thad

Investment thesis

An ongoing precious metals rally for the foreseeable future makes gold & silver miners a compelling investment opportunity. I currently have shares in three precious metals miners, Silvercorp (NYSE:SVM), Barrick (GOLD), and Wheaton (WPM). Of the three, I see the most upside for Silvercorp, based on its comparative valuation, as well as its future production profile, including volume growth and the increasingly diverse metals mix. My thesis rests on expectations that silver prices have far more upside potential for the long term due to the added industrial demand angle, which benefits Silvercorp. Furthermore, I expect precious metals miners to see a delayed improvement in their financial results due to the appreciation in precious metals prices that have already occurred. I also expect the precious metals rally to continue for the foreseeable future. For these reasons, I decided to add to my current Silvercorp position, which is uncharacteristic of my overall investment strategy, given that after a sizable appreciation in any stock position, I usually tend to look for an exit strategy rather than add to my position.

Silvercorp's financial results show great improvement on the back of higher precious metals prices.

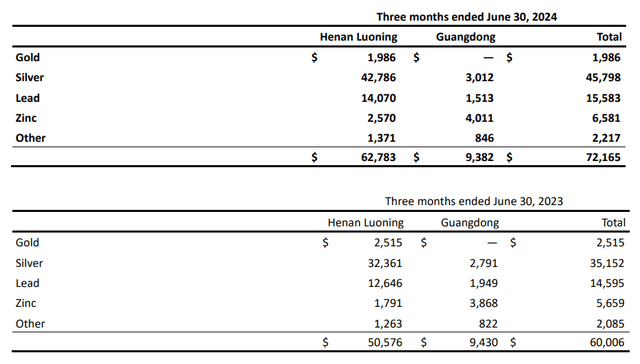

For the latest quarter ending in June, Silvercorp experienced a significant leap in revenue growth and profitability. Revenues increased by just over 20% to, $72.2 million. Even as there was a significant increase in revenue growth, the cost of running its mines declined by 3%. The combined result was a doubling of its net income to $28.13 million compared with the same quarter in 2023.

Other financial trends of note include a lack of share issuance. The number of shares outstanding increased by less than 1% for the past year. Cash from operations for the quarter came in at just under $40 million, while net cash used in investing activities came in at $40.71 million. At the moment Silvercorp can use internal resources to cover its investment activities, which bodes well for long-term positions in this stock, assuming that the trend can last on the back of rising precious metals prices.

Silvercorp's operations at a glance

Silvercorp's revenues currently come from its China operations.

Silvercorp

As we can see, silver makes up the bulk of its revenues, meaning that this is largely a play on the silver price outlook. Lead also plays a notable role in its financial results.

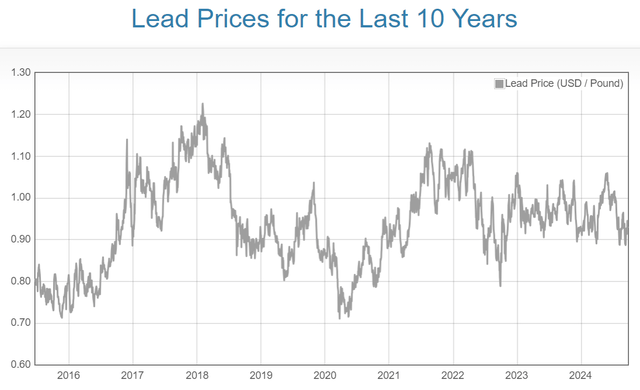

Dailymetalprice.com

Lead is not always a metal that the market gets very excited about. It tends to be somewhat volatile, yet at the same time, it tends to go nowhere fast, as the chart shows. It can potentially see a long-term upward swing from here, on-demand factors associated with the continued electrification of the global economy.

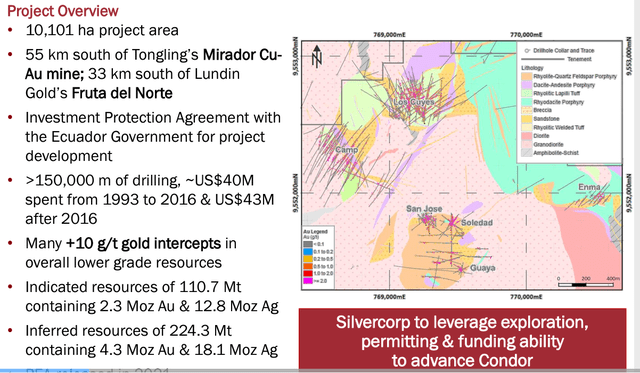

In addition to its current active China operations where it expects to increase production, there are also other projects in the pipeline, which could change its product mix while growing the overall company.

