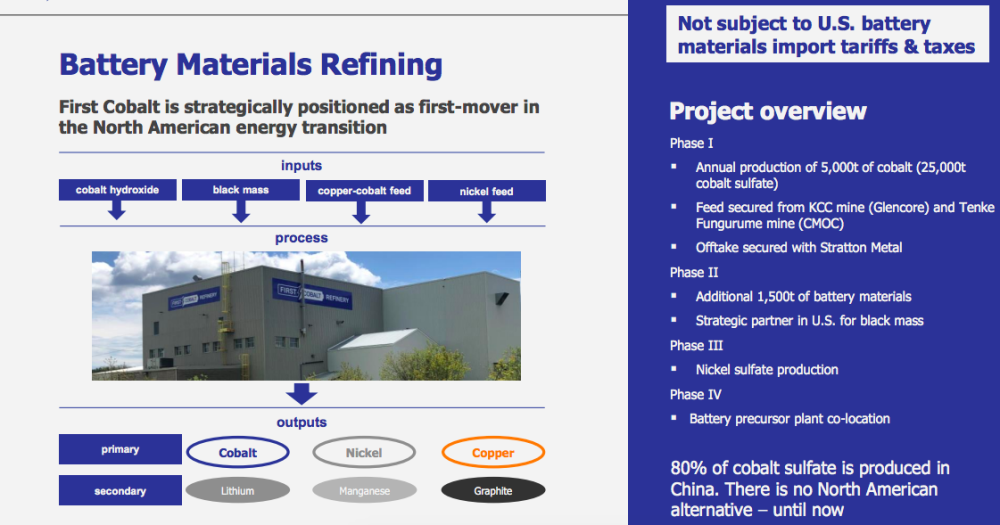

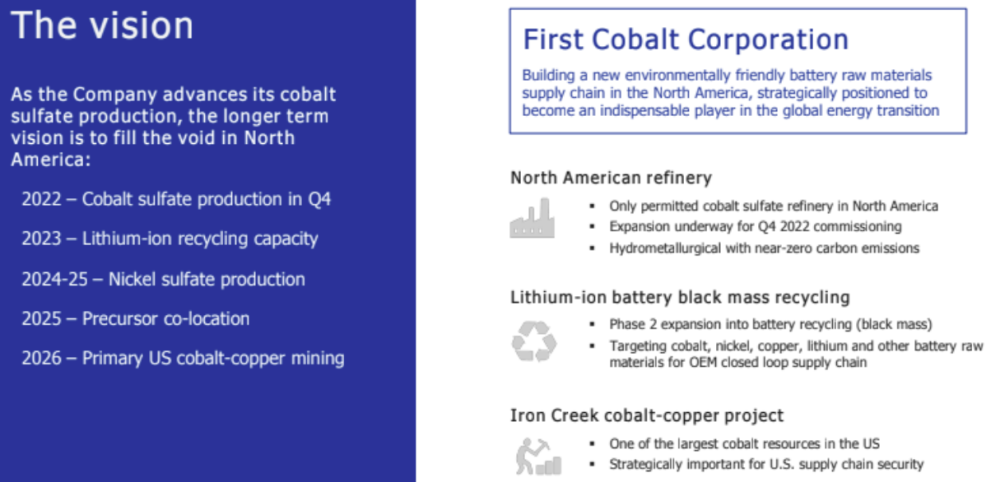

First Cobalt Corp. plans to; 1] produce cobalt (“Co”) sulfate (“CoSO4”) from late-2022, 2] recycle black mass (from end-of-life batteries) & scrap (battery materials waste from new EV production) from 2023, 3] produce Ni sulfate by 2024 or 2025, 4] entice one or more third-parties to co-locate a precursor / battery cathode plant by 2025, and 5] be a Co/Cu producer in Idaho (USA) by 2026 or 2027.

First Cobalt to Be a Significant LI-Ion Battery Materials Player in North America

In Phase 1, management is expanding, optimizing & recommissioning North America’s only permitted refinery — capable of producing clean, conflict-free, battery-quality CoSO4.

Phase 1 will be completed in late 2022, at which time the refinery will start ramping up to 25,000 tonnes per year CoSO4, making it the second largest producer outside of China. (Note: Subject to market conditions, management believes it can increase CoSO4 production by up to 30%.)

First Cobalt has achieved a major derisking milestone. For the past few months investors were anxiously awaiting news of a final US$45M funding package for the 100%-owned hydro-metallurgical refinery in northern Ontario.

That news arrived on August 23rd in the form of a US$37.5M secured convertible note, [6.95% interest rate, due 12/1/26], convertible at a 25% premium to the pricing of a concurrent equity issuance of approximately CA$9.5M. (Note: Cobalt junior Jervois Global Ltd. recently issued five-year (non-convertible) secured notes at 12.5%, @ 98% of par, for a yield of about 13.1%.)

The new equity was priced at CA$0.25 per share, with no warrants. The notes are therefore convertible at about CA$0.31. Note holders have a 60-day option to take down an incremental US$7.5M under the same terms. For the purposes of this article, I assume that extra US$7.5M is issued.

