TSXV:ILC - Post Discussion

Post by

TrueCanuck1 on Feb 15, 2021 8:04pm

Lithium price in China surges 40% to 18-month high

Outlook for lithium prices less hazy now. Stock image

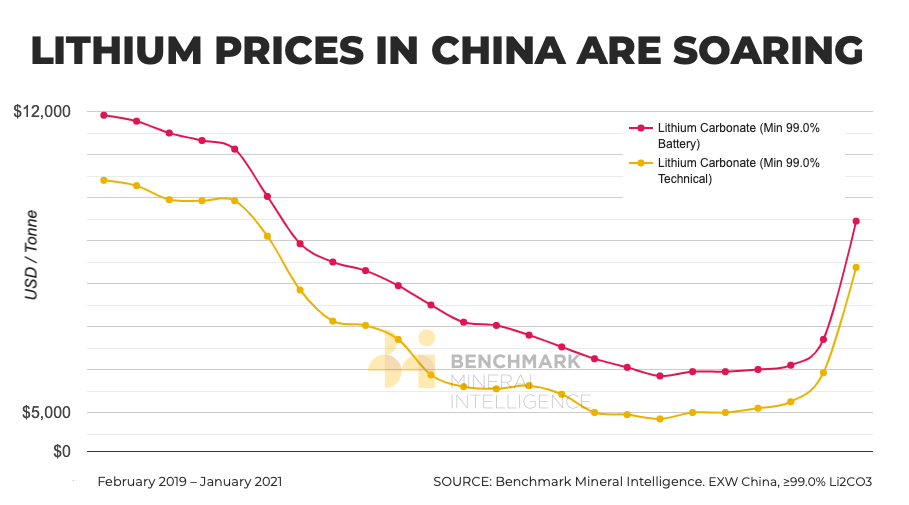

Lithium prices are soaring in China on the back of heavy demand for lithium iron phosphate (LFP) batteries, a new report by battery supply chain research and price reporting agency Benchmark Mineral Intelligence shows.

Benchmark’s battery grade lithium carbonate midpoint price (EXW China, ≥99.0% Li2CO3) in January surged by over 40% compared to the same month last year to 61,000 yuan per tonne (~$9,450 a tonne), the highest level since June 2019. Price came close to $25,000 a tonne at the start of 2018 but has been in steady decline since then.

A very similar story to what we saw in lithium’s last price run of 2016 but with a much improved product for the 2020s

Benchmark lithium analyst George Miller said the “lithium ion battery related policy incentives in China are geared towards subsidising shorter-range vehicles, public transport fleet electrification, 5G power stations, all of which encourage LFP consumption”:

“It’s back to the future for lithium in China.

“Demand for durable, improved, and low cost LFP cathode material has become rejuvenated in China – a very similar story to what we saw in lithium’s last price run of 2016 but with a much improved product for the 2020s.

“Although this surging price trend has largely been confined to lithium carbonate within China, this has had a knock-on effect elsewhere, drawing up lithium carbonate prices out of South America by 10%, and 6% for spodumene feedstock in Australia.”

0

Be the first to comment on this post