Silvercorp

The Condor acquisition, if it is finalized, will probably transform Silvercorp into a silver-gold mixed play for the long term. At the moment, however, it is yet to finalize the deal.

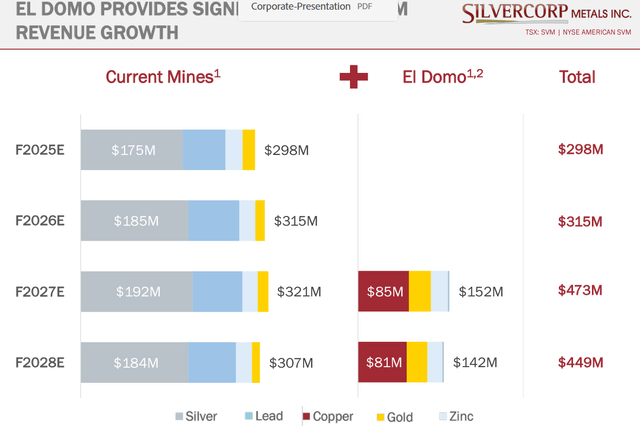

In the meantime, the El Domo project in Ecuador is going ahead. It will create a leap in revenues by 2027. It will also diversify its metals mix, with more copper, gold & zinc.

Silvercorp

As we can see, silver will continue to play a significant role in the company's revenue mix, but we are about to see a great deal of diversification. To sum it up, Silvercorp will transition toward being not only a silver-gold precious metals play, but also a precious metals-industrial metals play, with silver already characterized as being a metal that is both a precious metal and an industrial metal.

External long-term market factors are worth considering

- The gold price melt-up that is taking silver with it is the main short-term factor.

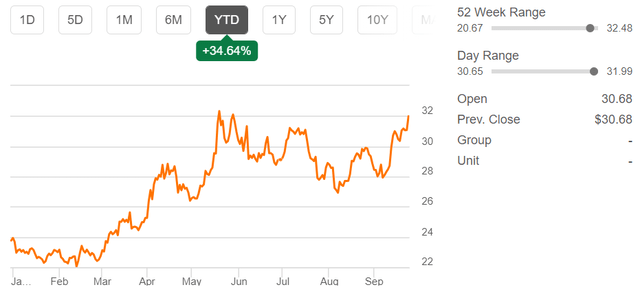

There is no denying the fact that so far this year, Silvercorp's stock performance has been tied to the rise in the price of gold, even though it currently produces only modest amounts of it. The price of silver increased just slightly more than gold so far this year, by almost 35%.

Silver spot price (Seeking Alpha)

There are arguably many factors that are likely to propel gold prices forward for the foreseeable future. High deficit spending in the US and in other major economies around the world are pushing central banks to accommodate those fiscal needs. The global post-WW2 order is disintegrating, causing more instability. These are just a few of the factors to keep in mind when it comes to the gold price outlook, but not the only ones. Silver prices are likely to go along for the ride, in the same direction, but not necessarily in perfect proportional correlation, regardless of the metal-specific fundamentals that additionally impact the outlook for the silver market.

- Silver's long-term prospects are driven by industrial demand growth.

I wrote an article entitled "Not Enough Silver To Power The World Even If Solar Power Efficiency Were To Quadruple" back in 2017. It highlights the fact that if all energy consumed on the planet had to come from solar power, all the known silver mined throughout history as well as all the known reserves underground would not be enough to manufacture the solar panels needed to get it done. It was a hypothetical meant to take us through a mental exercise to explore the potential for global silver demand growth as we move toward a greener economy.

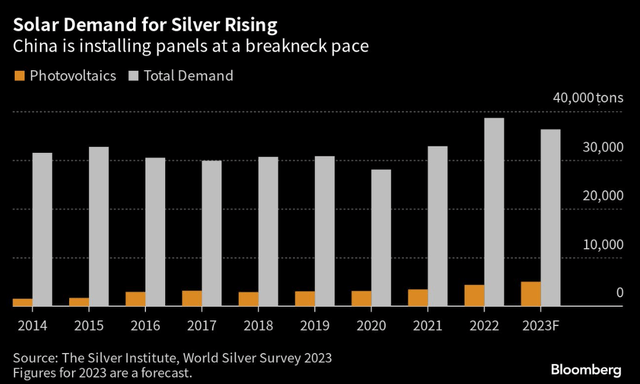

Since I wrote that article, demand for silver in the photovoltaics industry has grown significantly, and it is thought to continue expanding, despite continued gains in efficiency of use.

