Global Atomic

increased their resource size and mine life in --------> PFS.

Wait for PFS - trend ?

50% mineral resource increase

doubled the mine life

- On March 5, 2024, the Company published its Dasa Project 2024 Feasibility Study ("FS") as an update to its 2021 Phase 1 Feasibility Study which confirmed an extension of the Mine Plan from 12 years to 23.75 years (2026-2049), a 50% increase in Mineral Reserves to 73 million pounds U3O8 and an increase in total production by 55% to 68.1 million pounds U3O8.

- Using an average uranium price of US$75/lb U3O8, the FS shows an after-tax NPV8 of US$917 million, an after-tax IRR of 57% and a payback period of 2.2 years.

https://www.newswire.ca/news-releases/global-atomic-announces-q1-2024-results-892806662.html

Global was once trading above $3 dollars.

Hardrock ug mine.

Will Global have smooth sailing mining under ground ?

1200 tpd ?

Global also has stake in,

Turkish Zinc Joint Venture

- In Q1 2024, the Turkish JV processed 19,990 tonnes EAFD.

- Zinc contained in concentrate shipments totalled 9.3 million pounds and the average monthly LME zinc price was US$1.11/lb.

- The Company's share of the Turkish JV EBITDA was a gain of $0.7 million in Q1 2024 (a loss of $0.4 million in Q1 2023).

- The cash balance of the Turkish JV was US$2.3 million at the end of Q1 2024.

https://www.newswire.ca/news-releases/global-atomic-announces-q1-2024-results-892806662.html

9.3 million pounds = 4227 tonnes ( concentrate )

