What do you get when you combine some of the best uranium geologists in the world, a world-class project in a mining-friendly jurisdiction, and a green energy fuel that is the most reliable and a cost-efficient baseload power source the world? You get

Baselode Energy Corp. (

TSX-V.FIND,

OTCQB: BSENF,

Forum) – an exploration company focused on discovering near-surface, basement-hosted, high-grade uranium deposits in Canada's prolific Athabasca Basin.

According to a

September 2021 World Nuclear News Fuel Report, nuclear generation capacity is expected to grow by 2.6% annually, reaching 615 GWe by 2040. Only 74% of 2020's reactor requirements were covered by primary uranium supply. As a result,

current nuclear capacity needs to double by 2050 to achieve the Intergovernmental Panel on Climate Change’s (IPCC) plan to limit global temperature rise to 1.5°C. Many countries have already committed under the Paris Agreement.

Of note to investors in this skyrocketing sector – several uranium stocks have rebounded since the March 2020 collapse ($23.67 / lb. low) in global markets. And they aren’t just rallying with the markets, but because uranium itself is back again…and up sharply. This has significant investment implications…especially for companies like Baselode Energy.

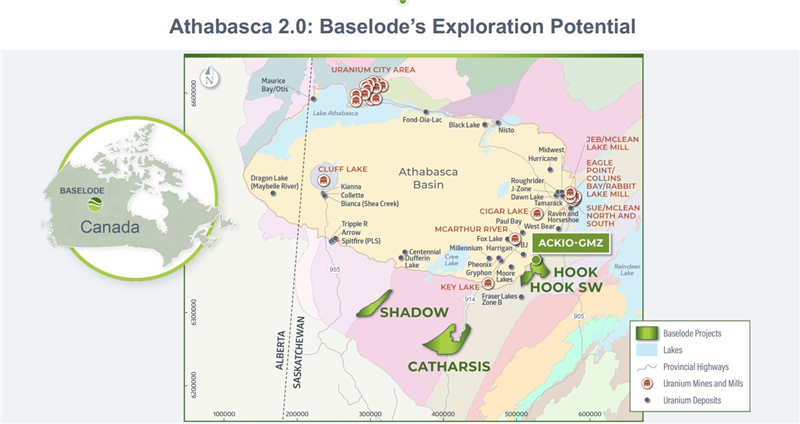

The company is currently exploring large-scale, drill-ready targets at its three uranium projects in the Athabasca Basin – a region in the Canadian Shield of northern Saskatchewan and Alberta best known as the world's leading source of high-grade uranium. To date, the region currently supplies around 20% of the world's uranium.

The company’s projects include

Shadow,

Catharsis, and

Hook; all comprising approximately 227,000 hectares of highly-prospective land within the Athabasca Basin area. Each project was staked on the basis of –

- preferred district-scale structural corridors hosting numerous high-grade uranium deposits

- initial geophysical interpretations suggest the project areas may have been subject to hydrothermal alteration fluids, which might have carried uranium within them

- and, readily-accessible basement rocks at or near-surface with little to no sandstone cover, and proximity to infrastructure, such as highways, powerlines, and mills.

(Click image to enlarge)

Investors Corner: Cashed Up and Drilling a New Discovery

(Click image to enlarge)

Investors Corner: Cashed Up and Drilling a New Discovery

Baselode Energy is a fully-funded, debt-free uranium exploration company looking for the next world-class deposit in the Athabasca Basin area of northern Saskatchewan, Canada. The company is currently focused on advancing their recent high-grade uranium ACKIO discovery, while moving forward to discover additional near-surface, basement-hosted, high-grade uranium orebodies outside of the Athabasca Basin on their projects.

Baselode utilizes a combination of innovative technology, well-understood geophysical methods, and thoughtful geological interpretations to map deep structural controls, designed to identify shallow targets for diamond-drilling. By doing so, the company believes they can make a discovery that could go into production at an expedited rate.

