

| EBL21-14 | CPL | 122.00 | 181.72 | 59.72 | 0.32 | 0.09 | 0.02 | 0.05 | 0.04 | 0.54 |

| inc. | | 122.00 | 129.00 | 7.00 | 0.45 | 0.12 | 0.02 | 0.05 | 0.03 | 0.66 |

| and | | 137.00 | 143.00 | 6.00 | 1.30 | 0.33 | 0.07 | 0.14 | 0.09 | 1.94 |

| EBL21-15 | SPL | 0.90 | 18.00 | 17.10 | 0.18 | 0.09 | 0.01 | 0.04 | 0.03 | 0.35 |

| and | | 44.00 | 46.00 | 2.00 | 1.22 | 1.60 | 0.09 | 0.15 | 0.05 | 2.45 |

Notes:

- Based on current 3D geological interpretations, the true thickness is estimated to range between approximately 50-80% of the length of the reported mineralized intervals.

- Pd Eq is the palladium equivalent grade expressed in grams per tonne that is calculated using the following long-term consensus price forecasts ($US) sourced from S&P Global Metals and Mining Research and dated October 30, 2020: Pd - $1,813.90/oz; Pt - $955.55/oz; Au - $1,832.01/oz; Cu - $2.96/lb; Ni - $6.87/lb.

Next Steps

Recent drilling and geophysical modeling indicates that the Central Parisien Lake Zone is associated with discrete resistivity low anomalies that the Company believes are reflecting both increased alteration intensity and total sulfide abundance. The trend of resistivity lows underlying the Central Parisien Lake Zone extends approximately two kilometres further to the west into an area with no previous drilling and limited surface sampling. This represents an important target for the next phase of drilling, which is expected to commence toward the end of the summer. Other drilling being planned for the Parisien Lake area include:

- Follow-up on massive sulfide intersections and associated borehole EM anomalies obtained from the 2020 and 2021 drilling at Parisien Lake

- Complete short step out holes around the platinum-rich mineralization intersected in EBL21-15

- Test for the presence of feeder structure-related palladium mineralization in the modelled north-south structure cutting across the Central Parisien Lake Zone (Figure 1) adjacent to which the best palladium grades and widths are present

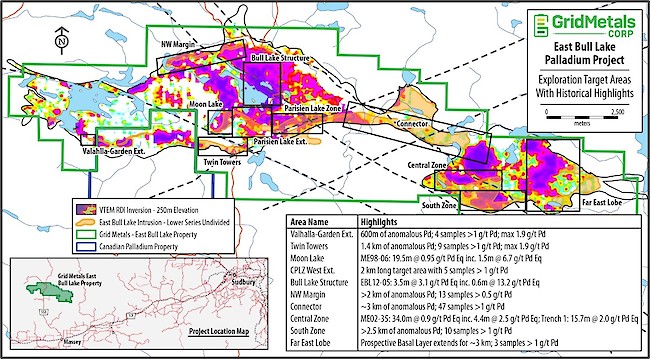

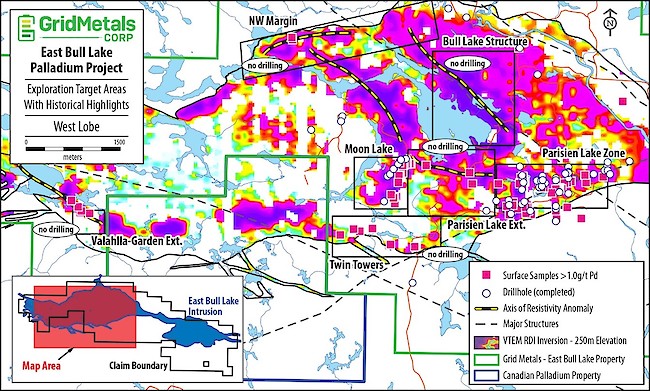

In addition to the Parisien Lake target there are several other kilometre-scale exploration targets on the Property (Figure 2). Many of these targets have never been drilled (Figures 3 and 4) and all exhibit similar favourable characteristics to those observed at Parisien Lake, e.g.:

- Outcropping or near surface palladium mineralization

- Prospective geology (Basal Layer, Footwall Breccia)

- Low resistivity and total magnetic intensity

- Proximity to potential feeder structures

The Company will soon initiate a summer field program to help prioritize these other targets for drilling. Several of these targets will be tested in the next phase of drilling, following which the Company will be in a much stronger position to determine where it should focus initial resource delineation drilling on the Property.

The Company is also awaiting results from selective rhodium analyses and preliminary metallurgical test work on Parisien Lake core samples and expects to report on this work within the next several weeks.

Figure 2. Additional exploration targets at the East Bull Lake property. The background image is a resistivity depth slice at 250m below surface in which darker and warmer colours represent areas of anomalously low resistivity that are believed to correlate with thick sections of mineralized Lower Series (Basal Layer) rocks near the base of the intrusion. Historical drilling and surface sampling highlights, keyed to the target name and sourced from previously filed Company Assessment Reports, are also provided.

Figure 3. West lobe exploration targets showing historical anomalous surface assays, drill hole locations and resistivity anomalies.

Figure 4. East lobe exploration targets showing historical anomalous surface assays, drill hole locations and resistivity anomalies.

Update on Bannockburn Nickel Property

The Company recently completed eight holes in a ~2,700 metre exploration drilling program at its Bannockburn Township nickel property located ~100 km south of Timmins, Ontario. The program is focused on determining the average grade and thickness of secondary, bulk-tonnage nickel sulfide mineralization along a one kilometre section of the previously intersected B Zone target. Historical drilling results for the B Zone indicate strong similarities in terms of thickness, grade and mineralogy to the Crawford nickel deposit owned by Canada Nickel Company (TSXV: CNC), which is also located in the Timmins region. Initial results from the new drilling are expected prior to month end.

Quality Assurance and Quality Control

Grid Metals applies best practice quality assurance and quality control ("QAQC") protocols on all of its exploration programs. For the current drilling program, core is logged and sampled at a core facility located in the town of Massey, Ontario – approximately 30 km south of the property. NQ-size drill core samples are cut into halves using a diamond saw. Standard sample intervals of 1.00 metre length are used unless a major geological, structural or mineralization boundary is encountered. Samples are bagged and tagged and transported by courier to, for this news release, the Actlabs Thunder Bay analytical facility. Actlabs analyzes each sample for Pd, Pt and Au using a lead collection fire assay on a 30 g pulp split and an ICP-OES finish. Copper, Ni and Co are analyzed using a ‘near total’ fusion multi-acid digestion and an ICP-OES finish. The Company uses two PGE certified reference materials ("CRMs") and one analytical blank purchased from Canadian Resource Laboratories to monitor analytical accuracy and check for cross contamination between samples. One of the CRMs or the blank are inserted every tenth sample within a given batch. The analytical results for the two CRMs and the blank for the sample batches reported here did not show any significant bias compared to the certified values and the results fell within the acceptable limits of variability.

Dr. Peck, P.Geo., has reviewed and approved the technical content of this release for purposes of National Instrument 43-101.