My Stance

I believe Questor Technology, Inc. (OTCPK:QUTIF) (TSX-V:QST) is a buy. To date, the company has lost 70% of its value since the coronavirus sell-off and is currently trading only 28% above its 52-week low. The large discount is because Questor derives most of its revenue from the oil and gas industry, which is surrounded by negative sentiment. Although most of their revenue comes from the oil and gas industry right now, they are not married to it long-term. Questor's technology has applications in landfills, biomass, and waste management, making the company more of a pollution treatment firm rather than an oil field services firm. With the future demand for pollution treatment solutions expected to rise due to stricter regulations on air quality and investor pressures, methane producers will become more motivated to purchase Questor's products and services. Furthermore, the company is solid financially. They generate high returns on invested capital, have a strong capital structure, and can grow cash flows. I believe Questor should be trading at $2.60 based on a DCF valuation with an EV/EBITDA exit multiple of 13. The company is currently trading at $1.74, representing a 33% discount.

Company Background

Through its series of patented technologies, Questor has sought to provide an environmentally friendly alternative to flaring. Flaring is a common combustion technique used to incinerate waste gas which is created primarily in the oil and gas industry, the biomass industry, and the waste management industry. Traditional candlestick flaring releases methane gas, Volatile Organic Compounds (VOCs), and NOx into the atmosphere. These gases are harmful to the environment and to people living close to flaring. As an alternative, Questor has developed three solutions.

The first is a proprietary high-efficiency waste gas incineration system that removes close to all methane and VOC emissions without producing any smoke clouds. The second is a proprietary power generation solution designed to efficiently transform otherwise wasted high and low-temperature heat into electrical power. The third is a cloud-based product designed to provide real-time emissions data and analysis.

Questor's patented technology ensures the complete incineration of both methane and VOCs and their temperature control system reduces NOx. Methane emissions are harmful to the environment and it is a significant emission in various industries. VOCs and NOx are harmful to humans and therefore cause health risks to anyone living close to flaring. All three solutions enable Questor's customers to meet emission regulations, address community concerns, and improve safety at industrial sites.

What Makes Questor's Technology Special?

The Q-Series

The Q-series is the company's waste gas combustion technology. This is their flagship technology. The system eliminates more than 99.99% of harmful pollutants and leaves a small ecological footprint. The combustor uses a natural draw design, which is common among competitors. The innovative part of the combustor is that it has no fans, blowers, or moving parts and is capable of accepting multiple gas streams. The design uses vents to create an air vortex that when mixed with the injected gas stream creates a thoroughly mixed and stable fireball to maximize residency time inside the combustor. This allows the combustors to require less maintenance while also having higher efficiencies than the competitors.

Q-Power

Q-Power is a complementary system to the Q-series combustors. The system is designed to transform otherwise wasted high and low-temperature heat into electricity that can be used on site. The all Organic Rankine Cycle system utilizes an axial turbine expander coupled to a synchronous generator via a gearbox and has an evaporator, condenser, economizer-heat exchanger, centrifugal refrigerant pump, and programmable logic controller. This design creates a high efficiency, low maintenance system, leading to valuable energy savings.

Q-Insights

Q-Insights is a cloud-based program that provides real-time emissions data and analysis. The program works with any waste gas emitting system. It is designed to help waste gas producers improve their emissions transparency as monitoring becomes more prevalent from regulatory bodies and investors.

Operational Summary

Questor has three business segments: equipment sales, equipment rentals, and services. Roughly 44% of revenue is generated from equipment sales, equipment rentals make up 45%, and services make up the balance. Geographically, 85% of revenue comes from the USA and 15% comes from Canada.

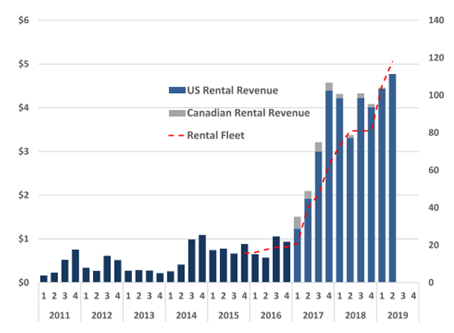

Questor's primary business is equipment rentals. Leading up to 2019 the company consistently increased its rental fleet, resulting in 120 total units. In the first quarter of 2021, over 90% of the company's deployed rental fleet was in Colorado or North Dakota.

Source: Raymond James Ltd.

Questor does not manufacture its own equipment. The fabrication process for the incinerators is outsourced and estimated to cost between USD$185,000 to $250,000 a unit.

Due to current economic conditions, Questor has suspended Q-series capital expansion plans until there is a sustained economic recovery. The company is currently focusing on improving operating efficiencies and reducing costs to enhance cash flows.

