bjdlzx

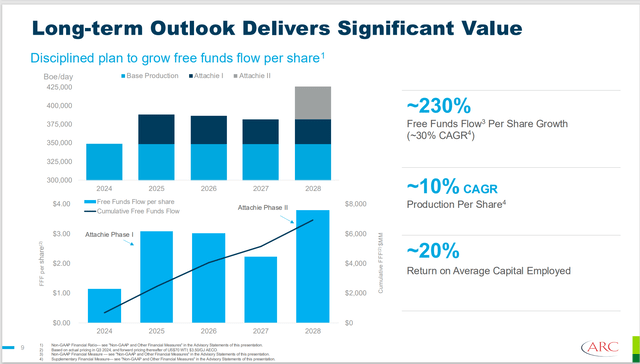

My last article mentioned the Attachie project startup that ARC Resources (OTCPK:AETUF) has been working on for some years. Part of the reason that free cash flow will take a jump is because now necessary projects will dip until the "part 2" of this same development gets underway. All of this is subject to commodity prices throughout the project. Because this project will also produce condensate, this is a gas producer that will produce more gas during this cold winter that has sent natural gas prices soaring. The condensate amounts are often enough to justify drilling the wells. The soaring natural gas prices make a good situation better.

Long-Term Outlook

(Note: ARC Resources is a Canadian producer that reports using Canadian dollars unless otherwise noted.)

The onset of the project production likewise saw the company raising the dividend to C$.19 per quarter.

ARC Resources Cash Flow And Free Cash Flow Guidance (ARC Resources Fourth Quarter 2024, Corporate Presentation)

The Attachie results will dominate the corporate growth picture due to the sheer size of the project. Other producing areas may well show some growth. But in summary, they do not have the effect on the corporate picture that this one project has.

As is the case with the "part 1" part of the project, the next phase of growth will likewise be dominated by condensate prices (outlook) rather than natural gas prices.

Natural Gas

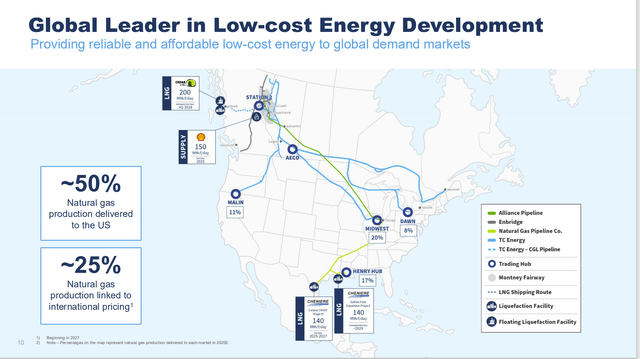

But unlike many producers in the United States, this producer has always tried to maximize the sales prices received for production.

ARC Resources Natural Gas Sales Strategy Map (ARC Resources Fourth Quarter 2024, Corporate Presentation)

The company has long gone to great lengths to avoid exposure to the very volatile AECO pricing. This has often given it a sales price premium compared to many in the Canadian industry.

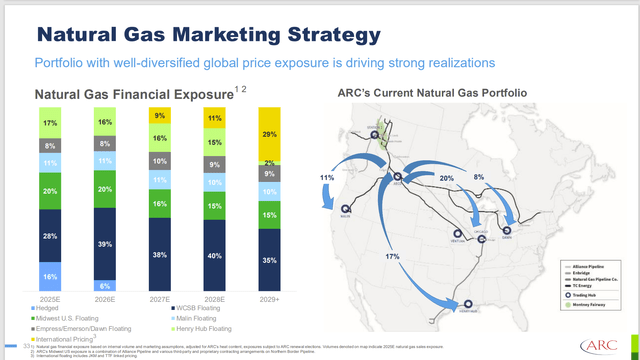

ARC Resources Detail Of Natural Gas Marketing Strategy Diversification (ARC Resources Fourth Quarter 2024, Corporate Presentation)

While the Henry Hub exposure is going away, the international pricing exposure will take that place. Since the growing ability to export essentially adds to total demand for natural gas, all the different areas shown above should see natural gas price increases.

There is, of course, a considerable discussion as to what that will look like. But there could well be a cyclical industry boom on the way that could last for several years.

Now, beginning in 2027, the company will have considerable exposure to the much stronger world pricing market.

