Image Source/DigitalVision via Getty Images

Investment action

I recommended a buy rating for Bombardier (TSX:BBD.B:CA) (OTCQX:BDRBF) when I wrote about it during March last year, as I expected the business to achieve its FY25 EBITDA target, and when that happens, the stock should at least trade back to its historical average EBITDA multiple. BBD.B:CA share price took a massive dive since my post in March, with EBITDA multiple dropping further down to ~6x forward EBTIDA. Based on my current outlook and analysis, I recommend a buy rating. My key update to my thesis is that BBD.B:CA remains well on track to meet its FY25 EBITDA targets and, if true, could potentially beat consensus estimates by 11%, prompting the market to re-rate valuation multiples upwards.

Review

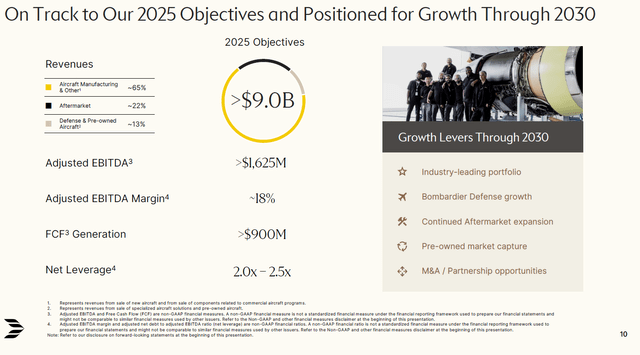

BBD.B:CA reported earnings on ~3 weeks ago and had its investor’s day held on 1st May. In the 1Q24 results, total revenue fell by 12% to $1.28 billion, driven by fewer deliveries, despite aftermarket revenue continuing to grow. However, adj EBITDA margin came in better than 1Q23, at 16% vs. 14.6%. As of 1Q24, the backlog stood at $14.9 billion, representing 5% sequential growth and a book-to-bill ratio of 1.6x.

BDRBF

What gave me confidence to reiterate my buy rating is the bullish update provided on Investor’s Day. Management reiterated their FY25 guidance for adj. EBITDA of more than $1.625 billion and more than $900 million of FCF. Based on this, it implies that the stock is trading at just 6.4x FY25 EBITDA, way below the lower end of BBD.B:CA’s historical trading bend (7.2x to 13x forward EBITDA multiple range over the past 10 years). This EBITDA figure is also higher than what consensus is expecting (now expecting $1.58 billion), which means there is a visible catalyst for valuation re-rating (consensus upgrading their estimates). Specifically, the FY25 guidance for $1.625 billion in adj. EBITDA meant that BBD.B:CA is on track to beat consensus FY25 estimates by at least 3%. Historically, BBD.B:CA has beat its annual EBITDA guide by 8% on average (over the past 5 guides). Using that as a gauge, it implies that BBD.B:CA could beat consensus FY25 estimates by ~11%.

Fundamentally, I think this target is well within reach, as BBD.B:CA is seeing strong demand that has driven the company’s backlog to a record $14.9 billion (up from $14.2 billion in FY23). This easily covers a large part of the next two years of revenue: consensus $8.5 billion FY24e revenue estimate and the FY25 guide for >$9 billion in revenue. The aircraft manufacturing segment is expected to generate the majority of revenue, with a target of approximately $6 billion in 2025, driven by around 150 deliveries. This target does not appear to be very aggressive, considering that FY24 is also anticipated to deliver about 150 to 155 jets. With a total production capacity of 200, BBD.B:CA is more than capable of increasing deliveries, even if necessary. It gets better because management said they wouldn't need to spend more on capital expenditures to increase deliveries in the future., which bodes well for FCF.

The outlook for the Defense segment is also very positive, with management projecting a $25–40 billion market size (including aircraft and modification spend) and an opportunity for around 375 aircraft between 2023 and 2032. All things considered, the BBD.B:CA defense end market has the potential for three-to-five-times its revenue. Take note that the defense margin is greater than the new aircraft delivery margin. This bodes well for meeting the FY25 EBITDA guide, especially with the expanded opportunity for revenue growth. I am also optimistic about the FY25 EBITDA target in the following areas: (1) the effective implementation of the strategy to reduce costs, and (2) the contribution from the aftermarket business as the BBD.B:CA fleet will grow in the next few years.

The other thing is part sales is very key and we continue to see very strong part sale activity, much more of which we control now because of our growth in the percentage of aftermarket that flows through our business. And that's been key as well to margin expansion. 1Q24 call

The reiteration of the FY25 FCF guide also sets a very positive outlook for the business balance sheet, which saw net debt to EBITDA increase from 3.3x in 4Q23 to 3.6x in 1Q24. With at least $900 million of FCF in FY25, we can safely assume that net debt to EBITDA can at least go back to 2.9x using LTM EBITDA (assuming FY25 FCF stays as cash in the balance sheet). This makes meeting management targets for net leverage of 2 to 2.5X in 2025 very plausible if we consider the improvement in adj. EBITDA and FCF generation in FY24.

Valuation

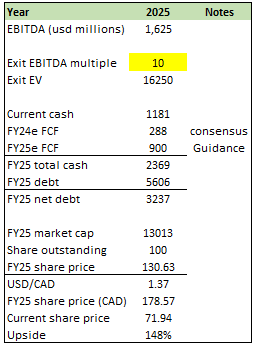

Author's work

I believe the upside for BBD.B:CA remains attractive. I am still confident that BBD.B:CA is on track to meet its FY25 targets, although the market seems to think otherwise (based on consensus estimates). Achieving a FY25 EBITDA target of at least $1.625 billion would mean that consensus needs to upgrade their estimates for the following years (FY26 and beyond), which I expect to prompt an upgrade in valuation. From a historical perspective, achieving the FY25 EBTIDA target also meant that BBD.B:CA is a much higher margin business than in the past ($1.625 billion will mark the highest EBITDA that BBD.B:CA has generated since FY11 and at a much lower revenue base), which further supports my view that the stock should trade at a higher multiple than today. Using the historical 10-year average multiple of 10x forward EBITDA, I believe the stock is worth CAD178 (which is also where BBD.B:CA traded back in FY11 when it generated a similar level of EBITDA: $1.567 billion, slightly below the FY25 EBITDA guide).

Risk

Private jets are highly discretionary items that I worry may be impacted by the direction that the macroeconomy is moving in. In a recessionary environment, I would expect customers to delay or cancel the delivery of their orders. Despite having these orders in the backlog, BBD.B:CA is not able to recognize this as revenue until they deliver the product. This may result in BBD.B:CA missing FY25 guidance, which, I believe, will put a lot of pressure on the stock’s valuation.

Final thoughts

My recommendation is a buy rating for BBD.B:CA as the company remains on track to meet its FY25 EBITDA target, potentially exceeding consensus estimates. This could lead to a valuation rerating. Investor day guidance reaffirmed the FY25 EBITDA target of over $1.625 billion, implying a beat on consensus estimates by at least 3% and potentially 11% based on historical trends. A strong backlog exceeding $14.9 billion provides revenue visibility for the next two years. Increased production capacity and positive defense segment outlook further strengthen the achievability of the FY25 target.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.