Neo Performance Materials (

TSX:NEO:CA) (

OTCPK:NOPMF) is a small but complicated Canadian company that has a surprisingly large role in global rare earth and magnet supply chains. While you wouldn't know it from the

relentlessly dropping share price in 2022 and 2023 there's a case to be made for Neo having huge growth ahead of it as a supplier of sintered magnets for EVs (if you are long-term bearish on EVs, avoid Neo). While that growth opportunity is still some years away, the company's working capital of $285 million more than covers the current market cap of ~$220 million with cash alone being $113 million. Neo has profitable existing operations and a dividend yield of almost 6% at today's share price.

Neo is on the riskier side compared to what I would normally prefer, as it requires a leap of faith in EV growth materializing in the years to come. However, the potential upside is so large that I'm willing to accept the risk and collect the dividend while waiting to see if the growth thesis comes true.

A note: Neo's primary listing is on the Toronto Stock Exchange and its share price and market cap are therefore natively in Canadian dollars. The company uses US dollars for its reporting. All numbers in this article are US dollars unless explicitly stated otherwise.

Introduction to Neo

The first thing to understand about Neo is that it is not a new company whose share price has dropped as a speculative business model turned out bad. Neo and its component parts have been around for decades and its products are part of the supply chain for a large number of multinationals (Neo's investor presentation has an overview).

Selection of Neo customers (Neo Performance Materials)

Going through the full corporate history of Neo would require more space than available here, so I'll only cover Neo in its current form. I would recommend anyone investing to dive into the history since it is a quite fascinating tale and in some ways illustrates the major forces that have shaped the world economy in recent decades (outsourcing, US-China tensions, disruptive innovation, the rise of private equity and more).

As far as numbers go, Neo currently has a market cap of ~$220 million with 2022 revenue of $640 million and adjusted EBITDA of $79 million. For 2023, year-to-date revenue is $443 million, and adjusted EBITDA is $34 million (certain lead-lag effects make Neo's reported results volatile). As of Q3 Neo has long-term debt of $25 million, working capital of $285 million, and $113 million in cash and cash equivalents. The company spent $17 million on share buybacks in 2023 and has for several years been paying a quarterly dividend of CAD $0.10/share. The debt number will likely go up over the next years as the company looks to expand into sintered magnets and cash is likely to decline for the same reason. I do not see any threat to the dividend as Neo is generating significant cash flows from operations: year to date they've generated $59 million, of which $35 million was consumed by capex and a small acquisition, leaving more than enough to cover the $10 million in dividend payments.

Neo is in the rare earth and magnets business with a rare metals division thrown in for good measure (Neo seems to gravitate towards complexity as a company). The bull case for Neo is simply put that they have a shot at establishing themselves as a key Western sintered magnet supplier for EV manufacturers looking for alternatives to the Chinese companies dominating the space now. With that Neo would gain access to a massive new market that could be growing for years to come. You get that potential for practically free as Neo's existing business plus working capital in my view is more than enough to justify the current share price.

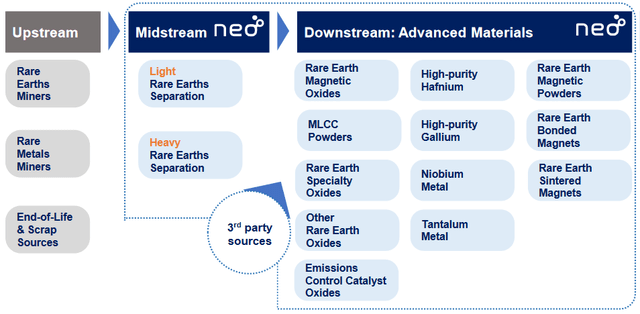

Before getting to that, let's first look at what Neo currently does. This slide from their investor presentation shows their full product set:

Overview of Neo's products (Neo Performance Materials)