After three years, if the share price is greater than CA$0.47 for any 20 (of 30 consecutive trading days), First Cobalt can force conversion, which would save CA$4M per year in interest expense for up to two years. (Note: Importantly, shares issued from note conversions will have no warrants attached.)

If/when this new debt is converted, the combined US$52.5M in funding would equate to approximately 44% equity dilution. However, the vast majority of that dilution will occur after August, 2024.

Fully Funding the Expansion of the Refinery Marks Major Project Milestone

Upon conversion, First Cobalt will have a pristine balance sheet with just CA$5M of debt — comprised entirely of a Canadian gov’t loan [interest-free, ~9.5 yr. remaining maturity], and a partially-drawn US$5M working capital facility.

A bulletproof balance sheet will serve First Cobalt well if management wants to expand operations and/or make acquisitions.

Importantly, all these activities (except the Idaho operations) are anticipated to run concurrently at the company’s expanded & integrated battery materials park. Companies with long-term, sustainable cash-flow generation typically command attractive valuations.

For example, six well-known gold/silver royalty and streaming companies are trading, on average, at an EV ratio of about 23 times trailing 12-month EBITDA. Major cannabis players are valued at an average of greater than 20 times trailing EBITDA. Lithium giants Albemarle & SQM are trading at 34x & 39x!

If First Cobalt could achieve a 12 times multiple of 2024e EBITDA (estimated at CA$55M, including CA$5M from recycling), discounting that indicative CA$660M valuation back three years at 10% per year would equate to a valuation of approximately CA$0.80 per share (based on 534.2M pro forma shares and CA$70M of pro forma net debt).

Assuming the eventual conversion of US$45M of notes, First Cobalt would have about 717M shares outstanding (after August 2024). CEO Trent Mell has said that, at an opportune time, the company will do a reverse stock split in order to obtain a NYSE (American) or OTC listing in the U.S.

Several Canadian-listed lithium juniors — most notably Lithium Americas and Standard Lithium — have garnered premium valuations, strong institutional support, and excellent trading liquidity via U.S. listings.

Management Now Ready, Willing & Able to Attract New Long-Time Shareholders & Institutions

Now that First Cobalt is fully funded through cash flow positive operations in late 2022 or early 2023, management can more readily tell the story to attract longer-term investors and institutions.

I suspect we’ll see updated sell-side research notes from Cantor Fitzgerald, Eight Capital, and Red Cloud Securities, plus new coverage from BMO and hopefully a few others. Readers are reminded of the relative scarcity of Li-ion battery materials players, especially ones that will be meaningfully cash flow positive in 2023.

There are dozens of pre-revenue companies tied to the global paradigm shift to EVs — OEMs, EV charging and recycling start-ups, battery makers, etc. — but most will not be substantially EBITDA positive before 2025, if ever. Yet, many high-flying names have valuations in the billions of dollars.

ESG credentials + near-term cash flow + cheap valuation = attractive entry point?

First Cobalt has the added advantage of being a green energy metals company. It’s hydro-metallurgical process scores high on (low) emissions. And, combined with its North American location and 100% use of hydroelectric power, it also scores high on ESG metrics.

Not only is First Cobalt in a select class of juniors that will soon be cash flow positive with environmentally-friendly practices, it’s expanding, enhancing, and constructing what will become a very valuable, integrated battery materials park. Compare First Cobalt’s robust business plan to preproduction mining projects.

The probability of First Cobalt generating meaningful cash flow in 2023 is far greater than that of most battery metals and EV-related peers. And, the risks of commissioning the refinery are much lower (in my opinion) than the risks of developing a new mine.

Management has expertly positioned the company to be a significant part of the EV / battery story unfolding in North America. In Canada and the U.S. it would likely take six to 10 years to plan, permit, fund, construct, and commission a new battery materials park plus the associated regional infrastructure.

By contrast, First Cobalt will be up and running late next year with Phase 1 CoSO4 production. Cash flow from Phase 1 should self-fund the expansion into a fully integrated battery materials park by 2025, and also exploration and development of its promising cobalt and copper project in Idaho.

Conclusion

It would be hard to overstate how much derisking has occurred in the past year. In addition to fully funding the refinery expansion, management has secured Co hydroxide feedstock for refinery operations, lined up a long-term, off-take agreement for up to 100% of its CoSO4 production, and secured CA$10M of government funding (CA$5M in a free cash grant, plus CA$5M from a 10-year, interest-free loan).

Moreover, the business plan has been greatly enhanced to include ever-stronger ESG credentials, black mass / battery scrap recycling, and Ni sulfate refining.

With prospects for the battery materials park in Ontario now a lot more compelling, the ability to fund and actively advance the cobalt-copper project has gone way up.

North America is poised to become a major, world-class, manufacturing hub for EVs and Li-ion batteries. First Cobalt Corp.’s Ontario operations will be right in the heart of it all.