DieterMeyrl

Introduction

Calibre Mining (TSX:CXB:CA) is a mid-sized gold miner with tremendous upside potential. The primary catalyst is the deal with Marathon Gold (MOZ:CA). CXB already owns 16.6% of MOZ shares. The shareholder’s vote is scheduled for January 2024, and the deal will be closed immediately.

After the deal's completion, CXB`s NAV will be well diversified between North America (Canada and the US) and Nicaragua. Reserves will grow from 1.3 M oz Au to 4.0 M oz Au. The goal is to increase annual production to 500 k oz Au in 2025-2026.

Financially, CXB is sound, with $97 million cash and $20.5 million total debt. The company`s profitability has been stable over the last five years. In the previous quarter, the results were impressive YoY: higher grades and recovery, increased ore mined, and gold production, all multiplied by the higher realized gold price. The company trades at low multiples compared to its past figures and peers. The deal with MOZ will transform CXB into one of the most undervalued mid-size gold miners. I give CXB a buy rating.

Company Overview

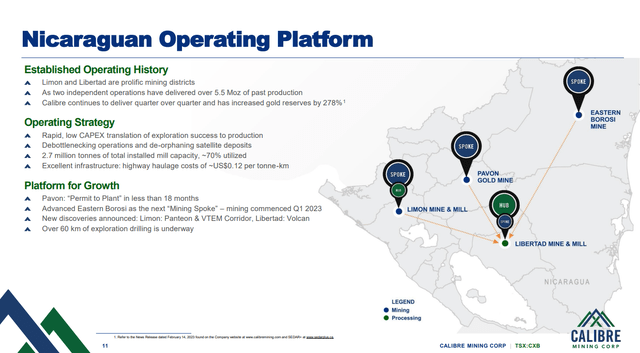

CXB has three 100% owned producing mines. Two are in Nicaragua: Limon and Libertad; one in the US, Pan. The company follows a hub and spoke strategy: Limon and Libertad mines have processing plants, acting as the “hub.” The image below from the last corporate presentation represents the company's Nicaraguan assets.

Calibre presentation

Once the Pavon and Eastern Borosi projects start production, the ore will be processed in the Limon or Libertad plants. Currently, the annual output is 260 k oz Au. P&P reserves are 1.5 M oz Au, and M&I are 4.5 M oz Au.

Pan Mine is an open pit mine in the Eureka gold trend in Nevada. Since the restart of production in 2017, the annual output has reached 45 k oz Au. The 2022 update shows 359 k oz Au M&I resources and 264 k oz Au P&P reserves. CXB has exploration assets in Nevada with excellent potential. Golden Eagle has 2 M oz Au M&I resources.

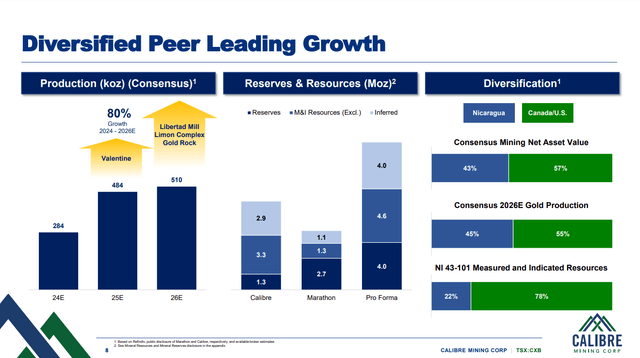

The acquisition of MOZ will significantly improve CXB's standing.

Calibre presentation

CXB reserves will double, while its resource base will grow by 30%. The most considerable advantage of the deal for CXB is the diversification of NAV and revenue. The company`s NAV will be distributed between Nicaragua at 43% and Canada at 57%. The projected 2026 production follows the same pattern. 78% of the company`s resource base will be in Canada.

The deal between CXB and MOZ is planned to be completed in 1Q24. MOZ shareholders will receive a 0.614 CXB share with an implied value of C$0.84 or a 32% premium over VWAP (volume weighted average price) of MOZ shares.

Valentine Mine

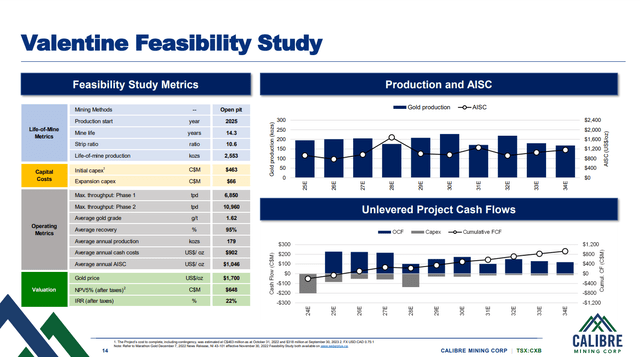

MOZ's flagship asset is Valantine in Canada. The mine is expected to deliver its first gold in 2025. The image below shows a Valentine FS`s highlights.

