2021

December 14, 2021

BANYAN GOLD REPORTS 72.4M OF 1.73 G/T AU AT THE POWERLINE DEPOSIT, AURMAC PROPERTY, YUKON

VANCOUVER, BC, December 14, 2021 –

Banyan Gold Corp. (the "

Company" or "

Banyan") (

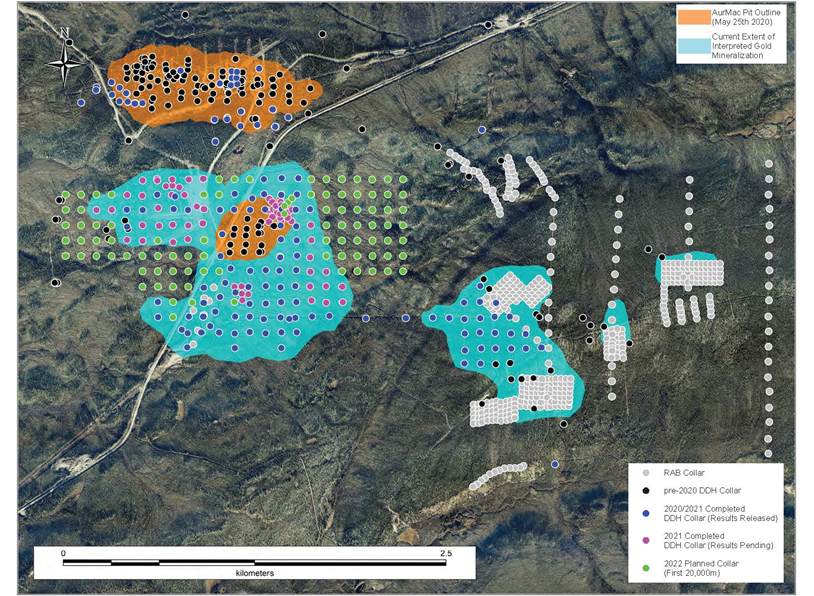

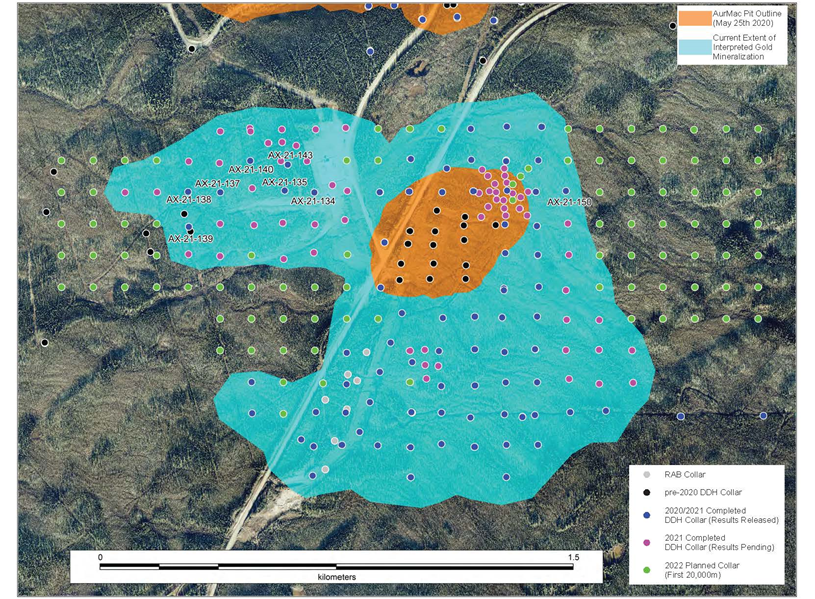

TSXV: BYN) is pleased to release assay results from eight (8) diamond drill holes of the Phase 2 exploration campaign at the rapidly developing Powerline Deposit, AurMac Property, Yukon (Table 1, Figure 1 and 2). These results continue to demonstrate that the Powerline Deposit has the potential to host near-surface gold mineralization over at least 1.2 kilometres (“km”) strike length in the east-west direction; the continuity of this growing trend remains open in both directions.