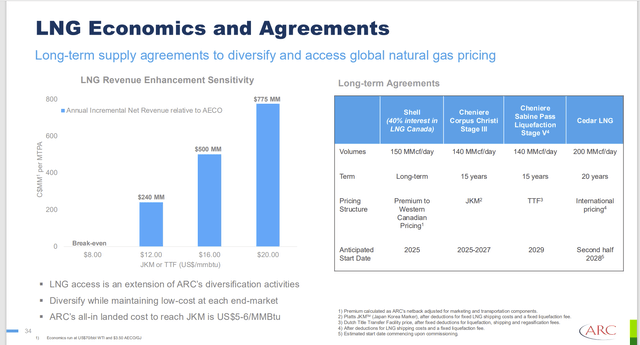

ARC Resources LNG Agreement Guidance (ARC Resources Fourth Quarter 2024, Corporate Presentation)

As shown above, the world prices are considerably higher than the United States prices. A big chunk of the premium pricing is used for transportation because the distances involved in LNG sales are substantial.

However, it would not be all that unusual for the base price in the United States to move towards $4 MCF as the United States export capacity rapidly expands. That is at least double what the price was for fiscal year 2024. It could prove to be politically problematic given that United States voters just voiced concern over high prices. Some of the scenarios shown above would definitely result in even higher North American prices. As the expanding export abilities continue, there is likely to be a heated political discussion. That would definitely impact the future of the industry.

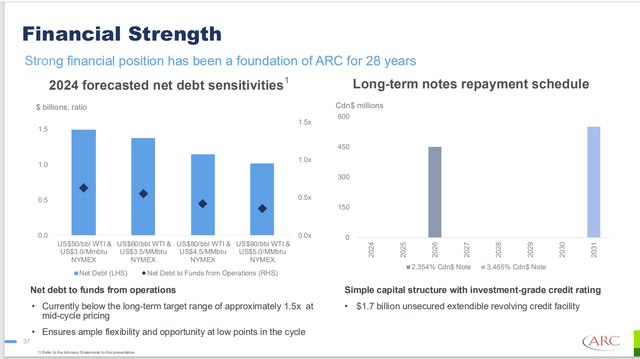

Debt Ratio

The company emerges from the end of construction (or capital investment) with a remarkably good debt ratio. There are intentions to drive that ratio lower still to maintain financial flexibility.

ARC Resources Net Debt And Debt Ratio Guidance (ARC Resources Fourth Quarter 2024, Corporate Presentation)

Generally, the company has a "balance sheet first" strategy. That makes defending the dividend a lower priority. However, a low payout ratio takes the place of a lot of other defensive measures.

The company has made opportunistic acquisitions in the past and is likely to do so in the future. It also will divest older projects when profitability falls below predetermined levels.

However, the condensate production that this company emphasizes appears to ensure a reasonable profitability throughout the business cycle. Natural gas can aid that profitability, but it will not hurt the company finances as is the case with some dry gas producers that I follow.

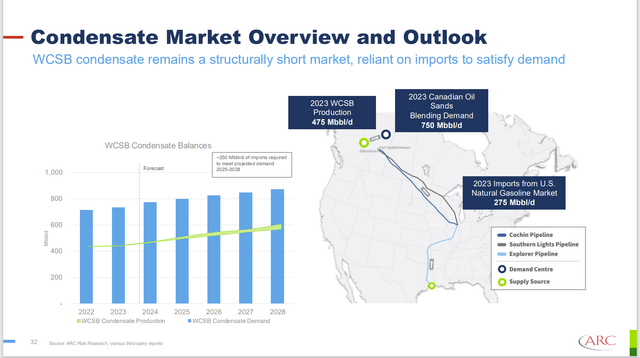

Condensate Outlook

The outlook for condensate (that this company produces a lot of) remains bullish.

ARC Resources Summary Of Condensate Outlook (ARC Resources Fourth Quarter 2024, Corporate Presentation)

Canada has long imported condensate because it is needed to make thermal oil and heavy oil flow adequately through pipelines to market. For this reason, the condensate prices are often a premium to the light oil benchmarks.

That premium helps the company show a low breakeven point. Any premium lowers the breakeven point compared to natural gas and light oil benchmarks. The risk here is that the premium can change unfavorably or even disappear at some points in the business cycle. But even if the price were to decrease to the light oil benchmark temporarily, that is still a lot more profitable than natural gas has been recently.

The long-term outlook is for Canada to continue to import some condensate to meet the industry needs. That is good news for condensate prices as well as for the company outlook.

Summary

ARC Resources is an investment grade Canadian idea that remains a strong buy consideration. Growth will come in lumps because the company does develop fairly large projects.

However, the natural gas pricing recovery is likely to overshadow any lumpy growth for the next couple of years. There is a wide range of opinions as to the effect of the growing ability of North America to export natural gas. But most of those opinions agree that the "base price" of natural gas is likely to rise substantially. That should imply that this stock is going to do very well through the export ability additions that run through 2028 (currently).

What is keeping a rapid addition to natural gas supplies by natural gas producers is the debt market demand for better balance sheets coupled with the market demand for shareholder returns. How that is influenced by the coming natural gas price recovery remains an open question.

But it is clear that there is a lot of good things happening in the natural gas industry over the next few years for investors.