Candente Gold Corp. (CDG, TSX-V) is actively exploring the El Oro gold-silver district in Mexico. The district contains 20 veins with past production and more than 57 veins in total, with 6.4 million ounces of gold and 74 million ounces of silver produced from just two of these veins. The reported mine grades of the San Rafael vein, one of the district's richest producers, averaged over 10-12 g/t gold and 120-160 g/t silver over average widths of 3-10 metres. High grade bonanza shoots in San Rafael graded up to 50 g/t gold and 500 g/t silver, and in some places the vein is over 70m wide.

Summary Highlights • Documented historic production of more than 8 Million ounces of Gold equivalent from just 2 of over 57 known veins

• San Rafael and other known veins were only mined to an average depth of 200 metres, Candente has proven mineralization extends to depths of +500 metres

• Evidence and modern day geological understanding suggests El Oro is analogous to other epithermal vein systems in Mexico such as the Fresnillo, Guanajuato, Pachuca, and Pinos Altos mines where gold and silver have been discovered to depths over 1,200 metres, far below the historic levels mined

• Rich tailings opportunity could generate near-term cash flow

• 115 Historical shafts, 44 adits, and more than 50 kilometres of underground workings within the property boundary

• Candente Gold controls 100% of El Oro, previously Mexico’s 1st or 2nd largest mine, a significant high-grade gold-silver district with excellent exploration potential spanning across 12,314 hectares

Table of Contents Page

1 One of The World’s Few +8 Million Ounce Gold Mining Camps 3

2 Tremendous Brownfields and Grassroots Exploration Potential 4

3 Located 3 Hours from an International Airport via Paved Roads 6

4 Geological Setting and Mineralizing Features 6

5 Buddingtonite: Why is its Presence at El Oro Significant? 8

6 Rich Tailings Opportunity for Near-Term Cash Flow 9

7 Investment Highlights 10

8 Management and Board 11

9 Summary 13

10 Disclaimers, Disclosures, and Risks 14

1 One of The World’s Few +8 Million Ounce Gold Mining Camps

1 One of The World’s Few +8 Million Ounce Gold Mining Camps The significant and prolific history of “El Oro” dates back to 1529, when records indicate the Spanish began mining in the Borda Coronas area.

However, it would be another three centuries before the district achieved greatness.

Upon discovering the San Rafael vein, around 1880, the bonanza period of mining began at El Oro and it lasted until 1929. Measuring up to 70 metres wide and extending for 2.4 kilometres on strike, the San Rafael vein has yielded at least 5 million ounces of gold equivalent. The richness of this massive vein is also impressive, grades average 10-12 g/t gold and 120-160 g/t silver.

Spectacular grades of 1.6 ounces gold and 15.6 ounces silver have also been mined.

Operations in the San Rafael and Dos Estrellas veins ceased in 1937 due to low metal prices, labor difficulties, and war.

How Candente came to control this prolific and high-grade district is actually a fascinating story, one born out of a large porphyry discovery in Peru and good old-fashioned competition.

Luismin, a subsidiary of Goldcorp controlled El Oro until 2006, which speaks to its major potential in modern times. Goldcorp wasn’t keen on exploring the property so it posed an exploration challenge to 7 companies that were. After evaluating each of the 7 company’s technical expertise and plans for El Oro Candente emerged as the winner.

Finally, after spending $10 million exploring and years negotiating, Candente has wrestled 100% ownership of El Oro away from Goldcorp (as of January 2017). Goldcorp will be left with approximately a 5% equity stake in Candente. The all-important 100% ownership opens up many new possibilities and opportunities for Candente and its shareholders, whom control one of the world’s few +8 million ounce gold mining camps.

2 Tremendous Brownfields and Grassroots Exploration Potential In the late 19th and early 20th century the El Oro mine was considered to be the most important gold-silver camp in Mexico. Past production is documented at more than 8 million gold equivalent ounces, so the true number is likely much higher.

Despite a long history of mining, this region still hosts great potential for discovering new economic gold and silver resources. Additionally, San Rafael, the most prolific known vein has been proven to extend down to +500 metres (approximately 300 metres below historical workings). With 57 known veins and 44 adits this 12,314 hectare land package has no shortage of excellent drill targets.

