J Studios

In the spirit of transparency, one year ago, I wrote a review of my performance, covering the recommendations I had made up to that point as well as my returns. Having made another nine new recommendations this year, I'm returning to do another annual review.

Returns

broker website

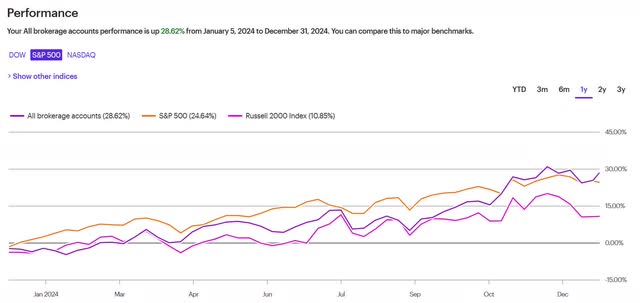

In 2024, my portfolio returned 28.6%, beating the S&P 500's 24.6% by almost exactly 4%. The year got off to a rocky start, and it was not until the search in small caps in Q4 that my returns accelerated. As many other writers have noted, 2024 was a great year to be in the market. Shares advanced, and growing companies were rewarded with expanding multiples. Many writers on Seeking Alpha and elsewhere had exceptionally good years, boasting returns of well over 50%. Part of the reason that my returns were less extraordinary is that I completely avoided large-cap tech stocks. This portion of the market has remained expensive, and I don't have an edge in evaluating the prospects of these companies, so I sat out the tremendous rally in the Magnificent 7. Time will tell if that turns out to be a good decision or not.

Recommendations

Here is a review of my picks in 2024. I include three recommendations which I made late in 2023 (ABG, OTCPK:HMDPF, MAMA) since I continued to recommend them through part of this year. I list the return since the date of initial recommendation compared with the S&P return over the same period, as reported on Seeking Alpha as of the end of the year.

| Ticker | Return | S&P return |

| ABG | 17.37% | 29.08% |

| HMDPF | 50.62% | 29.06% |

| MAMA | 97.03% | 24.76% |

| CURN | -8.72% | 23.31% |

| NPWR | 9.85% | 25.04% |

| CTLP | 39.24% | 18.61% |

| VFC | 51.13% | 12.69% |

| CLMB | 127.55% | 13.35% |

| GKPRF | -12.08% | 8.30% |

| ALAR | -76.76% | 6.21% |

| NICE | -6.73% | 4.87% |

| KRKNF | 72.52% | 4.29% |

| average | 30.09% | 16.63% |

As the table shows, there were some winners (MAMA, CLMB, OTCQB:KRKNF, and to a lesser extent OTCPK:HMDPF, CTLP, VFC), some duds (ABG, OTCPK:CURN, NPWR, OTCPK:GKPRF, NICE), and one big loser (ALAR).

The winners benefited both from exceptionally good operating results and big multiple expansions. By year-end, I had sold both Mama's Creations and Climb Global Solutions because of valuation concerns. Since both companies have indicated that their revenue growth and margin expansion will not continue accelerating over the medium term, I think that their premium valuations are hard to justify. This is not the case for Kraken Robotics, which continues to have exceptionally bright long-term prospects. Kraken remains one of my larger positions despite its run-up and rich valuation.

I was frustrated that I did not buy Hammond when it doubled in the months after my recommendation. But since then, as the share price has gone sideways, I think my initial skepticism has been confirmed. Cantaloupe and VF Corporation have been more straightforward successes: both have delivered better-than-expected operating results and seen their multiples expand based on the promise of brighter futures. I have closed my position in Cantaloupe over valuation concerns, but think that there is still room for VF's turn-around to drive shares significantly higher in 2025. After some concerns in summer 2024, NetPower delivered a strong set of results last quarter, and I remain optimistic about its long-term prospects. I would not yet consider this a loser, even though it was dead money in 2024.

