RGtimeline/iStock via Getty Images

Baytex Energy (OTCPK:BTEGF) is one of Canada’s small pure-play E&P companies. It extracts and sells crude oil from Western Canada, and from Eagle Ford in the United States. The company has been in business since 1993. It had a huge run up in the last oil bull market, from 2009 to 2012, when it rose nearly 600%.

However, Baytex started encountering weakness in 2012. Oil prices were still reasonably high then–the oil price crash of 2014/2015 was still years away. However, BTEGF’s sales for the year declined. Net income hit a record in 2012, but that was mostly due to strength in the early half of the year. By the fourth quarter, earnings were already starting to go down.

In the 2009-2014 period, BTEGF purchased a lot of assets. For example, it acquired $120 million worth of oil sands leases in 2012. These deals seemed to make sense at the time, because oil prices remained reasonably high then. However, the spending continued well into 2014. For example, Baytex spent an eyebrow-raising $2.6 billion buying Aurora Oil & Gas that year. The announcement was followed very shortly by an $800 million bond offering.

If you know what happened with oil prices in 2014, you can probably see where this is going. Starting in the Summer of that year, oil entered a long and painful bear market which, depending on how you look at it, lasted until 2020. There were substantial rallies in the 2014-2020 period. For example, there was a period between the start of 2016 and the end of 2018 in which WTI Crude rallied 137%. However, it was not until April of 2020 that WTI reached the lowest low prior to this year’s new high.

As a result of the weakness of crude oil in 2014-2020, Baytex stock got hammered. At one point, it was reduced to penny stock territory, trading for just C$0.44 on the TSX. With its high level of debt, it was incapable of turning profits at the oil prices that prevailed at the time.

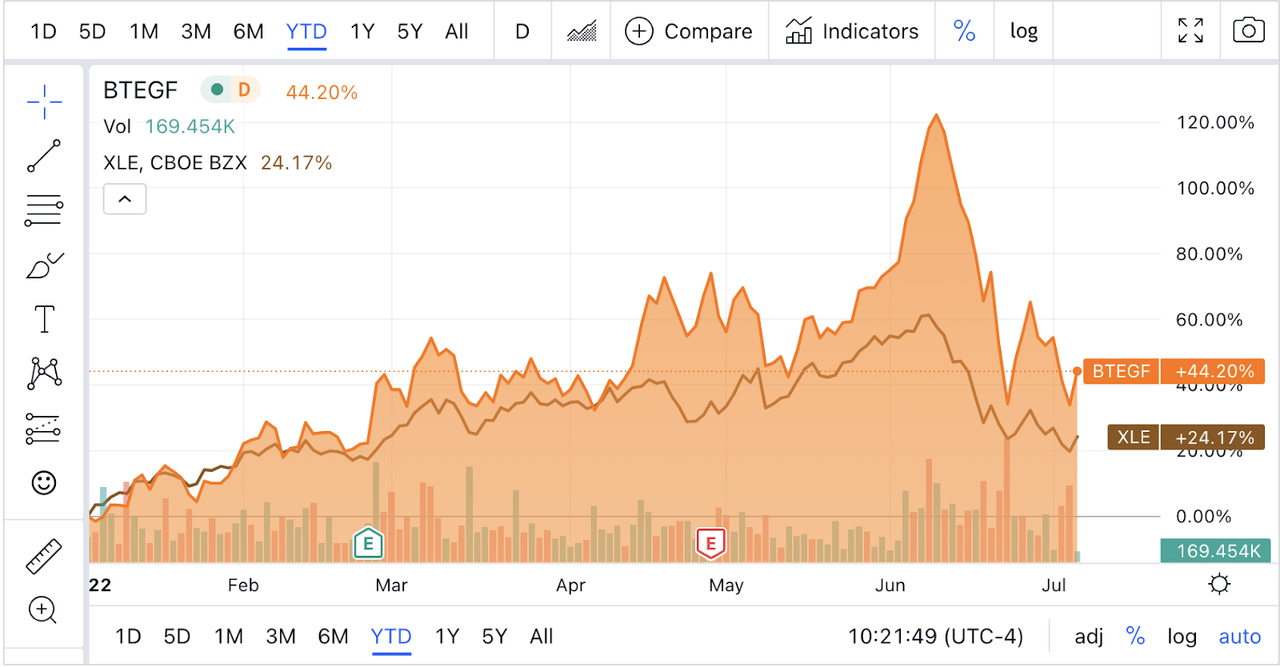

This year’s oil price rally changed all that. With prices well above $100 for most of this year, oil stocks like Baytex Energy have been doing well. The sector as a whole has been doing well, but Baytex much more so than most. If you look at a chart of Baytex against the Energy Select Sector SPDR Fund (XLE), you’ll see that Baytex is up almost twice as much as the energy sector as a whole.

Baytex vs XLE (Seeking Alpha Quant)

This has to do with Baytex’s unique financial situation. Because it is a smaller energy company with a lot of debt, it can report huge increases in earnings when revenue clears interest and other expenses. This effect can be compounded by paying off the debt, which Baytex is already doing. Because of these factors, BTEGF can really soar when oil prices are strong. However, it also has way more downside than the average oil stock when oil prices go down. For this reason I rate the stock a ‘hold,’ only suitable for investors with specific experience in the energy sector, and definitely not for the faint of heart.

Baytex’s Financial Picture

Baytex’s finances have improved in recent quarters thanks to its efforts to reduce its debt. However, the company is still more indebted than most of its competitors, when compared to both equity and cash flows.

