Many of us in the gold community fear bear markets because they can inflict some damage to gold and silver stocks. That is a fair concern even though some go overboard.

That aside, it’s vital to understand that these bear markets are the catalyst for big moves and bull markets in Gold.

Let’s take a trip down memory lane.

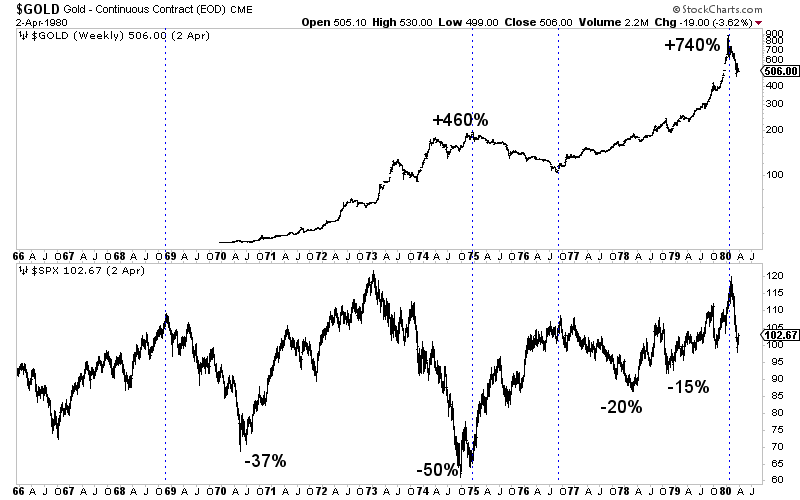

From 1969 through 1974 the S&P 500 had declines of 37% and 50%. During this period Gold gained 460%. (The gold stocks bottomed in 1969 five months before the stock market).

Before Gold went parabolic, the S&P corrected another 20% and 15%. Gold rebounded 140% during this period. Then it went parabolic.

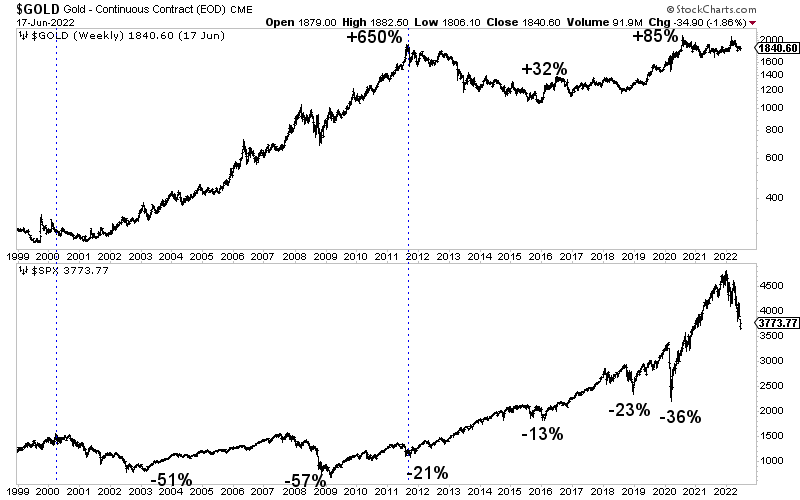

The 2000s were a similar story to the 1969 to 1974 period. The S&P 500 had twin declines of 51% and 57%, along with another decline of 21%. Gold gained 650%.

From 2011 to late 2018, the S&P had a smooth run with only a 13% decline in between. Gold performed poorly.

However, from August 2018 to August 2020, Gold rebounded by 85%. That was fueled by S&P 500 declines of 23% and then a 36% crash during Covid.

As 2022 began, Gold had corrected for 17 months and the stock market remained at all time highs. For months I had written and said that Gold would not perform or break resistance until a significant correction or bear market in the stock market.

Gold is now so much closer to a big move than it was in 2021 or late 2020.

The stock market, which declined 24%, may have made an interim bottom on Monday. It is extremely oversold and tested the 40-month moving average, an incredibly important support level.

Given that the worst isn’t remotely close to being over for the economy, odds favor another leg lower in the stock market and therefore a 35% to 40% bear market.

That by itself would be more than enough to get Gold to breakout and hit my $4000 target by the end of 2024.

Now is the time to find the quality companies that can best leverage that outcome. I continue to focus on finding high-quality juniors with at least 5 to 7 bagger potential over the next few years.