The cobalt price is about to surge. So far, the market is missing it

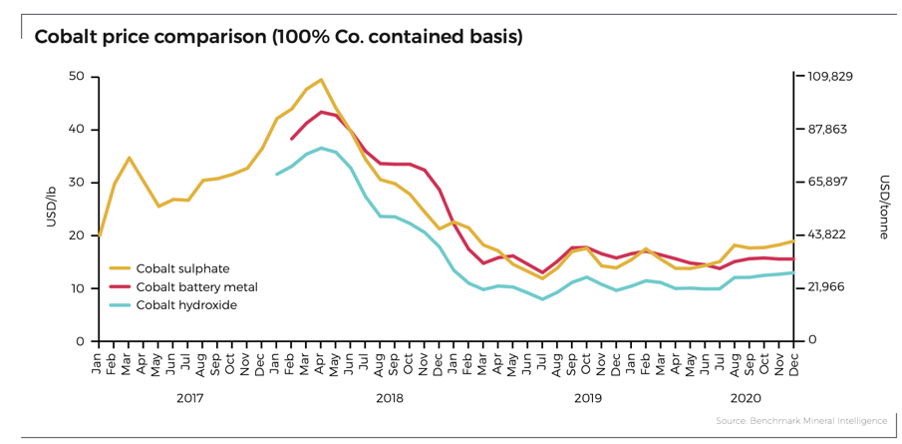

Benchmark Mineral Intelligence says cobalt sulphate prices increased by ~3.2 per cent in December to hit a YTD (year to date) high.

The sulphate price today is around $US19/lb: far higher than March lows of $US12/lb, but still pretty low in historic terms.

And yet as the EV sector ramps up in the coming years Benchmark is forecasting the cobalt market to move into structural deficit.

When demand exceeds supply, prices go up.

The major players know this.

Recently, China Molybdenum paid $US550m for a 95 per cent stake in the Kisanfu copper-cobalt project in the DRC.

Owner Freeport had previously tried to offload the Kiansfu operation to China Moly for $50m in 2016, who didn’t want it at the time.

“China Moly’s decision to acquire the mine, which had been available at less than 10 per cent of its current value only three years ago, is a sign of a new trajectory for the cobalt industry and its long-term place in the battery supply chain,” Benchmark says.

https://stockhead.com.au/resources/the-cobalt-price-is-about-to-surge-so-far-the-market-is-missing-it/