by Jordan Roy-Byrne

Who sells a company at the bottom of the market just before

the biggest phase of the gold bull era is coming back? Who?

When rising gold metal prices and avid buyers of gold stocks

continuously bid up prices, fuelings more than enough money

to finance future projects, and make big profits with.

This article tells us why not to sell gold junior stocks now and

applies to both investors and management of gold companies.

From Jordan Roy-Byrne's

'Precious Metals Ignore Correction Calls'

https://thedailygold.com/preciousmetals-ignore-correction/ "Where are we now?

As we noted last week, if Gold follows the path of the 1976 and 2008 rebounds then it would soon reach $1400/oz and continue to reach higher levels in the months and quarters ahead.

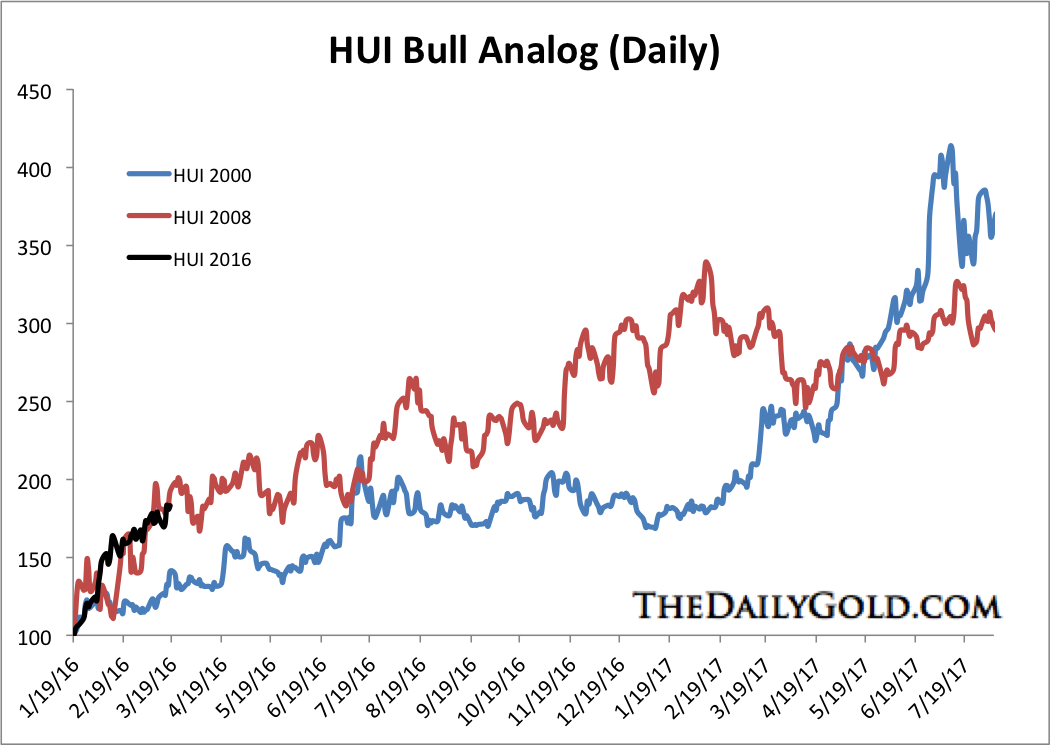

Meanwhile, the gold stocks are certainly overbought but history argues they could trend higher in the months ahead. Note the bull analog chart below. If the HUI follows its 2008 path then it would gain 46% over the next five months and 88% over the next 11 months. If the HUI follows its path after its 2000 bottom then it would rally 128% over the next 16 months."

"While it is very difficult to buy into a market that has already gained substantially, history argues that the larger risk is staying out of that market especially if it only recently made a major bottom. The epic “forever” bear market of 2011-2015 lingers in the minds of many and that is why it is so difficult to believe the recent strength can continue. Hence, many continue to apply bear market thinking and bear market parameters without realizing the sector has made a major character change. (me- an apparently many gold junior companies' management are no less susceptible to prolong bear market attitudes and discouragement) "

"That doesn’t preclude the likelihood of pullbacks. We even made a solid case two weeks ago for GDX to correct 20%. It will come to pass soon or later. (However) Going forward, look to accumulate select shares on weakness. Buy and hold. You don’t make money in a bull market by trading. (me- or by selling your company at the bottom, just when the biggest phase of the gold era is about to begin)."