bjdlzx

Baytex Energy Corp. (NYSE:BTE) management reported a significant increase in cash flow compared to what it would have been had the company not acquired Ranger Oil (ROCC). The fourth quarter cash flow represented more than half of the cash flow for the fiscal year. This is now a light oil upstream company. The market has yet to adjust to the transformational acquisition. But when the market does adjust, shareholders can expect a better stock price.

The Eagle Ford properties acquired are among the most profitable in the company portfolio. They also change the company from a heavy oil producer (subject to a discount from WTI pricing) to a light oil producer whose Eagle Ford production often gets a premium price to the local benchmark. It is not just the transformation to light oil that is important. It is instead the transformation to a light oil producer whose production gets additional return from the premium pricing of that production. This is something the market will value as well.

Management went into some immediate issues like stock overhang, and debt rearrangement as well as better cash flow that really first showed in the fourth quarter. All of this makes for a bumpier transition than the last article indicated. But it does not change the future outlook despite a lot of worries expressed in the conference call.

Fourth Quarter

The market appears to have focused on the impairment charges. Impairment charges are generally a noncash charge that corrections noncash allocations of the past (undetermined number of) years. This is why cash flow is far more important as an indicator of company health.

(Note: This Is A NYSE-Listed Canadian Company That Reports In Canadian Dollars Unless Otherwise Stated).

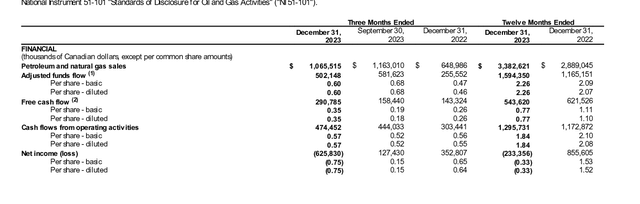

Baytex Energy Summary Of Fourth Quarter Results (Baytex Energy Earnings Press Release Fourth Quarter 2023)

As shown above, free cash flow strengthened considerably in the current fiscal year despite generally lower commodity prices when compared to the previous fiscal year. The Eagle Ford properties are in a class all by themselves when it comes to free cash flow. Management mentioned this in the conference call.

The premium obtained for the production combined with great geology allow for low breakeven for wells drilled that is seldom matched in North America. Since oil prices are not exactly low right now, then cash flow is going to be generous.

The market was concerned about more debt in absolute terms. But the debt ratio was 1.1.

Since the company has United States dollar-based loans, there is some concern about currency issues. However, the Eagle Ford business appears to be able to support the loans (and that is likewise United States dollars). Therefore, despite the accounting reporting, the dollars earned to go for loans likely will result in no gains or losses.

The Canadian business essentially makes the loans safer.

In short, there is a lot changing about this company that Mr. Market has to get used to. But management does not have to do anything special for many of the things that are new for the market to like the upcoming reporting.

Eagle Ford

Before the latest acquisition, Baytex had acquired non-operated Eagle Ford properties back around 2014 just before the big oil price decline. The market tends to discount non-operated properties because Baytex could not really control the development pace, nor could it control the accompanying capital budget. For many years management stated that those Eagle Ford properties had "first call" on any capital because those properties were extremely profitable compared to the company heavy oil business at the time.