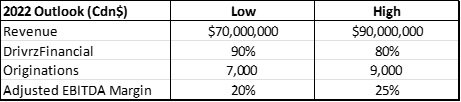

2022 Outlook and Achieves Key Milestone TORONTO, ON / ACCESSWIRE / November 30, 2021 / PowerBand Solutions Inc. (TSXV:PBX) (OTCQB:PWWBF) ("PowerBand" "PBX"or the"Company"), a comprehensive e-commerce solution transforming the online experience to sell, trade, lease, and finance vehicles is pleased to announce its 2022 Outlook for Key Performance Indicators and financial projections. Details are provided in the table below.

Revenue growth is expected to be significant in 2022, driven by strong penetration and adoption for DrivrzFinancial lease and retail loan originations. Dealer count has hit a key milestone ahead of schedule, now eclipsing 1,000 and currently at 1,200. Growth has been predominantly from enterprise customers who the Company believes will take a more systematic approach to achieving origination targets per dealer. While the implementation phase is more protracted for the larger dealer groups, the contribution will be significant in 2022. Industry-wide inventory levels continue to be a challenge; however, dealer adoption will drive growth as more dealers submit applications. The focus is on continued education of dealers on the platform to deliver more originations per dealer.

From a margin perspective, the Company continues to target 50-60% gross margins from DrivrzFinancial and higher gross margins from the other two business units. The Company is projecting a corporate EBITDA margin range of 20-25% in 2022 excluding stock-based compensation.

DrivrzXchange's marketplace connecting all types of sellers and buyers and DrivrzLane's e-commerce solution are projected to launch in the first quarter of 2022 and contribute materially to results in the second half of 2022. At the lower end of the revenue range, the two business units would comprise 10% of the consolidated revenue target, and at the higher end of the revenue target, the two business units would comprise 20% of the consolidated revenue target. The Company will provide more details on the business model and market opportunity for DrivrzXchange and DrivrzLane in its investor presentation on December 1, 2021.

As previously disclosed with third quarter 2021 results, PowerBand anticipates being EBITDA positive in the first quarter of 2022. In terms of growth initiatives that are underpinned by capitalized development costs, the Company is focused on three key projects: 1) Fully integrated loan operating system (Orca), 2) DrivrzXchange, and 3) DrivrzLane. The cash flow consumption from these projects are anticipated to be funded by non-dilutive sources. The Company is in advanced discussions to secure a line of credit or other credit instrument to fund the capitalized costs of the projects.

PowerBand continues to be focused on revenue growth for its shareholders, while employing cost containment to deliver profitability and a self-sustaining business model. The Company believes that it can demonstrate best in class profitability metrics in the industry as it further monetizes the revenue stack.

Kelly Jennings, CEO commented: "2022 will be the inflection year for this business as all of the pieces are in place to scale and deliver profitable growth to our shareholders. The three business units are operating in unison under one synergistic business plan. The opportunity in front of us is significant and we look forward to executing on our vision and achieving our objectives".