Investment Thesis

Tailwinds from ESG Investing

Questor aligns itself with the environmental part of ESG because their goal is the reduction of Methane in the atmosphere caused by traditional methods of waste gas incineration. Methane emissions are a major contributor to climate change. In fact, a United Nations report published on May 6, 2021, declared that drastically cutting emissions of methane is the world's best hope of slowing climate change. "Cutting methane is the strongest lever we have to slow climate change over the next 25 years and complements necessary efforts to reduce carbon dioxide. The benefits to society, economies, and the environment are numerous and far outweigh the cost. We need international cooperation to urgently reduce methane emissions as much as possible this decade," said Inger Andersen, Executive Director of UNEP.

Questor provides an excellent opportunity to investors and funds with a focus on the environment because of its mission to reduce methane emissions and slow climate change. The increased growth of ESG investing should provide a flow of new investors into the stock.

Growth in Cash Flows

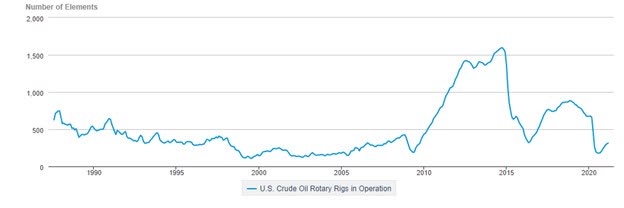

The OFS industry has been tough for investors over the past decade as declining oil and gas prices have strained industry growth, as you can see in the chart below. However, throughout this tough time, Questor has been able to grow its cash flows year over year. Between 2016 and 2019 Questor grew EBITDA from -$0.28 to $10.56.

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

In 2020, the emergence and rapid spread of a novel strain of the coronavirus significantly strained demand for crude oil and natural gas, impacting Questor's customers and its business. The black swan event caused Questor to post an EBITDA of -$1.71 in 2020.

However, the decline in cash flows should not be seen as the new normal because the demand for Questor's services is expected to quickly rebound.

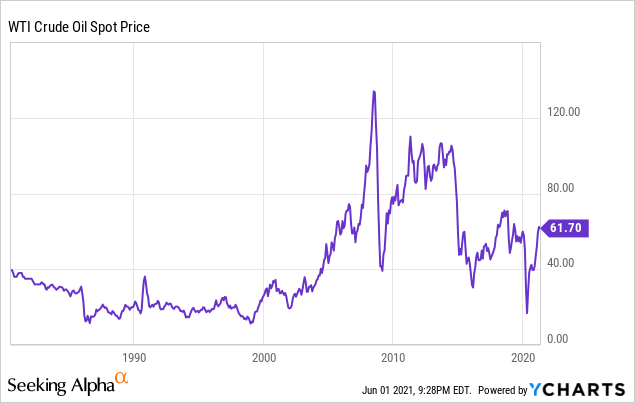

Oil prices began rebounding in the fourth quarter of 2020 and have continued into 2021. WTI crude oil prices are at USD$61.70/bbl at the time of writing, suggesting that North American energy producers have significantly improved economics. The increase in the prices of commodities should lead to improved cashflows for Questor's customers resulting in more business for them.

Data by YCharts Furthermore, Questor is diversifying its business to lessen the dependence on the oil and gas industry. Questor's technology has been deployed in other industrial sectors with methane emissions such as landfills, biomass, and waste management.

Finally, their solutions will be increasingly needed because policy regarding air quality will become more prevalent as nations move to limit the effects of global warming. As previously stated the United Nations has put a new emphasis on the reduction of methane emissions to slow climate change. This represents a shift away from the previous goal of reducing carbon dioxide and benefits Questor's technology.

New Markets

Questor's largest success has been in Colorado due to the state's strict air quality standards. In November 2020, the U.S. election brought a new president into power with dramatically different views in terms of environmental regulations. The new president is expected to enact policy that would increase air quality standards across the country, allowing Questor to mimic its success in Colorado on a larger scale.

Furthermore, Mexico has a lot of the ingredients for success. There is a large flaring market, an interface between flaring and population centers, and a progressive government with progressive views. Questor is optimistic for further business in Mexico given the country's aggressive objective to address energy emissions.

Finally, Canada recently established a $750 million Emission Reduction Fund, with a focus on methane reduction. This new fund indicates the federal government's understanding of the importance of the pollution treatment industry and it should provide Questor with opportunity in the future.

Reinvestment Economics

Questor's primary source of revenue comes from the rental segment of its business. They have been using their cash flows to aggressively grow their rental fleet with great success. Over the years they have seen an impressive returns on their capital. The average OFS firm in the U.S. has a ROIC of 1.29%. Over the past 5 years, Questor has had an average ROIC of 13%.