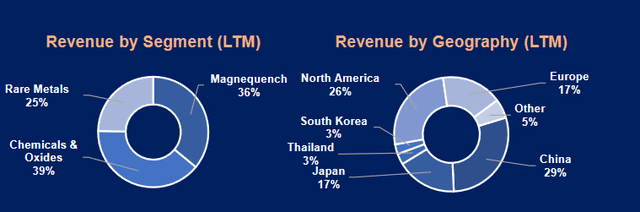

These products are produced by three separate divisions, which I'll go through in turn. The split of revenue across the three divisions as well as across geographies can be seen here:

Revenue share per division and per geography (Neo investor presentation)

Chemicals & Oxides

As is widely known, the magnets used in both EVs and other applications require what is known as rare earth metals, neodymium in particular. The use of rare earths increases performance characteristics and keeps weight down, which in turn allows engines to be more efficient. While there are attempts to find alternatives to rare earth magnets for such applications, the reliance on rare earths seems set to stay for the foreseeable future. Substitution may present a long-term risk to Neo and other rare earths magnet manufacturers.

Rare earth mining in recent decades has almost exclusively happened in China, which is where Neo got its start. Not as a miner of rare earths, but as a separator of them - that is, taking the output from mines and separating it into the individual rare earth metals. This separation business is still at the core of Neo's rare earths division (which they call "Chemicals & Oxides"). Uniquely Neo has separation facilities both in and outside China, with its separation facility in Estonia having a lineage going back to Soviet times. For a long time, Neo had the sole separation facility outside China, but they will soon have 4-5 competitors in the space. Even so, Neo has a rare earths pedigree and know-how few Western companies can match.

Neo sells the output of the separation process both externally and internally. For the internal part, it is used for magnets but also to make catalysts for emissions control and more recently water treatment products as well (the two latter being included in the Chemical & Oxides results). While not material at this time, Neo is doing R&D work to add more application areas with fire retardant and anti-viral use cases being namechecked by the company recently (see for instance slide 23 in the current investor presentation).

For 2023 year to date, the Chemicals & Oxides division has produced $180 million in revenue and $6 million in adjusted EBITDA. That compares to $189 million in revenue and $26 million in adjusted EBITDA for the same period in 2022. That huge drop illustrates a long-standing problem of the C&O division having volatile financial results. While Neo in theory has pass-through pricing and so should make the same margins regardless of rare earth prices, the separation process takes significant time which causes a lead-lag effect. When rare earth prices go up, the separation business will show increasing margins as it works through inputs acquired at lower prices; when prices go down, the process reverses. Neo provides a detailed breakdown of the mechanics in the section "Initiatives to Protect Margins Against Movements in Rare Earth Pricing" in their latest financial filings.

As rare earth prices went through a large boom during the pandemic and then a subsequent and ongoing bust, this has led to Neo presenting volatile results in recent years. Prices are now showing signs of stabilizing, which should help Neo present more stable results in coming quarters. Q3 was the first quarter in about a year with rare earth prices staying roughly stable quarter over quarter. The result was quarterly adjusted EBITDA of $7 million for Q3 for C&O, meaning all the divisional adjusted EBITDA for 2023 was generated in the quarter. Assuming rare earth prices stay relatively stable that is probably about the level I'd expect the C&O division to deliver going forward. Even if rare earths are a volatile market, recent years have been outside the norm. However, if the current prolonged slump in rare earth prices were to reverse into a mini-boom, I believe it would give a near-term boost to Neo's results due to the lead-lag effect.

Finally, a rare earth separator obviously needs raw materials to separate, so access to feedstock has historically been one of Neo's primary concerns, especially given China's near monopoly on rare earth mining. To ensure future feedstock, Neo has been putting offtake agreements in place with a large number of potential new non-Chinese mines and also has a JV in Greenland for a promising rare earths deposit there.

Historically this would have been the critical concern for Neo, but it is perhaps less so going forward. Neo's future growth is not going to come from rare earth separation but from magnets. I view that as a good thing as less exposure to the politics and problems of rare earths mining will make for a better investment case. The Western rare earths mining sector over the past decade-plus has not been a pleasant experience for most investors. Focusing more on the upstream parts of its business might also reduce Neo's lead-lag problem as more revenue will come from parts of the business where the phenomenon is less pronounced.

