Well Health Technologies (TSE: WELL) is the owner and operator of a portfolio of clinics delivering healthcare-related services. It operates through the following segments: Clinical services, Digital services, and others. It also engages in the Electronic Medical Records business that supports the digitization of clinics.

Well Health had recently raised C$34 million through an equity raise last week, which management claimed will be used to add accretive value for shareholders. It didn’t take long for the company to announce how it plans to use that cash.

On Wednesday, Well Health announced that it is ramping up its merger and acquisition program with multiple signed and actionable letters of intent. The important thing investors should note about Well Health’s acquisition strategy is its focus on increasing its intrinsic value on a per-share basis.

Higher revenues and earnings mean nothing if shareholders get diluted to the point where profitability actually decreases on a per-share basis.

In addition, the company announced that it is collaborating with all business unit leaders to reduce costs, which should lead to margin expansion going forward. This would also equate to higher operating cash flows that would allow the company to increase the number of acquisitions it can complete, as well as the size of the targets.

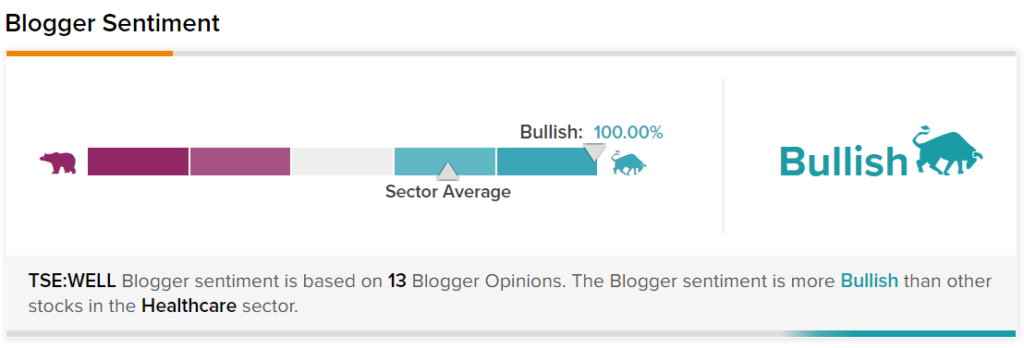

Blogger Sentiment

Sentiment towards Well Health appears to be very positive among bloggers.

The sentiment, which is based on the opinion of 13 bloggers, has a 100% bullish rating. This is above the sector average, as demonstrated in the picture above.

Wall Street’s Take

Turning to Wall Street, Well Health has a Strong Buy consensus rating based on nine Buys assigned in the past three months. The average Well Health price target of C$9.54 implies 178.1% upside potential.

Analyst price targets range from a low of C$6 per share to a high of C$12.83 per share.

Final Thoughts

It’s crucial for investors to see that management is focusing on creating value on a per-share basis because that is the main driver of share price appreciation in the long run. This is especially important for companies such as Well Health because it has a history of raising money through common share offerings.

Read full Disclosure