Vollant sold 34% less while price went down 8% in Q2-24 According to management, "Q2 2024 V2O5 equivalent sales align with material availability from Q1 2024 production: In Q2 2024, V2O5 equivalent sales of 1,841 tonnes (which includes 128 tonnes of purchase material sold) represented a 28-per-cent decrease in tonnes sold over Q2 2023. Lower sales in Q2 2024 were largely a result of decreased material availability from lower production in Q1 2024 due to previously reported and planned maintenance".

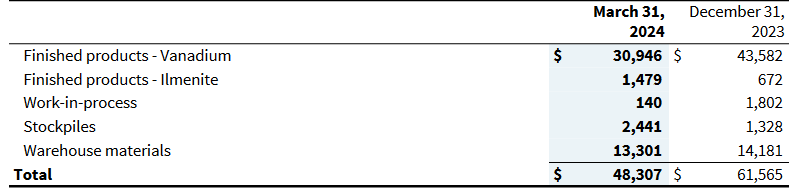

Yeah but the Q1-24 production was within the range of Largo’s quarterly production guidance of 1,700-2,200 tonnes for Q1 2024, was it not? Furthermore, didn’t the Q1-24 chart below also indicate that we had plenty of finished Vanadium products in inventory ready to be sold in Q2-24?

Here are the facts:

In Q2-24 V2O5 equivalent sales of 1,841 tonnes represented a 34% decrease in tonnes sold over Q1-24 (2,765T).

In Q2-24 the average V2O5 benchmark price went down to US$5.93/lb representing an 8% decrease from US$6.44/lb of the previous Q.

In summary Largo sold 34% less while price went down 8% in Q2-24. Thank you Paul Vollant.