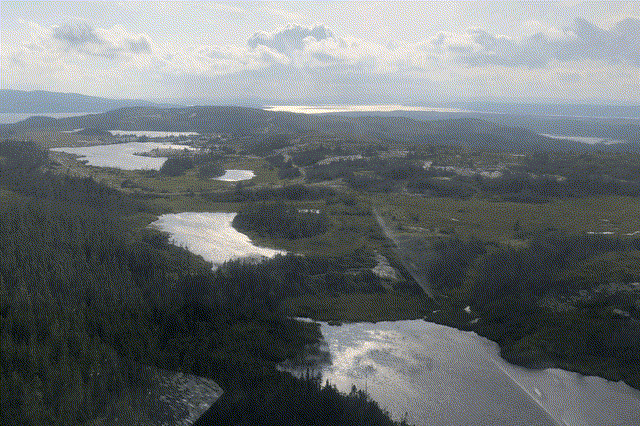

eyjafjallajokull/iStock via Getty Images

It's been a rough year thus far for investors in the precious metals sector, but one of the shining lights in the sector up until recently was Marathon Gold (OTCQX:MGDPF), up 30% year-to-date vs. a double-digit decline in the Gold Miners Index (GDX). Unfortunately, the stock has plummeted over the past month, with this correction accelerating following the request of an amendment to the Environmental Impact Study [EIS]. This is not a deal-breaker at all for the story, but it is a healthy reminder of why it's always best to book profits when a stock trades within close proximity to fair value. Given Marathon's scarcity as a mid-grade open-pit operation in a Tier-1 jurisdiction with modest capex, I continue to see the stock as a takeover target and would view pullbacks below US$1.81 as low-risk buying opportunities.

(Source: Company Presentation)

(Source: Company Presentation)