Calibre presentation

LOM is 14.3 years with an expected annual production of 195 k oz Au. The average grade is 1.62 g/t, much higher than the global average (1.29 g/t) for open pit mines. The expected recovery of 98% is impressive, too. Excellent grade and recovery led to a projected $1,046/oz AISC, much lower than the world average of $1,382/oz.

The initial CAPEX is $463 million, and expansion CAPEX is $66 million. The after-tax NPV5% is $648 million, resulting in a 5%IRR of 22% after tax. In my opinion, assuming a discount factor of 5% for the mining project, nevertheless, in Canada, while the yield of US T bills is 5%, is at least misleading.

I would add a 2.5-3.0 risk premium over the T bills yield, resulting in a 7.5-8.0% discount factor. The after-tax NPV will end up at C$510 million at a 7.5% discount rate and IRR 20%, respectively. Such figures are still good and show Valentine`s project's economic viability.

In my opinion, gold entered a new bull cycle. Mines like Valentine's with efficient cost structure will mint money. If the gold price moves from $2000/oz to $2200/oz, the earnings per oz will grow by 20% (using Valentine`s $1,046 AISC), while the gold spot will increase by 10%.

Valentine Mine is expected to go into production in 2025. The status of the project is 50% completion. Delivery of the SAG mill is scheduled for 1Q24, with mill commissioning in 4Q24.

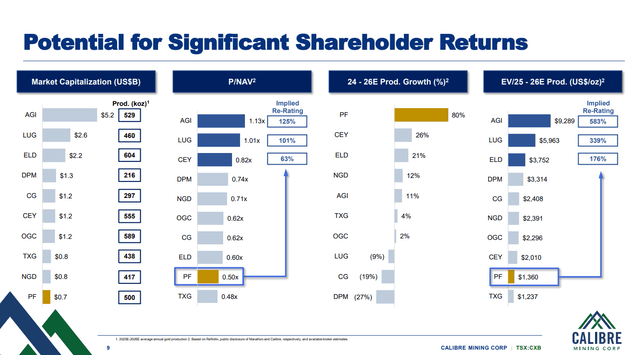

After the deal with MOZ, CXB will become one of the most underrated mid-size gold miners.

Calibre presentation

All figures are pro forma (PF). NAV, annual production, market cap, and EV are calculated on a completed deal basis. Comparing market cap vs. annual production, CXB is the cheapest with a $0.7 market cap and 500 k oz Au projected yearly production. Similar is the picture when we weigh a company`s NAV with its peers. By buying one share of CXB, we pay $0.5 for $1.0 of CXB`s NAV. Annual production is expected to grow by 80% between 2024-2026. CXB EV/Annual production is $1,360/oz, way lower than all peers except Torex (TXG:CA).

Calibre balance sheet

CXB has a healthy balance sheet with $97 million cash and $20.5 million total debt, resulting in a 4.85 cash-to-total debt ratio. Compared to similar-sized gold miners, the company falls in the lower percentile of debt to equity and cash to total debt.

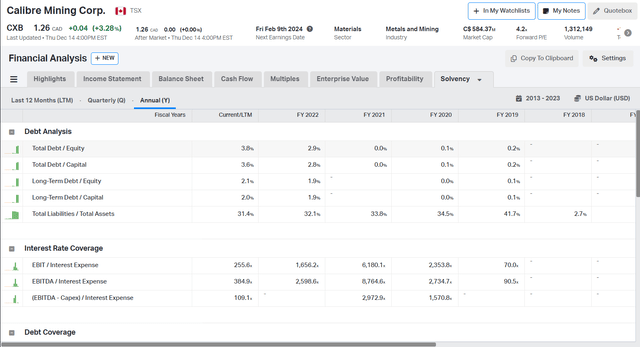

The capital structure of CXB has been stable over the last five years:

Koyfin

The company`s debt is at a 7.75% rate for the year's remaining months. After that, the interest rate will be calculated using a 2.44% premium over SOFR. The interest can not exceed 10.5% or fall under 7.5%. The maturity of the debt is July 31, 2026. Annual interest expenses (below $1M annually) are negligible to the company`s profitability. The EBITDA/Interest expenses ratio has been higher than 90 for the last four years.

