2023-08-09 14:15:19 ET

Summary

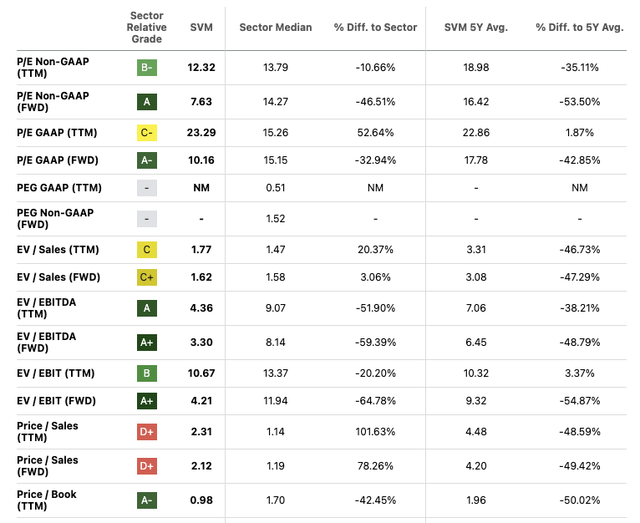

- Silvercorp Metals Inc. is undervalued compared to its competitors, with a low forward P/E and EV/EBITDA.

- The company has consistently reported positive net income and free cash flow, with a large reserve base.

- The jurisdiction risk associated with Silvercorp's operations in China and Bolivia is a major factor contributing to its low valuation.

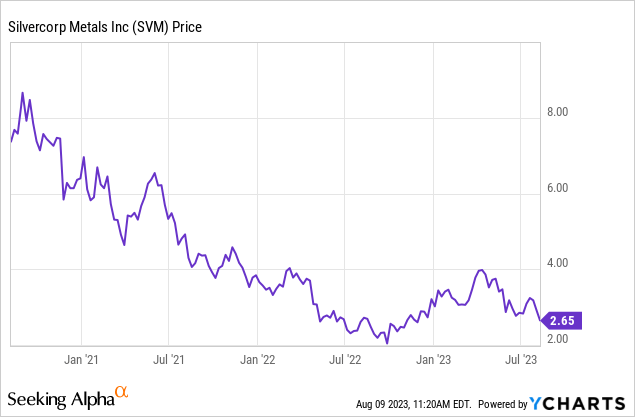

Data by YCharts

Data by YCharts

Silvercorp Metals Inc. ( SVM ) is a significant producer of silver and base metals, with its main operations located in China. This includes the GC project, which began production in 2014, and the Ying Mining District. Additionally, Silvercorp holds a valuable 28% stake in New Pacific Metals (worth $100+ million), a company that explores gold and silver with properties in Bolivia.

Despite its consistent performance, turning in strong profits year in and year out, Silvercorp's shares have remained undervalued compared to competitors for nearly a decade.

For example, Silvercorp's current forward P/E is 10.16 , well below the sector median of 15, and its EV/EBITDA is 4 , also under the industry average of 9. In its corporate presentation, Silvercorp highlights that its shares have a price-to-cash flow ratio of 6.5, less than peers like Hecla Mining ( HL ), First Majestic ( AG ), and Pan American ( PAAS ).

There's no question that Silvercorp is a profitable company. It has continually reported positive net income and free cash flow, even during periods of low metal prices, and pays a substantial dividend. In addition, the company has not only sustained but also expanded its large reserve base. At present, it boasts 115 million ounces of silver equivalent, plus an additional 200+ million ounces in various resource categories, ensuring a long production life for its assets.

But Silvercorp's valuation is likely to remain low compared to its peers going forward, and the stock is not worth buying here, as I argue below.

Silvercorp: Why Shares are So Cheap

Silvercorp's valuation metrics (Seeking Alpha)

I believe that a significant part of this discount is tied to the jurisdiction risk associated with the company.

Although Silvercorp Metals Inc. is a Canadian entity, its principal operations are in China. Many investors are hesitant to invest in China as a mining jurisdiction for several well-known reasons.

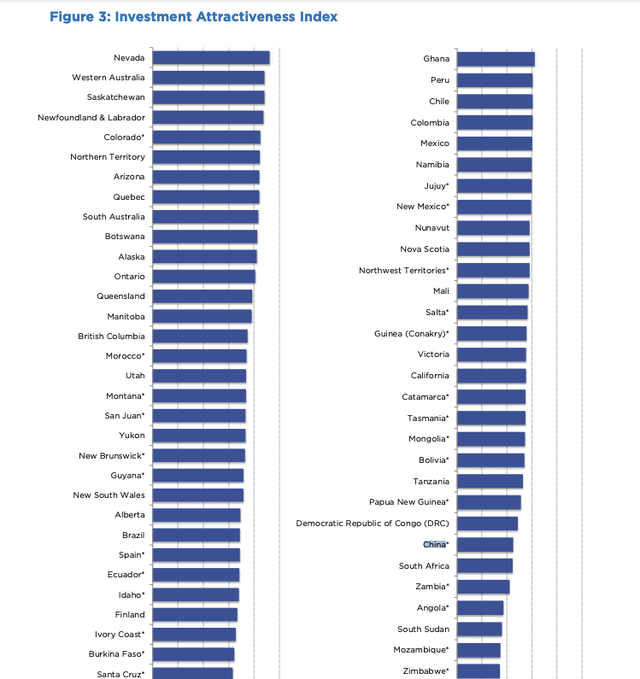

According to the latest Annual Survey of Mining Companies , China ranks among the bottom 10 least favorable jurisdictions for mining investment, alongside countries like Zimbabwe, Guinea (Conakry), Mozambique, Angola, Papua New Guinea, the Democratic Republic of Congo, Nunavut, Mongolia, and South Africa.

