shotbydave/E+ via Getty Images

Welcome to the February 2022 cobalt miner news. The past month saw a busy month for cobalt news as the industry continues to do well boosted by strong cobalt prices.

Cobalt price news

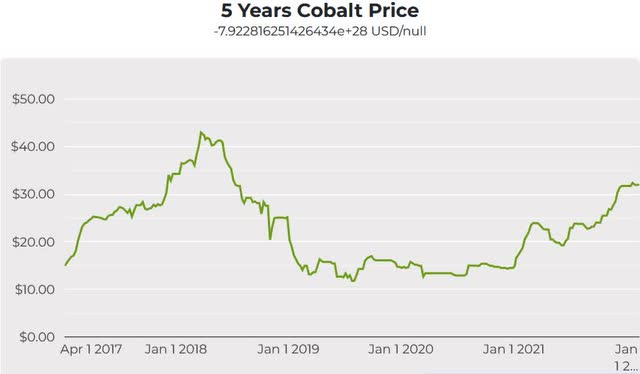

As of February 19, the cobalt spot price was slightly higher at US$31.97/lb, from US$31.71/lb last month. The LME cobalt price is US$72,000/tonne. LME Cobalt inventory is 259 tonnes, about the same as 261 last month. More details on cobalt pricing (in particular the more relevant cobalt sulphate), can be found here at Benchmark Mineral Intelligence or Fast Markets MB.

Cobalt spot prices - 5-year chart - USD 31.97

Cobalt 5 year price chart (Mining.com)

(Source)

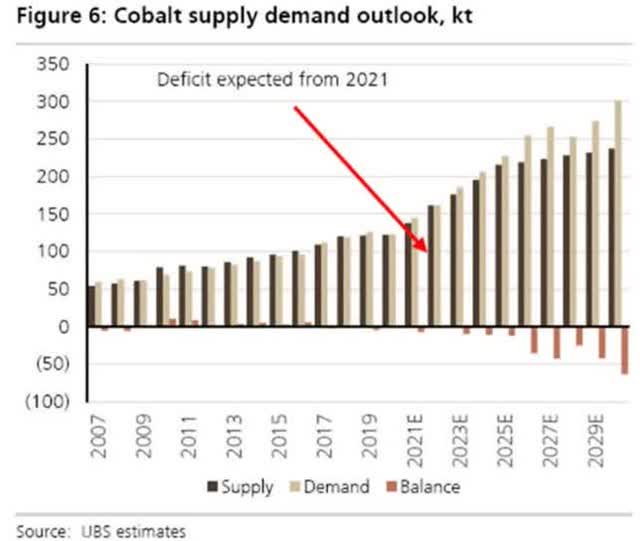

Cobalt demand v supply forecasts

UBS cobalt supply and demand forecast - Growing deficits from 2023

UBS cobalt supply and demand forecast (Fortune Minerals)

(Source)

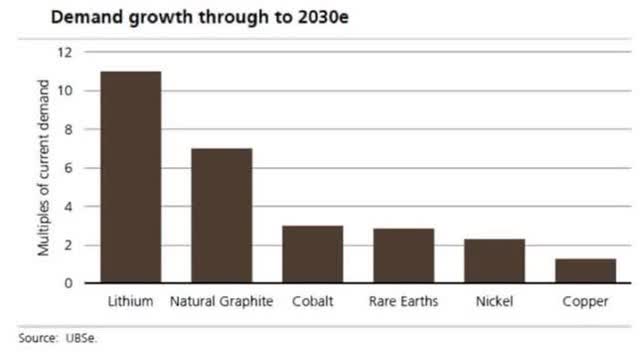

UBS's EV metals demand forecast (from Nov. 2020)

UBS's EV metals demand forecast (UBS)

Source

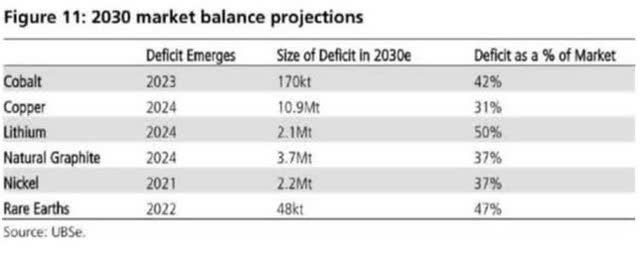

UBS forecasts Year battery metals go into deficit

UBS forecasts Year battery metals go into deficit (UBS)