Assay highlights from this latest batch of assays received from the 2021 Powerline drilling campaign include:

- 72.9 metres (“m”) of 0.51 g/t Au from 29.0 m in DDH AX-21-134

- 57.9 m of 0.61 g/t Au from 35.1 m in DDH AX-21-135

- 118.4 m of 0.44 g/t Au from 21.3 m in DDH AX-21-137

- 72.4 m of 1.73 g/t Au from 8.2 m in DDH AX-21-139

- 58.0 m of 0.47 g/t Au from 15.2 m in DDH AX-21-141

- 41.7 m of 0.66 g/t Au from 9.1 m in DDH AX-21-150

“These latest assays continue to expand the interpreted gold mineralization footprint at Powerline with 100 m step out drill holes. The continuity of mineralization across the 2 km of strike drilled is impressive.” states Tara Christie, President and CEO

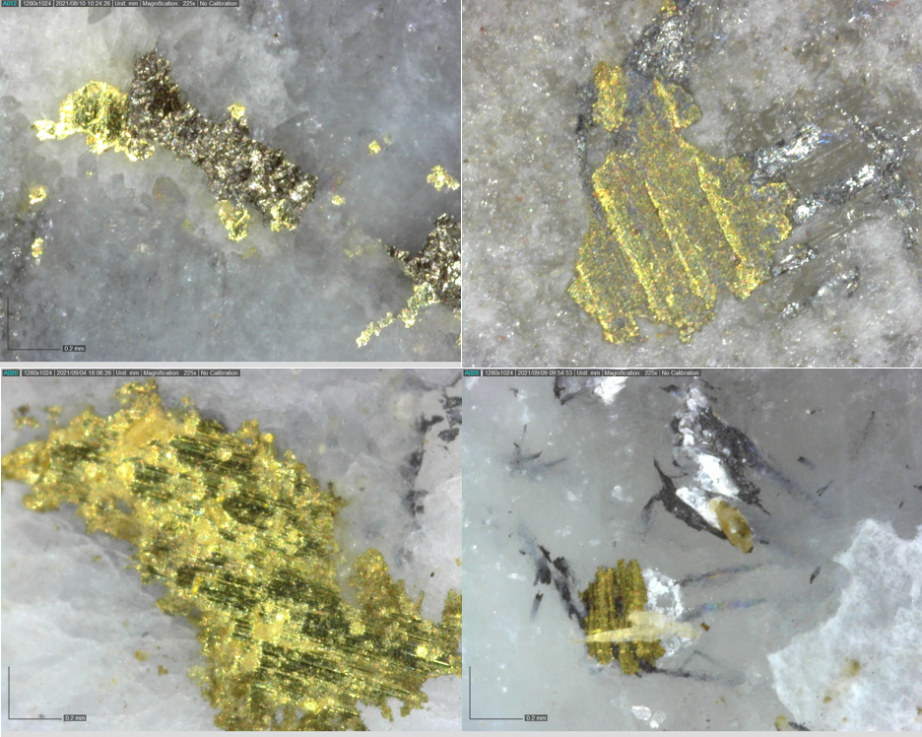

. “Field crews are beginning to wrap up after a long season having achieved our target 30,000 m of diamond drilling. Banyan will be back at drilling AurMac early in the New Year.” Results from these latest eight (8) drill holes are consistent with previous exploration drilling campaigns at Powerline deposit (Figures 1 and 2). Visible gold is commonly observed in quartz veins that are discordant to foliation (Image 1). The areal extent of this interpreted gold mineralization has expanded from

250 m by 250 m for the existing Powerline Resource, to over

2 km x 2 km; demonstrating the potential for Powerline to add measurably to the mineral resource catalogue of AurMac.

Image 1: Photographs of visible gold from: A) AX-21-137 100.3 m to 101.3 m which assayed 1.75 g/t Au over 1.0 m; B) AX-21-139 37.9 m to 39.5 m which assayed 47.2 g/t Au over 1.6 m; C) AX-21-143 103.1 m to 104.2 m which assayed 1.09 g/t Au over 1.1 m; D) AX-21-143 243.8 m to 244.8 m which assayed 1.32 g/t Au over 1.0 m.