Mining.com

Growth in silver demand from the solar panel industry is forecast to surge by 20% this year from the previous year. By contrast, global silver mined supplies are more or less stagnant. The continued decline in the amount of silver that goes in each panel may cut into demand growth, but at the same time, it improves the price resilience of the industry's use of silver, since the input per panel continues to shrink.

The solar industry is not the only major factor that needs to be considered when contemplating the long-term prospects of the global silver market. The electronics industry, as well as ornamental applications, have the potential to grow as well, while there is also investor demand growth for physical silver. The way I see it, the more industrial demand we see, the more attractive silver becomes as an investment. Driving demand from that sector higher as well.

- Other metals are a wild card for Silvercorp's outlook.

If all goes well, Silvercorp's mining profile will be of a diverse metals producer within a few years, rather than the mostly silver-dominated company that it is today. This comes with potential benefits, including perhaps reduced risk. Depending on global economic trends, other minerals like lead & zinc can become an additional driver of revenues & profits. On the other hand, a prolonged global economic slump can negatively impact Silvercorp's profile as an industrial metals producer, including its sizable silver segment. Gold might be immune to global economic weakness. Thus, it can act as a hedge, but it does not feature prominently enough in Silvercorp's production mix to have enough of a counter-balancing impact.

Investment implications:

- Strong internal factors, including solid financial results & production growth prospects, combine well with solid external trends in precious metals.

Silvercorp can convert favorable precious metals price trends into solid financial results, as evidenced by the strong leap in revenues and profits this year. The prospect of higher production volumes in the future, combined with favorable external market conditions, such as higher commodities prices, which we assume that Silvercorp will continue to combine effectively to produce improved financial results, makes for a strong argument in favor of Silvercorp stock as a long-term investment.

- A lower P/E ratio relative to industry peers may not be justified.

Despite being able to convert higher commodity prices into strong financial results, Silvercorp is still greatly undervalued compared with some industry peers measured in P/E ratio terms. It is currently at under 12, while Barrick's forward P/E ratio is almost 16. Wheaton, which is not quite a mining company but arguably trades as one has a forward P/E ratio of over 44. There is nothing in its financial reports or in its outlook that in my view justifies the lower P/E ratio, at least from a technical viewpoint, which is why I am currently increasing my position in Silvercorp rather than Barrick or Wheaton stock. The risk factor might be the only justifiable argument in favor of valuing Silvercorp lower compared with its earnings, comparatively speaking.

The most obvious risk factor associated with investing in precious metals miners is the possibility that the precious metals market turns and enters a substantial and prolonged decline, as it did over a decade ago, which left investors to deal with a prolonged wait until metals prices and the share price of miners recovered to previous highs. Some never recovered anywhere near those highs.

Silvercorp share price (Google)

As we can see, Silvercorp is one of the companies that failed to come close to recovering to those levels. It should be noted that silver prices are currently far from recovering to the price levels reached in 2011, in the mid $40/ounce range. Even if silver prices do recover to those levels, it might not be enough to propel Silvercorp's stock beyond its old peak in 2011 at nearly $16/share. In other words, investors who bought at that 2011 peak or near it, may never recover their investment principal.

Geopolitical risk is a factor that many investors might not take seriously, but within the current global geopolitical context, the fact that Silvercorp's revenues are currently produced in China is a factor that needs to be considered. Silvercorp is a Canadian-based company, and relations between the two countries are arguably on a deteriorating path. At some point, China could retaliate against Canadian companies operating in China. I do not foresee an immediate risk of this happening, but if relations keep deteriorating, it could become a serious risk factor that investors should keep in mind.

Taking the potential risks as well as all the positive factors into consideration, Silvercorp remains a buy in my view, even after its significant share price increase in the past few years. I picked Silvercorp as my best performer pick for 2023, in an article I wrote in 2022. Seems I was off by one year, but in the end, the stock did perform well, even if the gains were delayed. The stock is up by over 55% since then. When a stock shows such significant returns over a relatively short period, I usually contemplate an exit strategy. In this particular case, I think the precious metals bull market is set to continue for the foreseeable future, and I also think that silver will outperform gold. Silvercorp is also converting those higher metals prices into an impressive leap in earnings. I also believe that most miners are seeing a delay effect in their financial performance and, thus, their stock price appreciation. In other words, miners should outperform metals prices going forward. I am therefore adding more shares to my current position, going against my usual investment strategy.

Editor's Note: This article was submitted as part of Seeking Alpha's Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition -- open to all analysts -- is one you don't want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!