Canadian molybdenum explorer American Cumo Mining (TSXV:MLY, Forum) is having a big day today, with the release of an expanded resource that marches the big moly property ever closer to proving out as a mine proper.

But while that news has been a long time coming and goes a long way to proving out Cumo’s claims of ‘something big’ beneath the surface, what’s been even longer is Cumo’s emergence from a several-year long slump that was fraught with lawsuits, near bankruptcies, boardroom takeovers and claims of what it says is the world’s largest and cheapest unmined moly resource.

The new 43-101 packs on a 21.5% increase in silver, 17.4% increase in copper, a 10.5% increase in molybdenum, 19.5% increase in tungsten and a 19.6% overall increase in tonnage. In addition, the resource has moved into the ‘measured’ category – a big step.

But the biggest step of all comes from Cumo emerging from the category of ‘shitty companies’ that, since 2011, has been quite the expansive list. Many thought it could never have survived, let alone thrived. Many thought it dead and buried.

Back when it was Mosquito Consolidated Gold Mines Ltd, the company was a bona fide mess. Shaun Dykes, the technical brain behind the company back then, was frustrated at the slow going in exploration at the firm when he began to notice things weren’t exactly as they seemed behind the scenes.

For one, when he looked at the company finances and noted Mosquito was pegging drilling expenses at $600 per foot. That would have been about five times what it was actually costing. He should know – he was overseeing the drilling, when there was any to oversee.

So he started sniffing about, and found management had spent a large amount of money buying bulldozers and trucks on eBay. Not just a couple of bits here and there that might be useful down the road, but over 400 pieces of second hand heavy equipment, some of it completely inoperable.

“I found a snowblower with the engine in the cab,” Dykes recalls.

Dykes found money was being siphoned off to a subsidiary drilling services company, run by the son of the President, with precious little return for investors. Millions had been raised, and millions were gone.

So Dykes went to the board to report his findings, and was summarily dismissed. He then went to a large Chinese investor in the company and told him what had gone down, and the two of them did what many have tried before but few have achieved; they ran a successful shareholder revolt and took back the company.

Lawsuits bounced back and forth. More Chinese investors joined the board and were subsequently removed after attempting a coup of their own.

And, amid all this, dykes worked to track down all the items Mosquito supposedly owned.

That effort would gather 113 different pieces of heavy equipment from 5 different sites, which were duly sold off to reclaim capital. There were another 100+ assets that disappeared to Mexico where, frankly, the effort to reclaim them would cost more than it would bring in return, and 100+ more pieces simply vanished, either having been sold, moved to parts unknown, or having been cannibalized for parts.

Ultimately, the company would find 425 pieces of mining equipment had been purchased, while the drill holes that the financing had been specifically raised for were barely drilled.

Dykes says, when he took his run at the old Mosquito board, the company yard looked like a scrap metal facility.

“We were ready to drill in 2011 and raised $7m to do so, but there was no money to drill when the time came,” says Dykes today, now CEO of what has transformed into American Cumo Mining.

There are many more incredulous stories from that time, including allegations of vote-rigging, drugs, and shootings, but subsequent lawsuit settlements keep them out of print.

Suffice it to say, Shaun Dykes, one of those dusty, snaggletoothed, rocks-under-the-nails, drills-in-the-ground guys that look like they came out of a Lucky Luke comicbook rather than a boardroom, wrestled this company from the clutches of robber barons and now finds himself having to not only move it forward, but sweep away the debris of the past in order to do so.

The long promised expanded resource estimate goes a long way toward that, and it does so at exactly the right time; neighbouring copper/gold/moly miner and TSX big-boarder Thompson Creek (TSX:TCM, Forum) released Q2 production and sales results today showing 17% increases in copper and 39% in gold.

Cumo is a moly/silver/copper play a few hills over, and Dykes is no shrinking violet when he speaks of the potential of that property, and the area in general.

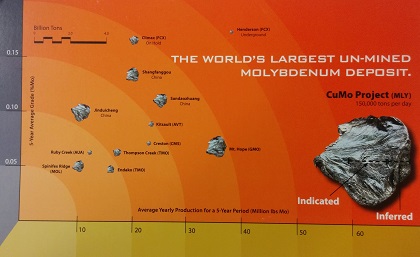

A circular shown below demonstrates what the company says is the size of its play compared to others in or nearing production.

Dykes insists his property could see recovery costs at less than $4 per lb, with many of his competitors struggling to stay afloat at a $6 spot price and costs of $12 per lb and higher.

“We have such a large potential resource, and moly is the primary commodity, so our costs will drop markedly compared to a lot of the competition, who only mine moly as a by-product, or have costs that make sense under old $14 per lb contracts, but not at the spot price,” he says.

Indeed 40% of the world’s molybdenum supply is by-product.

“What you see is, a lot of those companies mine out their high grade moly and they’re starting to hit the low grade stuff, so the economics don’t make as much sense. We believe, when we’re producing, we’ll be able to hit 150k per day of tonnes processed, which will get our costs right down, especially in a stable, mining-friendly, well-infrastructured area like Idaho.”

And silver will be his by-product, something that is helping Cumo finance today.

To raise money, the company is engaging in a silver streaming process, selling silver units at $250,000 at a time in an effort to, eventually, raise $25m to move the project forward. The new resource will go a long way to helping in that process, and that process will get the company a long way towards advancing.

"The new estimate represents a substantial milestone towards completing our feasibility study and achieving our goal of trading on a major international stock exchange," said Dykes in his news release Wednesday.

The markets responded by driving an 18% stock jump.

Molybdenum prices remain low, which is putting pressure on many producers and making some projects, such as China-based mines that produce with costs of $11+ per lb, unworkable.

Dykes says he’s okay with that, because his project is geared toward being economic even at historic commodity lows.

“If you can make a mine profitable when the commodity market is at its lowest, you’re in really nice shape whenever there’s an increase in prices,” says Dykes. “But we’re okay with prices where they are for a while. It’s only going to make our project more appealing when nobody else can keep the lights on.”

--Chris Parry

https://www.twitter.com/chrisparry

Postscript: People connected with previous management will want to be careful about posting on the Cumo Bullboard going forward. Healthy debate is encouraged. Slander and excessive bashing will lead to accounts being banned and, in certain circumstances, names being named.