Goldman Warns Copper "Is Having A Cocoa Moment" In a Goldman Materials note this morning covering China and copper, analyst James McGeoch pointed out that the base metal is "having a Cocoa moment." Comex copper futures for July delivery jumped nearly 5% to $5.12 a pound, exceeding an earlier record for the most active contract set in March 2022. According to Bloomberg, the short squeeze "prompted a scramble to divert metal in other regions to US shores."

Comex copper futures are breaking out.

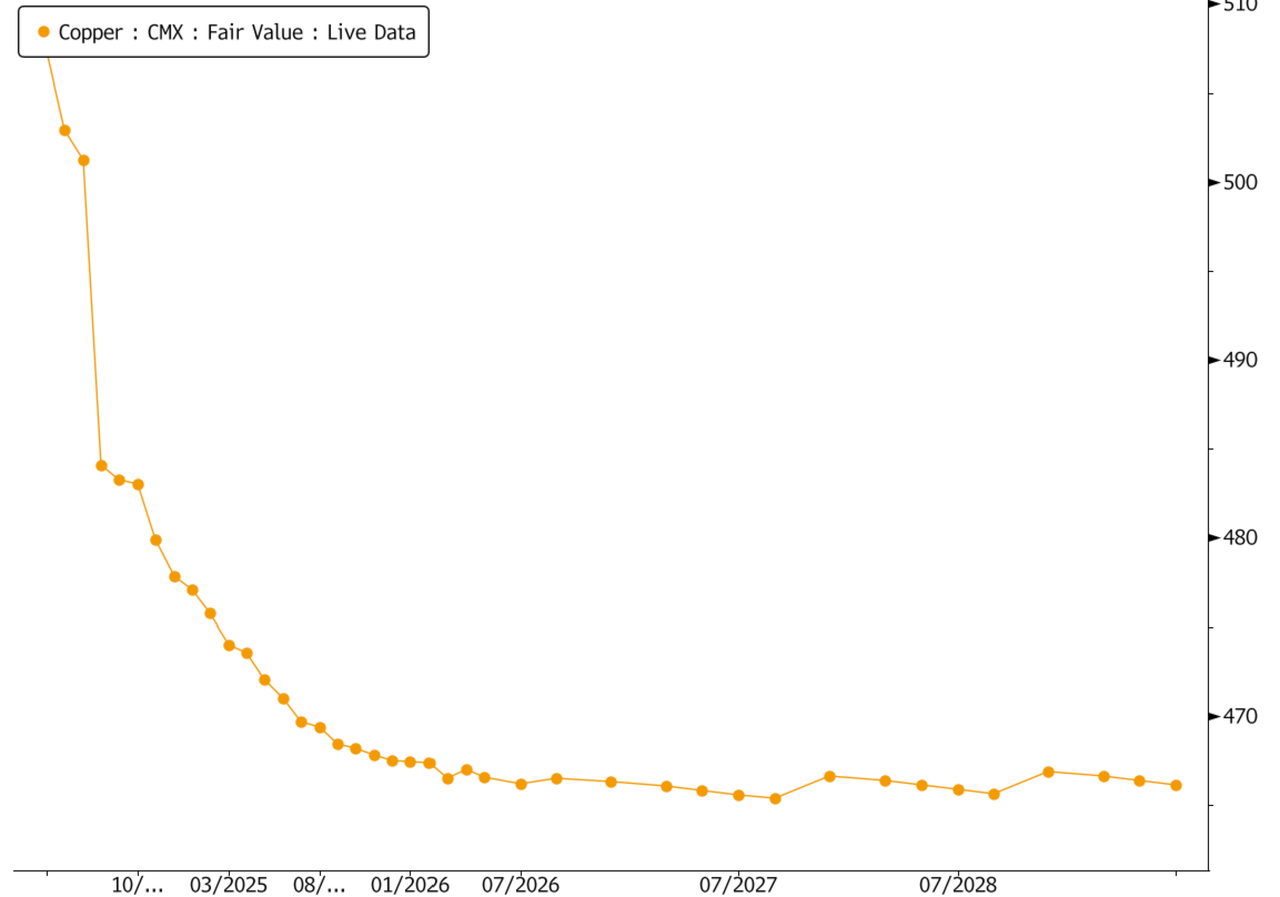

Comex copper futures are in one of the biggest-ever backwardation periods - a clear indication of severely tight supply.

"Short spread and futures holders are being squeezed," Michael Cuoco, head of hedge fund sales for metals and bulk materials at StoneX Group, told Bloomberg.

Here's more commentary on the copper squeeze in the US via McGeoch:

Copper got funky on LME close, the …Copper we see arb positions driving (short CMX/long LME basis producer hedges and other factors) and have seen big unwinds on this, the spread got to +$900 (o’night it got to 1200t….saw people shorting it at $600 and getting stopped out literally hours later). There is also a seemingly large Chinese/Asian position (the arb CMX/SHFE getting bought again over night). The financial flows are typically more CMX heavy (options and outrights) and the change in liquidity. mkt structure is compromised as there is not that much Copper available on CMX to be delivered. For the next two weeks its likely to stay unhinged, as the positions are all against July expiry and we are unsure how it solves ahead of that, ie the delivery mechanism to solve.

Short-squeeze in commodities markets occurs when traders are forced to exit positions due to increasing margin calls or the threat of having to deliver physical material.

Jia Zheng, head of trading at Shanghai Dongwu Jiuying Investment Management, explained that the surge in the July contract was partly driven by a squeeze on traders involved in reverse arbitrage, where they short Comex and go long on Shanghai copper.

This coincides with dwindling copper mining supplies and a surge in AI data center investments across the US. Additionally, the US and UK have banned Russian aluminum, copper, and nickel.

https://www.zerohedge.com/commodities/goldman-warns-copper-having-cocoa-moment