All figures are in United States Dollars unless otherwise noted. G/T = grams per tonne (of gold or silver). GEOs = gold-equivalent ounces. AISC refers to all-in sustaining costs. LOMP = life of mine plan. Any conversions from CAD/USD based on a 0.73/1.0 exchange rate.

Q2 Production & Sales

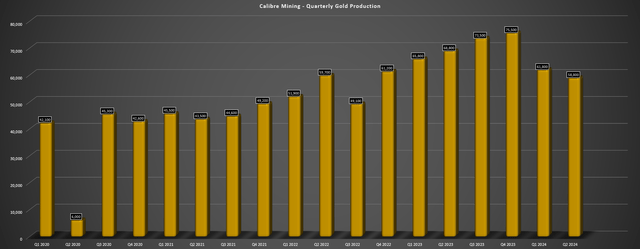

Calibre Mining (OTCQX:CXBMF) released its Q2-24 results last month, reporting quarterly production of ~58,800 ounces of gold. This translated to a ~15% decline from the year-ago period, affected by much lower output from its Nicaraguan operations. Lower production was partially related to a geotechnical issue at Limon Norte that dented open-pit ore tonnes mined at its Limon Mine and head grades were also impacted by the completion of mining at the high-grade Pavon Central Pit.

Unfortunately, this has left Calibre well behind the eight-ball for H2-24 regarding delivering on its guidance midpoint of 287,500 ounces while year-to-date all-in sustaining costs are tracking well above guidance (H1-24: $1,545/oz). However, the company has reiterated production (275,000 to 300,000 ounces) and cost guidance (though it expects to come in near the high end for costs) and is confident in a massive H2-24 to make up for the Q2-24 softness.

Calibre Mining Quarterly Gold Production - Company Filings, Author's Chart

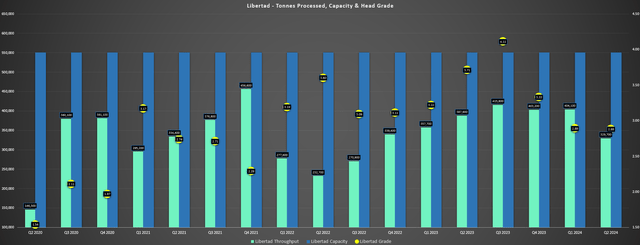

Digging into the results a little closer, Calibre produced ~30,400 ounces of gold in Q2-24 at its Libertad Complex, a ~25% decline from the year-ago period. Lower production was attributed to lower throughput and grades with ~329,700 tonnes processed at 2.88 G/T of gold, down from ~387,900 tonnes at 3.71 G/T of gold in the year-ago period. As noted previously, lower grades stemmed from the completion of mining at the high-grade Pavon Central satellite pit.

Libertad Complex - Total Capacity, Tonnes Processed & Grade - Company Filings, Author's Chart

As for its Limon Complex, production was up slightly, but unable to make up the sharp dip at Libertad, with Limon production of ~18,800 ounces, a 4% increase year-over-year. Higher production was related to slightly higher recoveries, offset by marginally lower throughput and grades (~125,900 tonnes processed at 5.07 G/T of gold). Finally, its Pan Mine produced ~9,600 ounces vs. ~10,400 ounces in the year-ago period. Calibre noted that lower output at Pan was related to longer recovery times, and also noted that Q4 production will benefit from ore replacement of new areas of its leach pad, with the leach pad expansion project nearly complete.

Nicaraguan Operations - Company Website

Given the sharp dip in production from its Nicaraguan operations, the result was significantly higher unit costs in the period, which increased to $1,407/oz vs. 1,076/oz in Q2-23. And combined with its higher-cost Nevada operation (Pan Mine) which produced ~9,600 ounces at $1,765/oz, Calibre’s consolidated AISC was up 30% year-over-year. That said, Calibre is expecting to access high-grade ounces from Limon that were deferred because of the geotechnical issue and also expects to benefit from higher production from Guapinol (Eastern Borosi) and its Volcan Mine where it expects to meet commercial production this quarter. Hence, a better Q3 and a much stronger Q4 are expected.