Magnequench

That brings us to Neo's magnet business, which goes by Magnequench. In rare earth magnets, that's not a random name: Magnequench, originally a General Motors division, literally was the company that commercialized neodymium magnets back in the 1980s. Through many twists and turns, it has ended up in the hands of Neo and with it an enormous amount of technical knowledge. Neo employs 100+ scientists, mainly in Singapore, and does a great deal of custom magnet development for some very blue-chip names (e.g. Honda (HMC)). This accumulated know-how should provide Neo some moat, even if I don't think it's an impenetrable one.

Custom magnet development for Honda (Neo investor presentation)

What Magnequench produces is mainly magnetic powders that others then use to manufacture magnets. In 2019 the company started to move upstream into actual magnet manufacturing by acquiring a Chinese manufacturer of bonded magnets (mainly used in smaller motors of various kinds). To this was added a small UK magnet manufacturer in 2023.

What Neo does not currently make is sintered magnets, which is by volume far the biggest market. For some background on sintered versus bonded magnets, see here, but simplifying sintered magnets offers more performance at the cost of a less flexible and more difficult production process. For EV vehicles, the performance and efficiency benefits of sintered magnets are critical.

I'll come back to sintered magnets, but first a look at the financial performance of the current Magnequench business. For 2023 to date, the Magnequench division has produced $159 million in revenue and $15 million in adjusted EBITDA. That compares to $220 million in revenue and $35 million in adjusted EBITDA for the same period in 2022. The drop is explained partly by our friend the lead-lag effect (albeit it has less impact for Magnequench) and partly by industry-wide destocking throughout the magnet supply chain in 2023. Neo management seems cautious about when the destocking will cease, but I would expect Magnequench to be back to $25+ million adjusted EBITDA in 2024 if the wider economy holds up, given the slight improvement seen in Q3 results.

The main historic use case for rare earth magnets was hard disk drive motors - this was Magnequench's dominant revenue source for many years. That steadily declining revenue stream has been masking Magnequench's growth in other areas in recent years, but this should hopefully start to moderate soon and Magnequench will get back to showing results that justify talking about it as a growth story. The Magnequench division is less dependent on the C&O division for inputs than one would suspect, getting about 90% from other sources (why Neo doesn't source more internally is a good question I don't know the answer to).

Rare Metals division

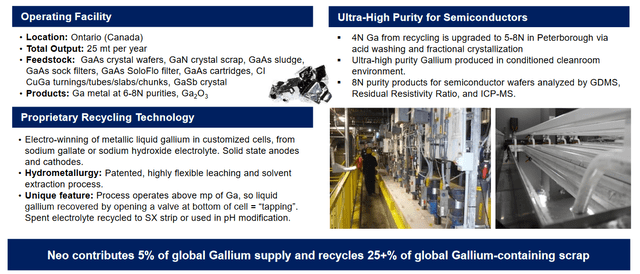

I won't dwell long on it, but Neo also has a rare metals division which is primarily focused on recycling hafnium and gallium. These niche metals play important roles in some critical industries, e.g. gallium is used extensively in semiconductors. Gallium is especially relevant at the moment, as China has recently imposed export restrictions on it. That leaves Neo in a good position as one of the world's largest recyclers (and so source) for it. By Neo's account, they recycle 25+% of all gallium scrap.

Overview of Neo's gallium operations (Neo investor presentation)

For 2023 to date, the Rare Metals division has produced $105 million in revenue and $26 million in adjusted EBITDA. That compares to $86 million in revenue and $15 million in adjusted EBITDA for the same period in 2022. Predicting how the Rare Metals division will perform in coming years is tricky: it operates in niche metals where political decisions can cause sudden changes in prices as witnessed by gallium.

As such, earnings will be volatile, but the division has a track record of positive EBITDA and I expect that to continue (with the occasional "jackpot" when supply worries cause a metal to spike in price as happened for hafnium in the first half of 2023). The division also offers diversification of Neo's revenue streams, but the synergies with the rest of the company appear limited and I wonder whether Neo might divest it to focus solely on magnets.

