US govt manipulation of oil inventory reporting - ZHhttps://www.zerohedge.com/markets/crude-tumbles-bidens-dept-energy-makes-mockery-private-data-cushing-draws-9-past-10-weeks

If ever in doubt whether the Biden admin will rig and manipulate "data" to suit its goals and policies, don't be: moments ago the Biden Dept of Energy published its weekly EIA oil storage report, which was a shocking mirror image of everything the private API reported yesterday.

As a reminder, this is what API said happened to various energy stocks over the past week:

- Crude -2.8MM (9th weekly draw in the past 10 weeks), and well below estimates of a +1.0MM build

- Gasoline -0.5MM

- Distillates +0.2MM

- Cushing -2.6MM (also 9th weekly draw in the past 10 weeks)

The last one was especially notable as it represented the biggest weekly drain in Cushing stocks since August 18, 2023 and sent the oil inventory in Cushing storage low enough to reach the dreaded "tank bottoms."

That's when Kamala's/Biden's department of goalseeking data stepped in, and moments ago reported what can only be described as a laughable mirror image of everything the API indicated yesterday. Here are the details:

- Crude +833K, Exp. +1.05MM

- Gasoline +2.31MM

- Distillates +2.308MM

- Cushing -1.704MM

- Production 13.3MMb/d, unch

That's right: instead of 3 sets of draws, the EIA somehow found builds pretty much across the board, with Crude rising 833K, barely missing the estimate of 1.05MM (and a far cry from the 2.6MM draw per API) except for Cushing, which has emerged as the great source of all the liquidation magic we have observed in the past three months, and as shown below, Cushing has now drawn 9 out of the past 10 weeks!

