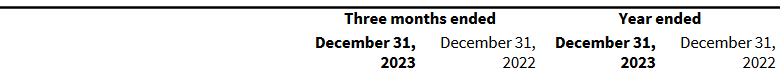

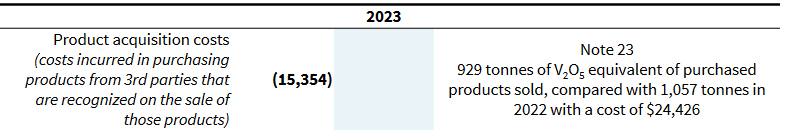

Bad business In 2023 the revenues earned from reselling V products purchased from 3rd parties = US$11,569 while the costs incurred in purchasing products from 3rd parties = US$15,354. The US$3.8M loss in reselling represents ~10% of Largo’s Net Loss before tax.

To succeed in their effort to cut costs in a meaningful way management must also stop engaging in the resale of third party’s V2O5 and FeV. Each time we resell $1 we have to spend more than $1. Largo is fighting for its survival right now so this luxury can’t be allowed to continue anymore regardless of why the company did it in the first place. The costs of acquiring these products from a third party are higher than the revenue Largo earns from the end customers. Getting out of this negative-margin resale practice will allow Largo to cut 100% of the acquisition costs and increase earnings. The problem is that if the sale commissions are based on “sale amount” (i.e revenue rather than profit) then the sales team couldn't care less about cost nor profit.

DYODD