Mostly, the recommendations which delivered bad returns this year simply failed to deliver the operating results the market (and I) hoped for. Asbury cut growth targets. Gatekeeper failed to deliver a jump in profitability, despite higher revenue. And NICE saw the market lose confidence after the long-time CEO retired. At a general level, this reflects the unpredictability inherent in stock-picking.

But to be more critical, it also reflects the fact that I failed to understand these companies well enough. As I noted in my initial recommendation of Asbury, Lithia (LAD) was growing faster, had higher insider ownership, and had seen some major recent purchases by informed institutional investors. And indeed, Lithia dramatically outperformed Asbury over the last year: advancing 33.3% vs. Asbury's 17.4%.

I think the jury is still out on Gatekeeper, but the CEO's lack of communication or guidance and the company's continued inability to show operating leverage as revenue grows has - rightfully, I think - made the market skeptical of the stock. Despite the fact that the CEO does not hold earnings calls and has not held a YouTube interview in some time, he did not respond to my request for a conversation or to inquiries from other investors I talked with about the stock. While this may still end up turning out to be a success story, it is not the sort of business that I want to be invested in because there is not enough guidance provided to be able to predict results.

The situation with Currency International is the opposite. The management team remains communicative and thoughtful, but their expansion from selling currency into foreign exchange banking is not materializing. It turns out that CURN's potential banking customers prefer working with larger banks, and that breaking into this business is much harder than they hoped.

As is often the case, the glaring failures were the more productive moments of learning. They were Moderna (MRNA), which I held but did not recommend to SA readers, and Alarum. I bought Moderna in fall 2023. I was optimistic about their pipeline and impressed with their use of AI in drug discovery and their entrepreneurial culture. I failed to account for the drop in COVID vaccine demand, as well as the fierce competition in the RSV vaccine market. This company turned out to be a loser fairly quickly, and I should have sold my shares as soon as it was clear that my thesis had failed to account for the most important factors determining the company's fate.

I bought Alarum in a moment of excitement this summer as it was soaring on the back of explosive growth. I will stand behind my initial thesis and due diligence. But as I noted at the time, the recommendation was speculative, as it remained unclear whether the growth would continue. It didn't, and shares quickly collapsed. I bought slightly before my article went up and sold relatively quickly, but still lost over 50%. Thankfully, I recognized this risk when I purchased shares, and only bought a relatively small stake.

Reflections

Most of my initial expectations turned out to be right, in 2024. I was right to be concerned about Gatekeeper's management team, and right to be concerned about the sustainability of Alarum's growth. And I was right about the growth prospects for Kraken, Climb, and Mama's Creations. Why, then, did my portfolio return less than the average of my recommendations? Part of the answer to this is that around 13% of my portfolio was invested in several bond funds, which had minimal returns this year. Removing them from the calculation, my total return would have been well over 30%.

My biggest take-away from 2024 is the importance of position sizing. The fact that I only bought a small position in Alarum (~3%), and did not add to it when the stock jumped over 50% saved me from a bigger loss later. And the large position (~10%) in Mama gave me my biggest winner of the year in dollar terms. But there are several recommendations which I was very confident about and could have been much bigger winners if I had purchased larger stakes. Climb Global Solutions in particular stands out here, but so do VF Corp and Kraken. In 2025, I plan to stagger my purchases as I build conviction (to forestall big drops), and I also plan to more aggressively build large positions in high-conviction names.

Remainder

We don't yet have enough hindsight to fully evaluate 2024. Will the stretched valuations in companies like MAMA, CLMB, CTLP, and KRKNF end up being obstacles to their continued advance, or will they melt up even further? Will NetPower, Asbury, and Gatekeeper deliver on their unfulfilled 2024 promises? Will the lesson of 2024 - bet bigger - be useful in the market in 2025? I will not pretend to know. But I have sold several winners which have gotten expensive, and rotated into new names which I am more optimistic about.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.