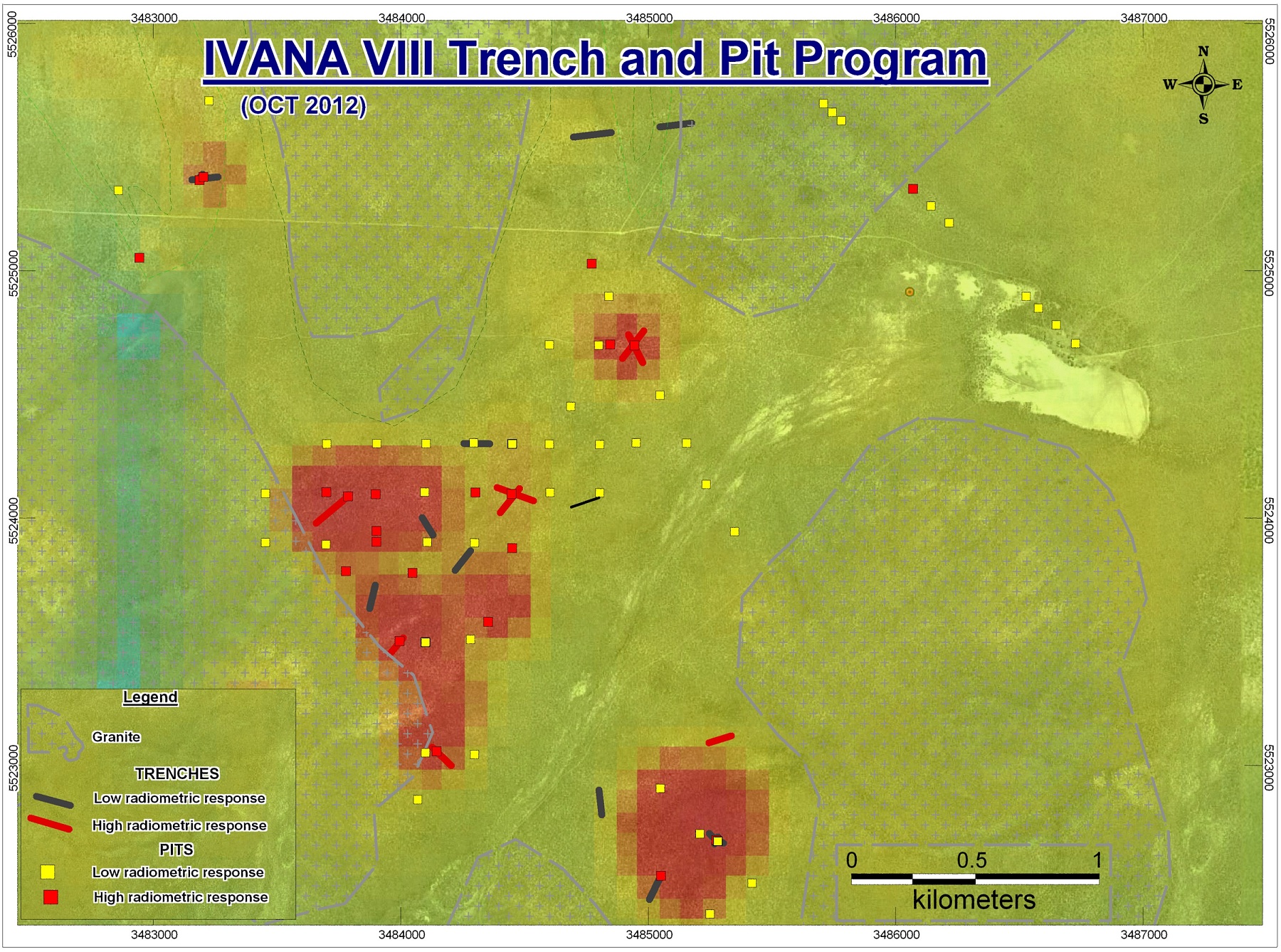

IVANA IVANA is all at surface to 30m

If bsk factored hardrock tonnage and grades - what would a PFS look like ?

Do the

salars have green highgrade silt sludge ?

Maria stepout 1.5 km away from Ivana, no not surficial values rather Maria's hardrock

has good grades.... even the radiometrics show high reading in this zonation.

Whit rectangle patch = Ivana's right shoulder

Red zones Maria's high radiometric readings

Aqua green border constraints = Granites

Zoom in to Picos Salar ( Laguna )

Comb the border shoilders

Scan upper Picos watershed

Notice the purple staining from purple rock

Mega loose purple rock on east hills all the way up to bluffs

Same going north into gut

MAP

https://www.google.com/maps/place/Valcheta,+R%C3%ADo+Negro+Province,+Argentina/@-40.2844451,-66.2561079,72m/data=!3m1!1e3!4m6!3m5!1s0x95fc6173783a1147:0x4998fb061bb27d63!8m2!3d-40.6804699!4d-66.1628028!16s%2Fm%2F0bwm65b!5m1!1e1?hl=en&entry=ttu&g_ep=EgoyMDI0MTEwNi4wIKXMDSoASAFQAw%3D%3D Global Atomic's deposit is in Niger Africa Jun 21, 2024 — Niger's military government has revoked a French fuel producer's permit to operate at one of the world's biggest uranium mines, the company say Niger Government Approves N50 Million Relief Funds For Victims Of Mine Pit Collapse. 238 views 1 month ago Jul 5, 2024 — The government of Niger holds a 20% stake in COMIMA SA, the Nigerien company set up to develop the Madaouela project. GoviEx said it continues ? Global Atomic Corp., due to significant investor demand, has entered into an amended and restated underwriting agreement with Red Cloud Securities Inc., as lead underwriter and sole bookrunner, and Canaccord Genuity Corp. to increase the size of its previously announced public offering. Under the revised offering, the company will sell to the underwriters for resale 29,167,000 units of the company at a price of $1.20 per unit for aggregate gross proceeds of $35,000,400. https://www.stockwatch.com/News/Item/Z-C!GLO-3606892/C/GLO

Red Cloud Securities maintains a buy rating for Global Atomic

$5.70 share

https://pbs.twimg.com/media/Gbe1Z7ObAAAaCqs?format=jpg&name=medium Why are junior's waiting for PFS studies before increasing economics of uranium mines ?

Fair to investors ...? Is Africa more favored than, SA deposits ?

Bias ?

Where's the equality for sm investors ?