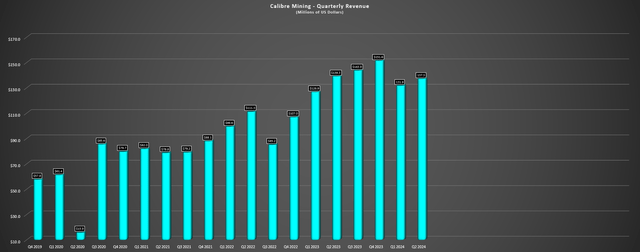

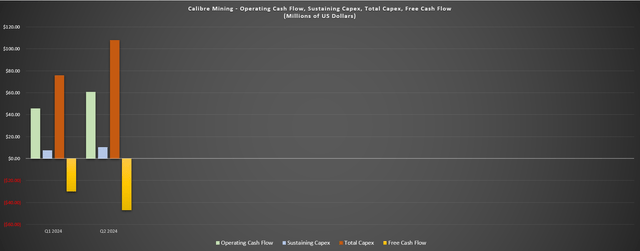

Moving to Calibre's financial results, quarterly revenue came in at ~$137.3 million, a 2% decline from the year-ago period and a divergence from its peers. This was related to fewer ounces sold which more than offset its record average realized gold price of $2,302/oz. Meanwhile, free cash flow remained negative at [-] $47.1 million. However, this was certainly to be expected, with ~$77.8 million spent on its Valentine Project which is now well past the halfway mark and set to head into production in Q2-25. Importantly, Calibre has more than sufficient liquidity to complete the Valentine build without any further equity dilution (~68.5 million shares sold at ~US$1.21 in Q2-24).

Calibre Mining Quarterly Revenue - Company Filings, Author's Chart

Calibre Mining Operating Cash Flow, Sustaining Capex, Total Capex & Free Cash Flow - Company Filings, Author's Chart

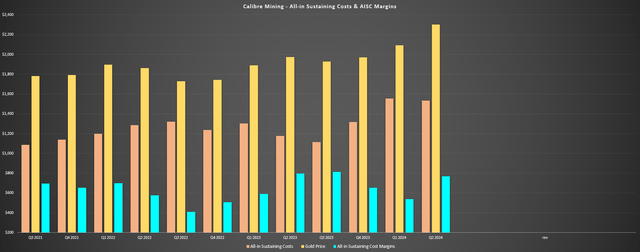

Costs & Margins

Looking at costs and margins, Q2-24 AISC came in at $1,533oz, up from $1,178/oz in the year-ago period. This was related to fewer ounces sold and higher corporate costs, offset by flat sustaining capital ($10.4 million) in the period. As noted, this figure is miles above its 2024 AISC guidance midpoint of $1,225/oz and the company will need solid execution to deliver into its annual guidance range of $1,175/oz to $1,275/oz for 2024.

Calibre Mining - AISC & AISC Margins - Company Filings, Author's Chart

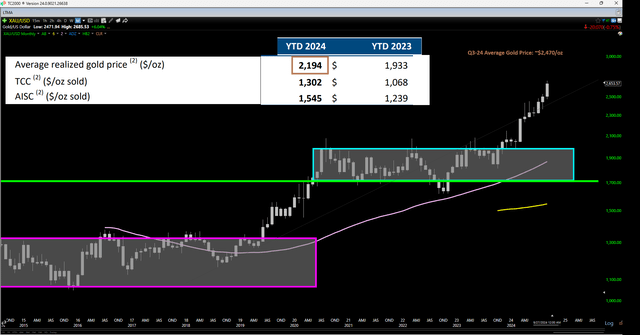

Fortunately, while AISC soared in Q2-24, the record gold price picked up some of the slack. In fact, Calibre’s average realized gold price of $2,302/oz allowed for much less margin compression than would have been expected, with AISC margins of $769/oz (33.4%) vs. $796/oz in Q2-23 (40.3%). Plus, the back-end weighted production this year is a blessing in disguise with the gold price looking like it will average $2,500/oz in H2-2024, allowing Calibre to sell ounces at over 12% higher prices (H1-24 average: $2,194/oz). In fact, even with Q4-24 expected to be much stronger than Q3-24, Calibre should enjoy materially higher margins its upcoming quarter ($1,000/oz+ AISC), lapping AISC margins of $814/oz in the year-ago period.