Figure 1: Drill program at Powerline and Aurex Hill Plan Map, showing historic, completed, and planned diamond drill holes.

Figure 2: Powerline Drill Hole Locations, showing historic, completed, and 2022 planned diamond drill holes.

Table 1: 2021 Highlighted Powerline Diamond Drill Analytical Results. Maps and full assay results are available on Banyan’s

website).

| Hole ID | From (m) | To (m) | Interval* (m) | Au (g/t) |

| AX-21-134 | 29.0 | 101.9 | 72.9 | 0.51 |

| and | 138.2 | 162.0 | 23.8 | 0.23 |

| and | 212.5 | 214.1 | 1.6 | 1.78 |

| and | 234.2 | 235.7 | 1.5 | 1.74 |

| and | 250.8 | 252.2 | 1.4 | 1.38 |

| | | | | |

| AX-21-135 | 35.1 | 93.0 | 57.9 | 0.61 |

| including | 62.5 | 64.0 | 1.5 | 3.85 |

| including | 68.6 | 71.9 | 3.3 | 3.37 |

| and | 123.4 | 129.5 | 6.1 | 1.32 |

| and | 158.9 | 186.1 | 27.2 | 0.47 |

| | | | | |

| AX-21-137 | 21.3 | 139.7 | 118.4 | 0.44 |

| including | 21.3 | 24.4 | 3.1 | 5.44 |

| including | 128.6 | 131.6 | 3.0 | 2.10 |

| and | 190.8 | 200.2 | 9.4 | 1.17 |

| | | | | |

| AX-21-138 | 39.6 | 253.1 | 213.5 | 0.26 |

| or | 39.6 | 65.5 | 25.9 | 0.39 |

| Including | 73.5 | 78.5 | 5.0 | 0.61 |

| and | 137.2 | 164.6 | 27.4 | 0.57 |

| and | 212.9 | 241.4 | 28.5 | 0.21 |

| | | | | |

| AX-21-139 | 8.2 | 80.6 | 72.4 | 1.73 |

| including | 34.9 | 37.9 | 3.0 | 3.17 |

| and | 144.9 | 202.5 | 57.6 | 0.23 |

| | | | | |

| AX-21-141 | 15.2 | 73.2 | 58.0 | 0.47 |

| including | 15.2 | 16.8 | 1.6 | 3.57 |

| including | 44.2 | 45.7 | 1.5 | 2.49 |

| including | 53.3 | 54.9 | 1.6 | 2.79 |

| and | 133.6 | 136.4 | 2.8 | 1.54 |

| | | | | |

| AX-21-143 | 25.9 | 29.0 | 3.1 | 5.74 |

| and | 50.2 | 51.2 | 1.0 | 1.82 |

| and | 95.9 | 97.4 | 1.5 | 1.21 |

| and | 103.1 | 104.2 | 1.1 | 1.09 |

| and | 112.2 | 154.0 | 41.8 | 0.36 |

| and | 164.6 | 180.7 | 16.1 | 0.8 |

| and | 186.8 | 206.0 | 19.2 | 0.41 |

| and | 238.3 | 246.3 | 8.0 | 0.88 |

| | | | | |

| AX-21-150 | 9.1 | 50.8 | 41.7 | 0.66 |

| including | 13.3 | 18.8 | 5.5 | 1.61 |

| and | 63.6 | 71.6 | 8.0 | 1.43 |

| and | 125.1 | 126.4 | 1.3 | 1.21 |

| and | 142.8 | 143.3 | 0.5 | 33.5 |

| and | 168.4 | 218.5 | 50.1 | 0.24 |

* True widths are estimated to be greater than 90% of the reported intervals. Collar locations and azimuth available on website. Detailed maps with drill hole locations and spreadsheet with full drill results is available on Banyan’s

website.