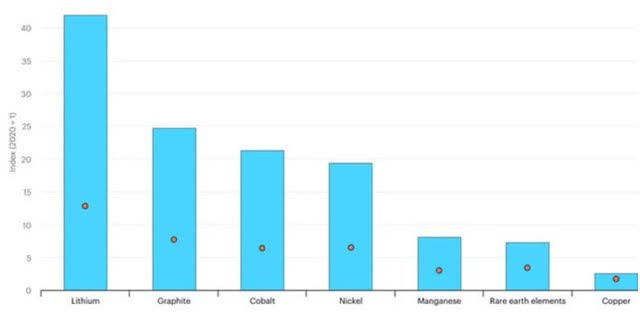

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 - Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 (IEA)

(Source)

Cobalt market news

On January 27, Fastmarkets reported:

Cobalt outlook bullish through 2022 and beyond, ERG CEO says. The situation in the global cobalt market is such that prices could climb to new highs through 2022 and beyond, according to the chief executive officer of diversified mining company Eurasian Resources Group (ERG).

On February 1, S&P Global reported:

INTERVIEW: ERG's Sobotka says metals prices on rising trend until recycling takes off in 15 years. Mainly primary metals to be used for 10-15 years. Recycling to kick in when initial EV wave completes lifespan. Aluminum price could see 30+-year high in 2022...Energy transition is a driving trend "with all the ingredients of a new supercycle," according to Sobotka. Annual investments in decarbonization of $750 billion-$1 trillion globally are foreseen in coming decades in a bid to keep to Paris Agreement 1.5 degree Centigrade global warming targets. This will boost demand for copper, aluminum, cobalt and other battery metals for renewable energy, transport and construction in "the biggest purchase order in the history of the mining industry: the amounts are just staggering," he said.

On February 3, Reuters reported: "Electric vehicles drive up nickel, cobalt and lithium prices.

- Nickel stocks in LME warehouses down 65% since last April.

- Chinese consumers draw down cobalt stocks.

- Lithium deficits likely for some years.

..."Chinese imports of cobalt hydroxide only increased 2.5% to 82,100 tonnes last year from 2020, meaning domestic stocks were drawn down considerably," said Benchmark Mineral Intelligence [BMI] analyst Caspar Rawles. BMI expects total cobalt demand at 177,500 tonnes this year, of which 104,000 tonnes will be consumed by the battery sector. Cobalt prices at around $70,000 a tonne are at their highest since July 2018. Traders expect further gains as Chinese consumers restock."

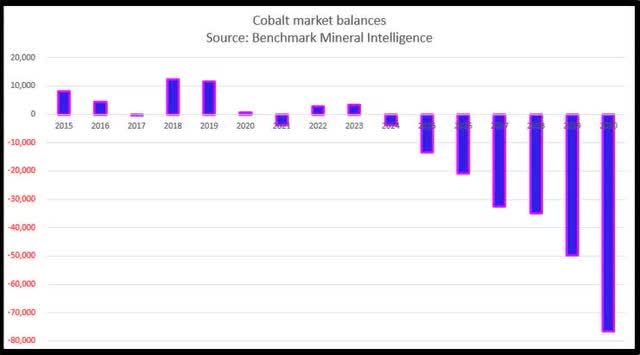

BMI 2022 forecast for cobalt - Deficits building starting from 2024

BMI 2022 forecast for cobalt - Deficits building starting from 2024 (Reuters - BMI)

(Source)

On February 16, S&P Global reported:

Electra forecasts 30% rise in cobalt demand by 2025..."The evolution towards lower cobalt content in the dominant EV batteries will be more than offset by larger battery packs and growing [EV] adoption rates," CEO Trent Mell said in a statement. Mell said Electra forecasts cobalt demand to grow more than 11,500 mt/year by 2025 compared with 2021 levels.

Cobalt company news

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On January 26, Glencore announced: "Glencore & Managem set up partnership for Moroccan production of cobalt from recycled battery materials."

On February 2, Glencore announced: "Full year 2021 production report." Highlights include:

"Own sourced cobalt production of 31,300 tonnes was 3,900 tonnes (14%) higher than 2020 due to the limited restart of production at Mutanda in 2021..."

On February 2, Reuters reported:

Glencore's cobalt output climbs on Mutanda restart; sticks to 2022 targets. Miner and trader Glencore said on Wednesday its cobalt output rose 14% in 2021, boosted by the restart of production at the world’s largest cobalt mine Mutanda in the Democratic Republic of Congo.

On February 3, Bloomberg reported:

Glencore moves into lithium recycling in deal with Britishvolt. Glencore Plc will build a new plant to recycle lithium-ion batteries in the U.K. as part of a deal to help Britishvolt Ltd. shore up its supply chain as it races to develop Britain’s first large-scale electric-vehicle battery plant.