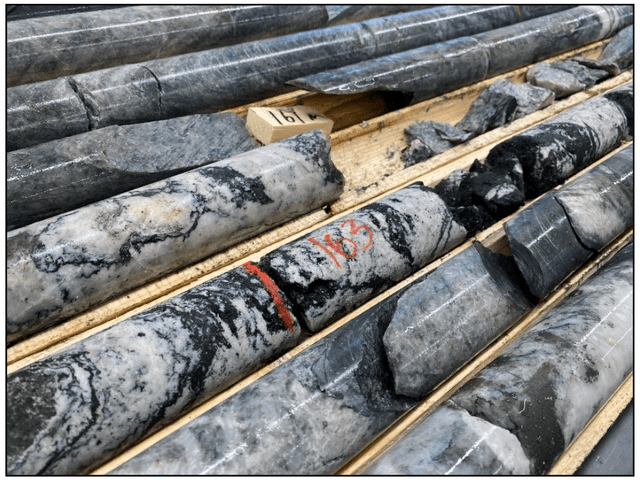

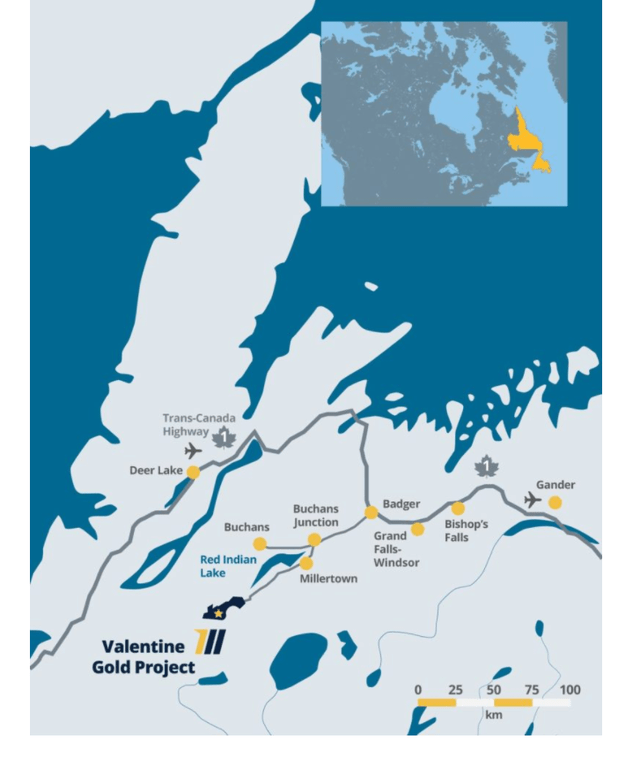

Marathon Gold has had an exceptional year thus far following the release of a robust Feasibility Study at Valentine Lake, steady medium to high-grade drill results from Berry over respectable widths, and a recent Indicative Term Sheet for US$185 million in financing with Sprott Resource Lending Corporation. This has helped Marathon to move well past many of its peers in the development stage, commanding a higher multiple due to its position as a developer in the more advanced stage. However, the solid news flow has been interrupted by negative news just recently, with Marathon receiving news that additional information is being requested for its [EIS] by the Newfoundland & Labrador Minister of Environment and Climate Change. Let's take a closer look below:

(Source: Company Presentation)

(Source: Company Presentation)

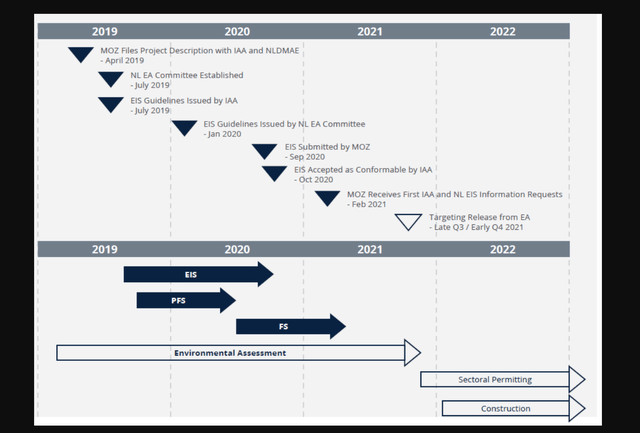

Last week, Marathon got the unfortunate news that the Minister of Environment and Climate Change for Newfoundland and Labrador has completed its review of the Valentine Project EIS and requested additional information. This involves the areas of Caribou Protection, Effects Monitoring, and Effects on Human Health. Given this news, Marathon will need to submit an amendment to the EIS. Once submitted (hopefully by year-end), the Environmental Assessment Division of the Department of Environment and Climate Change has an additional 70 days to complete their review and provide the amended EIS for public review. As the timeline shows below, Marathon was hoping to begin construction early next year, not anticipating any hiccups with the EIS. However, given this delay, a 6-month would not be surprising, pushing construction out to June 2022 at the earliest date. This pushes out revenue and cash flow by up to six months from previously planned, an unfortunate development.

(Source: Company Website)

(Source: Company Website)

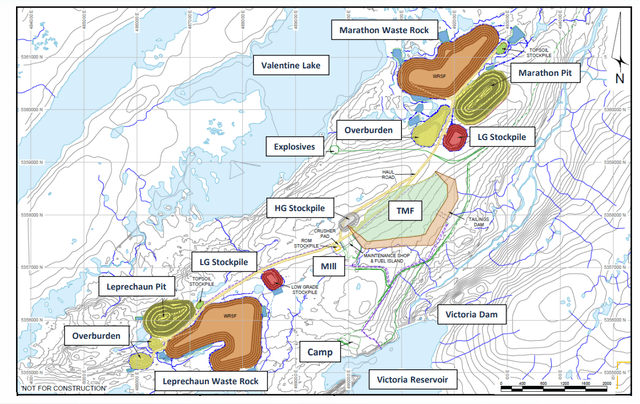

Given that Valentine Gold will be a significant contributor to the economy of Newfoundland and Labrador, and the largest gold mine in Atlantic Canada if built, I can't foresee this being a deal-breaker for Marathon. The company already has Cooperation Agreements with six surrounding communities, has signed a Social Economic Agreement with Qalipu First Nations, and a Memorandum of Understanding with the Miawpukek First Nations. Besides, Valentine is a relatively modest project from a footprint standpoint, compared to massive projects that can often require more extensive permitting and more hurdles.