The sintered magnet opportunity

Neo's current business should be able to grow in its own right, as there doesn't seem to be any reason to believe there will be a fundamental drop in demand for its current products. The world will continue to need lots of small motors and those motors will continue to need the efficiency and weight advantages rare earth magnets bring. The same can be said for most of the other end markets Neo sells into.

However, the real upside comes from the sintered magnets critical to EV engines. In short, if anything like the expected EV growth materializes, an awful lot of sintered rare earth magnets will be needed. China dominates the market now, but for both political and supply chain reasons, EV manufacturers are going to want a Western supply source (or multiple, given the auto industry's preference for having more than one supply source for critical inputs).

Neo fits the bill for that role: it has as good a pedigree in rare earth magnets as any Western company and it already is an established supplier to many auto companies, it "just" needs to move from manufacturing bonded magnets to sintered magnets.

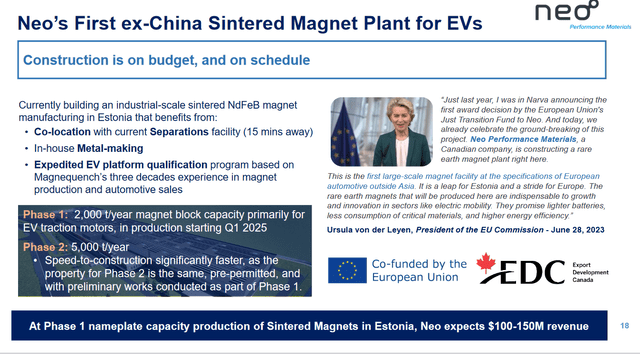

Neo has already taken the first step with a sintered magnets plant in Estonia with groundbreaking taking place in Q3. The EU has put up €20 million in a grant, leaving Neo to cover €80 million themselves, with the head of the European Commission giving a speech at the groundbreaking ceremony (see link above) to prove Neo's status as a "for real" player in sintered magnets. Initial capacity will be 2000 tons per year, but Neo management seems convinced they'll expand that to 5000 t/year in short order. To quote from their press release announcing the Estonia plant:

Neo has been in advanced commercial discussions for several years with multiple magnet customers in Europe, and those discussions indicate a level of demand for sintered rare earth magnets that far exceeds Neo's planned Phase 1 production capacity.

That plant will be up and running in 2025, though material revenue will likely not be until 2026. Management has indicated phase 1 alone will produce $100-150 million in annual run rate revenue with an EBITDA margin of ~15% (based on comments in the Q3 earnings call) so around $20 million in annual EBITDA. The expansion to 5000 t/year, which should come at lower incremental capex, will more than double that, putting annual EBITDA in the vicinity of $50 million.

Neo's new Estonian magnet factory (Neo Performance Materials)

Neo has also dropped some heavy hints that they'll soon be announcing a similar factory in the US, likely accompanied by government subsidies similar to the EU one. Examples of such hints include their investor presentation (see slide 37) or even more explicitly their recent Q3 earnings call with the CEO Rahim Suleman stating: "I also think that we will announce North America within a reasonable short order as well." One can then start doubling the EU EBITDA numbers and add even more on top to account for future expected growth in the EV market.

I do not want to get too far ahead of myself with such speculation - Neo's investor presentation does offer some examples of how large the numbers can get - except to say that if Neo successfully moves into sintered magnets and margins meet their expectations, then the resulting EBITDA will make the current market cap of $220 million look puny.

For the margins coming true, I'm not so worried - Neo is not new to the magnet business and knows both the buyers and the competitors - but the needed capex does concern me. Neo will have to invest literally hundreds of millions in manufacturing facilities to make sintered magnets happen. For a small company like Neo that will mean either taking on significant debt or finding other sources.

For the Estonia facility phase 1, Neo has enough cash on hand to see it through, but it will need to find money for what comes after as cash flow from operations seems unlikely to be enough. My personal assumption is Neo will use joint ventures to bridge the gap - Neo has the brains (know-how), and outside investors can bring the brawn (money) - but that is speculation on my part. There is a risk companies with more capital could outspend Neo and take control of the market.