Calibre Mining H1-24 Gold Price & Monthly Gold Price + Q3 Average - Worden, Company Filings

Recent Developments

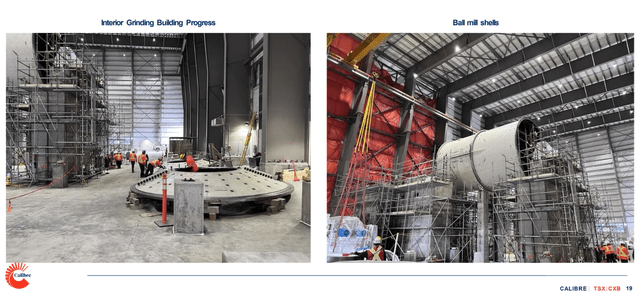

Valentine Construction

As for recent developments, Calibre continues to work on delivering its Valentine Gold Project on its revised schedule and budget (*), with it sharing that detailed engineering was 98% complete (Q1-24: ~60%) as of the end of Q2 and that overall construction was 77% complete as of the end of July. The company noted that the construction is progressing well and on schedule ahead of the winter season in Newfoundland and also shared that all critical path items are on site. Finally, the company confirmed that remaining cost to completion is ~$154 million, more than covered by its current cash & restricted cash position and ongoing cash flow from existing operations.

(*) Calibre updated its schedule and budget to Q2 2025 vs. Q1 2025 for first gold pour, and reported increased upfront capex excluding sunk costs of ~$477 million vs. ~$371 million previously. (*)

In addition, and as noted in a previous update, the company has hired Reliable Controls Corp. to aid with Valentine pre-commissioning and commissioning which should allow for a smoother ramp up than some other projects have experienced in their first year, with Calibre Mining's CEO commenting as follows on the RCC team:

Valentine Construction Progress - Company Website

"Yes, this group of people are really ensuring that transition and handover happens well. And the operators are great at operating the plant, but putting in place the processes by which you're going to operate to ensure that you can realize the full potential of the asset is not always a strong point, particularly as they're hiring teams of people. So really, as I see, that's what that -- the focus of this group is, is to help us. And it's a material cost (C$9-C$10 million). I mean it's a significant commitment we're making, but it significantly derisks the medium, longer term.

The last exposure I had with this group of people was actually at Boddington. They did the pre-commissioning/commissioning works at Boddington [NEM] in Australia when we delivered that asset. So it's a very experienced group of people. This is what they do for a living. So a good group of people, great to have them on board. And we've got a great project team to deliver the asset. We've got a great operations team to be able to run the asset. And I think that adding this third leg to the stool makes for a very stable chair."

- Calibre Mining Q1-24 Conference Call

Valentine Permitting & New CFO Appointment

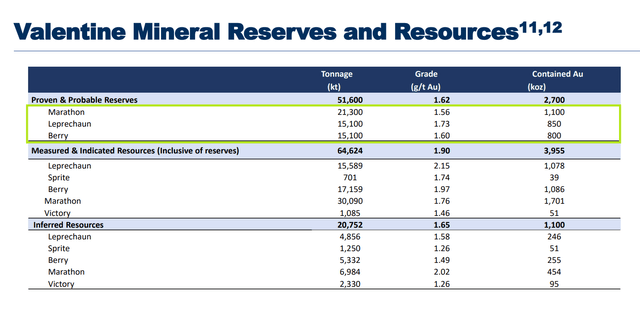

In other positive news, Calibre announced that it had received permits for development and associated infrastructure for the third pit of its three-pit mine plan, Berry. This is a key de-risking milestone, as it means that the life-of-mine will not be impacted at all if there had otherwise been any major delays to the receipt of this final permit. Meanwhile, the company has appointed Danielle Dimitrov as SVP and CFO of the company, with over 20 years of experience in the industry including a brief tenure as CFO and interim CEO at Iamgold (IAG), CFO of Orvana Minerals, with four years spent at Sprott Capital Partners.