Below is a chart that compares Baytex’s debt, cash flows and equity to two larger Canadian oil companies, Suncor Energy (SU) and Cenovus Energy (CVE). As you can see, Baytex has more debt relative to equity and cash flows.

| Stock | Debt | Operating cash flow | Equity |

| BTEGF | $1.28 billion | $632 million | $1.7 billion |

| SU | $11 billion | $9.3 billion | $30 billion |

| CVE | $9.3 billion | $5.6 billion | $19.7 billion |

From the table above, we get the following debt/equity ratios:

-

Baytex: 0.75.

-

Suncor: 0.36.

-

Cenovus: 0.47.

All of these ratios are well within the realm of “healthy,” but Baytex’s is the worst of the admittedly strong bunch. Why is the debt a problem? It comes down to interest. Debt comes with interest expenses and the higher they are, the harder it is to turn a profit. For Baytex, this is a bigger issue than it is for Suncor or Cenovus. Baytex has to clear $24.2 million in quarterly interest expenses before it turns a profit. In Q2 2020, the lowest point of that year’s oil crash, Baytex did just $123 million in net revenue. So BTEGF’s interest expenses alone are 19.6% of revenue in periods when oil is weak. In fact, the percentage was even higher than that in Q2 2020, as the interest expenses were higher that year.

Most Canadian oil companies are paying off debt this year, and Baytex is no exception. In Q2 of 2020, it reported $1.9 billion in net debt, by Q1 2022, that was all the way down to $1.28 billion. So we’re seeing debt slashed by nearly a third. That will reduce Baytex’s interest expenses, but if oil crashes abruptly, the progress will slow down.

Why BTEGF Rallied So Much Harder Than Other Oil Stocks This Year

Although BTEGF’s debt is a structural issue, it’s also a positive when oil prices are high. Interest expenses and other costs are hurdles a company has to cross before it achieves profit. However, such costs result in faster earnings growth when they are surpassed. If stocks are initially valued by earnings rather than sales, then shares of a high-cost company that just recently broke even will rise faster than one that never had any costs.

For proof of this, see the table below. It shows the revenue and earnings growth of two hypothetical companies, Company A and Company B. They both earn $11 in revenue in Q1, which grows to $12 in Q2. However, Company A has $10 in costs to clear, while Company B has zero costs.

Let’s see how their earnings growth compares:

| | Q1 Revenue | Q1 Costs | Q1 Earnings | Q2 Revenue | Q2 Costs | Q2 Earnings |

| Company A | $11 | $10 | $1 | $12 | $10 | $2 |

| Company B | $11 | $0 | $11 | $12 | $0 | $12 |

As you can see, Company A’s profit doubles, from $1 to $2, while Company B’s earnings grows by a mere 9.09%! This is the ‘virtue’ of debt in a commodity bull market: it can cause rapid profit growth.

Now you might be saying, “sure, Company A has the faster earnings growth rate, but Company B still has much more earnings.” That’s true, but companies are typically valued based on earnings, free cash flow, or some “net” measure, rather than sales. Given that Company A would likely have been far cheaper than Company B in Q1, its stock should rally more on the Q2 earnings.

Valuation

Having looked at some of Baytex’s strengths and weaknesses, we can now turn to its valuation. BTEGF is, like many oil stocks these days, cheap relative to earnings and cash flows, but only if we assume that oil prices remain fairly high. If prices were to collapse to truly abysmal levels it would not be undervalued.

According to Seeking Alpha Quant, BTEGF trades at the following multiples:

-

GAAP P/E - 1.8.

-

Price/sales - 1.7.

-

Price/book - 1.36.

-

Price/operating cash flow - 3.83.

These are all very low multiples. They suggest that the stock is undervalued. We could also approach the stock from a DCF perspective. With a commodity stock like BTEGF it’s pretty hard to forecast future earnings. However, using a discount rate of 10% and starting with $0.57 in free cash flow per share, we get the following target prices using 5%, 10%, and 15% earnings growth assumptions:

-

5% growth for 5 years, 0% thereafter - $7.

-

10% growth for 5 years, 0% thereafter - $8.55.

-

10% growth for 5 years, 0% thereafter - $10.38.

These are all higher than the current price, but the first one is lower than the highs for the year. Potentially, those who bought at the highs may have paid too much.

Risks and Challenges

As we’ve seen, Baytex Energy stock is undervalued if we assume that oil prices remain high enough for it to crank out positive earnings growth. However, this being a commodity play, such a scenario is far from guaranteed. Like all oil stocks, BTEGF is at the mercy of commodity prices, and there are several risks for investors to look out for.

-

Political intervention. U.S. politicians are already trying pretty hard to get oil prices down, for example by releasing 1 million barrels a day from the strategic petroleum reserve. So far that’s not stopping oil prices from remaining stubbornly high. However, politicians have more tools available. Ending the sanctions on Russia would probably have some effect, and the Fed’s interest rate hikes might cool demand. If the “bring down gas prices” chorus grows louder, Baytex Energy could see a hit to revenue.

-

Debt. BTEGF’s debt level is not a problem at today’s oil prices, but it would become a problem if oil prices crashed. The same phenomenon that causes earnings to grow faster when debt is high, also causes them to decline faster if the revenue is trending down - with greater debt, earnings go negative at a higher revenue level. BTEGF was experiencing profitability issues long before the 2020 oil price crash. If it doesn’t continue reducing its debt, it may experience them again in the future.

The Bottom Line

When factoring in both the opportunity and the risks inherent in BTEGF, a clear picture emerges. This stock is, even more than other oil companies, a direct bet on oil and gas prices. It rallies more than other stocks when oil goes up, and it crashes harder when oil goes down. The end result is an extremely volatile, bumpy ride. If you’re going to invest in Baytex Energy, you should have a very good reason for thinking that oil prices will be strong over your holding period. Given its debt level, this company just can’t afford low oil prices. Its stock, therefore, is not for the faint of heart.