TSXV:SR - Post Discussion

Post by

Visthefuture on Apr 13, 2023 8:01pm

Simple power move to DBL tonnage of SR flagship at Lac Dore

For around half the cost of a diamond drill program, SR could offer VRB $3.5m USD (= Current market capitalization of VRB-TSX).

Acquiring VanadiumCorp-TSX Venture has some potential benefits:

- Double tonnage to create the complete and ultimate land position Download feasibility study for SR's SOUTHWEST flagship here....

- Save XXX years of time

- Removing future risk and market confusion with VRB mining claims stuck in the middle of SR with a rivaling resource for over 15 years

- Capture bonus green technology production patent rights and vanadium battery expertise

- Pay peanuts for massive "Strategic Resources" acquisition without the monkees. [url=[url=[url=https://www.vanadiumcorp.com/wp-content/uploads/2020/12/R441.2020-VCOMRE01-VanadiumCorp-Lac-Dore-NI-43-101-Technical-Report.pdf][/url]][/url]]Download tech report here...[/url]

- Lower investment risk for trapped VRB-TSXV Canadian shareholders and VRBFF-OTC US shareholders

- Capture bonus Lac Dore type resource in Matagami, Quebec Download tech report here...

- Capture bonus copper-gold projects and royalties for benefit of locals and shareholders

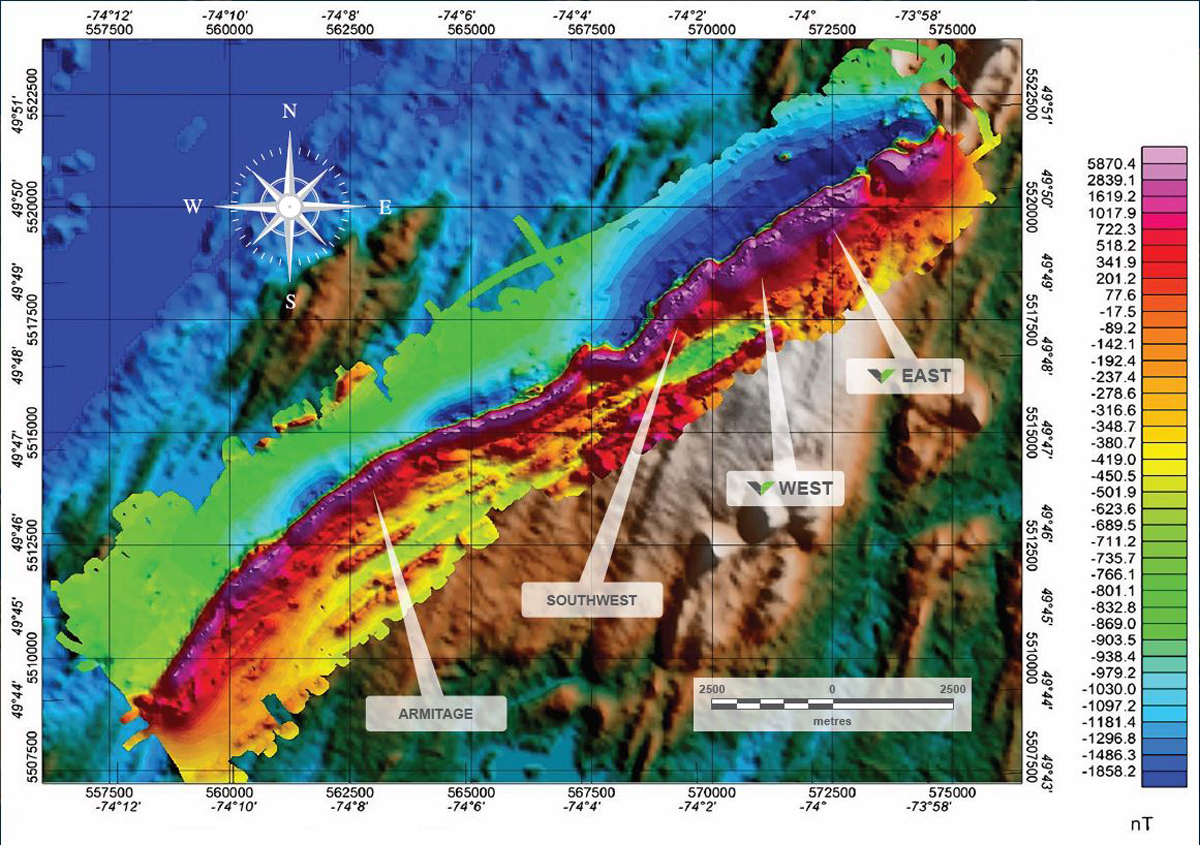

- Raise development capital easier without the giant missing claim hole within SR's Lac Dore claim map - see below project map with SR's mineralization labeled to the south from VanadiumCorp's website

- Capture bonus stock symbol "VRB" for dual vanadium play like Largo or future vanadium battery potential

- Own the bonus bragging rights once complete "the biggest $$$$$$$$ in the $$$$$$ World"

- Create potential market win for SR

Currently an all stock offer of 1 share SR for 3 shares of VRB would represent less than 8.3% dilution of SR and provide relief and major upside for VRBFF shareholders.

For all those who might support this you can potentially consider contacting Sean Cleary at 1-416.840.6972 or 1-905.399.4285 email at scleary@blackrockmetals.com. If we are in luck, they can tell us something positive as they clearly know how to develop mineral resources with main shareholder Lumina group delivering over a billion dollars of value to its own shareholders. Given the opposite occuring in VRBFF since January 2021, it would be good to hear what Sean has to say.

Your welcome!

All in IMHO, GLTA! VITF

From the recent RTO new release: Sean Cleary, Strategic chief executive officer and chairman, commented: "This is an excellent time to be taking the BlackRock project public given the positive metal market fundamentals. Our high-purity iron will be required for the transition to green steel and electrification of the iron and steel industry. Our vanadium will be required to fuel increased demand coming from growth in high-tensile steel and the increasing deployment of vanadium redox flow batteries. Continued support from Investissement Quebec, Orion Mine Finance and the Cree Nation government should enable the new Strategic to take advantage of these opportunities."

Be the first to comment on this post