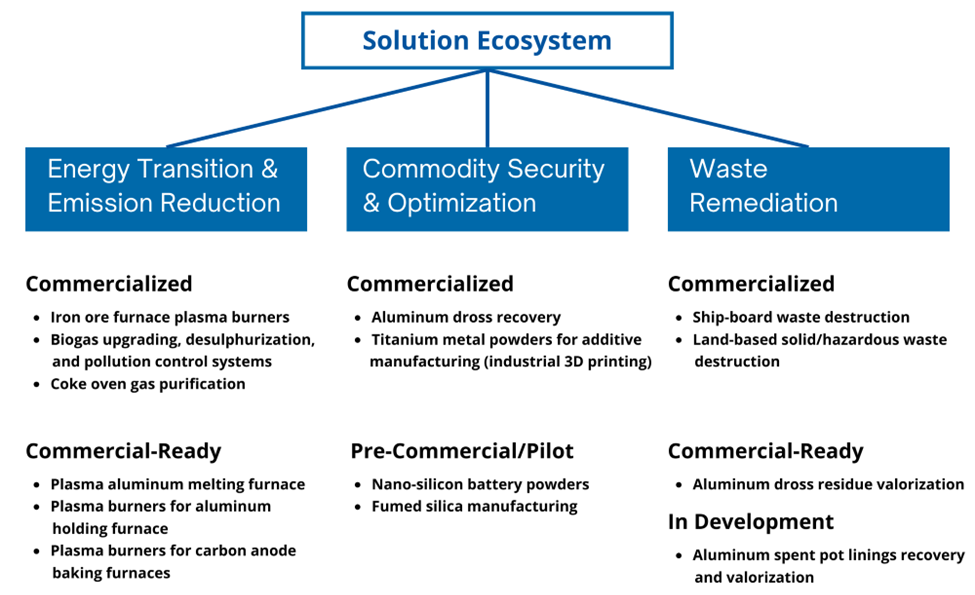

Keep in mind that PyroGenesis' business potential has drastically increased during the past couple of years, look at the new markets PYR has entered, new patents filed/granted, the second production facility coming online, and the growth in employee headcount. PYR is gearing up for exponential growth. It is not the size of the contracts (big contracts will come), it is the validation of the technology. If people cannot understand that, then they don’t understand PyroGenesis and where the company has come from but more importantly, where it will go when you have the biggest iron ore company in the world purchasing new game changing technology. It is simpy mind boggling what that will mean for PYR going forwards. The Market always lags behind R&D. It is rare for people to truely understand the value of technological advancements right away. A great visual of PyroGenesis' solutions. A number of these solutions have been commercialized during the past couple of years:

It is amazing that PyroGenesis has accumulated so much high tech and plasma expertise (and numerous patents, over 120 now granted/pending) over the past couple of decades (PyroGenesis was founded in 1991), and PYR never went under. PyroGenesis kept plugging away and over the past couple of years they have doubled their manufacturing space and employee headcount All the while more interest is garnered in PYR’s products, technology, and solutions.

From the 2023 AGM replay, Steve McCormick (VP Corporate Affairs) did an excellent presentation detailing his knowledge of the industries in which PYR is involved in and a comprehensive understanding of the industrial needs these players require and PyroGenesis’ top tier solutions to these. The corporate presentation starts at around the 12:35 mark. Great job Steve/ @midtownguy.

Here is the link to PyroGenesis’ 2023 AGM replay:

https://www.youtube.com/watch?v=c9_Tzu-qs9c

That is why the investors are here, for long-term growth. The magnitude of what PyroGenesis is undertaking is impressive.

Also, great post from Melida worth re-posting:

Melida wrote:

More importantly, investors have to decide if the technology is legit and whether it can be commercialized (my opinion is yes). In fact it has been commercialized in some verticals. We know all this so there's no point in detailing here.

Does Pyro have the cash and receivables and opportunities to carry on as a going concern well into 2025 (again, my opinion is yes). Pyro itself confirmed this in year end comments. It also has minimal debt.

As with all stock investments and especially with small cap start ups (and I consider Pyro to be in start up phase in spite of its actual age) you balance risk & reward. But, lets be blunt, you have to analyze the relevant information. Return on equity and return on assets,at this point in time, are ratios that don't provide prospective and existing investors in Pyro with particularly relevant information.

You can spend the time to figure out various ratios from the numbers contained in the financial statements (and I have no idea if yours are correct) but to simply post these ratios and to leave it at that, doesn't inform investors with respect to what's most important to review and discuss when making decisions on investing in Pyro.

You can pick away at these comments, but for me they're just common sense.

Mxz123 wrote: Three quarters you have said the market will judge the financials. But the share price decline a few cents, then recovered, and increased. So, what is going to be different about this quarter? Market knows the facts about this quarter financial. Market also understands the technology that Pyrogenesis has in hand.