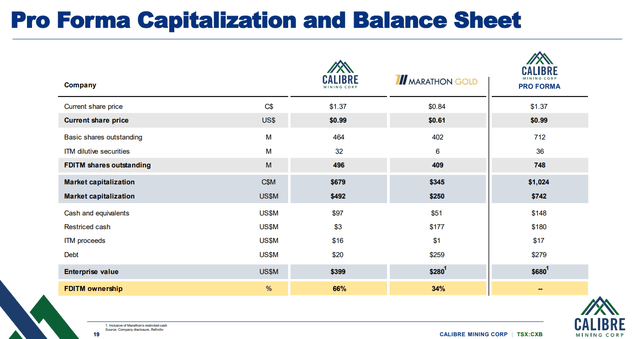

The Pro Forma balance sheet is shown below:

Calibre presentation

It`s worth mentioning both companies have a low percentage of derivatives compared to the fully diluted shares figures. In the long term, it is important because it mitigates the risk of significant dilution due to option/warrant exercising.

MOZ for developers has maintained an adequate balance sheet. The company has $51 million in cash and $259 million in debt. MOZ has $177 restricted cash associated with a credit facility with Sprott. CXB and MOZ will have $148 million cash, $180 million restricted cash, and $279 million debt. The derivatives will represent 4.8% of the fully diluted shares outstanding.

Company profitability

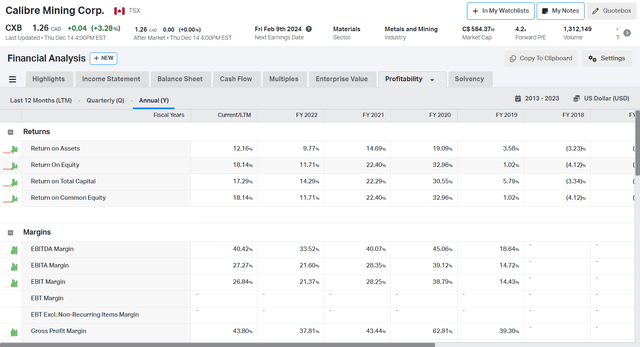

Over the last few years, CXB has maintained stable margins and returns.

Koyfin

Even in 2019, when the gold price was $1600/oz, gross margin remained above 35%. The rising gold price significantly improved the company`s profitability. Compared to similar-sized miners, CXB has higher than average returns and margins, a 40% EBITDA margin, 18% ROE, and 17% ROTC. Caledonia Mining (CMCL) has a 24% EBITDA margin and (5)% ROTC, and K92 has a 34.4% EBITDA margin and 8.4% ROTC.

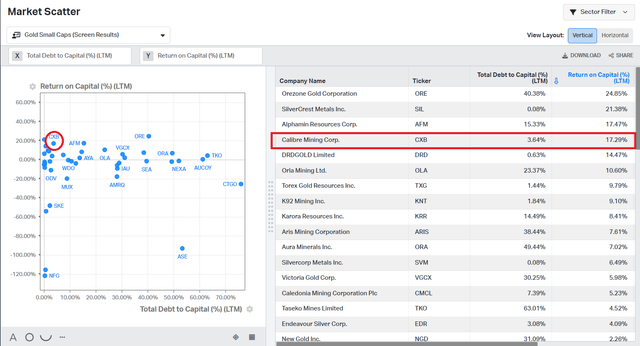

CXB is the most efficient capital allocator compared to its peers.

Koyfin

The company has a digit total debt-to-capital ratio while generating ROTC in the high teens. With such results, CXB ranks along DRD Gold (DRD), K92 (KNT:CA), and Silvercrest Mining (SIL:CA).

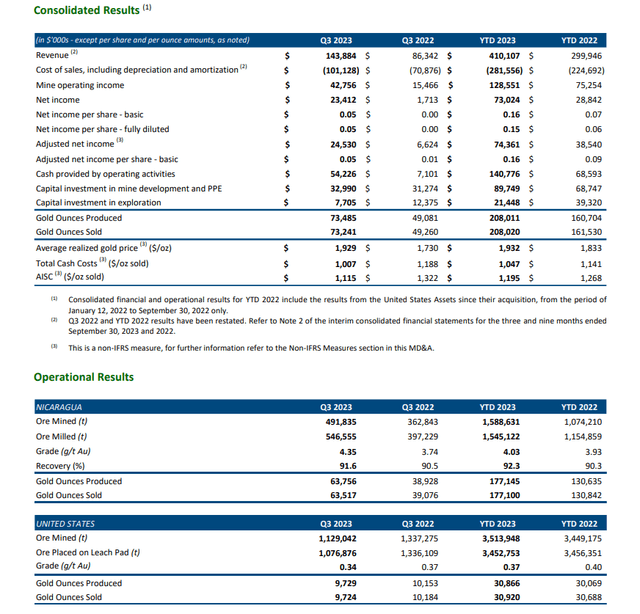

3Q23 was very successful for CXB. The table below shows 3Q23 highlights.