Here’s What Professional Geologists That Visited El Oro Have Said:

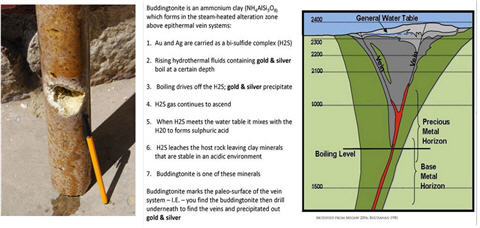

Here’s What Professional Geologists That Visited El Oro Have Said: • Dr. Peter Megaw, Director at MAG Silver and formerly Candente Gold, has said there is “tremendous potential” waiting to be unlocked at El Oro. The fact that we’re getting precious metals down to +500 metres and “buddingtonite” means a separate event. Buddingtonite is typically found in large systems and indicates lots of fluid. MAG Silver credits its Juanicipio discovery to buddingtonite, which was the indicator to drill much deeper than previously thought.

• Nadia M. Caira, P.Geo.: The 2012-2013 exploration program defined a simple block model estimate of potential tonnes and grade along a portion of the San Rafael vein modeled and confirmed in several 1993 holes that intersected significant near 1-ounce Gold and multi-ounce Silver. In addition, newly defined unique fault offset including down-to-north and down-to-south throws along easterly trending faults have relocated the potential vein targets along strike and to deeper levels.

• The Oriente area immediately northeast of the El Oro mines has the potential for the discovery of new mineralized veins. This area features similar geology as El Oro and was considered by previous property owners as very promising for the discovery of new, large, veins similar to San Rafael and Veta Verde. This area has had very little exploration work and it is almost entirely covered by post mineralization rocks (as is the El Oro area). –Mark J. Pryor B.Sc.

Low sulphidation epithermal gold-silver vein deposits like Candente’s El Oro Property can easily lie concealed beneath blankets of clay alteration and/or post mineral volcanic cover. Support and willingness for targeted and aggressive drilling is critical because surface features may not be a true representation of what lies at depth.

“Indicators point to El Oro being a stacked system. And what happens in a stacked low-sulphidation epithermal system is that the vein fluids rise up then precipitate gold-silver over about 200 metres vertical. Then you get another pulse and it will precipitate other gold-silver at a different level. So that’s what they’re finding at Juanicipio and most of the low-sulphidation epithermal systems in Mexico.”

--President and CEO Joanne Freeze, P.Geo.

3 Located 3 Hours from an International Airport via Paved Roads Only a 3 hour drive from Mexico City’s International Airport (approximately 110 km), the El Oro Property can be accessed easily via well-established paved roads year round.

The historic mining-friendly town of El Oro has a population of approximately 50,000. The locals have good memories of the lifestyle and employment mining can provide. El Oro hosts several elementary and secondary schools, one university, and a hospital. Internet access and cellular networks are readily available.

Consisting of 27 claim blocks, the El Oro Property is 12,314 hectares in size. The landscape consists of rolling hills, average elevation is between 2,200 and 3,000 metres. Existing infrastructure, including access to power and skilled labor, is considered to be excellent.

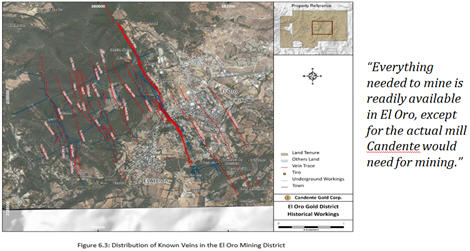

You can see the extensive network of underground workings and gold-silver veins featured above. The town of El Oro literally grew up around and on top of this prolific and historic mining camp, which straddles the border between the states of Mexico and Michoacn.