It is important to stress that other companies are also pursuing the sintered magnets market with GKN (OTCPK:DWLAF), Vakuumschmelze and the vertically integrated MP Materials (MP) all having announced manufacturing plants of their own. Investing in Neo requires believing they can carve out their own share of the market next to these larger companies.

Why not invest in one of the competitors? Vakuumschmelze is not a public company, but GKN and MP Materials are. In many ways, MP is a similar proposition to Neo, just larger: A large cash position, a share price that has dropped massively in 2022 and 2023, and a future that is in large part tied to producing sintered magnets for EVs. I find the potential upside in Neo higher, but I also know Neo better as a company. I first invested in Neo well over a decade ago (in a previous incarnation) and have kept an eye on it since. One could also look to Japanese and Chinese companies, of which there are many in this space, but those are not markets I'm comfortable navigating. I also believe the US and EU governments will ensure the supply chain for EVs does not end up solely in the hands of Asian companies. Without the current political focus on reshoring supply chains, I would be more skeptical about Neo's prospects.

There is a risk that magnet manufacturers will overestimate demand and build too much capacity. While continued EV growth would cure such a problem eventually, a prolonged period of supply overhang could prove fatal for a small company. Neo burning through its balance sheet in pursuit of what ends up being an oversupplied and unprofitable market is my nightmare scenario for the stock.

I trust Neo's management to understand the magnet and auto industries well enough to navigate such supply/demand dynamics, with both the CEO and other executives having backgrounds in the auto industry, but faith in the EV story is a requirement. If you think EV demand will turn out less robust than commonly expected, Neo is to be avoided. The transition to EVs will be a bumpy road at best and Neo's share price will suffer the bumps alongside everyone else.

Valuation

Valuing Neo is hard. It's a complex company, recent results have been volatile and there are still many open questions about its future. My approach is to split the valuation into two, the Neo of today and the Neo of the future, and try to make sure there is room for error.

For the Neo of today, we have what I expect will be around $45-50 million in adjusted EBITDA for 2023 combined with $113 million in cash and only $25 million in debt. EBITDA is likely to somewhat improve in 2024 if rare earth prices stay stable and magnet supply chain destocking finally runs its course. Outside major growth initiatives like sintered magnets and an ongoing facility expansion in China, Neo's base business does not require huge amounts of sustaining capex - ~$10-15 million annually based on recent years - and interest expense is currently minimal. In other words, Neo's EBITDA should convert into enough cash flow to cover the dividend and then some. Management is also taking steps to improve working capital management which should free up cash as well (on the Q3 earnings call Neo's CEO went into some detail on these steps).

Even being conservative, I would say Neo's current business more than covers today's market cap of ~$220 million with room for error. Neo has gone through significant headwinds in 2022 and 2023 without showing signs of turning into a fundamentally unviable business, yet given the working capital, Neo is valued as if its business is value-destroying. While I have only cited numbers from 2022 and 2023 above, in 2021 Neo generated $81 million in adjusted EBITDA and $21 million in a badly Covid-impacted 2020. There is a real business here.

That leaves the value of future Neo. Trying to predict exactly how Neo's future cash flows will look if they succeed in sintered magnets is a fool's errand given the many unknowns. To get a rough idea, I did a very crude DCF calculation assuming the following for Neo's sintered magnets business: No cash flow in 2024 and 2025, then a 6-year ramp up from $5 million in 2026 to $30 million in 2031, and I then let the model stay at that rate until letting it end in 2040. Using a discount rate of 9%, that gives a net present value of around $145 million. Now, I don't believe that is close to what it would look like if Neo were to be successful in sintered magnets or that it captures all the factors and risks involved. It does, however, illustrate one does not have to use aggressive assumptions to easily arrive at a value in the 9-digit range.