On February 9, BNN Bloomberg reported:

Glencore in battery-metal offtake deal with Missouri Cobalt...Glencore will buy all of Missouri Cobalt’s production of those three metals, the trading house said Wednesday in a statement. It gave no details of the offtake terms, saying only there’s “significant embedded pre-payment.” It also said the two companies will explore other joint opportunities, including recycling.

Note: On June 19, 2021 Reuters reported: "Exclusive: U.S. nickel-cobalt miner Missouri Cobalt hires bank to go public through SPAC."

Note: Feb 9, 2022 - Missouri Cobalt changes name to United States Strategic Metals, LLC.

On February 15, Reuters reported: "Glencore sets aside $1.5 billion for probes, reports record earnings.

- 2021 EBITDA jumps 84% to $21.3 bln

- Net debt falls 62% to $6 bln

- Glencore to pay $4 bln in dividends

- Expects to resolve U.S., UK, Brazil investigations this year."

China Molybdenum [HKSE:3993] [SHE:603993] (OTC:CMCLF)

No news for the month.

Zhejiang Huayou Cobalt [SHA:603799]

On February 14, Reuters reported:

China's Huayou ships first MHP shipment from Indonesia JV. Zhejiang Huayou Cobalt's [603799.S] Indonesian joint venture shipped its first batch of mixed hydroxide precipitate [MHP], a product used to be processed into nickel and cobalt chemicals for EV batteries, to China's Ningbo port on Monday. PT Huayue, jointly set up with Tsingshan Holding Group and China Molybdenum Co [603993.SS], said in a statement that it is carrying a cargo with around 9,500 tonnes of MHP from Tsingshan Morowali port. The venture, which started trial production in end-November, has the capacity to produce 60,000 tonnes of nickel and 7,800 tonnes of cobalt per year.

Jinchuan Group International Resources [HK:2362]

On January 28, Jinchuan Group International Resources announced:

Operational update for the year ended 31 December 2021. In 2021, the Group ’s mining operations produced 61,260 tonnes of copper content included in copper cathode and copper concentrate (2020: 72,477 tonnes) and 3,379 tonnes of cobalt content included in cobalt hydroxide (2020: 4,158 tonnes)...Out of the sales of the copper and cobalt, the Group’s mining operations generated revenue of approximately US$510.1 million and US$106.6 million, respectively, in 2021 (2020: approximately US$388.1 million and US$109.5 million, respectively), representing an increase of approximately 31% and a decrease of approximately 3% respectively as compared to 2020...

Chemaf (subsidiary of Shalina Resources)

No news for the month.

GEM Co Ltd [SHE: 002340]

No news for the month.

Investors can read more about GEM Co in my Trend Investing article: "A Look At GEM Co Ltd - The World's Largest Battery Recycling Company" when GEM Co was trading at CNY 5.08.

Eurasian Resources Group ("ERG") - private

ERG owns the Metalkol facility in the DRC where ERG processes cobalt and copper tailings with a capacity of up to 24,000 tonnes of cobalt pa.

On February 15, Eurasian Resources Group announced:

ERG carries out exploration works in Kazakhstan, commences drilling at an additional site in the Aktobe Region.

Umicore SA [Brussels:UMI] (OTCPK:UMICY)

On February 10, Umicore SA announced: "Umicore signs inaugural € 500 million sustainability-linked loan."

On February 16, Umicore SA announced: "Full year results 2021." Highlights include:

- "Revenues of € 4.0 billion (+22%).

- Adjusted EBITDA of € 1,251 million (+56%).

- Adjusted EBIT of € 971 million (+81%).

- EBIT adjustments of - € 75 million.

- ROCE of 22.2% (compared to 12.1% in 2020).

- Adjusted net profit (Group share) of € 667 million and adjusted EPS of € 2.77 (+107%).

- Cashflow from operations of € 1,405 million (vs € 603 million in 2020); free cashflow from operations of € 989 million (vs € 167 million in 2020)

- Capital expenditures amounted to € 389 million (vs € 403 million in 2020)

- Net debt at € 960 million, down from € 1,414 million at the end of 2020. This corresponds to a Net debt/ LTM adj. EBITDA ratio of 0.77.

- Proposed gross annual dividend of € 0.80, of which € 0.25 was already paid out in August 2021."