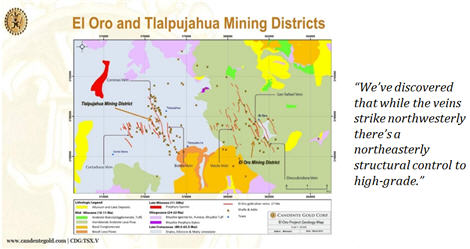

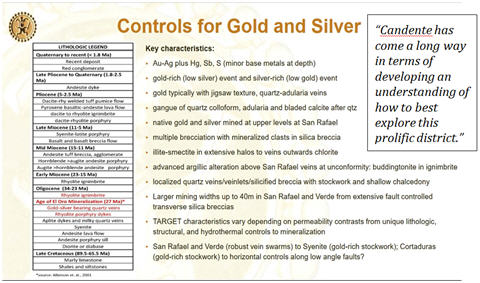

4 Geological Setting and Mineralizing Features El Oro is situated within the east-west trending Trans-Mexican volcanic belt in the central part of Mexico. The belt consists mainly of Tertiary and Quaternary andesitic flows and tuffs underlain by Cretaceous and Jurassic meta-sediments and meta-volcanics.

Productive veins of the El Oro district are hosted in the Cretaceous and older meta-sediments and meta-volcanics. In most of the area, these rocks are covered by post-mineral Tertiary and younger rock units. In the Tlalpujahua area, the older, pre-mineral rocks and veins are exposed on the surface. The same Cretaceous and older rocks with quartz-carbonate veins are exposed in erosional windows within the younger Tertiary volcanic rock units south of the town of El Oro (Descubridora vein) and in some parts of the Oriente area.

Initial mining in the El Oro – Tlalpujahua area started in veins out-cropping in these erosional windows (Corona, Borda, Descubridora veins). Productive veins of the El Oro area (San Rafael and Veta Verde veins) are mainly hosted in black meta-sediments and less commonly in meta-andesite tuffs. Veins are usually steeply dipping. They vary in thickness from less than 1 to over 70 metres, and can be traced for over 3.5 kilometres along strike. Most of the known veins in the El Oro district strike NW-SE with a steep dip (65-80 degrees) to the west in the veins located in the eastern part of the property (San Rafael and Veta Verde veins) and to the east in the veins located in the western part of the property in the Tlalpujahua area (Corona and Borda veins).

The most productive part of the two districts occupies an east-northeast vein corridor that measures approximately 4.0 miles (6.5 km) from east to west and 2.5 miles (4.0 km) from north to south.

A Huge Amount of Data Interpretation Has Been Completed Since 2013:

A Huge Amount of Data Interpretation Has Been Completed Since 2013: • Reviewed over 1,000 level plan maps from old workings

• 3D Modeling

• Structural Geochemistry

• Lithology

• ASTER Landsat

• Digitize extensive historical database

Summary of Important Geological Features: • Low sulphidation epithermal gold-silver deposit

• Located within Trans-Mexican volcanic belt, classified as the El Oro-Tlalpujahua

mining district

• Productive veins hosted in the Cretaceous, black meta-sediments, and meta- volcanics which are typically covered by post-mineral Tertiary and younger rocks

• Buddingtonite is associated with long-lived systems and lots of fluid;

• Texture of veins has been mineralized and broken several times;

5 Buddingtonite: Why Is Its Presence at El Oro Significant? Buddingtonite marks the paleo-surface of the veins system – I.E. – upon finding buddingtonite you drill underneath to find the veins, along with the gold and silver that precipitated out.

MAG Silver’s Juanicipio is one of a growing list of discoveries in Mexico that used this methodology and buddingtonite as the key indicator for drilling deep. Buddingtonite is well documented in big vein systems, and it doesn’t occur without lots of heat, boiling, and fluid.

6 Rich Tailings Opportunity for Near-Term Cash Flow The municipality of El Oro has 4 known tailings piles in or near the town and they are keen to build on this land. Therefore, the local government is in favor of mining and would earn an 8% Net Profits Interest (NPI) on any production.

Tailings piles are outlined below, in pink, and the “Mexico” deposit alone is estimated to contain 1.27 million tonnes at a grade of 2.94 g/t gold and 75.12 g/t silver (News Release dated July 10, 2014). That amount of material could feed a 750 tpd mill for nearly 5 years.

Candente optioned the rich tailings opportunity to Sun River Gold in favor of concentrating on exploration. The engineering team behind it has put more than 10 mining operations in place over prior decades.