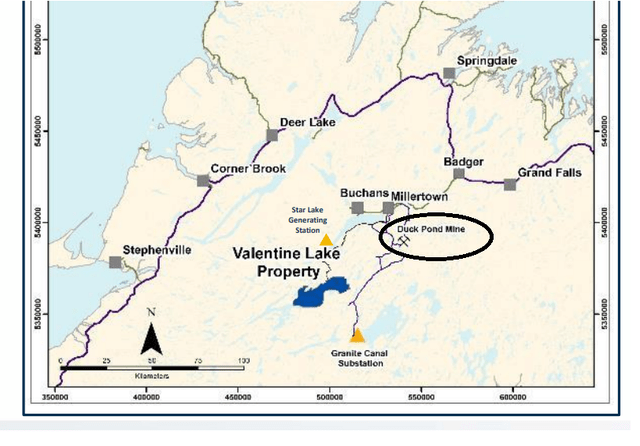

Meanwhile, the company has looked at a thickened tailings deposition strategy for better operational management. It's also worth noting that the Tailings Management Facility avoids areas of known fish habitat and is located downstream of the Victoria Reservoir and Victoria Dam. Finally, Teck Resources (TECK) Duck Pond Mine operated less than 100 kilometers northeast of the Valentine Property before being closed in July 2015, meaning this is not an area of Newfound that's opposed to mining. Therefore, from a permitting standpoint, this is not a project that should be a nightmare to get into production like Northern Dynasty's (NAK) Pebble Project, and I can't see any reason that further amendments will be required going forward. Based on the fact that this seems to be a short-term hiccup rather than a long-term issue, let's take a look at the valuation and whether this has presented a buying opportunity.

(Source: Company Presentation)

(Source: Company Presentation)

(Source: Company Presentation)

(Source: Company Presentation)

Valuation

Marathon Gold has 264 million shares on a fully diluted basis and trades at a market cap of ~$515 million based on a share price of US$1.95. With the Indicative Term Sheet in place for $185 million and over $85 million in cash, the company should be able to fully fund the Valentine Gold Project and G&A, with upfront capex estimated at ~$240 million, and the possibility that costs come in closer to $265 million with cost overruns. This means that dilution should be minimal over the next two years, given that the company has access to $270 million, and project construction should come in $265 million or less, which assumes a nearly 10% cost overrun, based on recent inflationary pressures sector-wide. Let's look at the value of the project and see whether this bakes in enough margin of safety:

(Source: Company Presentation)

(Source: Company Presentation)