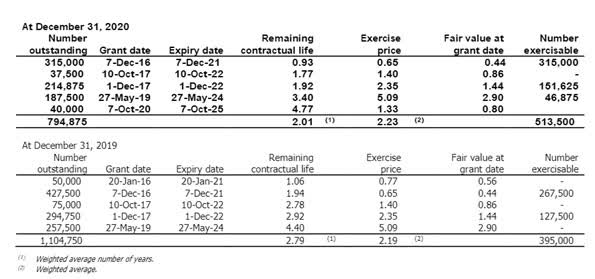

Insider Ownership

Individual insiders own 17.89% of Questor signifying an alignment between management and shareholders. Insider ownership is promoted by the company through their performance share unit and restricted share unit plan which incentivizes the long-term success of the company through equity-based incentives to management, employees, and contractors.

Source: Company Filings

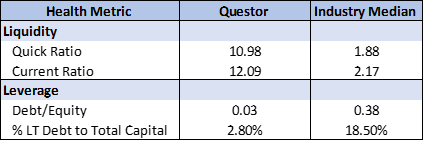

Capital Structure and Financial Health

Questor has a strong balance sheet with a large cash supply that will help the company weather the coronavirus storm.

Source: Created by author using data from company filings

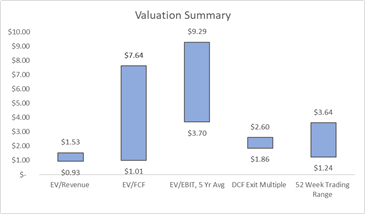

Valuation Summary

Questor is currently trading at a 46% discount to its 52-week high of $3.64. To value Questor on a relative basis, I used EV/Revenue and EV/FCF because the company was not profitable in 2020. QST is considered overvalued based on its EV/Revenue multiple and is in-line with its competitors based on its EV/FCF multiple. I do not see a relative valuation based on 2020 multiples as relevant due to the abnormality of the year. I believe valuing Questor on a relative basis using 5-year historical average multiples provides a better picture. Questor is undervalued based on its 5-year historical average EV/EBIT multiple.

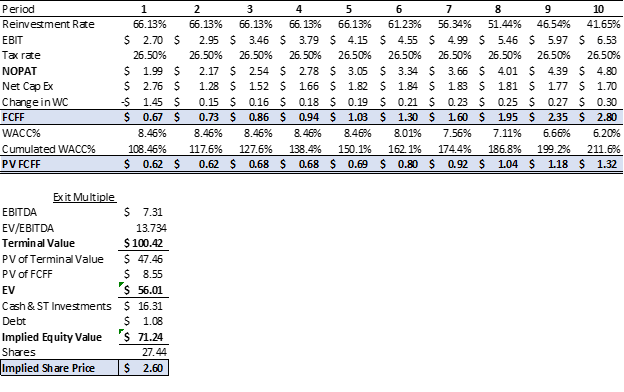

I have elected to value Questor using a Discounted Cash Flow model with an exit EV/EBITDA multiple of 13x. The multiple is the median EV/EBITDA multiple over the past 10 years. A 13x EV/EBITDA exit multiple yields a price of $2.60, with an upside of 49%. For the worst-case scenario, I used an EV/EBITDA exit multiple of 7.9x, which is what Questor traded for in 2017 when oil rigs in operation hit their lowest level since the crash began in 2014. The worst-case scenario yields a price target of $1.86.

Source: Created by author using data from company filings

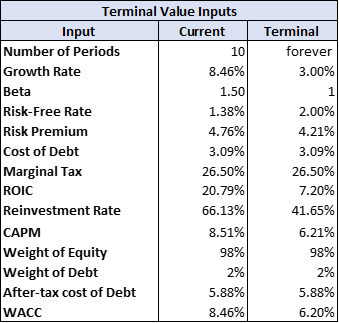

Discounted Cash Flow Model - Summary of Inputs

Source: Created by author based on assumptions made from past company filings

Source: Created by author based on assumptions made from past company filings

Risks

Currently, the demand for Questor's services and products are directly linked to the level of activity in the oil and gas industry. A reduction in oilfield spending impacts the demand for Questor, especially in places with loose air quality standards.

Questor operates in Canada, the United States, and Mexico. Due to its international presence, Questor is exposed to foreign currency fluctuations, changes in tax codes, and changes to legal structures. A longer than anticipated downturn in the OFS market or a failure to expand market share into other industries could hurt Questor's access to capital and their financial structure.

The environmental regulations that have helped Questor could also hurt the company if they are unable to expand into new markets. Environmental regulations and subsidies for renewable energy squeeze the oil industry, resulting in less business.

Conclusion

Based on my assessment of Questor I believe the company represents an excellent investment opportunity for anyone with a concern about environmental outcomes, who also has the risk tolerance to hold a small-cap company. Based on my discounted cash flow valuation there is currently a significant margin of safety and the company has a strong financial position, both of which make it a sound investment. However, its small market cap, cyclical trading nature, and a 5-year monthly beta of 1.57 make Questor a volatile holding.