(Click image to enlarge)

(Click image to enlarge)

Baselode is led by CEO James Sykes – a uranium explorationist with more than 15 years of experience in Athabasca uranium exploration and discovery who has contributed to the discovery of over 550 million pounds of uranium, including NexGen Energy’s (

TSX: NXE) Arrow Deposit and integral in the discovery and delineation of Hathor Exploration’s (

NYSE: RIO) Roughrider deposits.

Baselode is part of the

Ore Group – a Canadian-based natural resource discovery and development organization consisting of in-house technical and financial expertise focused on premier jurisdictions and on metals with strong, long-term fundamentals.

In a recent interview with The Market Herald Canada, Mr. Sykes talked about the recent assay results from the ACKIO uranium discovery at the Hook Uranium Project in the Athabasca Basin.

(Click image to play video)

In the News: Planned Winter Drill Program at ACKIO

In early December

(Click image to play video)

In the News: Planned Winter Drill Program at ACKIO

In early December, the ACKIO discovery revealed high-grade uranium intersected near-surface, widespread zones of mineralization and an alteration halo that exceeds over 230 metres from drill hole AK21-01 – the seventh drill hole on the 100% owned Hook uranium project. The primary mineralized zone measured 15.5 metres of 0.13 weight% U

3O

8.

Baselode is planning to push the envelope at ACKIO with a 10,000-metre diamond drill program scheduled to begin in mid-to late-January 2022. Drill holes will be planned to intersect mineralization along strike and dip, which remain open in all directions, and to test for unconformity-style of mineralization. The drill program will be operated with helicopter support to lessen any ground-induced environmental impacts within the project area.

ACKIO is located about 30 kilometres east of well-established infrastructure, including an all-season road and powerline that runs between Cameco Corp.’s (

TSX.CCO) and Orano Canada’s McArthur River mine and Key Lake Uranium mill joint ventures.

Watch the video presentation below to hear from the Baselode technical team about what their AK21-01 drill hole results mean in the context of other Athabasca high-grade uranium deposits. The Company is very clear that they could be within 25 to 50 metres of higher uranium grades over longer drill hole lengths.

(Click image to play video)

From the CEO

(Click image to play video)

From the CEO

In a detailed interview, Chief Executive Officer James Sykes sat down with Stockhouse Editorial to discuss Baselode Energy’s suite of highly-prospective uranium projects, its unique exploration and development business model, and what investors and company shareholders can expect in the upcoming months for this intriguing uranium play.

SH: For our investors that may be discovering Baselode Energy for the first time, can you please give us an elevator pitch about the company past, present, future?

JS: New uranium exploration company (since June 10, 2020), tight capital structure with less than 80 M shares outstanding, ~20 owned by insiders, fully-funded with over $20M in the bank to continue exploring our recent high-grade uranium ACKIO discovery, which was discovered in the Company’s first drill program. Proven technical team with a hand in over 550 M lbs. of Athabasca uranium discoveries in the past 15 years, and serially successful management and Board that continues to create shareholder wealth.

SH: So, can you update our investor audience on any important new company developments…particularly the recent closing of a $9.2 million dollar bought deal private placement?

JS: The recent raise has provided us with the funds to aggressively drill our ACKIO discovery in 2022, in an attempt to start an NI 43-101 mineral resource estimate by the end of the year. Pounds in the ground while the U market is hot would elevate Baselode into a new tier of our peers.

SH: Can you walk us through your three uranium projects in the Athabasca Basin area: Catharsis, Hook, and Shadow?

JS: All three projects are all unique and equally important for Athabasca high-grade uranium exploration. They were all staked based on regional structural fundamentals that have contributed to uranium deposit formation within the Athabasca Basin itself. Our projects were strategically staked outside of the current Athabasca Basin boundary to avoid the notoriously problematic sandstone that plagues many Athabasca deposits with mining engineering problems.

SH: You’ve just announced confirmation of a high-grade uranium discovery, ACKIO, on the Hook project. Can you highlight some of the results?