Sumitomo Metal Mining Co. (TYO:5713) (OTCPK:SMMYY)

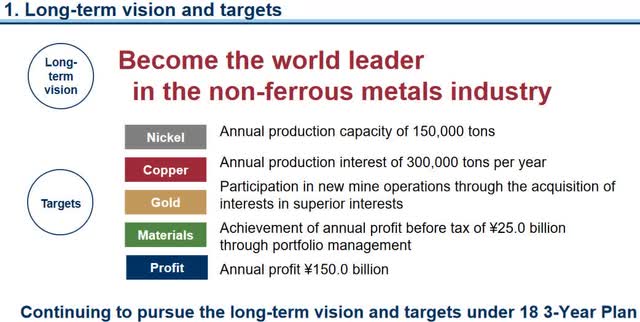

On February 15, Sumitomo Metal Mining Co. announced: "2021 3-year business plan. Renewed challenge for change."

Sumitomo Metal Mining long term vision and targets

Sumitomo Metal Mining long term vision and targets (Sumitomo)

(Source)

MMC Norilsk Nickel [LSX:MNOD] [GR:NNIC] (OTCPK:NILSY)

On February 10, MMC Norilsk Nickel announced: "Nornickel reports full year 2021 audited consolidated IFRS financial results." Highlights include:

- "Consolidated revenue increased 15% y-o-y to USD 17.9 billion owing to higher metal prices and sale of palladium from the inventories accumulated in 2020, which have positively offset production losses caused by industrial incidents in 1H21.

- Oktyabrsky mine returned to its full production capacity in the middle of May, while the Taimyrsky mine and Norilsk concentrator — in December 2021.

- EBITDA increased 37% y-o-y to USD 10.5 billion due to higher revenue, of which Bystrinsky GOK (Chita project) contributed USD1.1 billion, EBITDA margin amounted to 59%.

- Social expenses doubled to just over USD 1 billion mostly as result of provisions related to the agreements on social and economic development of the city of Norilsk and the Krasnoyarsk region.

- CAPEX increased 57% y-o-y to a record USD 2.8 billion driven by growth of investments into key strategic projects...

- Net working capital was up y-o-y to USD 1.3 billion...

- Free cash flow decreased 34% y-o-y to USD 4.4 billion...

- Net debt was almost flat y-o-y at USD 4.9 billion with net debt/EBITDA ratio of 0.5x as of December 31, 2021. Interest expenses decreased 38% due to effiient management of debt portfolio resulting in a record low average annual interest rate of 2.8%.

- In October 2021, the Company successfully placed a 5-year USD 500 mln Eurobond with a coupon rate of 2.80% marking the lowest ever spread to the benchmark in the history of Nornickel’s public offerings.

- On December 27, 2021, EGM approved the interim dividend for the 9 months of 2021 in the amount of RUB 1,523.17 per ordinary share (approximately 20.81 at the RUB/USD exchange rate set by the Russian Central Bank as of the EGM date) for the total amount of RUB 232.84 bn (approximately USD 3.05 bn)."

OZ Minerals [ASX:OZL] (OTCPK:OZMLF)

No significant news for the month.

Sherritt International [TSX:S] (OTCPK:SHERF)

On February 9, Sherritt International announced: "Sherritt ends 2021 with strong production results and a favourable outlook for nickel and cobalt markets." Highlights include:

- "Sherritt’s share of finished nickel and cobalt production at the Moa Joint Venture (Moa JV) were 4,266 tonnes and 476 tonnes, respectively...

- Net Direct Cash Cost [NDCC][2] at the Moa JV was US$3.60/lb, the lowest total since Q4 2018...

- Sherritt recognized net earnings from continuing operations of $14.4 million, or $0.04 per share...

- In support of the growth strategy announced on November 3, 2021 aimed at growing finished nickel and cobalt production by 15 to 20% of combined totals achieved in FY2021 and extending the life of mine at Moa beyond 2040...

Summary of key 2021 developments

- "Sherritt ended 2021 with cash and cash equivalents of $145.6 million ($78.9 million held by Energas in Cuba)...

- Sherritt improved its net earnings from continuing operations by $72.3 million in FY2021 as a result of strengthened nickel, cobalt, and fertilizer prices and efforts to reduce operating and corporate costs. Adjusted EBITDA was $112.2 million, up 188% from last year..."

Nickel 28 [TSXV:NKL] [GR:3JC]

No news for the month.

Investors can view the company presentations here.

Possible mid-term producers (after 2022)

Jervois Global Limited [ASX:JRV] [TSXV: JRV] (OTC: JRVMF) [FRA: IHS] (formerly Jervois Mining)

On January 31, Jervois Global Limited announced: "Jervois approves underground drilling campaign at ICO." Highlights include:

- "Idaho Cobalt Operations (“ICO”) project construction continues in line with Jervois’ updated schedule and cost announced in December 2021.