2021 Drilling Program Update The AurMac drill program for 2021 has now concluded, having expanded to four (4) drills and completing 30,091 m of drilling in 135 diamond drill holes.

Diamond drilling at AurMac since the Q1 2020 maiden resource announcement is now over 40,000 m to date – which has all targeted resource expansion of the Airstrip Deposit; the Powerline Deposit and the Aurex Hill zone.

The 2022 drill season will start early in the New Year and the first 15,000 m of 30,000 m has been planned. Additional drill locations will be determined after reviewing analytical results.

Analytical Method All drill core splits reported in this news release were analysed at SGS Canada in Vancouver, BC utilising their GE_IMS21B20 analytical package which comprises a two-acid aqua regia digestion followed by a 36-element ICP-MS scan, in conjunction with the GE_FAA30V5 30g Fire Assay with AAS finish for gold on all samples. Samples with gold content exceeding the analytical thresholds of this package were reanalysed utilising an additional 30g Fire Assay Gravimetric Finish (SGS Package GO_FAG30V). All core samples were split on-site at Banyan’s core processing facilities. Once split, half samples were placed back in the core boxes with the other half of split samples sealed in poly bags with one part of a three-part sample tag inserted within. Samples were delivered by Banyan personnel or a dedicated expediter to the SGS, Whitehorse preparatory laboratory where samples are prepared and then shipped to SGS laboratory in Vancouver, BC for pulverization and final chemical analysis. A robust system of standards, ¼ core duplicates and blanks was implemented in the 2021 exploration drilling program and was monitored as chemical assay data became available.

Qualified Person Paul D. Gray, P.Geo., Vice President of Exploration for the Company, is a “qualified person” as defined under NI 43-101 and has reviewed and approved the content of this news release.

Upcoming Events - Vancouver Resource Investment Conference – January 16 & 17, 2022

- AMEBC Round-Up – January 30 to February 4, 2022

- CEM Whistler Capital Conference – February 18 to 20, 2022

- The BMO 31st Global Metals & Mining Conference – February 27 to March 2, 2022

- PDAC 2022 – March 7-9, 2022

COVID-19 Update Banyan Gold continues to take proactive measures to protect the health and safety of our Yukon communities, our contractors and our employees from COVID 19. Exploration activities will continue to have additional safety measures in place, regularly updated to follow and exceed all the recommendations of Yukon’s Chief Medical Officer.

About Banyan Banyan's primary asset AurMac is adjacent to Victoria Gold's Eagle Gold Mine, in Canada’s Yukon Territory, which announced commercial production on July 1, 2020. The AurMac initial resource of 903,945 oz Au (see Table 2 below) was announced in May 2020. Our major strategic shareholders include Alexco Resource Corp, Franklin Gold and Precious Metals Fund, Osisko Development, and Victoria Gold Corporation. Banyan is focused on gold exploration projects that have the geological potential, size of land package and proximity to infrastructure that is advantageous for a mineral project to have potential to become a mine. Our Yukon based projects both fit this model and our objective is to gain shareholder value by advancing projects in our pipeline.

The 173 sq km AurMac Property lies 30 km from Victoria Gold's Eagle Project and adjacent to Alexco's Keno Hill Silver District and is highly prospective for structurally controlled, intrusion related gold-silver mineralization. The property is located adjacent to the main Yukon highway and just off the main access road to the Victoria Gold open-pit, heap leach Eagle Gold mine. The AurMac Property benefits from a 3-phase powerline, existing Yukon Energy Corp. switching power station and cell phone coverage. Banyan has optioned the properties from Victoria Gold and Alexco respectively with a right to earn up to a 100% subject to royalties.

The 2020 Initial Mineral Resource Estimate prepared in accordance with National Instrument 43-101 (“NI 43-101”) guidelines for the AurMac Property is

903,945 ounces of gold (Table 3). It is a near surface, road accessible pit constrained Mineral Resource contained in two near/on-surface deposits: The Airstrip and Powerline deposits.