Fraser Institute Mining Jurisdiction rankings put China near the bottom. (2022 Fraser Institute Mining Survey)

There's a prevailing fear among investors that worsening relations between the West and China might negatively affect mining operations in the country. Concerns even extend to the potential nationalization of Western mines located there.

While Silvercorp has not reported any major issues operating in China, this fear remains at the forefront of investors' minds.

In my opinion, the apprehension regarding Silvercorp and its China investments is not necessarily that China is an inherently poor mining jurisdiction, but rather the perception that it's an extremely risky place to conduct business. And that perception has only worsened over the past few years.

Furthermore, Silvercorp's ownership of a 28% stake in New Pacific Metals adds another layer of complexity to its risk profile. New Pacific Metals controls some promising gold and silver properties in Bolivia, a location often regarded as a second or even third-tier mining jurisdiction with substantial risk.

For instance, in the Fraser Mining Survey's Investment Attractiveness Index, Bolivia ranks just below Mongolia and California.

While this investment in Bolivian assets could eventually yield significant returns due to their upside potential - Silver Sand, in particular, has the potential to be developed into one of the world's largest silver mines - it does nothing to alleviate Silvercorp's overall jurisdictional risk.

What About Silvercorp's Latest Acquisition?

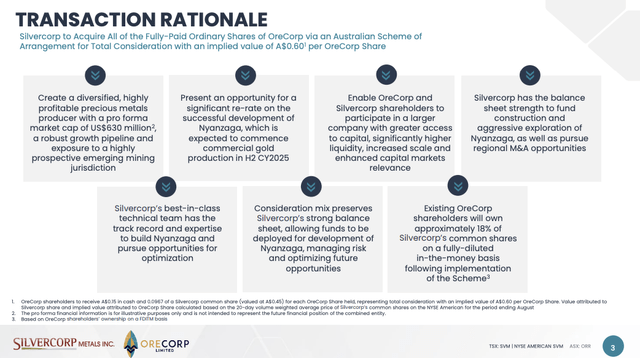

Silvercorp presentation

Silvercorp's decision to acquire OreCorp Limited ( ORECF ), an Australian company developing the Nyanzaga project , adds another layer of risk to its portfolio.

The Nyanzaga project, expected to begin commercial gold production in the second half of 2025, is valued at A$242 million (US$158 million) in the transaction.

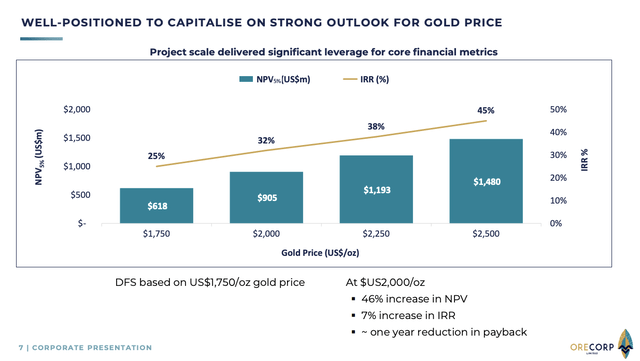

OreCorp owns 84% of Nyanzaga, located in Tanzania's Mwanza region, and is in partnership with the Tanzanian government. A definitive feasibility study from August 2022 estimated that Nyanzaga could yield 2.5 million ounces of gold over an 11-year mine life. Nyanzaga's post-tax NPV at a 5% discount rate is US$905 million, with an internal rate of return of 32%, using a recent spot gold price of US$2,000/oz.

Nyanzaga project economics. (OreCorp )

The project is highly levered to gold prices, which is great to see, but I would argue that this is the case for nearly every gold project and not a special case here, thus, not worth paying a high price tag for the project.

With a conservative gold price of $1,750/oz, the project's economics become less appealing, showing an NPV of $618 million. Additionally, the mine requires an initial capital expenditure of $474 million, so it's not exactly a cheap mine to build.

Silvercorp's Jurisdiction Risk Increases

More importantly, the acquisition raises further jurisdictional concerns, as Tanzania ranks in the bottom 10 of the Fraser Institute Survey, perceived as a tier-3 jurisdiction for investment attractiveness. It's ranked just below Bolivia and above China.

While Nyanzaga could prove to be a profitable venture, this acquisition does not mitigate Silvercorp's existing jurisdiction risk. In fact, it could arguably make it worse.

As a result, the stock's current valuation gap, which I believe is mostly attributed to its jurisdictional risk of China and Bolivia, is unlikely to narrow due to this deal.

Therefore, I am recommending Silvercorp as a HOLD at the moment.

For further details see:

Is Investing In Silvercorp Metals Worth The Risk?