- First drill bay delivered to site; ICO underground in-fill drilling due to commence in Q1 2022.

- US$1.2 million campaign is anticipated to deliver 5,800 metre in-fill drilling by Q4 2022..."

On January 31, Jervois Global Limited announced: "Jervois quarterly activities report to 31 December 2021." Highlights include:

- "Jervois Finland Q4 2021 revenue US$96.0 million (+26% vs Q3 2021), 2021 full-year proforma revenue US$295.8 million.

- Jervois Finland Q4 2021 adjusted EBITDA US$3.9 million; 2021 full-year proforma adjusted EBITDA US$19.0 million.

- Q4 2021 EBITDA impacted by transitional factors including lag in cobalt prices flowing through revenue, mark-to-market accounting for cobalt purchases, and deferral of Q4 2021 contracted cobalt deliveries into 2022 due to logistical delays.

- Jervois Finland EBITDA guidance for 2022 of US$50-55 million, based on current cobalt price of ca. US$34.50/lb.1

- Jervois continues to progress Idaho Cobalt Operations (“ICO”) construction – on track for first cobalt and copper concentrate production in Q3 2022. Underground drill programme to commence in Q1 2022.

- SMP feasibility studies advance: small pressure oxidation (“POX”) autoclave to be installed, dedicated to ICO cobalt concentrate.

- In light of strong nickel and cobalt prices, and elevated mixed hydroxide (“MHP”) payables, Nico Young drilling programme approved by Board for 1H 2022 restart.

- US$57.5 million drawn on Mercuria working capital facility – headroom to adapt to a higher cobalt price environment.

- Jervois ends December 2021 quarter with A$67.7 million in unrestricted and unescrowed cash (US$49.2 million)."

On February 7, Jervois Global Limited announced:

US$50 million bond drawdown to fund ongoing construction of ICO. Jervois Global Limited has completed the first of two drawdowns of 50% of the US$100 million bond offering (the “Bonds”) proceeds from the escrow account, as contemplated by the terms of the Bonds...

Upcoming catalysts include:

- End Q1 2022 - So Miguel Paulista Refinery BFS due.

- Q3 2022 - Idaho Cobalt Operations initial production target.

Electra Battery Materials [TSXV:ELBM] (OTCQX:ELBMF) - formerly First Cobalt

On February 10, Electra Battery Materials announced: "Electra announces receipt of key permit for its Ontario refinery."

On February 16, Electra Battery Materials announced: "Electra provides update on refinery construction and commissioning." Highlights include:

- "Project control budget remains at US$67 million (C$84 million) and commissioning is on schedule for December 2022..."

Upcoming catalysts include:

December 2022 - Target to have their North American cobalt refinery operational with ore feed from Glencore.

Investors can view the company presentations here and a good Crux Investor CEO interview here.

Sunrise Energy Metals Limited [ASX:SRL](OTCQX:SREMF)(formerly Clean TeQ)

Sunrise Energy Metals has 132kt contained cobalt at their Sunrise project.

On January 28, Sunrise Energy Metals Limited announced: "Quarterly activities report." Highlights include:

- "The Sunrise Battery Materials Complex (‘Sunrise Project’) was awarded Commonwealth Government Major Project Status...

- Post quarter end, the Company secured conditional finance support from Export Finance Australia (‘EFA’) for up to A$400 million of debt funding.

- ...A 53-hole reverse circulation (‘RC’) drill program is planned to test the extent of further cobalt and nickel mineralisation at Sunrise East.

- The Phase 2 diamond drill holes completed at Phoenix Platinum Prospect intersected multiple intervals of platinum mineralisation, though platinum grades are lower than previous bonanza grades intersected in the Phase 1 drill program.

- Work streams to advance the fully integrated Sunrise Project continued with activities focussed on: Application for a modification to the Sunrise Development Consent, with NSW Government approval for the modification received in January 2022. Progressing the long-lead electrical transmission line (‘ETL’) work scope. Successful relocation of the Sunrise Project autoclaves, the major component of the Project’s processing plant.

- The Company had A$29.3m cash on hand as at 31 December 2021."

Upcoming catalysts include:

2022 - Possible off-take agreements and project funding/partnering.

Investors can also read the latest company presentation here.

Fortune Minerals [TSX:FT] (OTCQB:FTMDF)

No news for the month.

Upcoming catalysts include:

- 2022 - Drill results, possible off-take or equity partners, project financing.

Investors can read the latest company presentation here, or view a good video - "An introduction to the NICO Project."