JS: Discovery drill hole returned 0.13 wt% U

3O

8 over 15.5 metres at 134.3 metres depth (2.01 Grade-Thickness, “GT”), including high-grade uranium returning 1.29 wt% U

3O

8 over 0.5 m at 138.8 m and 0.66 wt% U

3O

8 over 0.5 metres at 142.3 metres. The confirmation of high-grade uranium and the GT >2 are important because these are typical of well-known Athabasca U deposits. These results give us “hope” that we could be within 25 to 50 m of very high-grade ore (i.e., 10.00 wt% U

3O

8 over 10 m).

SH: For investors new to the uranium mining space, what are the advantages to the Athabasca Basin and near surface deposits?

JS: Athabasca Basin is notorious for high-grade uranium. McArthur River and Cigar Lake are the highest-grade uranium deposits in the world, and even at low uranium prices (i.e., $20/lb. U

3O

8), they’d remain the mines with the highest valued commodity in the world. To put that into perspective, the current spot uranium price is $45/lb. U

3O

8. One of these mines alone could easily produce 15 to 25%, or more, of the annual global uranium supply, a testimony to Athabasca high-grade ore. Athabasca near-surface deposits have, historically, gone from discovery to production within 6 to 12 years. Should ACKIO turn into one of these economically viable near-surface deposits, we believe it’s possible it could be developed and into production during the current uranium demand cycle.

(Photo courtesy Baselode Energy Corp.)

SH: Can you give us a boots on the ground investor progress report at your other two properties – Catharsis and Shadow?

JS:

(Photo courtesy Baselode Energy Corp.)

SH: Can you give us a boots on the ground investor progress report at your other two properties – Catharsis and Shadow?

JS: Catharsis: we plan to complete a property-wide airborne VTEM survey in Q1 2022. Moving into late Q2, we aim for field mapping and sampling known high-grade uranium showings at surface, and into Q3 we are planning for 3,500 to 5,000 m diamond drilling. Shadow: temporarily on hold until our consultation process has been successfully completed to Baselode’s and the Turnor Lake Indigenous Communities satisfaction, and we’ve been granted a social license to explore the project area. We are all very excited with the prospects that exist at both Catharsis and Shadow.

SH: For our investor audience that might not be that familiar with the Athabasca Basin, can you give us some details about this uranium jurisdiction? Pros and cons?

JS: Pros = high-grade uranium, potentially low-cost operations, infrastructure in place, politically stable, and the province of Saskatchewan knows uranium processing. The wheel does not need to be re-invented. Cons = sandstone, sandstone, sandstone. Most Athabasca uranium deposits have not gone into production because the sandstone causes geo-engineering problems. Only two mines (McArthur, Cigar; these are the MONSTER deposits with abnormally high-grades and high-tonnage, even by Athabasca standards) have been mined underground in the sandstone, but they have technical issues, development over runs, safety concerns and higher than expected costs. A great example is Cigar Lake was discovered in 1976. It didn’t start production until 2016. Why should a company or investors have to wait 40 years to see their hard work pay off? Deposits of smaller scale within the Athabasca sandstone simply don’t get considered for development because of the technical issues outweighing perceived economic returns. Even mining a MONSTER requires unconventional underground mining techniques. The most technically successful and cost-effective operations that have moved into production in the Athabasca area are the open pit mines. They’re the ones that have built the mills. That’s what we hope ACKIO can become.

SH: Can you discuss the long-term strategy for the company and how do you see the uranium exploration sector evolving in this region?

JS: Long-term strategy is to distinguish ourselves as

the uranium exploration company that investors should focus on. Break out of the exploration pack of companies by having NI 43-101 resource completed (i.e., pounds in the ground), and continue exploring our projects for more deposits and more pounds. The sector is evolving rapidly with a lot of ground being staked (more than 50% increase in the past few months). We’re very happy that we were early to the sector and staked the projects that we felt have the best opportunities for success. We’re one for one so far, with two more projects remaining to be explored.