Table 3: Pit-Constrained Inferred Mineral Resources at a 0.2 g/t Au Cut-Off – AurMac Property

| Deposit | Classification | Tonnage

Tonnes | Average Au Grade

g/t | Au Content

oz |

| Airstrip | Inferred | 45,997,911 | 0.524 | 774,926 |

| Powerline | Inferred | 6,578,609 | 0.610 | 129,019 |

| Total Combined | Inferred | 52,576,520 | 0.535 | 903,945 |

Notes: - The effective date for the Mineral Resource is May 25, 2020.

- Mineral Resources which are not Mineral Reserves do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, changes in global gold markets or other relevant issues.

- The CIM definitions were followed for classification of Mineral Resources. The quantity and grade of reported inferred Mineral Resources in this estimation are uncertain in nature and there has been insufficient exploration to define these inferred Mineral Resources as an indicated Mineral Resource and it is uncertain if further exploration will result in upgrading them to an indicated or measured Mineral Resource category.

- Mineral Resources are reported at a cut-off grade of 0.2 g/t Au, using a US$/CAN$ exchange rate of 0.75 and constrained within an open pit shell optimized with the Lerchs-Grossman algorithm to constrain the Mineral Resources with the following estimated parameters: gold price of US$1,500/ounce, US$1.50/t mining cost, US$2.00/t processing cost, US$2.50/t G+A, 80% heap leach recoveries, and 45° pit slop.

- Mineral Resource Estimate prepared in accordance with 43-101 guidelines by Marc Jutras, P.Eng., M.A.Sc., Principal, Ginto Consulting Inc, with technical report filed July 7,2020.

The Hyland Gold Project, located 70 km Northeast of Watson Lake, Yukon, along the Southeast end of the Tintina Gold Belt is a sediment hosted, structurally controlled, intrusion related gold deposit, with a large land package (over 125 sq km), with the resource contained in the Main Zone area (900 m x 600 m) daylighting at surface and numerous other known surface gold targets. The Main Zone oxide zone is amenable to heap leach open pit mining, with column leach recoveries of 86%. The project has an existing gravel access road.

Table 4 shows the Hyland Main Zone Indicated Gold Resource Estimate, prepared in accordance with NI 43-101, at a 0.3 g/t gold equivalent cutoff, contains 8.6 million tonnes grading 0.85 g/t

AuEq for

236,000 AuEq ounces with an Inferred Mineral Resource of 10.8 million tonnes grading 0.83 g/t

AuEq for

288,000 AuEq ounces. NI 43-101 prepared by Robert Carne, Allan Armitage and Paul Gray on May 1, 2018.

Table 4: Hyland Main Zone Indicated Gold Resource Estimate

Cut-off Grade

(AuEq g/t) | In situ Tonnes | Au | Ag | AuEq |

| Grade (g/t) | Ozs | Grade (g/t) | Ozs | Grade (g/t) | Ozs |

| Indicated |

| 0.3 | 8,637,000 | 0.78 | 216,000 | 7.04 | 1,954,000 | 0.85 | 236,000 |

| Inferred |

| 0.3 | 10,784,000 | 0.77 | 266,000 | 5.32 | 1,845,000 | 0.83 | 288,000 |

Notes: - Mineral resources which are not mineral reserves do not have demonstrated economic viability.

- All figures are rounded to reflect the relative accuracy of the estimate.

- Mineral resources are reported at a cut-off grade of 0.3 g/t AuEq. AuEq grade is based on $1,350.00/oz Au, $17.00/oz Ag and assumes a 100% recovery. The AuEq calculation does not apply any adjustment factors for difference in metallurgical recoveries of gold and silver. This information can only be derived from definitive metallurgical testing which has yet to be completed.

Banyan trades on the TSX-Venture Exchange under the symbol “BYN”. For more information, please visit the corporate website at

www.BanyanGold.com or contact the Company.

ON BEHALF OF BANYAN GOLD CORPORATION (signed)

"Tara Christie" Tara Christie

President & CEO

For more information, please contact:

Tara Christie • 778 928 0556 •

tchristie@banyangold.com Jasmine Sangria • 604 312 5610 •

jsangria@banyangold.com ...........Bluetick