CSE:NORD - Post Discussion

Post by

alphaflight on Jan 28, 2022 10:46am

Brascan: Gold Exploration Drilling Down in the Americas

Many junior gold exploration companies offer value and opportunity to investors. Few in that space, however, have a seasoned team with 120 years of experience and offer the unique and combined approach of optioning, entering into joint ventures or outright acquiring mining projects.

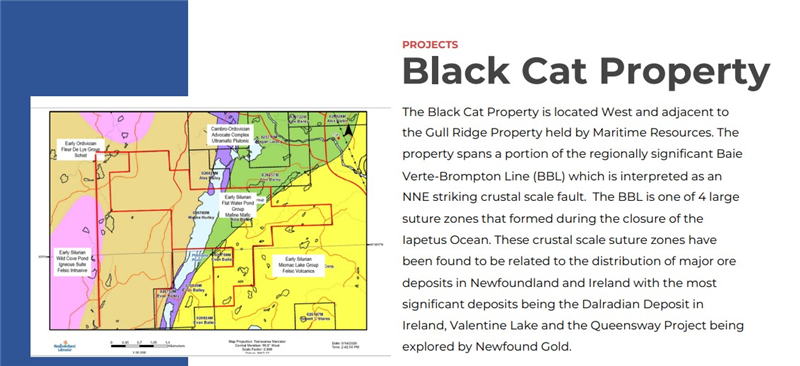

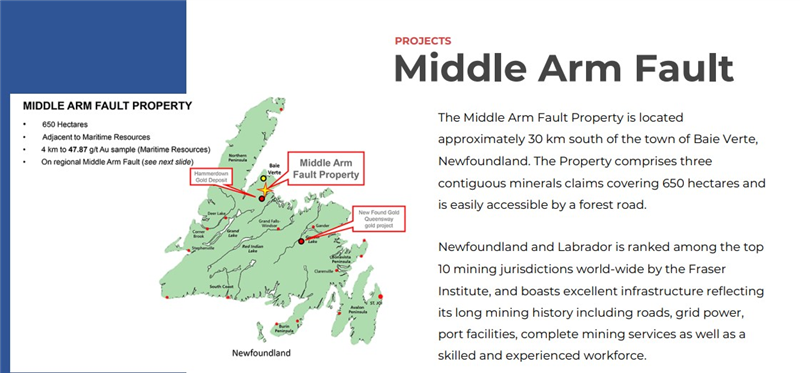

Enter Brascan Gold Inc. (CSE:BRAS; FRA:5ZT), a mineral exploration company primarily focused on gold, with its Black Cat and Middle Arm Fault properties located near the town of Baie Verte in Newfoundland and Labrador – one the hottest and most mining-friendly jurisdictions in the world. As an example of successful gold mining projects in the province, take a look at New Found Gold (TSX-V.NFG) with its current $1.3 billion-plus market cap and its massive Queensway Project.

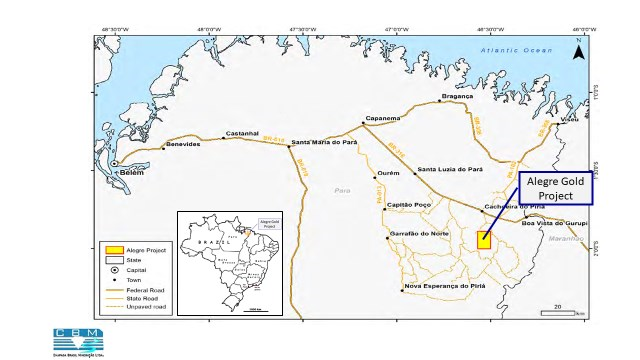

In addition to its Newfoundland and Labrador properties, Brascan has cast a wide net to identify other promising gold projects throughout the Americas. For example, Brascan has also entered into an option agreement to acquire a 100% interest in the Alegre Gold Property in Para State in northeastern Brazil and is evaluating several other gold projects in the Americas with one million ounce-plus potential.

In the News

On January 25th Brascan Gold announced the formal activation of the Alegre Gold Project earn-in option agreement in Par State in northeastern Brazil. Brascan can now commence exploration of the highly prospective Alegre Gold Property.

Brascan will earn a 100% interest in the project after spending exploration expenditures of $1,000,000 and making a payment of $400,000, as well as issuing 750,000 common shares to claim 100% ownership of Chapada Brasil Minerao Ltd. (CBM). CBM will retain a 2% net smelter royalty (NSR), of which 50% can be purchased by Brascan for $1 million, on or before a production decision.

(Click image to enlarge)

Balbir Johal, Brascan Gold Director and CEO, commented on the project:

"The Alegre Gold Project has exceeded our expectations. The potential to find an industrial grade gold resource is remarkable given the central location of the Alegre Property which is surrounded by gold resources owned by other mining companies. Brascan is fully funded to carry out a major exploration program in February."

He concluded by remarking that:

"European investors have shown very positive interest in the Alegre Gold project in Brazil. They see the Brascan Gold Project business case as quite compelling given the country's poor economic conditions which may lead to a bottom plateau. Timing is everything."

On the financial ledger, Brascan recently announced the closing of the second tranche of non-brokered private placement units. The Company plans to use the gross proceeds from the private placement to fund the exploration costs of its Black Cat and Middle Arm Fault properties located in of Baie Verte, NL. The province of Newfoundland and Labrador is ranked among the top 10 mining jurisdictions worldwide by the Fraser Institute.

(Click image to enlarge)

(Click image to enlarge)

A week after announcing the completion of its second tranche of private placement funding, Brascan Gold increased the maximum amount of its private placement from $2.4 million to $3.6 million in the wake of strong demand from strategic investors and existing shareholders.

Director and CEO Balbir Johal had this to say about the raise:

“Due to market demand for our $0.30 unit offering, Brascan has increased the $ 2.4 million financing to $ 3.6 million. This financing will enable Brascan to develop the Alegre Gold Project and acquire additional promising gold properties in Brazil. This project is near established infrastructure and located on the same gold mineralization trend as Goldmining Inc.'s advanced Cachoeira gold project 15 km. to the north as well as Oz Minerals' CentroGold Project 30 km. to the south (considered one of Brazil's largest undeveloped gold projects). Other adjacent neighbors to the Alegre Gold Project include Kinross Brasil Minerao and IAM Gold Corp."

The Bottom Line

With gold hitting an all time high of USD$2,067 an ounce in 2020, The Sprott Market Report gold analysts view presented the price of USD$1,800 an ounce as “exceptionally cheap.”

With private equity money pouring into Brascan Gold along with a strong stock performance over the past three months, it makes sense for retail investors to keep a keen eye on this intriguing gold play with global reach…today and into the future.

(3-month CSE.BRAS stock chart Oct 2021 – Jan 2022. Click image to link to chart)

For regular updates and more information, visit brascangold.com.

Be the first to comment on this post