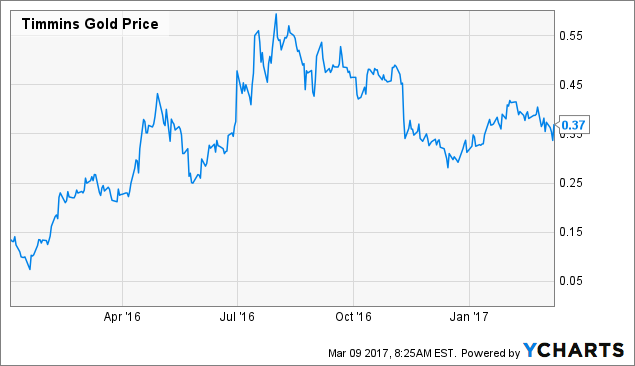

Timmins Gold (NYSEMKT:TGD) is a Canadian gold producer with a very interesting history. In late 2015, the company was on the brink of bankruptcy as the gold price attacked the $1,100/toz level and the only operating mine of Timmins Gold was not profitable. Moreover, an impairment charge worth $228 million pushed its 2015 loss to the $0.77 per share level. As of December 31, 2015, Timmins Gold held cash & cash equivalents of only $9 million and current assets worth $32 million, while the current liabilities climbed to $46 million. It seemed like the end was near.

But in early 2016, the gold price started to grow. Timmins Gold was able to fine-tune the operations at the San Francisco mine, which resulted into a significant decline of production costs. The positive cash flow and sale of the Caballo Blanco gold project helped Timmins to get rid of its debts. Timmins also managed to extend the life of the San Francisco mine, and it used the increased share price to boost its cash position via an equity financing.

TGD data by YCharts

Timmins Gold recorded EPS of $0.1 in 2016. As of December 31, it held cash & cash equivalents worth $34 million, its current assets were valued at $57 million, while the current liabilities represented only $19 million. The company is debt-free and it is in a much better shape than one year ago. Moreover, it can more than double the gold production by 2019, thanks to the Ana Paula gold project that is being developed. Ana Paula should replace the San Francisco mine that is expected to be closed by 2023, unless the gold price grows above $1,350. The Ana Paula mine should produce much more gold than San Francisco at a much lower AISC. Given the fundamentals, Timmins Gold is significantly undervalued at the current market capitalisation of only $120 million.

The San Francisco Mine

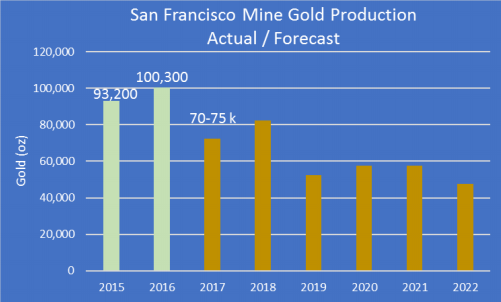

The San Francisco mine is located in north-western Mexico, in the state of Sonora. It is 100% owned by Timmins Gold. It produced 100,300 toz gold at an AISC of approximately $800/toz in 2016. The problem of the San Francisco mine is that it is expected to experience a notable production decline and AISC growth in the coming years. In 2017, 70,000-75,000 toz gold at an AISC of approximately $1,000 should be produced. In 2018, 80,000 toz gold should be produced, while between 2019 and 2022, the production should range between 50,000 and 60,000 toz gold per year.

Source: Timmins Gold

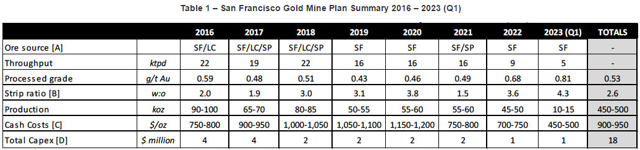

Due to the declining production volumes, the production costs should increase. The cash costs should grow from $900-950/toz in 2017 to $1,000-1,100 in 2018 and 2019 and to $1,150-1,200 in 2020. Although the management indicated that some cost reduction measures should be applied, it is hard to expect that it will be able to push the cash costs below $1,000 and AISC below $1,100. If the current gold price prevails, the San Francisco mine will be hardly profitable. On the other hand, at gold price above $1,350, the situation can change quite rapidly.