Sun River is working on the recovery process, making staged payments of $500,000 and fully-funding the project in exchange for a 100% interest. Initial test results suggest Sun River has figured out how to economically extract the gold and silver. If successful with the tailings Sun River envisions blending above ground material with even higher-grade backfill. Old maps suggest some underground sections are upwards of 10 metres thick and samples taken by Candente averaged 4.7 g/t gold and 53 g/t silver.

7 Investment Highlights One of the Most Significant Past Producers in Mexican Mining History: The reported mine grades of the San Rafael vein, one of the district's richest producers, averaged over 10-12 g/t gold and 120-160 g/t silver over average widths of 3-10 metres. High grade bonanza shoots in San Rafael graded up to 50 g/t gold and 500 g/t silver, and in some places the vein is over 70m wide.

There aren’t many +8 Million ounce gold mining camps in the entire world.

As of January 2017 Candente controls 100% of this prolific property (previously owned by Goldcorp), which opens up many new possibilities and opportunities.

Candente Has Proven Mineralization Extends at Depth: San Rafael and other known veins were only mined to an average depth of 200 metres, Candente has proven mineralization extends to depths of +500 metres.

With over 57 known veins and 44 adits on the property Candente has no shortage of drill targets and considerable blue sky potential.

Evidence and modern day geological understanding suggests El Oro is analogous to other epithermal vein systems in Mexico such as the Fresnillo, Guanajuato, Pachuca, and Pinos Altos mines where gold and silver have been discovered to depths over 1,200 metres, far below the historic levels mined.

Location and Existing Infrastructure: Only a 2.5 to 3 hour drive from Mexico City’s International Airport (approximately 110 km), the El Oro Property can be accessed easily via well-established paved roads year round.

Everything needed for mining is readily available in El Oro, including electricity and skilled labor. More than 50 historical shafts and +50 kilometres of underground workings allow for faster and less costly access.

Rich Tailings Opportunity for Short-Term Cash Flow: The El Oro Mine tailings deposit is estimated to contain 1.27 million tonnes at a grade of 2.94 g/t gold and 75.12 g/t silver. Historically, miners were thought to have used a cutoff grade of at least 8 g/t gold.

Sun River, a private company backed by a group of engineers, is earning a 51% interest in the tailings project by doing all the work themselves. Test results suggest Sun River has figured out how to economically get the gold and silver out. No costs are being accrued to Candente.

Experienced Management Team: Candente’s management and operational team is well suited to advance the Company’s El Oro Property. From boots on the ground exploration through marketing and financing, they have the ability to get things done, along with a track record of making discoveries and building mines.

8 Management & Board Paul H. Barry, MBA

Chairman

Mr. Barry has over 30 years of management experience and has served in senior executive roles for several of the world’s largest mining and energy companies. Previously, Mr. Barry served as Executive Vice President and Chief Financial Officer of Kinross Gold Corporation where he oversaw $16 billion of assets, raised $5 billion in new debt financing, and advised the Board regarding capital spending across four global regions.

Joanne C. Freeze, P.Geo.

President and CEO

Since entering the mineral exploration business in 1979, Joanne (Joey) Freeze has managed exploration programs and evaluated projects for both junior and major international mining companies such as Queenstake Resources, Arequipa Resources, and Placer Dome. Ms. Freeze established Candente Resource Corp. in 1997, and operated privately until going public during May 2010. Since then Candente has operated successfully and spun-out various assets, including Candente Gold.

Alec Peck, C.P.A.

CFO

Mr. Peck is a senior Chartered Professional Accountant, with vast experience in finance and operations. Mr. Peck's previous professional and career activities include a partnership in an international accounting firm followed by a career as Vice President in the corporate finance group of a Canadian investment dealer

Larry Kornze, P.Eng.

Director

Mr. Kornze holds an exceptional +30 year career in international gold exploration. He retired from Barrick Gold as the General Manager of Exploration for Mexico and Central America. Prior to working internationally Larry was the US Exploration Manager for Barrick Gold and was responsible for the Goldstrike Mine exploration with discoveries at Betze, Meikle, Deepstar, and Rodeo.

Dr. Kenneth G. Thomas, P.Eng.

