https://www.zerohedge.com/weather/texas-power-grid-warns-record-demand-amid-back-back-triple-digit-heatwave

Update (Saturday 0833ET): Texas' electricity grid operator asked customers Friday evening to conserve power this weekend after half a dozen generation plants were knocked offline amid another round of unseasonably hot weather.

"On Friday afternoon, six power generation facilities tripped offline, resulting in the loss of approximately 2,900 MW of electricity," The Electric Reliability Council of Texas (ERCOT) wrote.

"At this time, all generation resources available are operating.

"We're asking Texans to conserve power when they can by setting their thermostats to 78-degrees or above and avoiding the usage of large appliances (such as dishwashers, washers and dryers) during peak hours between 3 p.m. and 8 p.m. through the weekend," ERCOT said.

Local newspaper Austin American-Statesman said one megawatt of electricity powers 200 homes on a hot summer day. "That means the 2,900 megawatts that went offline are enough to power about 580,000 homes," it noted.

Heading into the weekend, ERCOT warned about a heatwave that would send electricity demand to record levels. With 2,900 MW of electricity removed from the grid as energy demand increases, this could strain the state's power system.

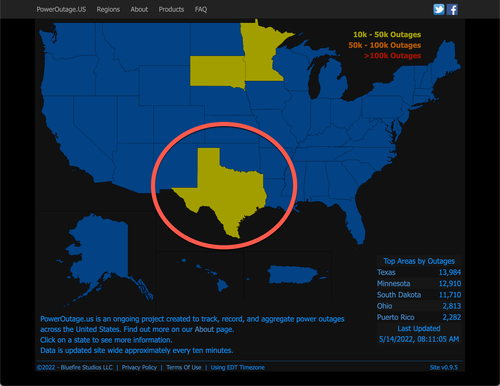

PowerOutage.US shows that 14,000 customers in Texas are without power on Saturday morning.

* * *

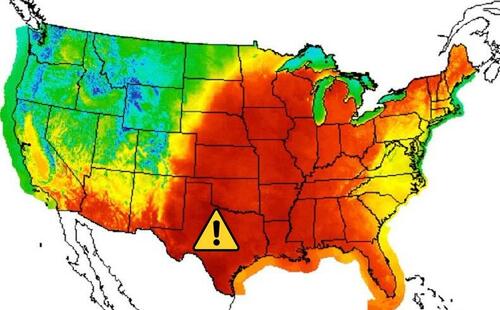

An early summer heatwave pattern continues to boil parts of the Central and Southern Plains. This means parts of Texas will continue to roast with temperatures forecasted to reach triple digits next week.

The Electric Reliability Council of Texas (ERCOT), the state's power grid operator, is already warning of record energy demand next week as customers crank up the AC.

Power consultant Doug Lewin, who actively monitors the Texas grid, told FOX 4 News Dallas-Fort Worth that triple-digit temperatures are very concerning because it's "still not even summer."

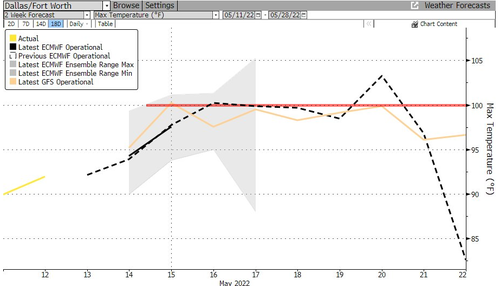

On Tuesday, ERCOT reported power grid demand jumped to 70,703 megawatts, smashing the May 2018 record demand of 67,271 megawatts due to an early week heatwave. Now the next round of heat has the power grid operator concerned.

ERCOT issued an operating conditions notice (OCN) for extremely hot weather. The OCN begins on Friday and lasts through next Wednesday. The grid operator ensured customers it had enough power to meet the demand spike.

The National Weather Service's Austin/San Antonio office warns that "more triple-digit heat is in store for early next week."

High temperatures across the Dallas/Fort Worth areas are expected to flirt with triple digits on Sunday through next week.

Back-to-back heatwaves hitting parts of Texas when power plants usually go offline for maintenance is concerning, though the latest from ERCOT is that they have everything under control.