Australian Mines [ASX:AUZ] (OTCQB:AMSLF)

On January 31, Australian Mines announced: "Quarterly activities report for period ended 31 December 2021.

Sconi project financing – continued negotiations with potential project finance partners following the securing of a binding Offtake Agreement with Korean-based LG Energy Solution for 100% of the projected future nickel and cobalt production from the Sconi Project. Those discussions continue to target finalisation by the end of the current financial year and the Company is set to further expand its project financing team during the first quarter of 2022 to assist in achieving this objective. Pilot production plant – the Company’s pilot precursor cathode active material (P-CAM) production plant commenced operation during the reporting period. This pilot production plant successfully produced a cutting-edge nickel-cobalt-manganese (NCM) 90/05/05 P-CAM and lithiated cathode active material (NYSE:CAM) in December 2021 from raw feedstock."

On February 9, Australian Mines announced: "Sconi Project - Greenvale mining lease compensation agreement."

Investors can read the latest company presentation here.

Upcoming catalysts include:

- 2022 - Possible Sconi financing.

Ardea Resources [ASX:ARL] (OTC:OTCPK:ARRRF)

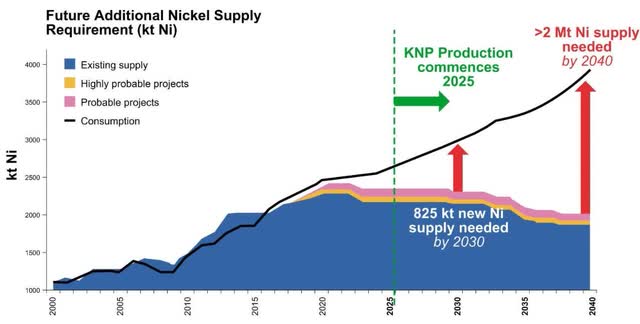

In total, Ardea has 5.9mt of contained nickel and 380kt of contained cobalt at their KNP Project near Kalgoorlie in Western Australia. Ardea is also exploring for gold and nickel sulphide on their >5,100 km2 of 100% controlled tenements in the Eastern Goldfields region of Western Australia.

On January 25, Ardea Resources announced: "Goongarrie hub feasibility study update." Highlights include:

- "...Two groundwater extraction licences [GWL] have been applied for with the WA Department of Water and Environmental Regulation (DWER) to secure this water from tenements already held by Ardea, near the planned Goongarrie Hub processing plant..."

On January 28, Ardea Resources announced:

Quarterly operations report for the quarter ended 31 December 2021...Nickel Sulphide – High grade discovery confirmed at Emu Lake. 2.72m @ 5.42% Ni, 0.85% Cu, 0.58g/t Pt, 0.27g/t Pd from 391.04m downhole...With Ardea’s KNP hosting one of the largest nickel-cobalt resources in the developed world, 830Mt at 0.71% Ni and0.046% Co (5.9Mt contained nickel metal, 380kt contained cobalt metal – ASX release 16 June 2021), Ardea is in the prime position to provide essential supplies of sustainably sourced nickel and cobalt, along with other Critical Minerals (notably scandium and the rare earth elements (REEs) neodymium and praseodymium).

Nickel demand v supply chart showing the world will need new nickel projects

Nickel demand v supply chart showing the world will need new nickel projects (Ardea Resources)

(Source)

On February 11, Ardea Resources announced:

Confirmation of high-grade nickel-cobalt from Highway metallurgical drilling. Intercepts at 0.5% Ni and 1% Ni cut-off grades include: AHID0002 42m at 0.77% nickel and 0.11% cobalt from 2m including 12m at 1.01% nickel and 0.22% cobalt from 16m and 6m at 1.00% nickel and 0.04% cobalt from 38m.

On February 18, Ardea Resources announced:

Trading halt. The securities of Ardea Resources Limited (‘ARL’) will be placed in trading halt at the request of ARL...pending the release of the results of an equity raising.

Upcoming catalysts include:

- 2022 - Possible off-take partner and funding for the GNCP Project. Further exploration results.

Cobalt Blue Holdings [ASX:COB] (OTCPK:CBBHF)

In total Cobalt Blue currently has 81.1kt of contained cobalt at their 100% owned Broken Hill Cobalt Project [BHCP] (formerly Thackaringa Cobalt Project) in NSW, Australia. LG International is an equity strategic partner.