Director

Dr. Kenneth G. Thomas was until July 2012 Senior Vice President, Projects, Kinross Gold Corporation. Previously, for 6 years, Mr. Thomas was a Global Managing Director and Board Director at Hatch, a leading international engineering and construction firm headquartered in Mississauga, Ontario with approximately 10,000 employees worldwide.

Ian Ward, P.Eng.

Director

Mr. Ward's specific areas of technical expertise include: Gold extraction, SAG milling, heap leaching, base metal flotation, environmental studies, feasibility studies and plant evaluations. He has extensive experience in Canada/USA and overseas through many assignments in South America, Mexico, Russia, Spain, West Africa and Saudi Arabia.

9 Summary Candente Gold (CDG, TSX-V) controls 100% of El Oro, previously Mexico’s 1st or 2nd largest mine, a significant high-grade gold-silver district with excellent exploration potential spanning across 12,314 hectares.

Mineralization at the San Rafael Vein, which averaged 10-12 g/t gold and 120-160 g/t silver over widths of 3-10 metres, has proven to extend 300 metres below historical workings. Brownfield targets are many, highlighted by 57 known veins. Plus, Candente generated 31 grassroots targets during its extensive data compilation program.

Arguably, “people” are just as important as “the rocks” when it comes to exploration stage projects. Candente’s management and operational team is well suited to advance the company’s El Oro Property. From boots on the ground exploration through marketing and financing, they have the ability to get things done, along with a track record of winning.

Given the size of the prize, Candente’s stock remains an attractive speculation at current prices.

10 Disclaimers, Disclosures, and Risks • Finance Risk

Finance risk is one of the most acute challenges facing publicly traded exploration and development companies in the current environment. Going forward, Candente Gold remains dependent on equity financing to fund its exploration and development activities, as well as corporate expenses.

• Dilution Risk

Prolonged periods of depressed equity values could force the company to continue financing operations at discounted prices. The net effect is a diluting of shareholder value over time and the threat of a share consolidation at some future date. Candente Gold has just over 107 million shares outstanding, not an unreasonable share structure. Nevertheless, the risk of dilution and/or a reverse merger is something that should be monitored.

• Operational/Execution Risk

There is an inherent risk with every exploration/development project that results are ultimately unsupportive of viable mine development. In such an event Candente Gold would likely realize a significant downgrade in the value of its property.

• Commodity Risk

Natural resources companies have no control over commodity price fluctuations. This can negatively or positively affect exploration and development companies like Candente Gold in many ways.

• Political Risk

Political risk relates to loss that may arise due to political decisions made by government leaders. Including but not limited to taxes, currency valuation, environmental regulations, and property rights. Although difficult to quantify, companies and investors must understand and examine the potential for political risks by closely examining the location’s history, political institutions, and political forces at work in the region. Considering the El Oro Property is located in Mexico, a country with a long history of respecting property rights and encouraging mine development, Candente Gold believes its political risk is relatively low.

Disclaimers & Disclosures Continued: 3rdEye Research Capital (“3ERC”) specializes in providing research based advisory services to financial advisory firms, accredited investors, and industry. This research is based on current public information that we consider to be reliable, but no representation or warranty, express or implied, is made by 3ERC, its employees, or affiliates as to its accuracy, completeness, or correctness. Any “forward looking statements” are our best estimates and opinions based upon information that is publicly available and that we believe to be correct but there is no guarantee that our forecasts will materialize. This research is provided for educational purposes only and does not constitute an offer or solicitation to buy or sell any securities discussed herein in any jurisdiction. This research does not have regard to the investment objectives, financial situation, or needs of any particular person. Investors should obtain advice based on their individual circumstances before making an investment decision. To the fullest extent permitted by law, neither 3ERC nor its employees or affiliates accept any liability whatsoever for any direct or consequential loss arising from any use of the information contained in this research. A fee of not more than $5,000 has been paid by Candente to 3ERC. The purpose of this fee is to subsidize the cost of research. 3ERC, its employees, or affiliates, may at any time beneficially own shares in companies covered. The firm’s principal place of business and registered office is in Scottsdale, AZ. Telephone: 561.596.5067 Email: 3rdEyeResearch@gmail.com