Source: Timmins Gold

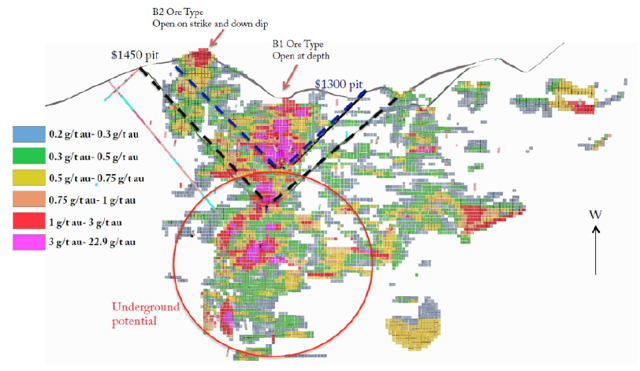

The reserves are based on gold price of $1,250/toz. They contain 574,000 toz gold. But the resources that contain 1.029 million toz gold are based on gold price of $1,350/toz. If gold price grows above the $1,350/toz level, Timmins will re-evaluate its mine plan. As a result, not only the life of mine should be expanded, but also the production volumes should grow and the production costs should decline. However, reaching numbers similar to 2016 is not probable. Simply said, the San Francisco mine is past its best years. The future of Timmins Gold is Ana Paula.

The Ana Paula Project

The Ana Paula project is located in Southern Mexico in the state of Guerrero. It is 100% owned by Timmins Gold that acquired it in 2015 by buying Newstrike Capital for C$140 million. The deposit contains measured and indicated resources of 1.859 million toz gold at a gold grade of 1.41 g/t and 7.076 million toz silver at a silver grade of 5.37 g/t. The updated PEA is based only on 1.28 million toz gold, which leads to a gold grade of 2.24 g/t. According to the PEA, the mine should produce 116,000 toz gold over an initial mine life of eight years.

Although the Ana Paula should produce only 116,000 toz gold per year on average, the project is very interesting due to its economics. It should produce gold at an AISC of only $479/toz. Also, the estimated CAPEX is very attractive. In late 2015, Timmins Gold acquired the closed El Sauzal mine from Goldcorp (NYSE:GG) for $8 million. The entire processing plant and facilities should be relocated to Ana Paula, which should not only cut the CAPEX by almost $42 million but also shorten the construction time by several months. As a result, the expected CAPEX is only $121.7 million, including a contingency of $19.8 million. Thanks to the low AISC and CAPEX, the after-tax NPV (5%) is estimated at $248 million and the after-tax IRR is estimated at 43%, using a gold price of $1,200.

What is important there is a high probability that the pre-feasibility study that should be completed by Q2 and the feasibility study that should be completed by Q1 2018 will provide even better numbers. According to the recent news release, further metallurgical tests showed gold recoveries in the 80-85% range, which is notably higher compared to the recoveries of 75% used in the PEA. At recoveries of 82.5%, the average annual production should increase to almost 128,000 toz gold while the AISC could decline to $435/toz (assuming that the changes in the flow-sheet don't increase the cash costs).

There is also a good probability that the mine life will be expanded. There is a high-grade mineralisation below the projected open pit. Timmins Gold assumes that there is some potential for an underground mining operation that could be able to extract it.

Source: Timmins Gold

Why Timmins Gold is so Cheap

The market value of Timmins Gold is $125 million. The company holds cash & cash equivalents worth $34 million and it has no debt, which means that the current enterprise value stands at $91 million. At the current gold price, the NPV of Ana Paula alone is almost $250 million. Not to mention the producing San Francisco mine with resources of over 1 million toz gold, the exploration potential in the Ana Paula region and the TIM claims and San Onesimo.

There are several factors that hold the share price down. Although Ana Paula provides exciting economics, it is still only in the PEA stage. The investors need the PFS and FS to be completed in order to be more confident in the data. This problem should be solved relatively soon as the PFS is expected in Q2 and the FS is expected in Q1 2018. If the results are as good as expected, a notable share price growth should follow. Another problem is the location of Ana Paula. The Guerrero state is one of the less safe parts of Mexico, which unnerves some of the potential investors. On the other hand, some other gold miners operate in close proximity to Ana Paula without any major security problems. But, probably, the main obstacle is the Ana Paula mine construction financing and the fear of a share dilution.

Timmins Gold should need around $120 million to build the Ana Paula mine. As of the end of 2016, it held only $34 million, which is obviously not enough. At the current gold price, the San Francisco mine should generate $15-20 million, at best, in 2017 and even less in 2018. The Ana Paula pre-construction expenditures are expected at $9.2 million. It means that the cash flow generated by San Francisco could be enough to cover various expenses of Timmins Gold before the Ana Paula mine construction begins, i.e., it is able to assume that Timmins Gold will have $30 million of own capital to finance Ana Paula. The remaining $90 million must be obtained elsewhere.

The worst-case scenario is an equity financing worth $90 million. At the current share price of $0.35, almost 260 million of new shares would be issued. Given that there are 384 million shares fully diluted right now, the current shareholders would be diluted by nearly 70%. However, this scenario is highly improbable.