As such, for now, I'm putting a value of $100 million on "future Neo". Combined with "current Neo" being valued at the current market cap, that gives me a target market cap of ~$320 million. That translates into a target share price of CAD $10 (not US dollars!), which is still well below the Q3 book value per share of CAD $13.82. Neo's historic median price-to-book value is 0.88 which aligns relatively well with my target price (0.88 * 13.82 = 12.16).

Valuing Neo based on measures like EV/EBITDA or PE ratio is somewhat hard due to the havoc the lead-lag effect has played with the results in the past couple of years making it hard to tell what its earnings potential is in "normal" times. For "good" years like 2021 and 2022, EPS came in at CAD $0.61 and CAD $0.91 respectively which at current share prices results in PE ratios of ~11.4 and ~7.6 respectively. For the first nine quarters of 2023, however, EPS stands at minus CAD $0.16 after the first nine months as the continuously dropping rare earth prices have caused the lead-lag effect to be a continual drag on earnings.

I think valuing Neo based on 2023 numbers would be a mistake as stabilizing rare earth prices and magnet supply chain destocking eventually ending should allow the company to produce numbers closer to what it delivered in 2021 and 2022. I am confident Neo will deliver such a recovery but the timing is hard to predict. Neo's historic median PE ratio is 14.59. Assuming Neo can get back to "just" its 2021 EPS of CAD $0.61, which is below analyst estimates for 2024, you would get a target share price of ~CAD $9 (0.61 * 14.59 = 8.96).

The analysts covering Neo currently have price targets between CAD $9 and CAD $13. Neo management also seems to consider the stock attractive at the current price and has been buying in the open market. As mentioned previously, Neo has also spent $17 million on share buybacks in 2023 further indicating management sees the stock as being undervalued.

Risks

Beyond the risks already discussed, there is no way to deny Neo has large exposure to China. That's unavoidable for any company in the rare earth space and it does mean Neo can get caught up in hard-to-predict geopolitical games. While their future growth will largely be outside China, Neo's current revenue is still in large part from there (29% in the last twelve months as per the pie chart in the introduction section). The revenue share of 29% probably understates China's importance to Neo, considering many of their inputs will be from China.

Any material revenue from sintered magnets won't come until 2026-27. The factories will take time to build and qualification of new suppliers in the auto business is anything but an instant process. The market may well decide not to pay attention until revenue actually arrives even if everything goes according to plan. Neo's current business and dividend should help in the meantime but patience may end up being required.

Finally, the relentless drop in Neo's share price in the last two years needs addressing. I believe the drop is due to a number of factors: fears about Neo's China exposure, the lead-lag effect having made results in the second half of 2022 and the first half of 2023 look poor, destocking throughout the magnet supply chain in 2023, lack of details about future investment plans and more recently muted sentiments about EVs as an industry and the economy as a whole.

I believe most of those are temporary and will reverse, especially if Neo's new-ish CEO (and former CFO) delivers on his promise to communicate the Neo story better. That is something the company has historically done a poor job of to the point the company highlights it in its investor presentation as an area of improvement:

Example of Neo promising better communication (Neo investor presentation)

Conclusion

To sum up, I view Neo as not being given enough credit for either its current business or its future potential, and have set a target price of CAD $10 that I think is a fairer assessment of Neo's value. Crucially, I think there's a good deal more upside than this initial target price, but I want to see more evidence of Neo's move into sintered magnets playing out. This should also help make clearer when and how much the company can actually make from it making it compared to the speculative assumptions that are currently required.

I also want to see the company demonstrate its "normalized" earnings power during 2024 in what will hopefully be a period of more stable rare earth prices and destocking in the magnet supply chain starting to end. This should persuade the market to give the current business a better valuation.

Given what I see as a limited downside in the near term, I've established a moderate position and will evaluate both the price target and whether to add more as news comes in throughout 2024. My primary reasons to exit would be either current operations showing signs of fundamental decline or the capex for the move into sintered magnets requiring Neo to take on unsustainable levels of debt. A cut in the dividend would be a strong warning sign that management is worried about the health of the business.

A broad economic downturn would be a risk, as a small-cap stock like Neo would get punished if the world economy slides into recession, but the company has a balance sheet strong enough to be able to weather a period of weakness.