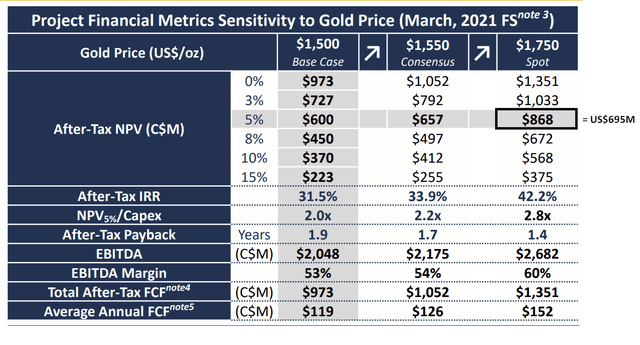

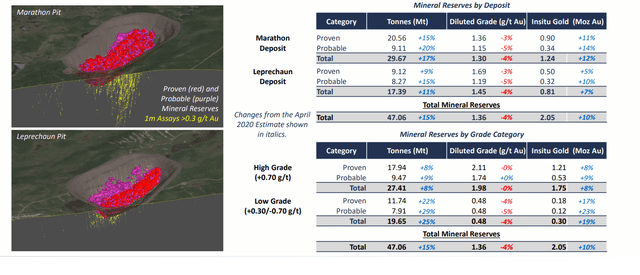

As shown in the table above, Marathon's Valentine Lake Project has an After-Tax NPV (5%) of C$868 million [US$695 million], but the study was done as of March 2021, and we have seen significant inflationary pressure since on materials (steel), fuel, and consumables. This has led to moderate cost creep in projects in construction, with recent examples being Seguela and Cote Gold. To be more conservative, given that the initial capex figure of $244 million might be difficult to meet, I believe a 7% discount to this After-Tax NPV (5%) figure makes more sense. This places the After-Tax NPV (5%) for the project at ~$646 million. However, it's important to note that the Feasibility Study is based on 2.05 million ounces of reserves (just the Marathon/Leprechaun pits). I believe it's more than fair to add in $140 million for regional upside (Berry/Sprite), which would place the project's total value at $786 million.

(Source: Company Presentation)

(Source: Company Presentation)

If we divide this valuation by an estimated fully diluted share count of 270 million at the end of 2022, the fair value for Marathon comes in at US$2.91 per share, assuming 1.0x NPV (5%). However, I would argue that 0.95x NPV (5%) is more suitable at this stage (funded for construction but awaiting permits), translating to a fair value of US$2.76 per share. At a current share price of US$1.95, this would point to more than 40% upside for Marathon Gold, with the stock trading at a near 30% discount to fair value. When it comes to developers, I generally prefer at least a 35% discount to fair value, which would translate to a low-risk buy zone of US$1.79 [US$2.76 x 0.65]. Obviously, the stock does not have to trade this low, but this is where the reward/risk picture would become the most compelling.

(Source: TC2000.com)

(Source: TC2000.com)

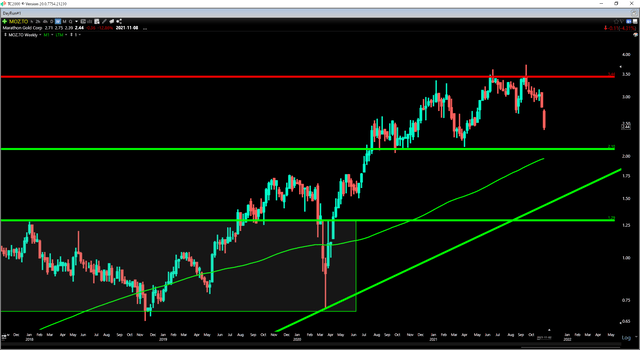

If we look at the technical picture, there have been 3 great buying opportunities for Marathon Gold over the past few years, occurring when the stock has dipped below its 150-week moving average (green line). As we can see above, this level is currently sitting at C$2.05 [US$1.64], and I would expect this area to provide strong support if the correction does deepen. Meanwhile, just above this moving average, Marathon has seen strong buying support at C$2.10 [US$1.68], and both of these support levels are converging between the US$1.64 and US$1.68 zone. With the stock already within the lower end of its current trading range [US$1.68 - US$2.75], the reward/risk has improved considerably. However, the lowest-risk buy zone looks to be at US$1.80 or lower, where it would trade at roughly 0.60x NPV (5%) and offer substantial upside for a re-rating at first gold pour (assuming permits are granted).

(Source: Company Presentation)

(Source: Company Presentation)

Marathon is an exceptional story in the right jurisdiction, and I continue to see the stock as a top-5 takeover target in the sector given its combination of grades, industry-leading projected margins, and modest upfront capex. This story is made even better by regional upside. Berry looks like it could contribute close to 1 million ounces in reserves long-term, pointing to a significant upside to the current mine life at Valentine Gold. However, with the recent permitting setback, it's no surprise that the stock has sold off sharply, given that sentiment in the sector is already grim, and bad news is being magnified. Having said that, I see no reason to believe permits won't ultimately be granted here, which suggests that this correction should present a buying opportunity if it continues. In summary, dips below US$1.80 would present low-risk buying opportunities.