RE:RE:RE:RE:RE:Sorry it won't copy and paste either Valuation

Author's work

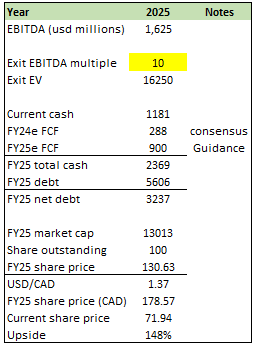

I believe the upside for BBD.B:CA remains attractive. I am still confident that BBD.B:CA is on track to meet its FY25 targets, although the market seems to think otherwise (based on consensus estimates). Achieving a FY25 EBITDA target of at least $1.625 billion would mean that consensus needs to upgrade their estimates for the following years (FY26 and beyond), which I expect to prompt an upgrade in valuation. From a historical perspective, achieving the FY25 EBTIDA target also meant that BBD.B:CA is a much higher margin business than in the past ($1.625 billion will mark the highest EBITDA that BBD.B:CA has generated since FY11 and at a much lower revenue base), which further supports my view that the stock should trade at a higher multiple than today. Using the historical 10-year average multiple of 10x forward EBITDA, I believe the stock is worth CAD178 (which is also where BBD.B:CA traded back in FY11 when it generated a similar level of EBITDA: $1.567 billion, slightly below the FY25 EBITDA guide).

Shamhorish wrote: Fundamentally, I think this target is well within reach, as BBD.B:CA is seeing strong demand that has driven the company’s backlog to a record $14.9 billion (up from $14.2 billion in FY23). This easily covers a large part of the next two years of revenue: consensus $8.5 billion FY24e revenue estimate and the FY25 guide for >$9 billion in revenue. The aircraft manufacturing segment is expected to generate the majority of revenue, with a target of approximately $6 billion in 2025, driven by around 150 deliveries. This target does not appear to be very aggressive, considering that FY24 is also anticipated to deliver about 150 to 155 jets. With a total production capacity of 200, BBD.B:CA is more than capable of increasing deliveries, even if necessary. It gets better because management said they wouldn't need to spend more on capital expenditures to increase deliveries in the future., which bodes well for FCF.