On January 31, Cobalt Blue Holdings announced:

December 2021 quarterly report. During the December quarter COB produced its first cobalt sulphate samples and these were subsequently delivered to partners. The production and dispatch of the cobalt sulphate samples represents an important milestone for the BHCP. The delivery of the cobalt sulphate samples also marked the formal end of Pilot Plant operations. Planning and procurement works are under way for the Demonstration Plant, with supporting bulk extraction and field work planned over the March quarter. COB received positive feedback from the samples dispatched to partners over Q3 2021. All samples were within commercial tolerances with feedback centred on customising products to individual customers.

Upcoming catalysts include:

- 2022 - Possible off-take agreements. Feasibility Study & project approvals. Final Investment decision. Project Funding.

Investors can watch a recent CEO interview here.

Havilah Resources [ASX:HAV] [GR:FWL]

Havilah 100% own the Mutooroo copper-cobalt project about 60km west of Broken Hill in South Australia. They also have the nearby Kalkaroo copper-cobalt project, as well as a potentially large iron ore project at Grants. Havilah’s 100% owned Kalkaroo copper-gold-cobalt deposit contains JORC Mineral Resources of 1.1 million tonnes of copper, 3.1 million ounces of gold and 23,200 tonnes of cobalt.

No news for the month.

Upcoming catalysts include:

- 2022 - West Kalkaroo gold starter open pit permitting and Feasibility Study.

Investors can learn more by reading my article "Havilah Resources Has Huge Potential and/or my update article. You can also view my CEO interview here, and the company presentation here.

Aeon Metals [ASX:AML](OTC:AEOMF)

Aeon Metals 100% own their Walford Creek copper-cobalt project in Queensland Australia.

On January 31, Aeon Metals announced: "Quarterly activities report for the period ending 31 December 2021." Highlights include:

- "Site exploration activities were concluded in November 2021 ahead of wet season.

- All assay results for the 2021 drilling campaign have been received.

- Drilling at Vardy Deeps has revealed exciting new and highly prospective horizons within the Walford Dolomite.

- Updated Mineral Resource Estimate is scheduled for completion in February 2022.

- Metallurgical test work continues with flowsheet optimisation progressing well.

- Walford Creek PFS remains on schedule for completion at end of Q1 2022.

- Commodity prices for the Walford Creek Project metal portfolio continue to perform strongly.

- Commonwealth R&D refund of A$1.17 million received in December 2021.

- Bacchus Capital Advisers appointed in December 2021 and currently advancing financing options for Walford Creek Copper-Cobalt Project development."

On February 18 Aeon Metals announced: "Aeon awarded A$0.3M in CEI funding."

Investors can view the latest company presentation here.

Upcoming catalysts include:

- Q1 2022 - Walford Creek revised PFS due.

GME Resources [ASX:GME][GR:GM9] (OTC:GMRSF)

GME Resources own the NiWest Nickel-Cobalt Project located adjacent to Glencore’s Murrin Murrin Nickel operations in the North Eastern Goldfields of Western Australia. The NiWest Project which has an estimated 830,000 tonnes of nickel metal and 52,000 tonnes of cobalt.

On February 15, GME Resources announced: "Six gold and three nickel anomalies outlined by soil sampling at the Abednego Project."

Investors can read a company investor presentation here.

Global Energy Metals Corp. [TSXV:GEMC][GR:5GE1] (OTC:GBLEF)

On January 27, Global Energy Metals Corp. announced:

Global Energy Metals closes sale of new 1% NSR royalty on Norway-based Rna Nickel Project; provides update on Lovelock Drill Program.

On February 8, Global Energy Metals Corp. announced:

Global Energy Metals Engages SJ Geophysics for Project data compilation and interpretation at Nevada-Based Treasure Box Copper Cobalt Project.

On February 9, Global Energy Metals Corp. announced:

Global Energy Metals receives approval to drill the Treasure Box Copper-Cobalt Project in Nevada.

On February 14, Global Energy Metals Corp. announced:

Global Energy Metals engages North Equities to support marketing initiatives as the Company advances its cobalt-copper-nickel project portfolio.

Investors can read my article on GEMC here.