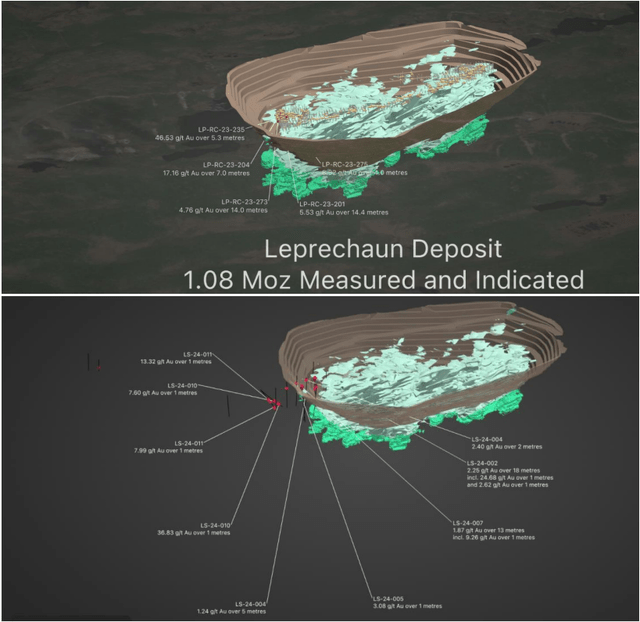

Exploration

While all of the other developments were positive and more than overshadowed the ~9% share dilution from the equity financing completed in early Q2 to bolster the company's balance sheet, the most significant developments continue to come on the exploration front. In fact, Calibre has begun an additional 100,000-meter drill program and continues to state that it believes Valentine is a camp-scale opportunity, which is what it envisioned when buying this ~190,000 ounce per annum project. Overall, I see the positive exploration results paving the way towards growth to a 6.0+ million ounce resource base over the next couple of years (~5.0 million ounces currently), potentially paving the path for a longer mine life and slightly beefier production profile overall.

Leprechaun Deposit Drilling - Company Website

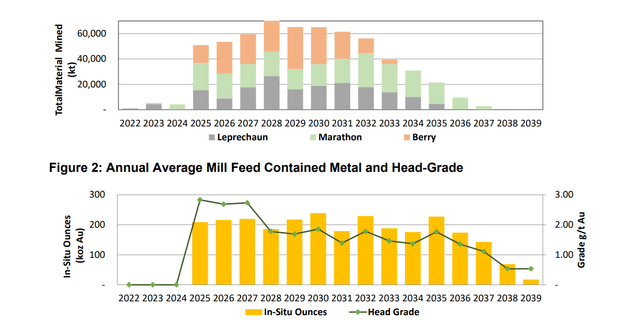

And on that vein, Calibre stated in a recent presentation that it sees the opportunity to take Valentine to 5.0 to 5.5 million tonnes per annum in Phase 2 in terms of overall throughput, well above the planned Phase 2 throughput rate of 4.0 million tonnes per annum under a less well capitalized and understandably slightly less ambitious Marathon Gold (previous owner). Assuming a 20% expansion to ~5.0 million tonnes per annum was pursued which could be completed with minimal incremental capex, production could come in closer to 260,000 ounces in peak years, and I see the potential for an optimized mine plan of ~17 years with an average production profile of ~210,000 ounces per annum, a meaningful improvement from ~14 years at ~180,000 ounces envisioned in Marathon Gold's 2022 FS.

Valentine Gold Project 2022 FS - Company Website

"As we start to look at what's next from a build perspective, those that are familiar will know that Valentine was a 2.5 million tonne build, in Year 3/4 expanded to 4.0 million tonnes per annum. We see the opportunity with the existing infrastructure to be able to optimize that, and early indications yet, but I think there's an opportunity to maybe take that to 5.0 to 5.5 million tonnes."

- Calibre Mining CEO, Darren Hall, Gold Forum Americas

Peer-Leading Growth Profile

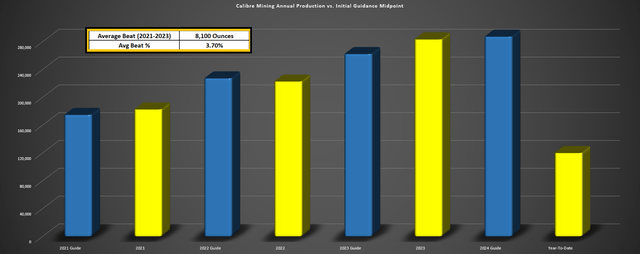

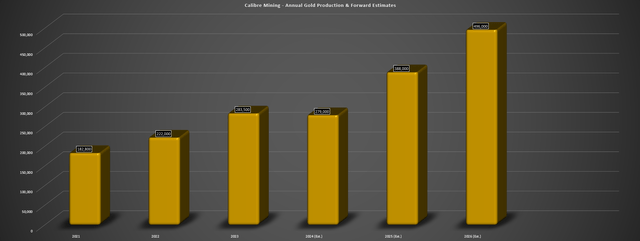

Looking at the bigger picture, Calibre may come in just shy of its guidance midpoint of 287,500 ounces of gold production this year and if so, this would weigh on its multi-year record of beating its guidance midpoint. However, the company deserves a pass given that it has executed near flawlessly across nearly every facet of the business over the past few years and has been one of the few per share growers sector-wide. Besides, as the chart below highlights, this is a company with a path to ~490,000 ounces per annum in 2026, but with multiple upside opportunities that could push production closer to 550,000 ounces even with its current portfolio only.