3Q23 report

The US operations in 3Q23 realized lower figures YOY. Ore mined dropped to 1.12 M tons in 3Q23 from 1.33 M tons in 3Q22. Gold production declined from 10.1 k oz Au to 9.7 k oz Au. The grade dropped by 8.9% YoY, too.

Nicaraguan mines have excelled on all metrics. Ore mined has increased to 491,835 tons in 3Q23 from 362,843 tons in 3Q22; gold ounces produced grew from 38,928 oz Au in 3Q22 to 63,756 oz Au in 3Q23. The ore grade and recovery improved significantly, too, resulting in lower cash cost and AISC.

Revenue YoY increased 66% (from $86M in 3Q22 to $143M in 3Q23). Given the decreased costs, higher output, and better average realized gold price, net income increased from $1.7 million in 3Q22 to $23.4 million in 3Q23.

Calibre valuation

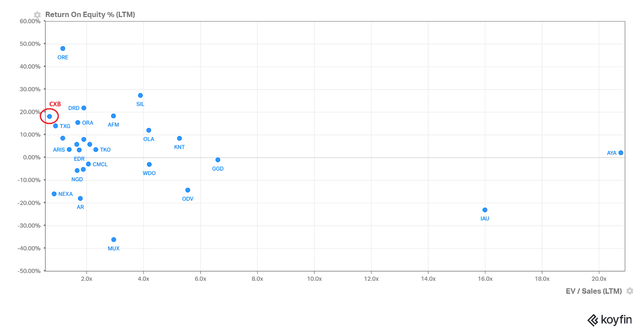

The chart below represents ROE (LTM) on the Y axis and EV/Sales (LTM) on the X axis for gold miners with a $200-$1000 market cap.

Koyfin

To get 18% ROE, I must pay 0.7 EV/Sales. CXB is one of the cheapest in the peer group. Similar valuations have Orezone Gold (ORE:CA), operating in Burkina Faso, and the South African gold miner DRD Gold (DRD).

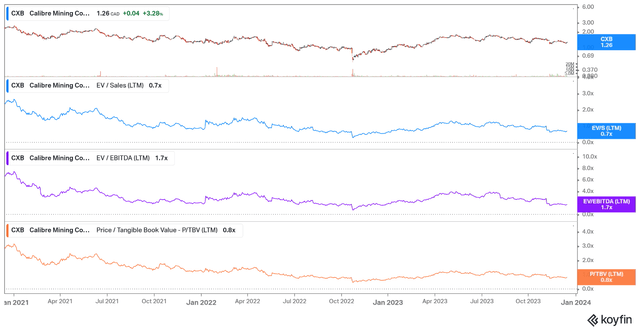

The chart below shows CXB EV/Sales, EV/EBITDA, and Price/Book over the last two years.

Koyfin

CXB trades at 0.7 EV/Sales, 1.7 EV/EBITDA, and 0.8 P/TBV, well below the previous peaks (2.5 EV/Sales, 7.3 EV/EBITDA, and 2.9 Price/Book). The company, even without MOZ assets, is deeply undervalued. As I pointed out, once the deal is complete, CXB will become one of the cheapest mid-size gold miners, measured in NAV, market cap vs annual production, and EV/annual production.

Price action

The price action is supportive for long positions.

Trading View

The price is on the verge of breaking out above 100 weekly simple moving average (SMA) and a significant price level while the SQN is in a neutral regime. Such a combination is excellent for building a long position. Before a confirmed breakout above the SMA, I would put a fraction of the intended position size for CXB. Once the price moves up, I would use the pullbacks to add more risk to the position.

Risks

CXB is a valuable company on its own. However, the MOZ deal will considerably improve its standing. The share price will suffer if the transaction fails, but I believe it will be a temporary glitch. Financially, CXB is sound and does not expect difficulties meeting its debt obligations and funding its projects. A more pronounced risk is the gold price. However, the declining bond yields are very favorable for higher gold prices. The political risk operating in Nicaragua is always present. Resource nationalism becomes more apparent; the last example is the First Quantum Minerals (FM:CA) and Panama. I believe the market already discounted the political risk by looking at the CXB low multiples.

Investors takeaway

CXB is a gold miner with huge growth potential. The deal with MOZ will enhance the company`s portfolio quality. Once Valentine Mine starts production CBX will grow by more than 80%. The pro forma valuation of the new CXB shows the company will be deeply undervalued based on NAV, market cap vs annual production, and EV/annual production. CXB has healthy financials with $97 million cash and $20.5 million total debt. 3Q23 results are excellent with growing gold production, ore grades and recovery, and higher average realized gold price, resulting in higher net income. CXB trades at lower multiples compared to its peers and historic multiples. CXB a buy rating.