Other juniors and miners with cobalt

I am happy to hear any news updates from commentators. Tickers of cobalt juniors I will be following include:

21st Century Metals (CSE: BULL) (OTCQB: DCNNF), African Battery Metals [AIM:ABM], Alloy Resources [ASX:AYR], Artemis Resources Ltd [ASX:ARV] (OTCPK:ARTTF), Aston Minerals [ASX:ASO] (formerly European Cobalt), Auroch [ASX:AOU] [GR:T59], Azure Minerals [ASX:AZS] (OTC:AZRMF), Bankers Cobalt [TSXV:BANC] [GR:BC2] (NDENF), Battery Mineral Resources [TSXV:BMR], Blackstone Minerals [ASX:BSX], BHP (NYSE:BHP), Brixton Metals Corporation [TSXV:BBB](OTC:BXTMD), Canada Nickel [TSXV:CNC], Canada Silver Cobalt Works Inc [TSXV:CCW] (OTCQB:CCWOF), Canadian International Minerals [TSXV:CIN], Carnaby Resources [ASX:CNB], Castillo Copper [ASX:CCZ], Celsius Resources [ASX:CLA] [GR:FX8], Centaurus Metals [ASX:CTM], CBLT Inc. [TSXV:KBLT] (OTCPK:CBBLF), Cobalt Power Group [TSX:CPO], Cohiba Minerals [ASX:CHK], Corazon Mining Ltd [ASX:CZN], Cruz Battery Metals Corp. [CSE:CRUZ][FSE: A2DMG8] (OTCPK:BKTPF), Cudeco Ltd [ASX:CDU] [GR:AMR], DeepGreen Metals Inc. (TMC)/ Sustainable Opportunities Acquisition Corporation (SOAC), Dragon Energy [ASX:DLE], Edison Battery Metals [TSXV:EDDY], Electric Royalties [TSXV:ELEC], First Quantum Minerals (OTCPK:FQVLF), Fuse Cobalt Inc [CVE:FUSE] (WCTXF), Galileo [ASX:GAL], GME Resources [ASX:GME] (OTC:GMRSF), Group Ten Metals Inc. [TSXV:PGE] (OTCQB:PGEZF), Hinterland Metals Inc. (OTC:HNLMF), Hylea Metals [ASX:HCO], Independence Group [ASX:IGO] (OTC:IIDDY), King's Bay Res (OTC:KBGCF) [TSXV:KBG], Latin American Resources, M2 Cobalt Corp. (TSXV: MC) (OTCQB: MCCBF), MetalsTech [ASE:MTC], Meteoric Resources [ASX:MEI], Mincor Resources (OTCPK:MCRZF) [ASX:MCR], Namibia Critical Metals [TSXV:NMI] (OTCPK:NMREF), Pacific Rim Cobalt [BOLT:CSE], PolyMet Mining [TSXV:POM] (NYSEMKT:PLM), OreCorp [ASX:ORR], Power Americas Minerals [TSXV:PAM], Panoramic Resources (OTCPK:PANRF) [ASX:PAN], Pioneer Resources Limited [ASX:PIO], Platina Resources (OTCPK:PTNUF) [ASX:PGM], Quantum Cobalt Corp [CSE:QBOT] GR:23BA] (OTCPK:BRVVF), Regal Resources (OTC:RGARF), Resolution Minerals Ltd [ASX:RML], Sienna Resources [TSXV:SIE], (OTCPK:SNNAF), and Victory Mines [ASX:VIC].

Conclusion

February saw cobalt prices very slightly higher.

Highlights for the month were:

- Cobalt outlook bullish through 2022 and beyond, ERG CEO says.

- ERG's Sobotka says metals prices on rising trend until recycling takes off in 15 years. Energy transition is a driving trend "with all the ingredients of a new supercycle".

- Electric vehicles drive up nickel, cobalt and lithium prices. BMI 2022 forecast for cobalt - Deficits building starting from 2024.

- Electra forecasts 30% rise in cobalt demand by 2025 due to larger battery packs and growing [EV] adoption rates.

- Glencore & Managem set up partnership for Moroccan production of cobalt from recycled battery materials. Glencore's cobalt output climbs on Mutanda restart; sticks to 2022 targets. Glencore moves into lithium recycling in deal with Britishvolt. Glencore sets aside $1.5 billion for probes, reports record earnings.

- China's Huayou Cobalt ships first MHP shipment from Indonesia JV.

- Umicore announces adjusted net profit (Group share) of € 667 million and adjusted EPS of € 2.77 (+107%).

- Nornickel consolidated revenue increased 15% y-o-y to USD 17.9 billion owing to higher metal prices.

- Jervois Global continues to progress Idaho Cobalt Operations construction, on track for first cobalt and copper concentrate production in Q3 2022.

- Electra announces receipt of key permit for its Ontario refinery and is on budget and schedule for commissioning in December 2022.

- Sunrise Energy Metals secured conditional finance support from Export Finance Australia (‘EFA’) for up to A$400 million of debt funding.

- Aeon Metals Updated Mineral Resource Estimate due in February 2022. Walford Creek PFS remains on schedule for completion at end of Q1 2022.

As usual, all comments are welcome.