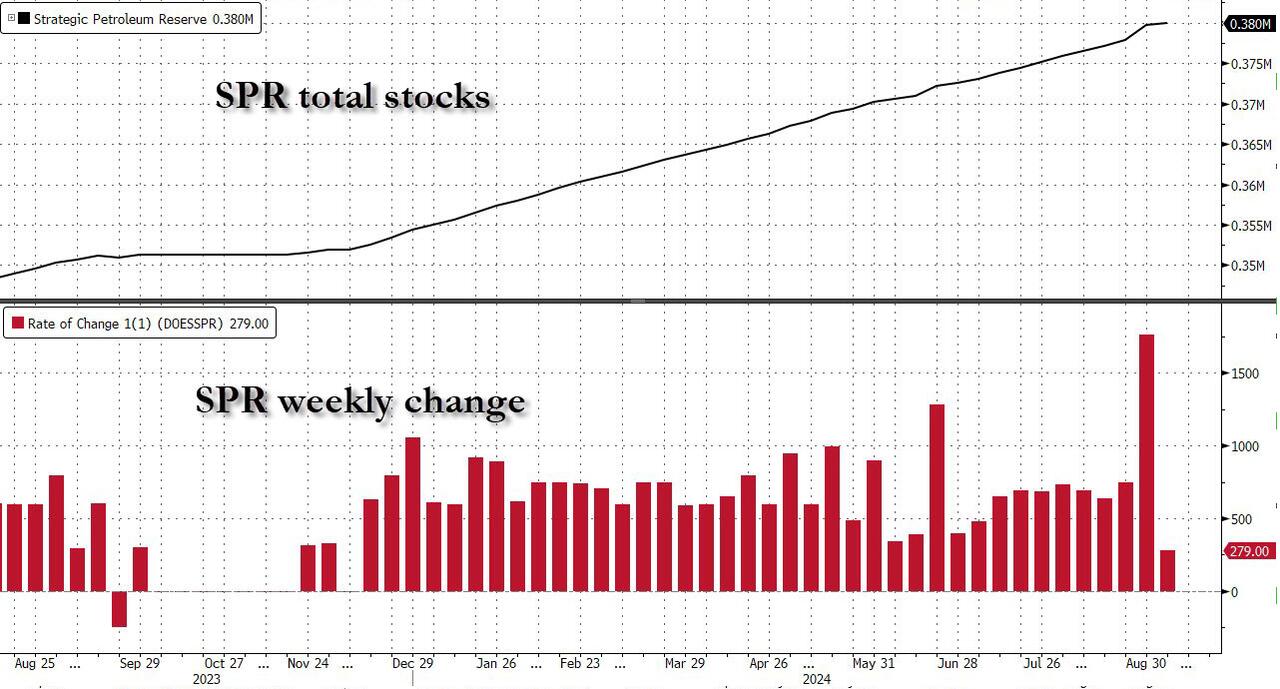

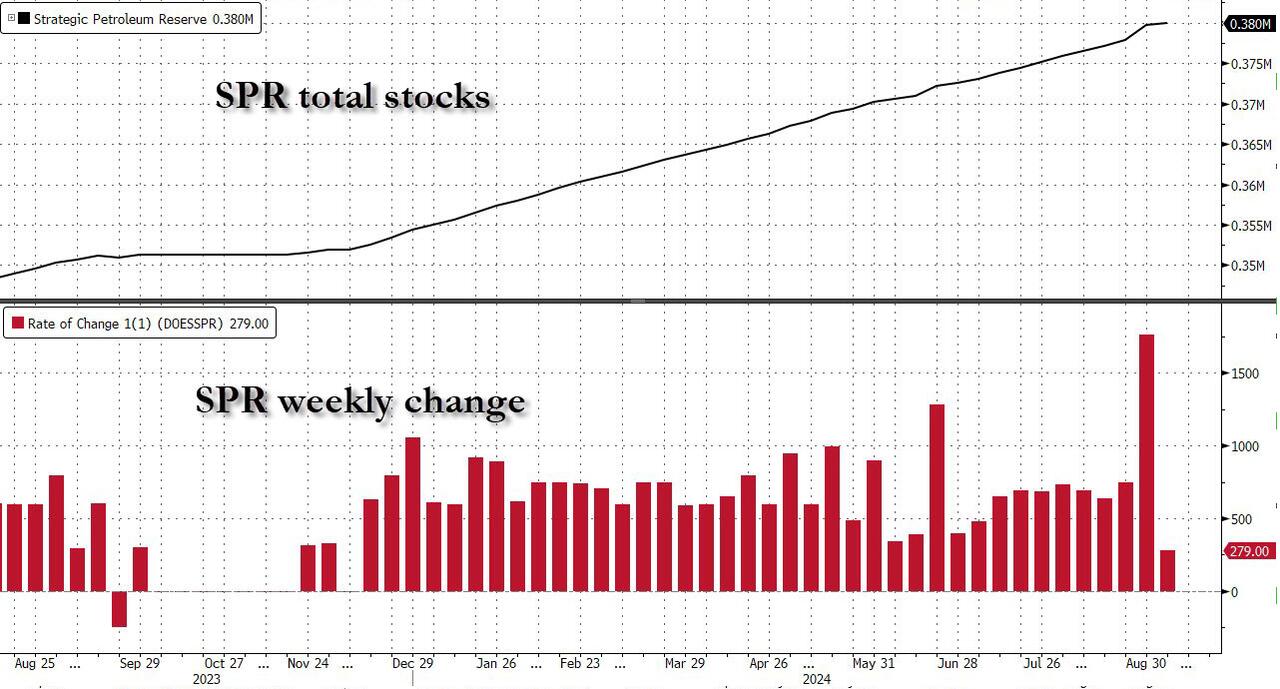

One possible reason for the build is that in the past week, the Biden admin added just 279K to the SPR, the lowest weekly addition this year, and a huge swing from last week's 1.8mm increase to the SPR,, which was the largest increase since June 2020.

The increase in stocks meant that after hitting a one year low, total crude inventory (ex SPR) posted a small gain.

And even though the drop in Cushing was lower according to the EIA vs the API's huge 2.8MM draw, 1-2 more weeks of this drain means that Cushing is still facing tank bottoms.

But there is still some time before we hit the bottom of Cushing: until then the CTAs and shorts are in control, and after staging a modest rebound, oil was slammed by over a buck to session lows, and just shy of the lowest level since 2021 (which in turn preceded a doubling in the price of oil in the next 3 months).

The increase in stocks meant that after hitting a one year low, total crude inventory (ex SPR) posted a small gain.

And even though the drop in Cushing was lower according to the EIA vs the API's huge 2.8MM draw, 1-2 more weeks of this drain means that Cushing is still facing tank bottoms.

But there is still some time before we hit the bottom of Cushing: until then the CTAs and shorts are in control, and after staging a modest rebound, oil was slammed by over a buck to session lows, and just shy of the lowest level since 2021 (which in turn preceded a doubling in the price of oil in the next 3 months).