Calibre Mining Actual Production vs. Guidance Midpoint - Company Filings, Author's Chart

Calibre Mining - Annual Gold Production & Forward Estimates - Company Filings, Author's Chart

For starters, while all eyes are on Valentine since the acquisition, Panteon North was an incredible new high-grade discovery made by Calibre at its Limon Complex that should provide another high-grade feed source to boost production at its Nicaraguan operations later this decade. It's also important to note that its Libertad Complex continues to have a hungry mill with ~1.0 million tonnes of excess capacity, potentially setting its Nicaraguan hub up to deliver ~300,000 ounces per annum in an upside case scenario. Second, Valentine looks to have upside relative to its base case 2022 FS, with hints of positive future grade reconciliation at the Marathon Pit and the potential for higher tonnes from the Leprechaun Pit.

In summary, I think there is room to expand to 550,000+ ounces with its current portfolio later this decade. Assuming a $2,400/oz gold price assumption, this could close to $450 million in annual free cash flow or ~US$0.50/share. If we assume a conservative free cash flow multiple of 8.0 to factor in the persistent Nicaragua discount, this could support a share price closer to US$4.00 later this decade.

Valuation & Technical Picture

Based on ~860 million fully diluted shares and a share price of US$2.00, Calibre trades at a market cap of ~$1.72 billion. This is a significant increase from where the stock traded just over four years ago in 2020 when it was reliant solely on cash flow from Nicaragua (shown below), but the re-rating is certainly deserved. And while I wasn't elated with the purchase of Fiore which was the case of buying a below-average asset (though it provided much needed diversification) in a top-ranked jurisdiction at a reasonable price, the acquisition of Marathon Gold was a home-run and a brilliant move.

The reason? Valentine was a case of buying a very solid asset with a reasonable capex bill and the potential for industry-leading margins in a top-ranked jurisdiction with an above-average grade multi-pit gold project in Canada.

Most importantly though, Calibre practically stole the asset, paying just ~$250 million - a fraction of the ~$1.0 billion estimated NPV (5%) today at updated gold price assumptions ($2,300/oz near-term, $2,150/oz post-2026) and ~$1.55 billion (5%) at $2,400/oz gold near-term and long-term assuming an optimized mine plan (throughput increase to 5.0 million tonnes per annum in Year 4).

Valentine Reserves & Resources - Company Website

Today, Calibre does not screen as well given its free cash outflows during the capital-intensive last leg of the Valentine mine build and saw disappointing year-over-year financial results with the geotechnical incident at Limon Norte (Nicaraguan operations). However, this is expected to change very quickly in H2-25 once Valentine is online, and Calibre looks set to generate upwards of $370 million in free cash flow in 2026 even using quite conservative gold price assumptions. Assuming the stock were to trade at 8x free cash flow, which is hardly a stretch and even assuming 890 million fully diluted shares, this would translate to a fair value of ~$2.96 billion or US$3.30 to its 2-year target price (year-end 2026).

So, what's a fair value for the stock today?

Using what I believe to be conservative multiples of 6x FY2025 cash flow estimates and 1.0x P/NAV for a diversified producer with a mixed jurisdictional profile (Nicaragua, Canada, Nevada), I see a fair value for the stock of US$2.40. This points to a 20% upside from current levels. This suggests that the stock could make a run at its 2020 highs if it were to trade up to fair value.

That said, I am looking for a minimum 30% discount to fair value to justify starting new positions in small-cap producers so while I see long-term upside for Calibre and I have high confidence in it executing successfully, I continue to see far more attractive bets from a relative value standpoint elsewhere in the sector. Hence, if I were still long the stock, I see this rally to US$2.10 as an area to book partial profits given that the stock has found itself a little extended short-term with a less favorable short-term reward/risk setup.

Summary

Calibre has outperformed its peer group this year, but is finally heading towards its first real resistance area and is no longer as deeply discounted, trading at ~0.80x P/NAV vs. an estimated net asset value of ~$2.18 billion. This doesn't mean it can't go higher, but I prefer to buy with a very comfortable margin of safety or pass entirely, and I prefer to buy hated or out of favor names that have extremely low expectations which means even just delivering the bare minimum can provide an upside shock to the share price.

Hence, while I see Calibre as a solid buy-the-dip candidate if we get a decent correction, I continue to see more attractive bets elsewhere in the sector where I remain focused currently.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.