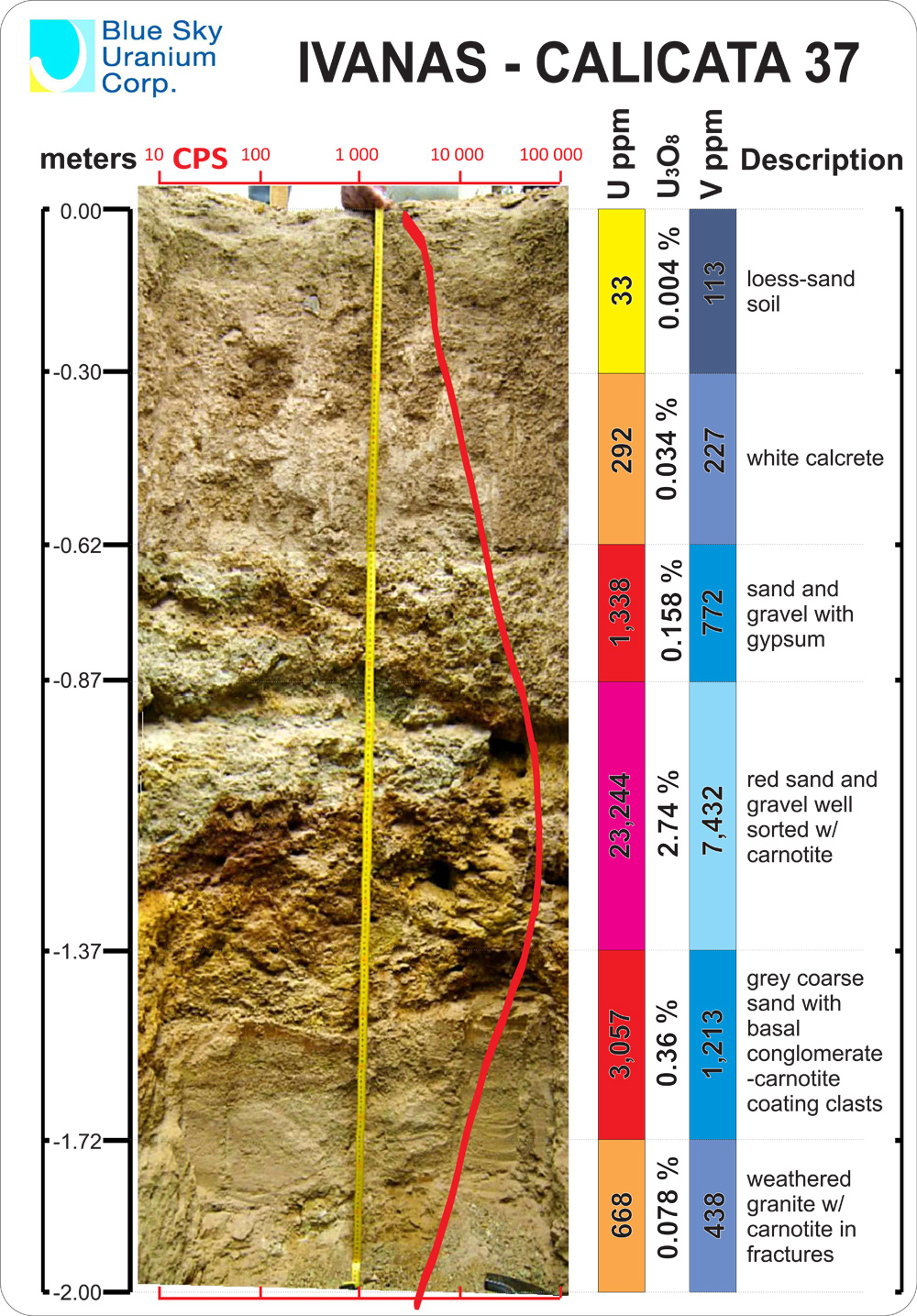

Washing and Scrubbing ores to capture under 100 micron

= About the thickness of a human hair

= Kernal of sand is much larger

If one were to mill the loose rocks and sands...and factor hard rock

What would Ivana's resource size be ?

Stock value ?