SH: Stockhouse metals & mining investors know that there’s been a dearth of capital available for junior exploration companies for the past few years, yet you’re fully funded with tight capital structure. Beside this and your three large projects, what makes Baselode attractive to both retail and institutional investors?

JS: Proven technical team having contributed to over 550 M lbs. of Athabasca uranium discoveries within the past 15 years, and serially successful management team that has continuously created share holder returns. Consider NexGen, for example, my success there helped transform that company from a $10M market cap to its current valuation of over $1B. We hope to make the same true for Baselode.

SH: Considering the company’s technical expertise, what sets Baselode apart from other junior mining companies in the uranium exploration sector and what makes your business model unique?

JS: We developed the Athabasca 2.0 thesis, in which we are looking for near-surface, basement-hosted, high-grade uranium deposits that are close to infrastructure (roads, powerlines, mills) and could be economically viable. The latter is important because although the Athabasca is known for high-grades, and everybody knows “Grade is King”, most of the time, we believe that “Economics are the Emperor and they rule over the King”. Our technical team have worked on more than five uranium discoveries, combined. We’ve seen uranium mineralization, and we looked at the Basin area but with outside-the-box thinking and applications. Our projects are unconventional, that’s why we were able to stake them so easily.

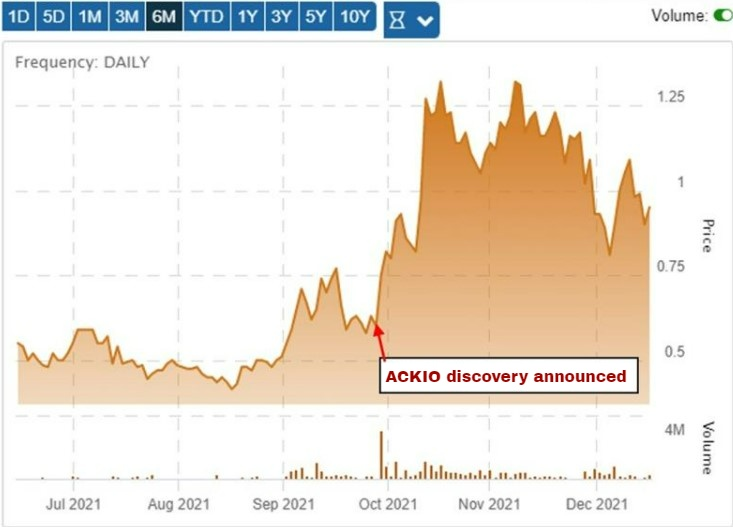

SH: And finally, James, what can you tell our investor audience regarding revenue traction the current valuation of your stock and why it’s a good value buy right now?

JS: We’re up 10 times since our IPO ($0.10/share in June 2020). Investors have not missed the boat. Not by a long shot. We’ve only completed 4 drill holes into the new ACKIO discovery. We believe any thick high-grade drill hole intersections will have a large positive impact with the share price. A significant NI 43-101 mineral resource will do the same. We’ve got 77 M shares outstanding with ~20 controlled by insiders, market cap approximately $80M, 110 M shares fully diluted. We’ve successfully completed very finance round at higher prices and we’re very proud of that. We are fully-funded and believe we can achieve the same market as some of our peers (i.e., $400M to $500M), in the short-term, which provides at least another 5x markup on share price. If we can make another discovery on any of our projects, there’s a great chance for more positive market reaction. In short, we believe we’ve got a lot of room to grow and benefit share holders in the near-term (i.e., less than 12 months).

(6-month TSX-V.FIND stock chart June 2021 – Dec 2021. Click image to link to chart)

(6-month TSX-V.FIND stock chart June 2021 – Dec 2021. Click image to link to chart)

For more information, visit

baselode.com.

FULL DISCLOSURE: Baselode Energy Corp. is a client of Stockhouse Publishing.