GREY:DULMF - Post Discussion

Post by

jjeeddoo7 on Nov 20, 2014 10:38am

comparison...

Majors Focus On Acquiring Large Polymetallic PGM Projects In North America

Nov 19, 2014

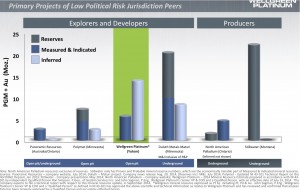

The Twin Metals Deposit is similar to Wellgreen’s (WG.V or WGPLF) as they are large PGM deposits in North America. Dundee put out a research note after the transaction which showed if Wellgreen was bought out at the same valuation as Duluth it would be priced at $1.85 share. Today’s price in the mid fifty cent range is quite cheap especially as we see the growing interest in Platinum and Palladium sources outside South Africa.

For many reasons I chose the Wellgreen asset over the Duluth asset. I had some concerns about permitting for Duluth whereas the Yukon is much more mining friendly. Wellgreen has much more exposure to nickel and PGM’s compared to Duluth and a much lower potential Capex. Wellgreen should be considered at these cheap levels especially in light of the recent Antofogasta purchase of Duluth.

I wouldn’t be surprised if Polymet, Stillwater and First Quantum are taking a look at Wellgreen especially as it has a lower capex. The upcoming PEA could be a huge catalyst to bring the project recognition in the eyes of the majors. They will be able to compare it to the recent benchmark of the Duluth transaction.

Wellgreen’s total in situ metal is over 19 million ounces of PGM’s and Gold in the open pit constrained resource. The overhang on the stock from previous management could soon be over and the new PEA could be quite exciting.

https://www.youtube.com/watch?v=OqPFPBrbqG4

get out of Minnesota with your investment in PGM and get real in the Yukon...where they actually like mining copper/nickel/PGM's...the biggest reason that DM needs to jump ship is the 11% IRR on the recent release...plus the CAPEX was way to high to start this for any bank to be interested.

Polymet and Wellgreen both have CAPEX monies in the 500 Million range...not 2.5 billion like DM woud look at for an underground pipe dream.

sell this and scoup up the Wellgreen shares...PEA will be out in the next few weeks...it will be more than double the IRR...some are looking at 30% even...plus the use of LNG to power...half the cost of diesel power...plus these folks in the management team actually have taken numerous companies from 50 million to 2 billion...still a ways to go to mine...but a good risk for PGM investors.

Wellgreen is worth 1.85 VS .45 for DM

Come on Geologists/miners/investors/rookies...give some educated feedback.

Be the first to comment on this post