Given the economics of Ana Paula, Timmins Gold should have no problem to secure a debt financing. It is also quite possible that the company will be able to secure a loan worth $90 million, or a loan that approaches this value. In this case, no share dilution or only a very limited share dilution would be needed. There are several examples of companies that were able to finance a better part of the initial CAPEX via a debt in recent years.

For example, in March of 2015, Red Eagle Mining (OTCQX:RDEMF) secured a credit facility worth $60 million to finance the San Ramon mine construction. Back then, the gold price was approximately at the current level. On the other hand, the mining sector was in the middle of a huge bear market and the overall sentiment was not good. Moreover, the San Ramon mine is located in Colombia in a region that has a reputation comparable to the Guerrero state. But it didn't prevent Orion Mine Finance from financing more than 80% of the projected initial CAPEX. Just for comparison, the San Ramon mine had an estimated average annual production of 48,500 toz gold at an AISC of $758/toz. At a gold price of $1,300, the after-tax NPV (5%) was only $108 million.

In December 2016, Hummingbird Resources (OTCPK:HUMRF) secured a $45 million senior secured term facility and a $10 million cost over-run facility, provided by Taurus Funds Management. The money should be used to finance the construction of the Yanfolila gold mine located in Mali. The mine construction should cost $79 million, which means that the debt facilities cover almost 70% of CAPEX. The San Ramon mine and Yanfolila are hardly comparable to Ana Paula. Yanfolila should produce 107,000 toz gold per year over an initial mine life of seven years but the AISC is expected at $695/toz. Using a gold price of $1,250/toz, the resulting after-tax NPV (8%) is $162 million.

In both of the abovementioned cases, a loan covering more than two-third of the projected CAPEX of a project located in a less safe jurisdiction was provided to a small company with some debt on its balance sheet and without a producing asset. Timmins Gold has the producing San Francisco mine that should be able to generate positive cash flow, has experiences with operating a mine, has no debt and over $30 million in cash & cash equivalents. What is more important, Ana Paula is superior to San Ramon, as well as to Yanfolila. This is why I believe that Timmins Gold should have no problem to finance $90 million or 75% of the projected CAPE via a debt.

The Upside Potential

The Ana Paula mine should produce 116,000 toz gold per year at an AISC of $479/toz. At a gold price of $1,200/toz, it should be able to generate cash flow of $83.64 million. Assuming that the company will be able to secure a loan worth $90 million at an interest rate of 10% p.a., the annual interest payments should equal $9 million. At the Mexican corporate tax rate of 30%, Ana Paula should generate earnings of more than $50 million. There are 384 million shares fully diluted. Assuming that Timmins Gold is able to secure the debt financing worth $90 million, no more shares should be issued. But to make the calculations more conservative, let's assume that there will be 400 million shares outstanding, which leads to an EPS of $0.125. At a conservative P/E ratio of 10, Timmins Gold's share price should climb to $1.25. It means a 260% upside to the current share price, based on the Ana Paula mine alone. But at the current gold price, the San Francisco mine should be unprofitable or only slightly profitable in 2019, when the Ana Paula mine should start production. In this case, it is reasonable to expect that the stock market will attribute only little value to this asset.

Right now, the market doesn't reflect the potential of Ana Paula. This should start to change in the coming months as the PFS is expected in Q2 and FS is expected in Q1 2018. If everything goes well, the permitting should be finished by Q4 2017 and the financing package should be completed sometime in 1H 2018. The gold production should start by the end of 2019. As the whole gold mining sector is under pressure right now, it is quite possible that Timmins Gold's share price hasn't reached the bottom yet. But for investors with an investment horizon of 2-3 years, now is the right time to buy shares of Timmins Gold.

Conclusion

At the current gold price, Timmins Gold has the upside potential of more than 260%. This number is based on the Ana Paula project alone; it attributes no value to the San Francisco mine or to the other assets owned by the company. Moreover, there is a good probability the pre-feasibility and feasibility studies will lead to further improvements of the Ana Paula economics. Timmins Gold holds cash & cash equivalents of more than $30 million and as the examples of other companies show, the probability that it will be able to finance the remaining CAPEX of $90 million via a debt is high. The rest of 2017 should be full of catalysts that will push Timmins Gold's share price higher. If everything goes well, the construction of the Ana Paula mine will start in the middle of 2018 with first gold production in late 2019. By that time, the share price should approach the $1.25 level if the current gold price prevails.

This article is part of Seeking Alpha PRO. PRO members receive exclusive access to Seeking Alpha's best ideas and professional tools to fully leverage the platform.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in TGD over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.